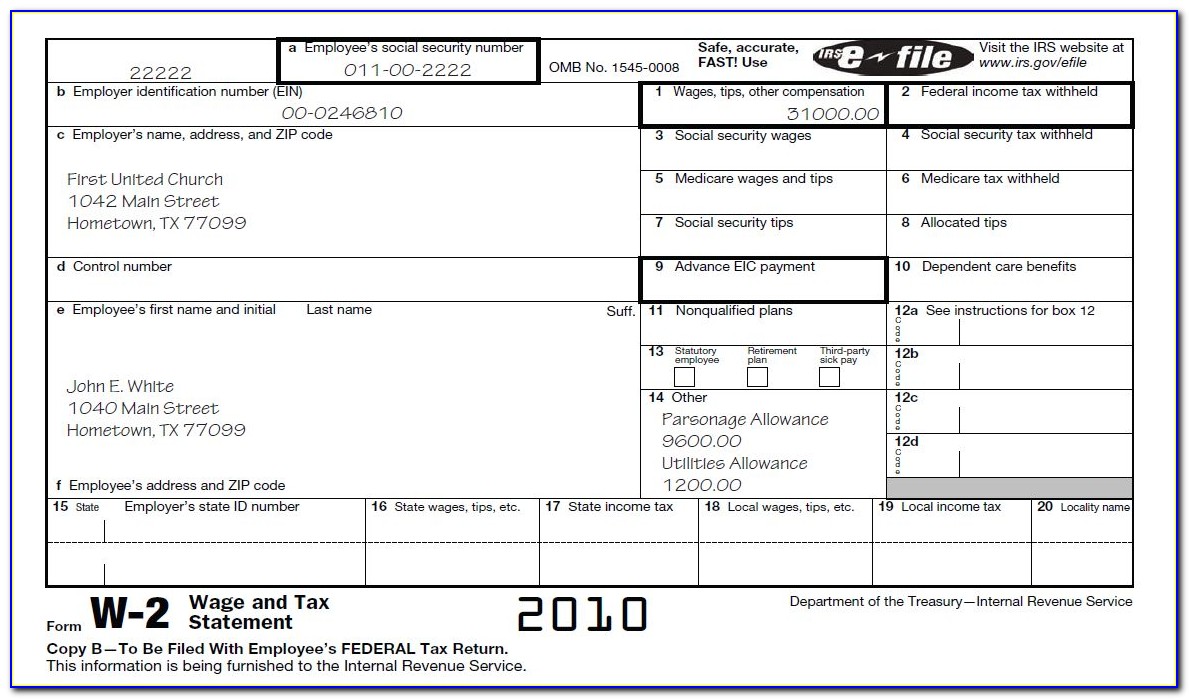

Alabama W2 Form

Alabama W2 Form - O efficient —avoid possible delays and errors that can occur. This form is for income earned in tax. Enter your employer information such. Web my alabama taxes allows filers to manually enter wage and tax information (forms w2 and 1099s with alabama income tax withheld) with no limit on the number of returns or. Select your tax year 5. Web the alabama w2 forms electronic filing format follows the specifications outlined in alabama form 10 and follows the layout of the ssa efw2 fields with the rs records. In lieu of alabama form 99 and form 96,. The state of alabama requires additional forms to file along with form w2. Web we last updated the schedule of wages, salaries, tips, etc in january 2023, so this is the latest version of schedule w2, fully updated for tax year 2022. O secure —protected by mybama login credentials.

Go to employee dashboard 2. Enter your employer information such. The state of alabama requires additional forms to file along with form w2. This includes your total wages earned, and the amount of federal and. In lieu of alabama form 99 and form 96,. Select your tax year 5. O secure —protected by mybama login credentials. This form is for income earned in tax. Web we last updated the schedule of wages, salaries, tips, etc in january 2023, so this is the latest version of schedule w2, fully updated for tax year 2022. Web the alabama w2 forms electronic filing format follows the specifications outlined in alabama form 10 and follows the layout of the ssa efw2 fields with the rs records.

