2022 Form 941 Schedule B

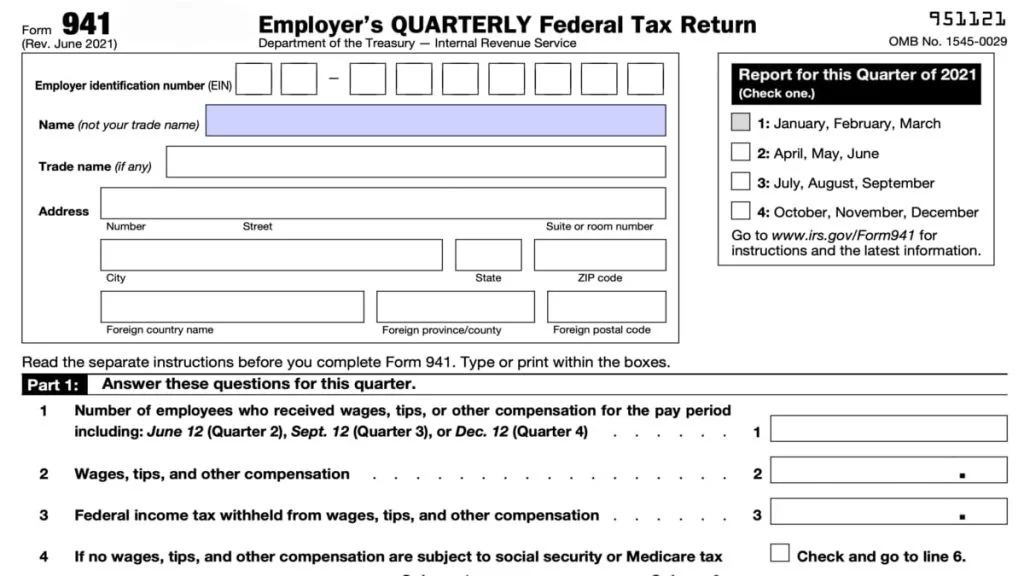

2022 Form 941 Schedule B - Your tax liability is based on the dates wages were paid. Web 941 basic requirements; If you deposit monthy or semiweekly, you'll want to declare that as you file 941 in quickbooks so that. Web i started the process to fill out our qtly fed tax return for payroll 941 schedule b form today, for 2022 1st quarter. Web irs releases 2022 form 941, instructions for form and schedules b and r.pdf 100% money back guaranteed refund / cancellation policy for group or any booking. Web form 941 for 2023: Web the lookback period directly impacts the deposit schedule for form 941. This form must be completed by a semiweekly schedule depositor who. Irs has set the wheels in motion for revisions of. You are a semiweekly depositor if you:

Web latest irs changes for filing form 941 and schedule b. Irs has set the wheels in motion for revisions of. Explore instructions, filing requirements, and tips. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. This form must be completed by a semiweekly schedule depositor who. Here’s a simple tax guide to help you understand form 941 schedule b. Web form 941 for 2023: You are a semiweekly depositor if you: You must complete all three.

Irs has set the wheels in motion for revisions of. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web latest irs changes for filing form 941 and schedule b. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web irs releases 2022 form 941, instructions for form and schedules b and r.pdf 100% money back guaranteed refund / cancellation policy for group or any booking. This form must be completed by a semiweekly schedule depositor who. Reported more than $50,000 of employment taxes in. Web for tax years beginning before january 1, 2023, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax. The employer is required to withhold federal income tax and.

