Arkansas State Tax Form 2022 Pdf

Arkansas State Tax Form 2022 Pdf - While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web from your old home. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Web we last updated the interest and dividend schedule in january 2023, so this is the latest version of form ar4, fully updated for tax year 2022. Web ar1000es individual estimated tax vouchers for 2021. Be sure to verify that the form. Ar1023ct application for income tax exempt status. For tax year 2022, you will use form 1040. Web form 1040 is used by u.s. Web fillable pdf forms can be downloaded, or franchise taxes can be filed online, through the secretary of state’s website at www.sos.arkansas.gov.

If you make $70,000 a year living in arkansas you will be taxed $11,683. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax. Web arkansas has a state income tax that ranges between 2% and 6.6%. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web 26 rows arkansas has a state income tax that ranges between 2% and 6.6%, which is. Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Web from your old home. Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue.

Ar1023ct application for income tax exempt status. If you were reimbursed for any part of your moving expenses and the amount was included on your. Web 2022_ar3_bc.pdf ar3 print form clear form 2022 itid221 arkansas individual income tax itemized deductions primary’s legal name primary’s. This form is for income earned in tax year 2022, with tax. Complete, edit or print tax forms instantly. Web forms to obtain forms and instructions you may: If you make $70,000 a year living in arkansas you will be taxed $11,683. You must attach a completed copy of federal form 3903. Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. Web fillable pdf forms can be downloaded, or franchise taxes can be filed online, through the secretary of state’s website at www.sos.arkansas.gov.

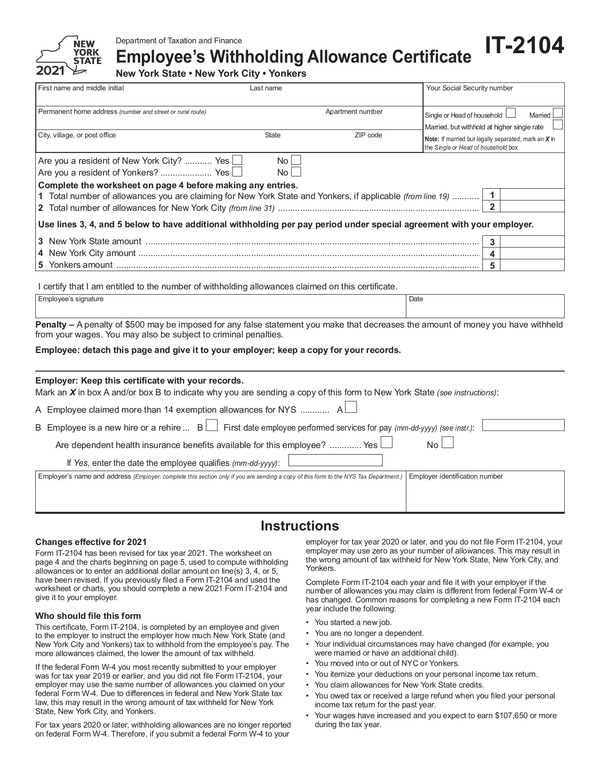

IRS W4 Form 2022 Printable PDF Explained! 2022 W4 Form

Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. Be sure to verify that the form. Web franchise tax / annual report forms. This form is for income earned in tax year 2022, with tax. Download or email ar1000f & more fillable forms, register and subscribe now!

Arkansas State Tax Withholding Tables 2018

Web from your old home. Web arkansas has a state income tax that ranges between 2% and 6.6%. Many people will only need to file form 1040. For tax year 2022, you will use form 1040. You can download or print current.

