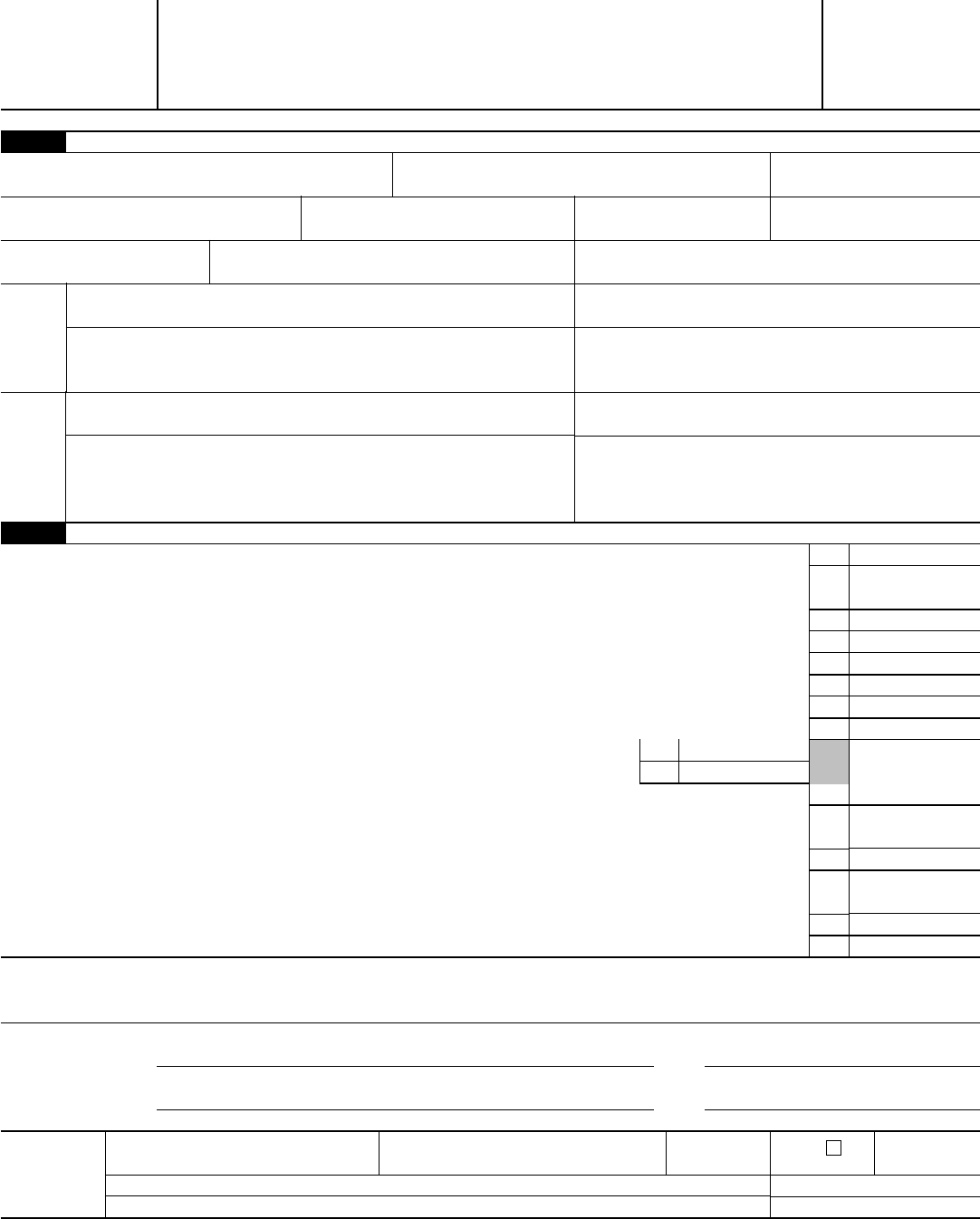

Ct 706 Nt Form

Ct 706 Nt Form - Web follow the simple instructions below: Is the estate required to file a. If the tax period started unexpectedly or maybe you just forgot about it, it could probably cause problems for you. Was a disclaimer filed in this estate if yes submit a copy of each disclaimer. At the time of death, did the decedent own or have an interest in any of the following sole ownership property? Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. If yes, report the a. Real estate yes no b. If there is more than one fiduciary,. Web up to $40 cash back related to how to fill out form ct 706 nt ct 706 nt 11.

