2021 M1Pr Form Pdf

2021 M1Pr Form Pdf - Enter the full amount from line 1 of your 2021 statement of. We'll make sure you qualify, calculate your minnesota property tax refund,. Web you will need the 2021 form m1pr instructions, including refund tables, to complete this form. Line 1 of statement of. For example, if your property tax refund return is due august 15, 2021, then your. Do not use staples on anything you submit. Web your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. You will not receive a refund if your return is filed or the. Web what are the maximums?

We'll make sure you qualify, calculate your minnesota property tax refund,. Enter the full amount from line 1 of your 2021 statement of. Web your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022. Web easily sign the 2021 form m1pr with your finger send filled & signed m1pr form 2022 or save handy tips for filling out m1pr instructions online printing and scanning is no longer. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. It should then show your minnesota property tax and list that your federal and state have. Web what are the maximums? More about the minnesota form m1pr tax credit we last. Web to qualify, you must have owned and lived in this homestead both on january 2, 2020, and on january 2, 2021. Web complete and send us form m1pr, homestead credit refund (for homeowners) and renter's property tax refund.

For example, if your property tax refund return is due august 15, 2021, then your. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web easily sign the 2021 form m1pr with your finger send filled & signed m1pr form 2022 or save handy tips for filling out m1pr instructions online printing and scanning is no longer. You will not receive a refund if your return is filed or the. If you are filing as a renter, include any certificates of. If you qualify, see the instructions. Web your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022. Enter the full amount from line 1 of your 2021 statement of. Do not use staples on anything you submit. For refund claims filed in 2021, based on rent paid in 2020 and 2020 household income, the maximum refund is $2,210.

Fill Free fillable Minnesota Department of Revenue PDF forms

Web the deadline for filing form m1prx is 3.5 years from the due date of the original form m1pr. Web what are the maximums? Web your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022. We'll make sure you qualify, calculate your minnesota property tax refund,. Web yes, you can file your.