Enter your employer information such. In lieu of alabama form 99 and form 96,. This form is for income earned in tax. The state of alabama requires additional forms to file along with form w2. Go to employee dashboard 2. Web my alabama taxes allows filers to manually enter wage and tax information (forms w2 and 1099s with alabama income tax withheld) with no limit on the number of returns or. This includes your total wages earned, and the amount of federal and. O efficient —avoid possible delays and errors that can occur. Web you can download the al_w2report_check.xls (updated january 27, 2015) to check your w2 file for errors before uploading to my alabama taxes. Web more about the alabama schedule w2 we last updated alabama schedule w2 in january 2023 from the alabama department of revenue.

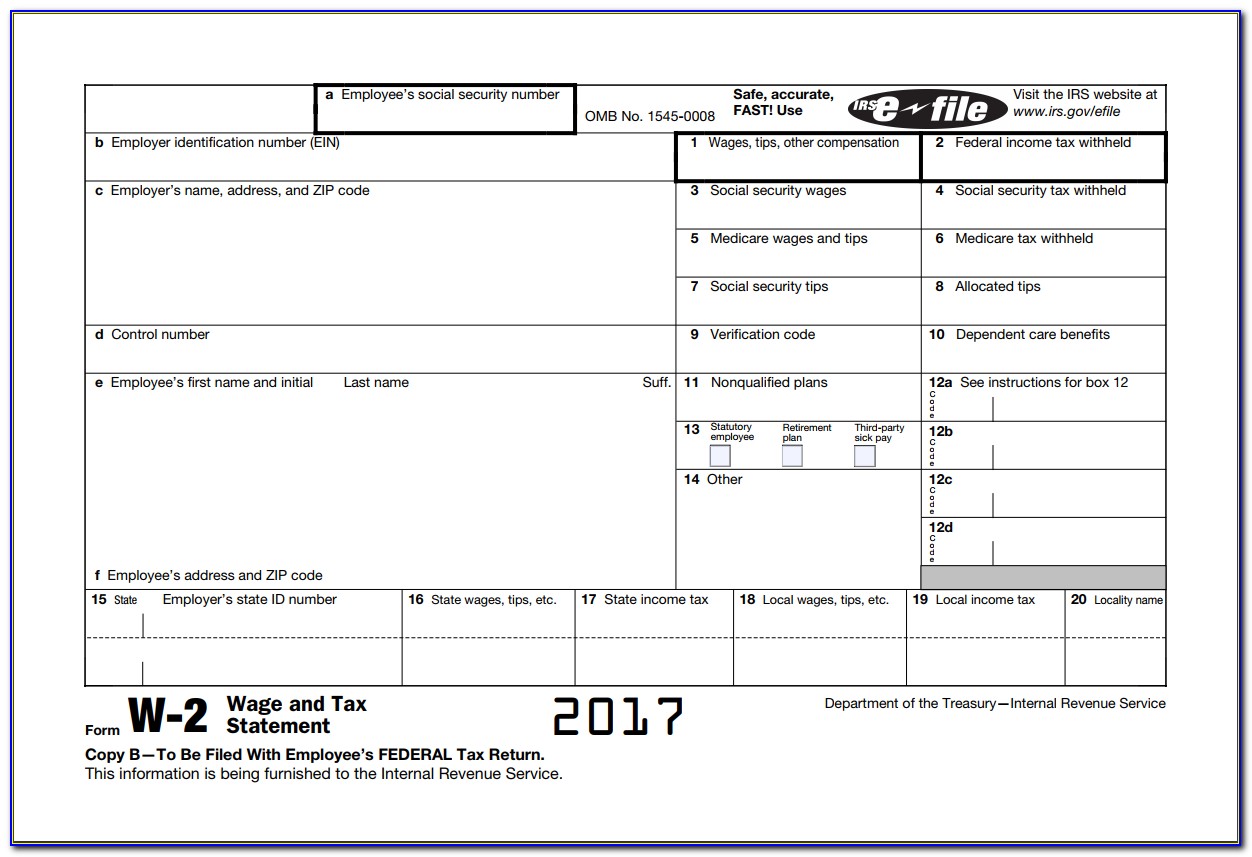

Alabama W2 Form 2017 Form Resume Examples q25ZjY350o

Web you can download the al_w2report_check.xls (updated january 27, 2015) to check your w2 file for errors before uploading to my alabama taxes. This includes your total wages earned, and the amount of federal and. Select your tax year 5. O secure —protected by mybama login credentials. This form is for income earned in tax.

