1099 Nanny Form

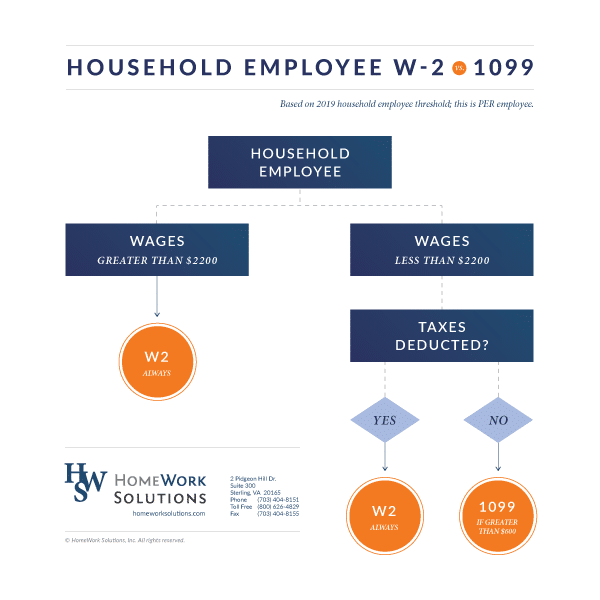

1099 Nanny Form - Web key takeaways if you control what work your nanny does and how they do it, the irs likely will consider them your employee. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Web 1 best answer. As you probably already know, this is illegal. Nanny & household tax and payroll service Therefore, families must report them by using a form w2. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her on the appropriate. Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. When you hire someone to work in your.

As you probably already know, this is illegal. We will explain why you must use a. Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. Web the internal revenue service classifies nannies as household employees. Ad care.com® homepay℠ can help you manage your nanny taxes. Web the employer says they will give you a 1099. No, she is not a household employee. Web 1 best answer. Web the taxpayer is neither a trained nurse nor therapist and doesn't provide such services to anyone other than her spouse. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion.

Web key takeaways if you control what work your nanny does and how they do it, the irs likely will consider them your employee. Simply answer a few question to instantly download, print & share your form. Nanny & household tax and payroll service For 2020, the annual wage. When you hire someone to work in your. By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her on the appropriate. We will explain why you must use a. Web 1 best answer. Web nanny taxes refer to the payroll taxes household employers are supposed to withhold and pay from a household employee's paycheck. Forms for setting up as an employer 1.

25 ++ sample completed 1099 misc form 2020 325140How to fill in 1099

For 2020, the annual wage. Web should you 1099 a nanny? When you hire someone to work in your. Get ready for tax season deadlines by completing any required tax forms today. Forms for setting up as an employer 1.

Free Nanny Contract — Nanny Counsel Nanny, Nanny tax, Nanny contract

Takes 5 minutes or less to complete. Withheld federal taxes regardless of. Forms for setting up as an employer 1. No, she is not a household employee. Web here are the 10 nanny tax forms every household employer will need.

Fillable Form 1099 Form Resume Examples xz20gvGVql

Nanny & household tax and payroll service Ad access irs tax forms. If you earn $2,600 or more during the calendar year, your employer has until january 31st of the following year to send you. By renee booker if you employed a nanny to help care for your children during the year, you must report the income paid to her.

