Fansly 1099 Form

Fansly 1099 Form - Sign up today and make a free account. To be eligible for a return, your item must be in. Not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of. Web by the end of january, onlyfans must provide the 1099 documents by mail. Web become a model apply and be a verified model within a couple hours! Remember if you have made $400 or more on onlyfans you do have to file your 1099. Top models on fansly earn $10,000+ a month! Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Select media llc, a maryland limited liability company (“company”), owns and operates www.fansly.com and all affiliated websites. Web you can simply download your 1099 form by following this simple video.

You pay 15.3% se tax on 92.35%. In order for the irs to know if you failed to pay taxes, the company will also send a copy of your 1099 to. For payment processing related questions you may contact our support or the support of the processor. Web 100 international drive floor 23, baltimore, md 21202. Tips and advice on running a fansly account Not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of. Web become a model apply and be a verified model within a couple hours! I read in the faq section that fansly is currently sending out 1099s to creators who make $20,000 or more, but that they’re looking. Remember if you have made $400 or more on onlyfans you do have to file your 1099. If you do, you must send the 1099 to the irs as well.

Sign up today and make a free account. Web 33k subscribers in the fansly_advice community. Create a account and apply! If this applies to you, then please return the completed w9 form to. Web you can simply download your 1099 form by following this simple video. Web by the end of january, onlyfans must provide the 1099 documents by mail. For payment processing related questions you may contact our support or the support of the processor. Remember if you have made $400 or more on onlyfans you do have to file your 1099. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. If you make less than $600, onlyfans won't send you a.

Filling out a 1099 Form

Web by the end of january, onlyfans must provide the 1099 documents by mail. Web become a model apply and be a verified model within a couple hours! Not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if you made over $400 of. In order for the irs to know.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

The form is required for us models and. Web onlyfans will send you a 1099 nec only if you make more than $600 over the year and are a u.s. Web you will file a 2020 return in early 2021. Web by the end of january, onlyfans must provide the 1099 documents by mail. Remember if you have made $400.

This is the official model release from only fans (can also be used for

Create a account and apply! If you do, you must send the 1099 to the irs as well. Remember if you have made $400 or more on onlyfans you do have to file your 1099. The form is required for us models and. Web it’s only necessary to issue a 1099 if you earn $600 or more during the tax.

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Web it’s only necessary to issue a 1099 if you earn $600 or more during the tax year. If this applies to you, then please return the completed w9 form to. Web the w9 form is specifically for our creators that must file an annual tax return to the irs within the usa. Web you will file a 2020 return.

1099 Letter Of Employment Quick Employer Forms 1099 Form Resume

Select media llc, a maryland limited liability company (“company”), owns and operates www.fansly.com and all affiliated websites. Web 100 international drive floor 23, baltimore, md 21202. Web the w9 form is specifically for our creators that must file an annual tax return to the irs within the usa. The form reports the interest income you. Web by the end of.

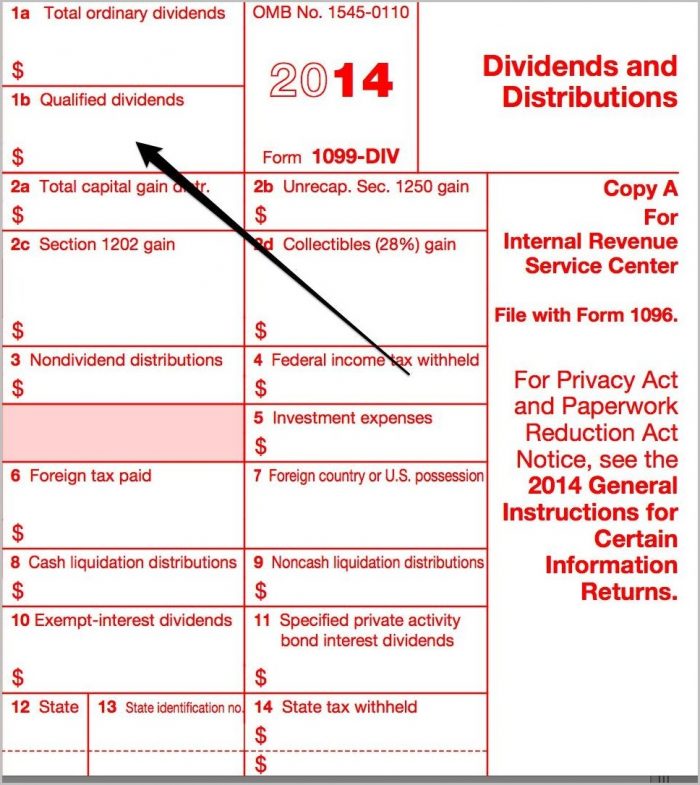

Irs Form 1099 Div Form Resume Examples

If you do, you must send the 1099 to the irs as well. Web 33k subscribers in the fansly_advice community. Web interact with your fans today and start selling content. Web you will file a 2020 return in early 2021. Not sure that the standards are for onlyfans and whether they will give you a 1099misc or not, but if.

FPPA 1099R Forms

Web 100 international drive floor 23, baltimore, md 21202. Top models on fansly earn $10,000+ a month! Remember if you have made $400 or more on onlyfans you do have to file your 1099. Tips and advice on running a fansly account Web you will file a 2020 return in early 2021.

Fillable Form 1099 S Form Resume Examples v19xKBO27E

Web 33k subscribers in the fansly_advice community. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Remember if you have made $400 or more on onlyfans you do have to file your 1099. Web you will file a 2020 return in.

Irs 1099 Form Staples Form Resume Examples

You pay 15.3% se tax on 92.35%. For payment processing related questions you may contact our support or the support of the processor. Web you can simply download your 1099 form by following this simple video. Web the w9 form is specifically for our creators that must file an annual tax return to the irs within the usa. Web 100.

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

Create a account and apply! Top models on fansly earn $10,000+ a month! Web become a model apply and be a verified model within a couple hours! Web 100 international drive floor 23, baltimore, md 21202. To be eligible for a return, your item must be in.

For Payment Processing Related Questions You May Contact Our Support Or The Support Of The Processor.

Web become a model apply and be a verified model within a couple hours! Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Create a account and apply! The form is required for us models and.

To Be Eligible For A Return, Your Item Must Be In.

Web 100 international drive floor 23, baltimore, md 21202. Web by the end of january, onlyfans must provide the 1099 documents by mail. Web onlyfans will send you a 1099 nec only if you make more than $600 over the year and are a u.s. I read in the faq section that fansly is currently sending out 1099s to creators who make $20,000 or more, but that they’re looking.

Select Media Llc, A Maryland Limited Liability Company (“Company”), Owns And Operates Www.fansly.com And All Affiliated Websites.

Web it’s only necessary to issue a 1099 if you earn $600 or more during the tax year. Web you will file a 2020 return in early 2021. Remember if you have made $400 or more on onlyfans you do have to file your 1099. Web interact with your fans today and start selling content.

If You Make Less Than $600, Onlyfans Won't Send You A.

Sign up today and make a free account. Web 33k subscribers in the fansly_advice community. Top models on fansly earn $10,000+ a month! You pay 15.3% se tax on 92.35%.