Our platform gives you a rich variety. Web in order for form ct‐706 nt to be considered a complete return copies of the following documents must be attached: If the tax period started unexpectedly or maybe you just forgot about it, it could probably cause problems for you. • for each decedent who, at the time of death, was a nonresident. If yes, report the a. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. Web up to $40 cash back related to how to fill out form ct 706 nt ct 706 nt 11. If there is more than one fiduciary,. Is the estate required to file a. 2021 application for estate and gift tax return filing extension and for estate tax.

Was a disclaimer filed in this estate if yes submit a copy of each disclaimer. Is the estate required to file a. Real estate yes no b. If yes, report the a. 2021 application for estate and gift tax return filing extension and for estate tax. Recorded deed for any real property. If there is more than one fiduciary,. If the tax period started unexpectedly or maybe you just forgot about it, it could probably cause problems for you. Web where applicable, the code will link directly to information on the type of probate matter associated with the form. • for each decedent who, at the time of death, was a nonresident.

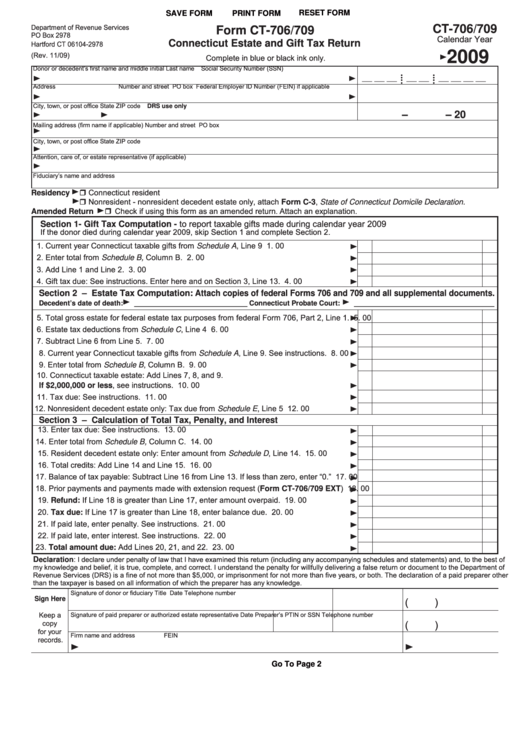

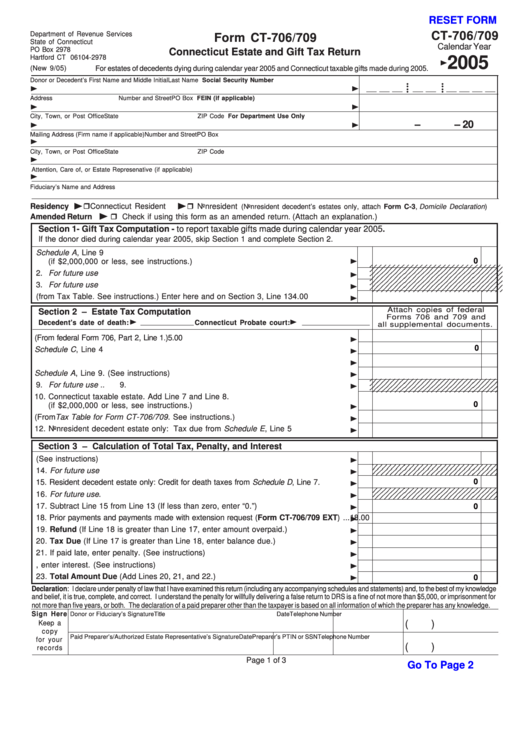

Fillable Form Ct706/709 Connecticut Estate And Gift Tax Return

If the tax period started unexpectedly or maybe you just forgot about it, it could probably cause problems for you. Real estate yes no b. Web up to $40 cash back related to how to fill out form ct 706 nt ct 706 nt 11. Our platform gives you a rich variety. Is the estate required to file a.