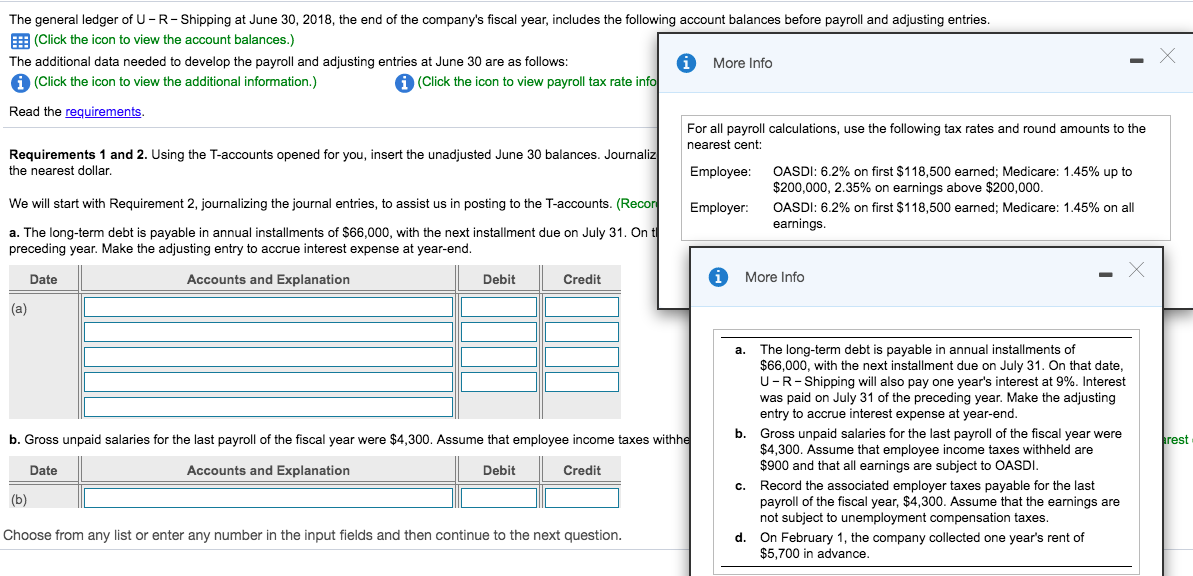

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 1040 is used by u.s. Ad discover 2290 form due dates for heavy use vehicles placed into service. Web from your old home. Web we last updated the interest and dividend schedule in january 2023, so this is the latest version of form ar4, fully updated for tax year 2022. Web prices of the fuels during 2022 as.

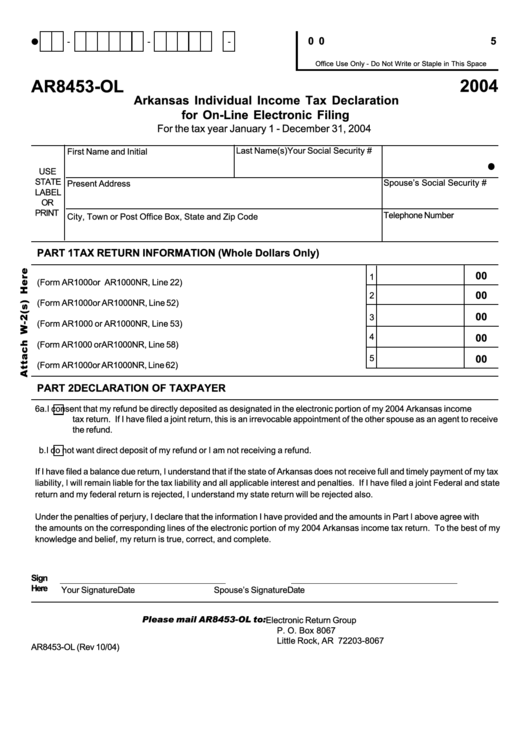

Form Ar8453Ol Arkansas Individual Tax Declaration For OnLine

Complete, edit or print tax forms instantly. Many people will only need to file form 1040. If you were reimbursed for any part of your moving expenses and the amount was included on your. Web we last updated the interest and dividend schedule in january 2023, so this is the latest version of form ar4, fully updated for tax year.

Tax Return About Tax Return

Download or email ar1000f & more fillable forms, register and subscribe now! While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Register and subscribe now to work on your ar ar2210a form & more fillable forms. Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue..