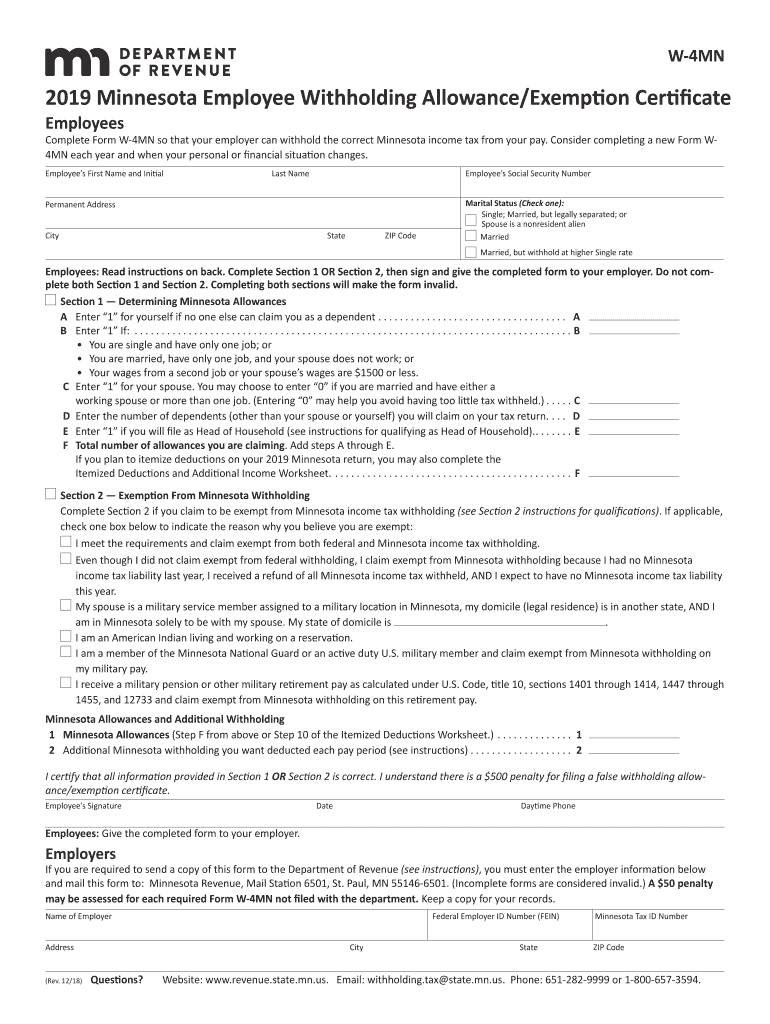

2019 Form MN W4MN Fill Online, Printable, Fillable, Blank pdfFiller

Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: Web your 2021 form m1pr should be mailed, delivered, or electronically filed with the department by august 15, 2022. For example, if your property tax refund return is due august 15, 2021, then your. Web you will.

Minnesota Property Tax Refund Fill Out and Sign Printable PDF

Web only the spouse who owned and lived in the home on january 2, 2021, can apply as the homeowner for the home. If you are filing as a renter, include any certificates of. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: For refund claims.

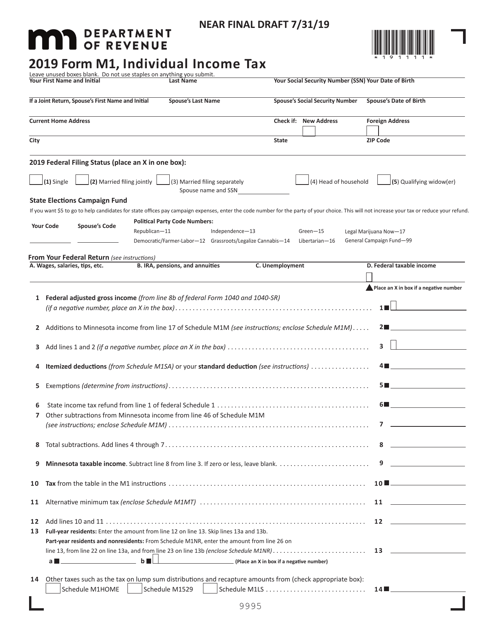

2019 Form MN DoR M1 Fill Online, Printable, Fillable, Blank pdfFiller

Current home address city check. Web easily sign the 2021 form m1pr with your finger send filled & signed m1pr form 2022 or save handy tips for filling out m1pr instructions online printing and scanning is no longer. If you qualify, see the instructions. If you are filing as a renter, include any certificates of. Do not use staples on.

Fill Free fillable Minnesota Department of Revenue PDF forms

For refund claims filed in 2021, based on rent paid in 2020 and 2020 household income, the maximum refund is $2,210. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial last name your social security number your date of. Web only the spouse who owned and lived in the home.