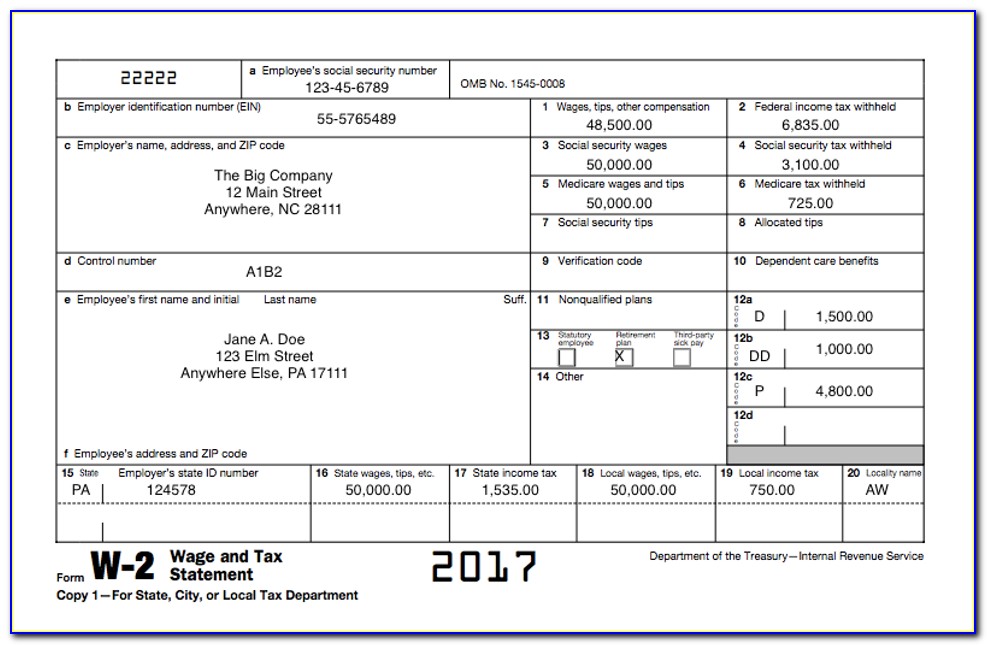

How To Get W2 Forms From Previous Employers Form Resume Examples

O efficient —avoid possible delays and errors that can occur. This form is for income earned in tax. Web my alabama taxes allows filers to manually enter wage and tax information (forms w2 and 1099s with alabama income tax withheld) with no limit on the number of returns or. Web you can download the al_w2report_check.xls (updated january 27, 2015) to.