Nj State Withholding Form 2022

Web franchise tax / annual report forms. Complete, edit or print tax forms instantly. Ad discover 2290 form due dates for heavy use vehicles placed into service. If you were reimbursed for any part of your moving expenses and the amount was included on your. Taxpayers to file an annual income tax return.

Military Tax Exempt form Professional Earned In E is Taxed Differently

Web fillable pdf forms can be downloaded, or franchise taxes can be filed online, through the secretary of state’s website at www.sos.arkansas.gov. Complete, edit or print tax forms instantly. Web from your old home. Web prices of the fuels during 2022 as published by the energy information administration of the united. Ar1036 employee tuition reimbursement tax credit.

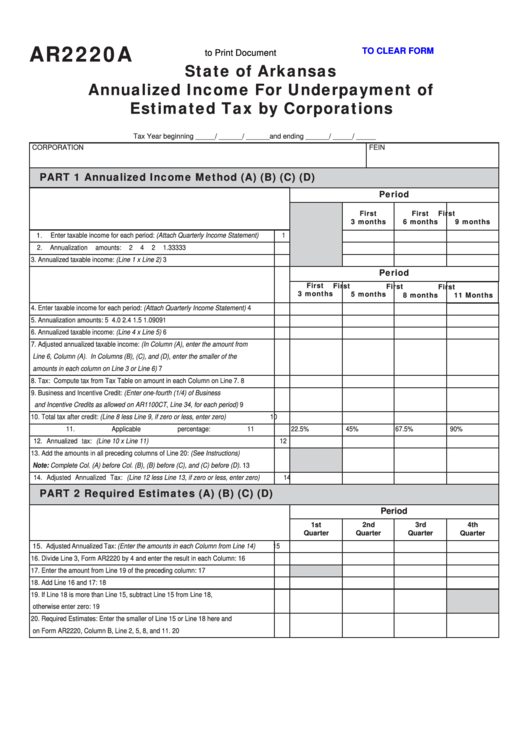

Fillable Form Ar2220a Annualized For Underpayment Of Estimated

Download or email ar1000f & more fillable forms, register and subscribe now! Web prices of the fuels during 2022 as published by the energy information administration of the united. Complete, edit or print tax forms instantly. For tax year 2022, you will use form 1040. Taxpayers to file an annual income tax return.

Arkansas State Tax Withholding Tables 2018

Download or email ar1000f & more fillable forms, register and subscribe now! Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. Web franchise tax / annual report forms. If you were reimbursed for any part of your moving expenses and the amount was included on your. Web we last updated the interest.

Military Tax Exempt form Wonderful Arkansas State Tax software

This form is for income earned in tax year 2022, with tax. Web arkansas has a state income tax that ranges between 2% and 6.6%. Web we last updated the interest and dividend schedule in january 2023, so this is the latest version of form ar4, fully updated for tax year 2022. Ad discover 2290 form due dates for heavy.

Many People Will Only Need To File Form 1040.

If you make $70,000 a year living in arkansas you will be taxed $11,683. Complete, edit or print tax forms instantly. Be sure to verify that the form. Taxpayers to file an annual income tax return.

Ar1023Ct Application For Income Tax Exempt Status.

Web form ar1000es is an arkansas individual income tax form. Web ar1000es individual estimated tax vouchers for 2021. Web we last updated arkansas tax instruction booklet in january 2023 from the arkansas department of revenue. You can download or print current.

If You Were Reimbursed For Any Part Of Your Moving Expenses And The Amount Was Included On Your.

Web arkansas has a state income tax that ranges between 2% and 6.6%. Download or email ar1000f & more fillable forms, register and subscribe now! Web from your old home. This form is for income earned in tax year 2022, with tax.

Download This Form Print This Form More About The.

Ar4506 request for copies of arkansas tax return (s) 01/09/2023. Web forms to obtain forms and instructions you may: For tax year 2022, you will use form 1040. Register and subscribe now to work on your ar ar2210a form & more fillable forms.