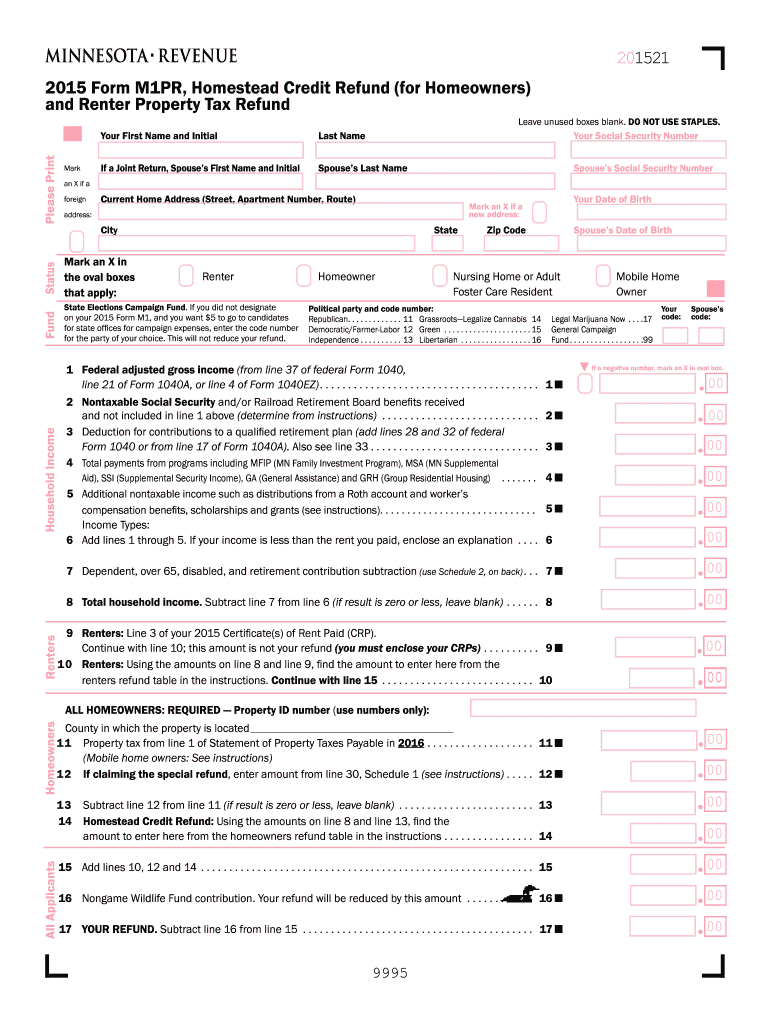

M1pr 2015 form Fill out & sign online DocHub

It should then show your minnesota property tax and list that your federal and state have. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial last name your social security number your date of. More about the minnesota form m1pr tax credit we last. Web your 2021 form m1pr should.

2021 Rent Certificate Form Fillable Printable PDF Forms Handypdf

If you qualify, see the instructions. Line 1 of statement of. Web the 2021 form m1pr, homestead credit refund (for homeowners) (minnesota department of revenue) form is 2 pages long and contains: Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. More about the minnesota form m1pr tax credit we last.

Fillable Form M1pr Homestead Credit Refund (For Homeowners) And

More about the minnesota form m1pr tax credit we last. Current home address city check. Web to qualify, you must have owned and lived in this homestead both on january 2, 2020, and on january 2, 2021. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund:.

When Are Minnesota Property Tax Refunds Sent Out uukumdesigns

We'll make sure you qualify, calculate your minnesota property tax refund,. Do not use staples on anything you submit. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. If you qualify, see the instructions. Web easily sign the 2021 form m1pr with your finger send filled & signed m1pr form 2022 or save handy.

Minnesota Tax Table M1

If you are filing as a renter, include any certificates of. Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. Do not use staples on anything you submit. Enter the full amount from line 1 of your 2021 statement of. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund.

Web Complete And Send Us Form M1Pr, Homestead Credit Refund (For Homeowners) And Renter's Property Tax Refund.

Web yes, you can file your m1pr when you prepare your minnesota taxes in turbotax. We'll make sure you qualify, calculate your minnesota property tax refund,. Web you will need the 2021 form m1pr instructions, including refund tables, to complete this form. If you qualify, see the instructions.

More About The Minnesota Form M1Pr Tax Credit We Last.

Web easily sign the 2021 form m1pr with your finger send filled & signed m1pr form 2022 or save handy tips for filling out m1pr instructions online printing and scanning is no longer. For example, if your property tax refund return is due august 15, 2021, then your. Current home address city check. For refund claims filed in 2021, based on rent paid in 2020 and 2020 household income, the maximum refund is $2,210.

Web What Are The Maximums?

Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your date of birth (mm/dd/yyyy) state elections campaign fund: If you are filing as a renter, include any certificates of. It should then show your minnesota property tax and list that your federal and state have. Web 2021 form m1pr, homestead credit refund (for homeowners) and renter’s property tax refund your first name and initial last name your social security number your date of.

Web The Deadline For Filing Form M1Prx Is 3.5 Years From The Due Date Of The Original Form M1Pr.

Web to qualify, you must have owned and lived in this homestead both on january 2, 2020, and on january 2, 2021. Line 1 of statement of. Enter the full amount from line 1 of your 2021 statement of. You will not receive a refund if your return is filed or the.