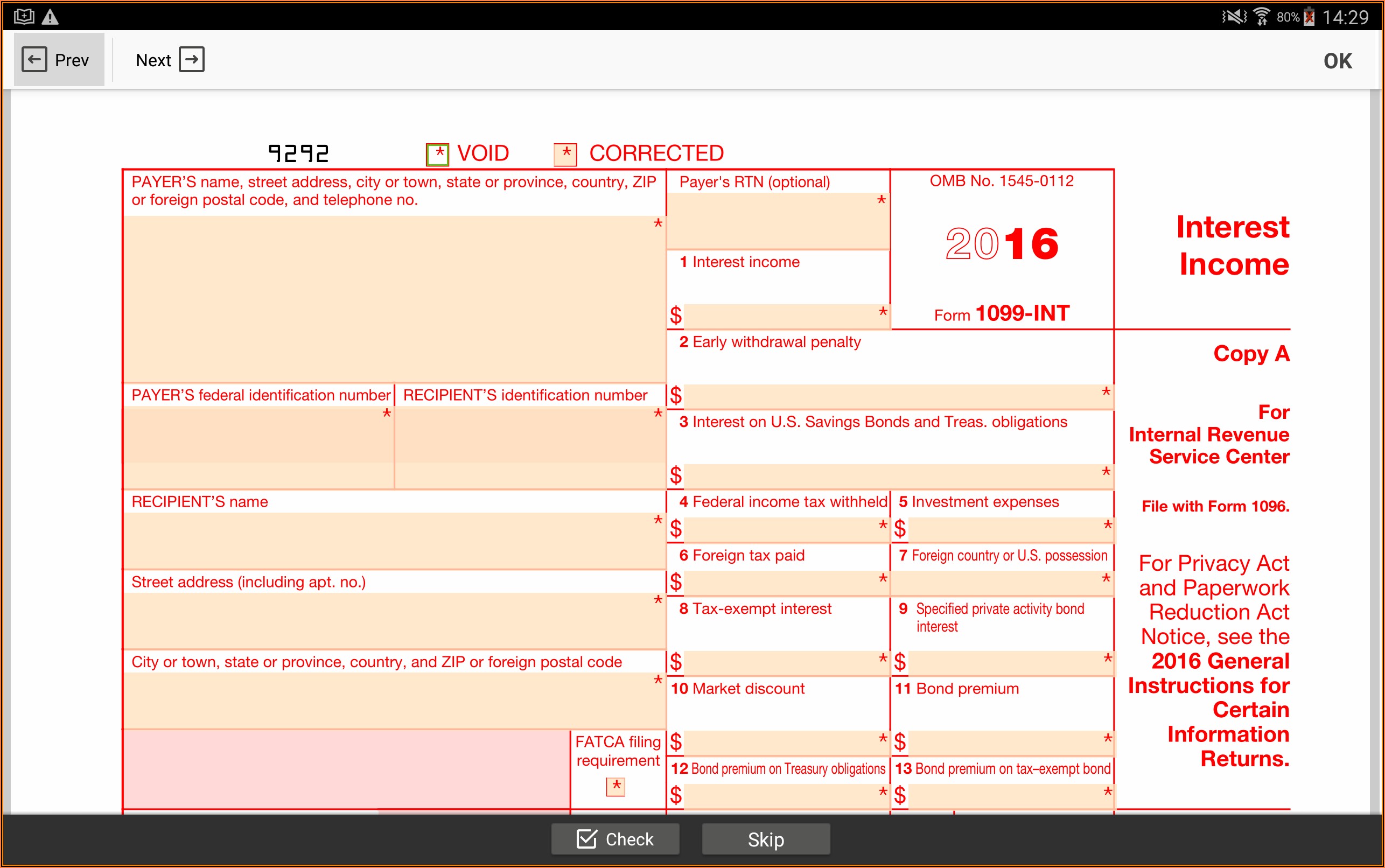

Form 1099INT Interest , Recipient's State Copy 2

Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Web here are the 10 nanny tax forms every household employer.

11 Common Misconceptions About Irs Form 11 Form Information Free

Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Web nanny taxes refer to the payroll taxes household employers are supposed to withhold and pay from a household employee's paycheck. Web the employer says they will give you a 1099. If you earn $2,600 or.

What is a 1099Misc Form? Financial Strategy Center

Ad access irs tax forms. Ad care.com® homepay℠ can help you manage your nanny taxes. If you earn $2,600 or more during the calendar year, your employer has until january 31st of the following year to send you. Web the internal revenue service classifies nannies as household employees. Get ready for tax season deadlines by completing any required tax forms.

Form1099NEC

Takes 5 minutes or less to complete. Therefore, families must report them by using a form w2. Web nanny taxes refer to the payroll taxes household employers are supposed to withhold and pay from a household employee's paycheck. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with.

13 Form Nanny Understanding The Background Of 13 Form Nanny AH

We will explain why you must use a. Forms for setting up as an employer 1. Pay them $2,600 or more in 2023 (or paid them $2,400 or more in 2022) or; For 2020, the annual wage. Get ready for tax season deadlines by completing any required tax forms today.

13 Form Nanny Understanding The Background Of 13 Form Nanny AH

Web 1 best answer. Web here are the 10 nanny tax forms every household employer will need. Complete, edit or print tax forms instantly. Takes 5 minutes or less to complete. Forms for setting up as an employer 1.

Form 1099 Misc Fillable Universal Network

Therefore, families must report them by using a form w2. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Nanny & household tax and payroll service Takes 5 minutes or less to complete. Web here are the 10 nanny tax forms every household employer will.

Web 1 Best Answer.

Ad care.com® homepay℠ can help you manage your nanny taxes. Web steps to create w2 for nanny. For 2020, the annual wage. Web a nanny contract allows someone else, the “nanny,” to take care of a parent or legal guardian’s children or toddlers in exchange for payment.

Simply Answer A Few Question To Instantly Download, Print & Share Your Form.

Nanny & household tax and payroll service Ad care.com® homepay℠ can help you manage your nanny taxes. Web key takeaways if you control what work your nanny does and how they do it, the irs likely will consider them your employee. As you probably already know, this is illegal.

Takes 5 Minutes Or Less To Complete.

Web the employer says they will give you a 1099. Web here are the 10 nanny tax forms every household employer will need. When you hire someone to work in your. Web the taxpayer is neither a trained nurse nor therapist and doesn't provide such services to anyone other than her spouse.

Forms For Setting Up As An Employer 1.

Ad access irs tax forms. If you earn $2,600 or more during the calendar year, your employer has until january 31st of the following year to send you. Web families that misclassify their nanny as an independent contractor by providing a form 1099 for filing taxes can be charged with tax evasion. Complete, edit or print tax forms instantly.