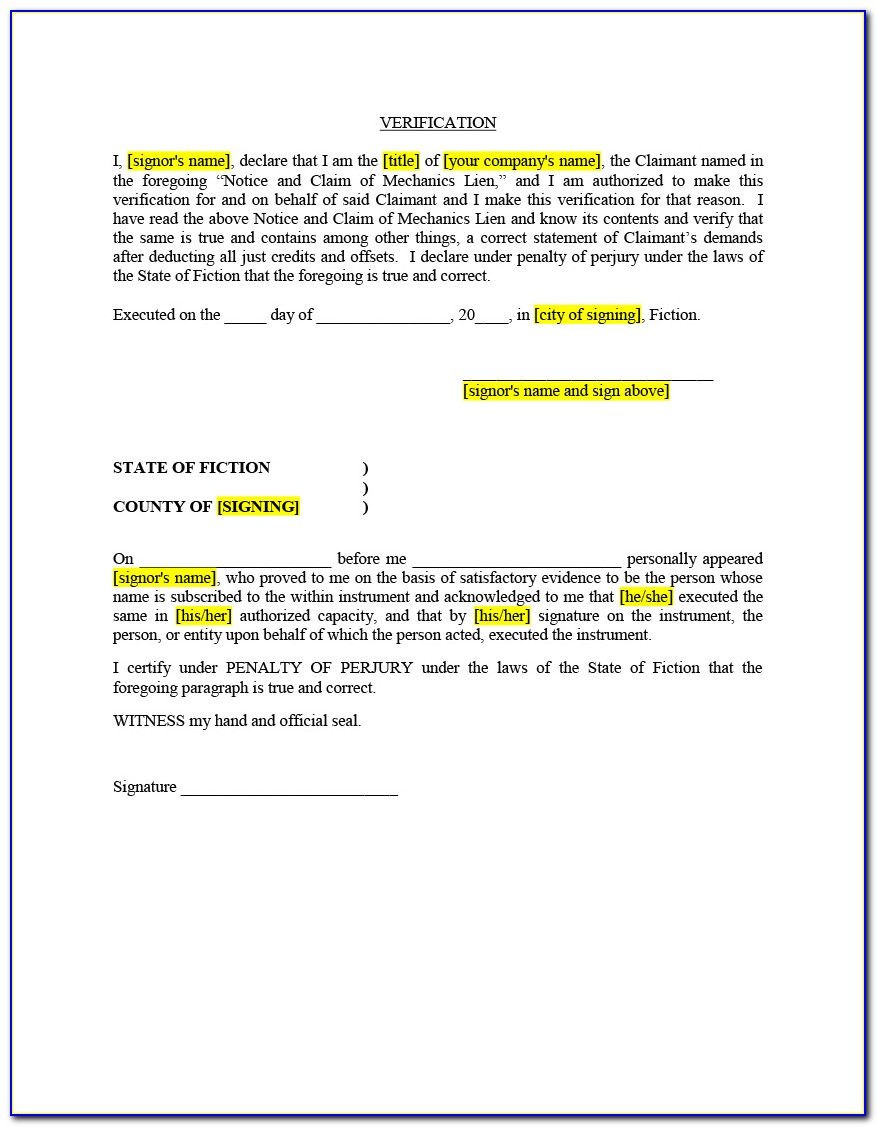

Unlawful Detainer Form Alabama Form Resume Examples 86O7BJa5BR

Web you can download the al_w2report_check.xls (updated january 27, 2015) to check your w2 file for errors before uploading to my alabama taxes. This form is for income earned in tax. Web my alabama taxes allows filers to manually enter wage and tax information (forms w2 and 1099s with alabama income tax withheld) with no limit on the number of.

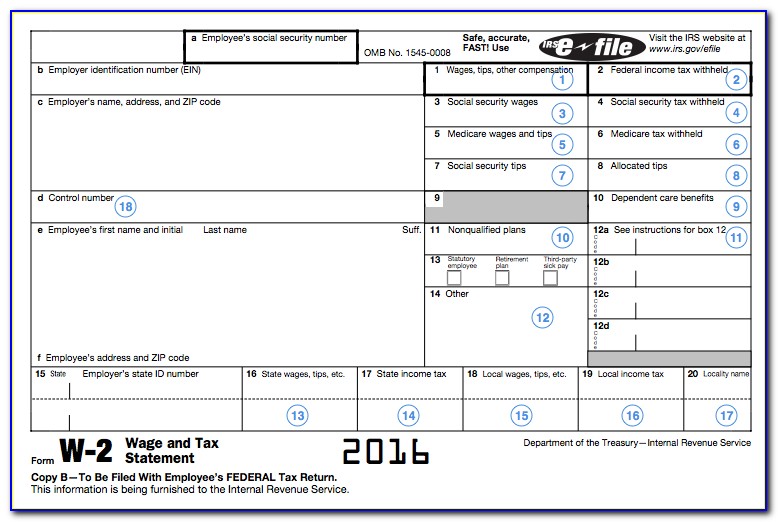

Alabama W2 Form Form Resume Examples Vj1yRxNKyl

O secure —protected by mybama login credentials. Go to employee dashboard 2. In lieu of alabama form 99 and form 96,. Web we last updated the schedule of wages, salaries, tips, etc in january 2023, so this is the latest version of schedule w2, fully updated for tax year 2022. Select your tax year 5.

Qmb Application Form Alabama Form Resume Examples 9x8rbEY8dR

Web you can download the al_w2report_check.xls (updated january 27, 2015) to check your w2 file for errors before uploading to my alabama taxes. The state of alabama requires additional forms to file along with form w2. Go to employee dashboard 2. Web more about the alabama schedule w2 we last updated alabama schedule w2 in january 2023 from the alabama.

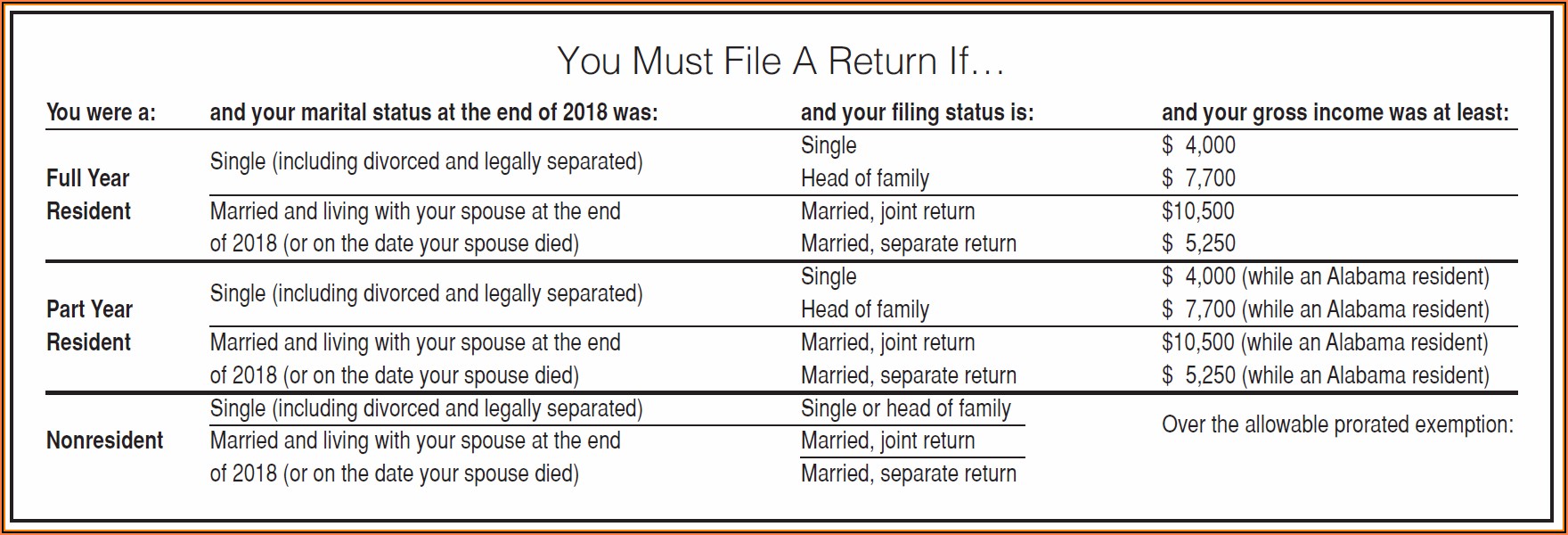

Alabama W2 Form 2018 Form Resume Examples pv9wpBOY7A

Web more about the alabama schedule w2 we last updated alabama schedule w2 in january 2023 from the alabama department of revenue. This includes your total wages earned, and the amount of federal and. In lieu of alabama form 99 and form 96,. Web the alabama w2 forms electronic filing format follows the specifications outlined in alabama form 10 and.