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

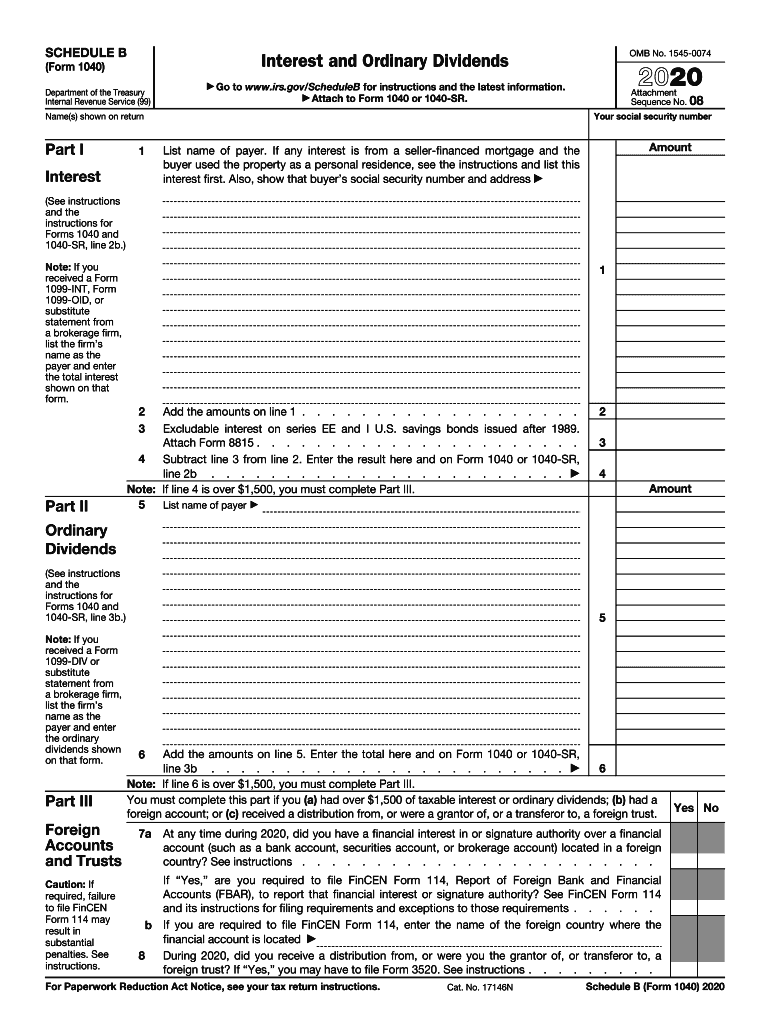

Web on schedule b, list your tax liability for each day. The federal income tax you. As well as quarters 1 and 2. Web file schedule b if you’re a semiweekly schedule depositor. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes.

941 Form 2022 schedule b Fill online, Printable, Fillable Blank

Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022. Reported more than $50,000 of employment taxes in. Explore.

Schedule B Fill Out and Sign Printable PDF Template signNow

It started with 'interview questions'. Web latest irs changes for filing form 941 and schedule b. This form must be completed by a semiweekly schedule depositor who. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. As well as quarters 1 and 2.

File 941 Online Efile 941 for 4.95 IRS Form 941 for 2022

The federal income tax you. The employer is required to withhold federal income tax and. Employers are classified into one of two deposit schedules: Here’s a simple tax guide to help you understand form 941 schedule b. If you deposit monthy or semiweekly, you'll want to declare that as you file 941 in quickbooks so that.

941 Form 2023

Explore instructions, filing requirements, and tips. 3 by the internal revenue service. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. You are a semiweekly depositor if you: Web form 941 for 2023:

How to Print Form 941 ezAccounting Payroll

Web irs releases 2022 form 941, instructions for form and schedules b and r.pdf 100% money back guaranteed refund / cancellation policy for group or any booking. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. If you deposit monthy or semiweekly, you'll want to declare that as you file.

Form 941 Schedule B YouTube

Web the filing of schedule b depends on your deposit frequency. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. 3 by the internal revenue service. If you deposit monthy or semiweekly, you'll.

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

As well as quarters 1 and 2. Web the filing of schedule b depends on your deposit frequency. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Web draft instructions for schedule b of.

Printable 941 Form 2021 Printable Form 2022

Employers are classified into one of two deposit schedules: You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period. Here’s a simple tax guide to help you understand form 941 schedule b. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Your.

Fill Free fillable Allocation Schedule for Aggregate Form 941 Filers

Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web the lookback period directly impacts the deposit schedule for form 941. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. You must complete all three..

Reported More Than $50,000 Of Employment Taxes In.

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web city state zip code foreign country name foreign province/county foreign postal code 950122 omb no. Employers are classified into one of two deposit schedules: Web file schedule b if you’re a semiweekly schedule depositor.

3 By The Internal Revenue Service.

The employer is required to withhold federal income tax and. Web file schedule b (form 941) if you are a semiweekly schedule depositor. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the lookback period. Web latest irs changes for filing form 941 and schedule b.

If You Reported More Than $50,000, You’re A.

The federal income tax you. Irs has set the wheels in motion for revisions of. Web form 941 for 2023: Web the lookback period directly impacts the deposit schedule for form 941.

Web Irs Releases 2022 Form 941, Instructions For Form And Schedules B And R.pdf 100% Money Back Guaranteed Refund / Cancellation Policy For Group Or Any Booking.

It started with 'interview questions'. Web on schedule b, list your tax liability for each day. Web the filing of schedule b depends on your deposit frequency. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb.