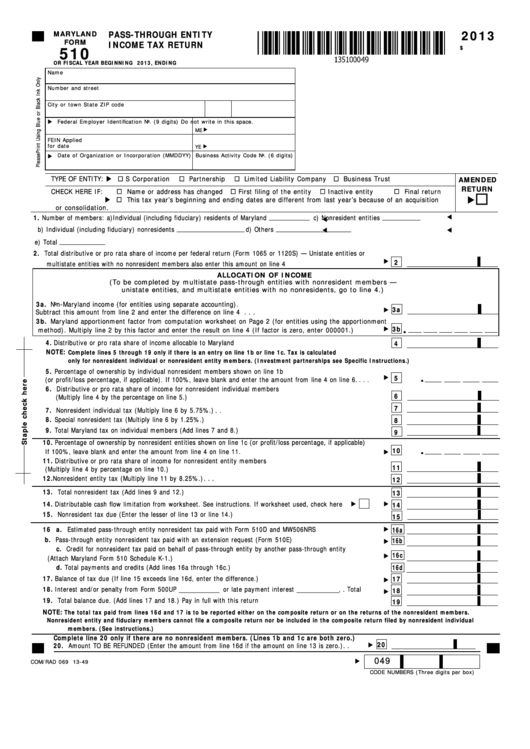

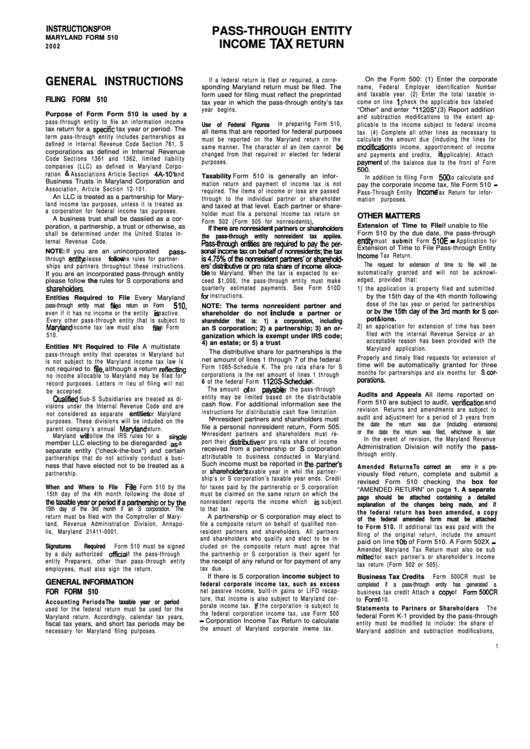

Maryland 510 Form

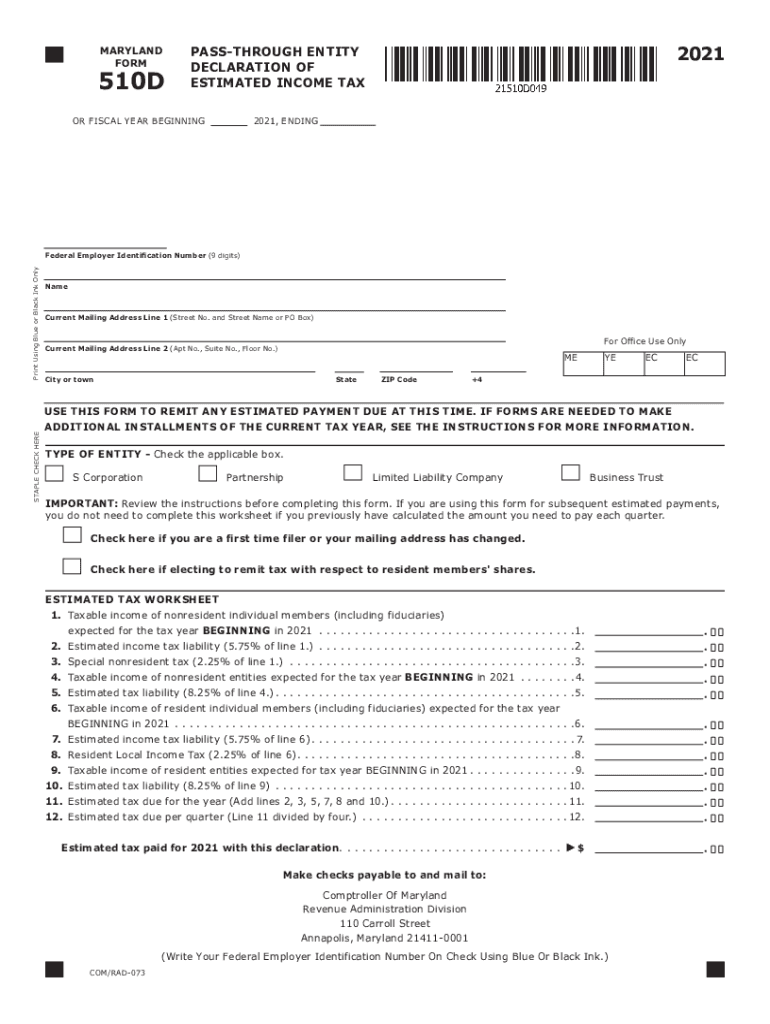

Maryland 510 Form - This form is for income earned in tax year 2022, with tax returns due in april. Resident individuals income tax forms electronic filing signature and payment. Web income tax, also file form 510. You can download or print current. Web do you need to file for an extension request? Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021. Check here if electing to remit tax on behalf of resident. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland. Welcome to the comptroller of maryland's internet extension request filing system.