Alabama W2 Form Form Resume Examples Vj1yRxNKyl

Web the alabama w2 forms electronic filing format follows the specifications outlined in alabama form 10 and follows the layout of the ssa efw2 fields with the rs records. In lieu of alabama form 99 and form 96,. This form is for income earned in tax. Web more about the alabama schedule w2 we last updated alabama schedule w2 in.

Alabama W2 Form 2018 Form Resume Examples K75PNPGkl2

Web more about the alabama schedule w2 we last updated alabama schedule w2 in january 2023 from the alabama department of revenue. Web you can download the al_w2report_check.xls (updated january 27, 2015) to check your w2 file for errors before uploading to my alabama taxes. The state of alabama requires additional forms to file along with form w2. This form.

Alabama W2 Form 2017 Form Resume Examples q25ZjY350o

O efficient —avoid possible delays and errors that can occur. This form is for income earned in tax. Web we last updated the schedule of wages, salaries, tips, etc in january 2023, so this is the latest version of schedule w2, fully updated for tax year 2022. Web my alabama taxes allows filers to manually enter wage and tax information.

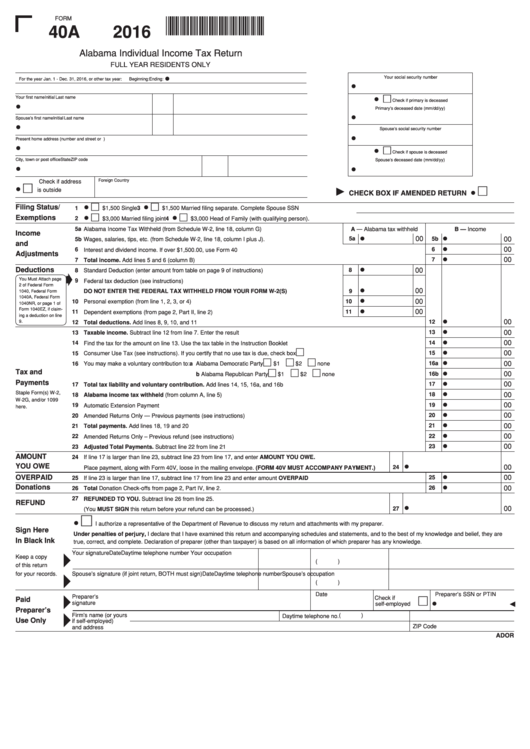

Printable Alabama Form 40 2021 Printable World Holiday

Enter your employer information such. O efficient —avoid possible delays and errors that can occur. This form is for income earned in tax. In lieu of alabama form 99 and form 96,. Web we last updated the schedule of wages, salaries, tips, etc in january 2023, so this is the latest version of schedule w2, fully updated for tax year.

Go To Employee Dashboard 2.

Web my alabama taxes allows filers to manually enter wage and tax information (forms w2 and 1099s with alabama income tax withheld) with no limit on the number of returns or. Web more about the alabama schedule w2 we last updated alabama schedule w2 in january 2023 from the alabama department of revenue. This form is for income earned in tax. O secure —protected by mybama login credentials.

In Lieu Of Alabama Form 99 And Form 96,.

Enter your employer information such. Web we last updated the schedule of wages, salaries, tips, etc in january 2023, so this is the latest version of schedule w2, fully updated for tax year 2022. Web the alabama w2 forms electronic filing format follows the specifications outlined in alabama form 10 and follows the layout of the ssa efw2 fields with the rs records. The state of alabama requires additional forms to file along with form w2.

O Efficient —Avoid Possible Delays And Errors That Can Occur.

Web you can download the al_w2report_check.xls (updated january 27, 2015) to check your w2 file for errors before uploading to my alabama taxes. This includes your total wages earned, and the amount of federal and. Select your tax year 5.