Complete, edit or print tax forms instantly. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april. This form may be used if the pte is paying tax only on. This form is for income earned in tax year 2022, with tax returns due in april. Web forms are available for downloading in the resident individuals income tax forms section below. Check here if electing to remit tax on behalf of resident. This system allows instant online electronic. Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021. Resident individuals income tax forms electronic filing signature and payment.

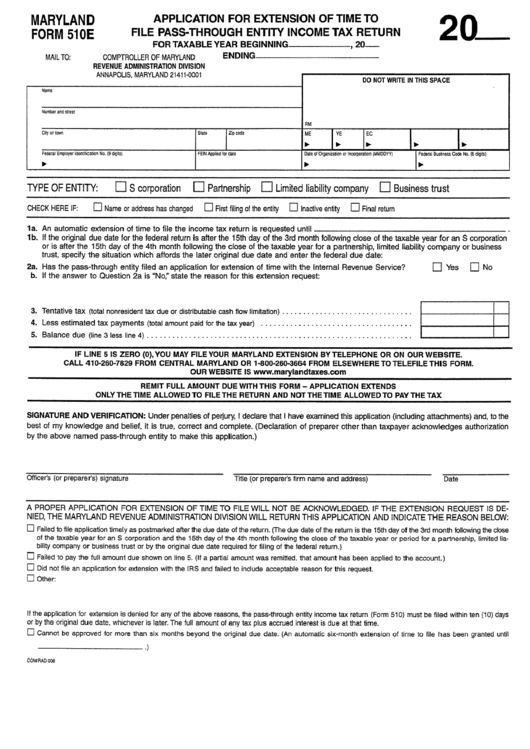

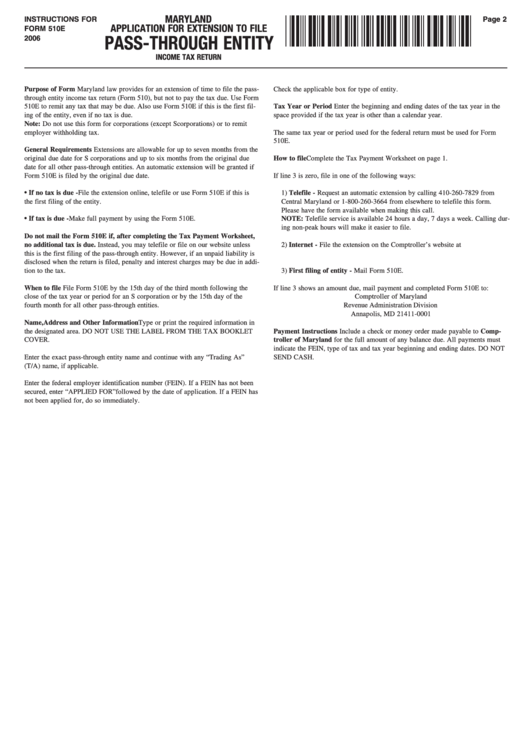

Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland. Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021. Web form 510e is a maryland corporate income tax form. Resident individuals income tax forms electronic filing signature and payment. Register and subscribe now to work on your md form 510d & more fillable forms. Web do you need to file for an extension request? Payments made with the previously filed form. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation.

Maryland Form 510e Application For Extension Of Time To File Pass

Web we last updated maryland form 510d in january 2023 from the maryland comptroller of maryland. This form is for income earned in tax year 2022, with tax returns due in april. Check here if electing to remit tax on behalf of resident. Web 510c filed this tax year's beginning and ending dates are different from last year's due to.

B E E G Fill Out and Sign Printable PDF Template signNow

Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. Register and subscribe now to work on your md form 510d & more fillable forms. Every other pte that is subject to maryland income tax law must also file form 510. Web 510c filed this tax year's beginning and.

Jv 510 Fill Online, Printable, Fillable, Blank PDFfiller

Resident individuals income tax forms electronic filing signature and payment. Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. Web income tax, also file form 510. This form is for income earned in tax year 2022, with tax returns due in april. Web do you need to file.

Fillable Maryland Form 510 PassThrough Entity Tax Return

Welcome to the comptroller of maryland's internet extension request filing system. Web this affirms the instructions for 2023 maryland form 510/511d: Web forms are available for downloading in the resident individuals income tax forms section below. This form is for income earned in tax year 2022, with tax returns due in april. Every other pte that is subject to maryland.

20122022 Form MD App for CDS Registration Fill Online, Printable

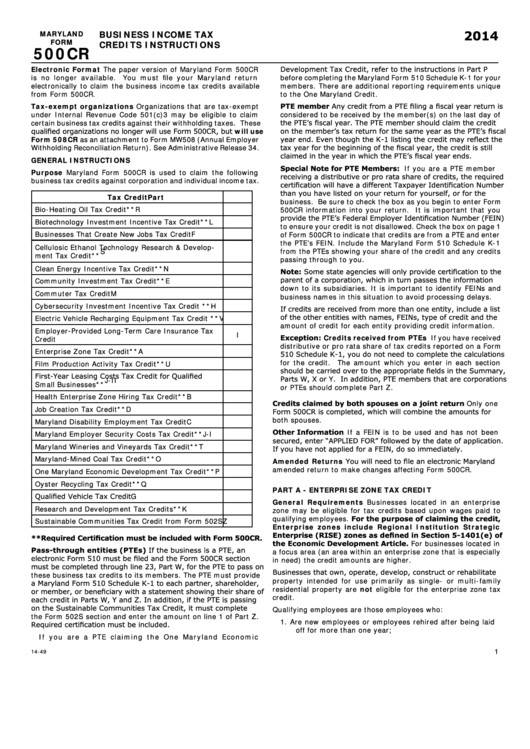

This form may be used if the pte is paying tax only on. Web forms are available for downloading in the resident individuals income tax forms section below. Check here if electing to remit tax on behalf of resident. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to.

Instructions For Maryland Form 510 PassThrough Entity Tax

Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021. Complete, edit or print tax forms instantly. Web income tax, also file form 510. Every other pte that is subject to maryland income tax law must also file form 510. Payments made with the previously filed form.

elliemeyersdesigns Maryland Form 510

Payments made with the previously filed form. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Web forms are available for downloading in the resident individuals income tax forms section below. Maryland has a special nonresident tax that the pte must pay on behalf of its nonresident individual members on form 510. This.

Md 510D Fill Out and Sign Printable PDF Template signNow

Web this affirms the instructions for 2023 maryland form 510/511d: Payments made with the previously filed form. Web form 510e is a maryland corporate income tax form. Web income tax, also file form 510. Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland.

Instructions For Form 510e Maryland Application For Extension To File

Web forms are available for downloading in the resident individuals income tax forms section below. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Every other pte that is subject to maryland income tax law must also file form 510..

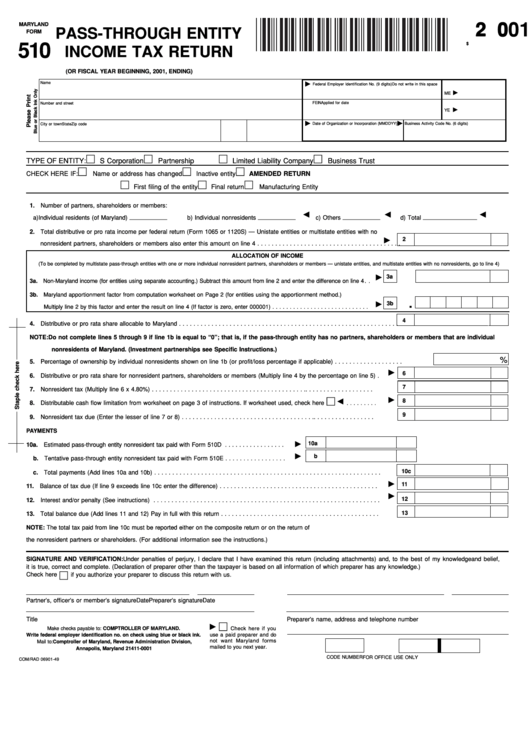

Fillable Form 510 PassThrough Entity Tax Return 2001

Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland. Check here if electing to remit tax on behalf of resident. Register and subscribe now to work on your md form 510d & more fillable forms. Web income tax, also file form 510. You can download or print current.

Maryland Has A Special Nonresident Tax That The Pte Must Pay On Behalf Of Its Nonresident Individual Members On Form 510.

Web do you need to file for an extension request? The special nonresident tax is. This system allows instant online electronic. Web taxpayers that have already made the pte election by filing form 510 should file form 511 before september 15, 2021.

Web Form 510E Is A Maryland Corporate Income Tax Form.

Register and subscribe now to work on your md form 510d & more fillable forms. Payments made with the previously filed form. You can download or print current. Web file maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members.

This Form May Be Used If The Pte Is Paying Tax Only On.

Web income tax, also file form 510. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. Web this affirms the instructions for 2023 maryland form 510/511d: Web we last updated maryland form 510 in january 2023 from the maryland comptroller of maryland.

Web 510C Filed This Tax Year's Beginning And Ending Dates Are Different From Last Year's Due To An Acquisition Or Consolidation.

Welcome to the comptroller of maryland's internet extension request filing system. This form is for income earned in tax year 2022, with tax returns due in april. Every other pte that is subject to maryland income tax law must also file form 510. Web maryland pte must file form 510, even if it has no income or the entity is inactive.