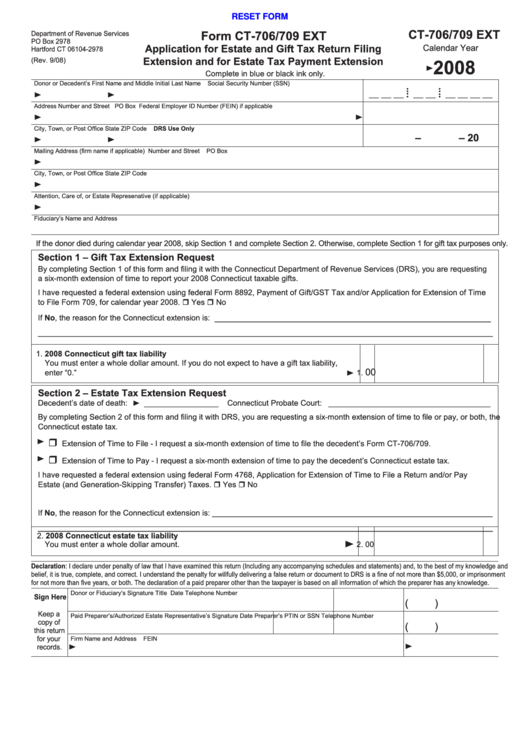

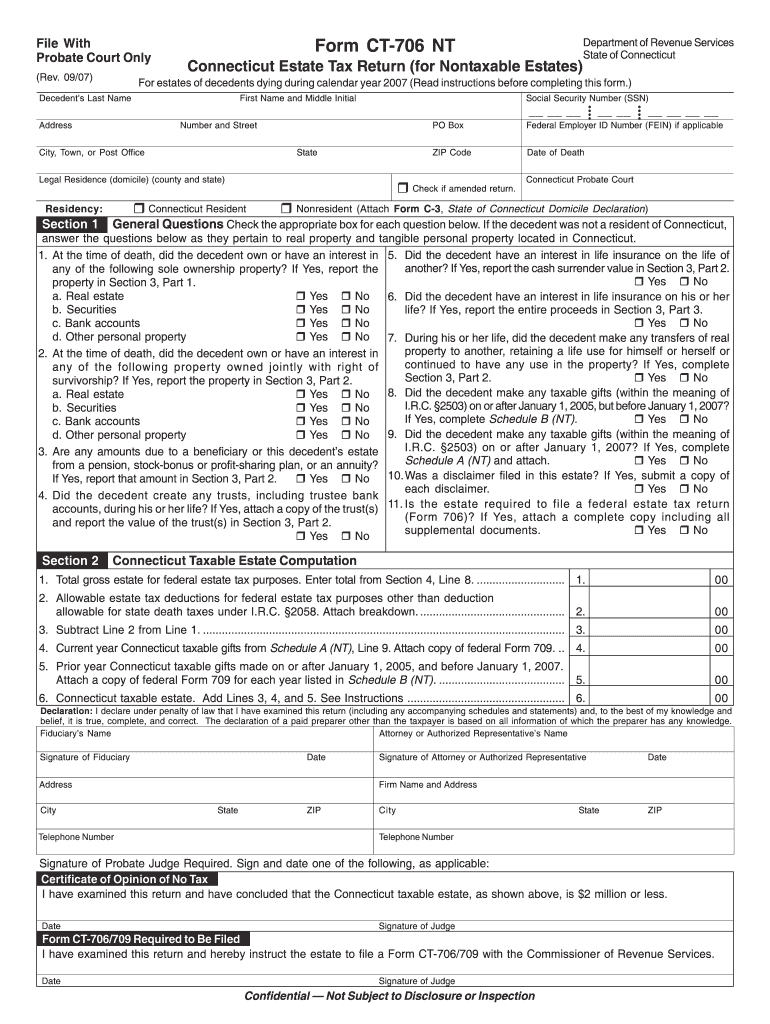

Fillable Form Ct 706/709 Ext Application For Estate And Gift Tax

• for each decedent who, at the time of death, was a nonresident. • each decedent who, at the time of death, was a connecticut resident; 2021 application for estate and gift tax return filing extension and for estate tax. Web where applicable, the code will link directly to information on the type of probate matter associated with the form..

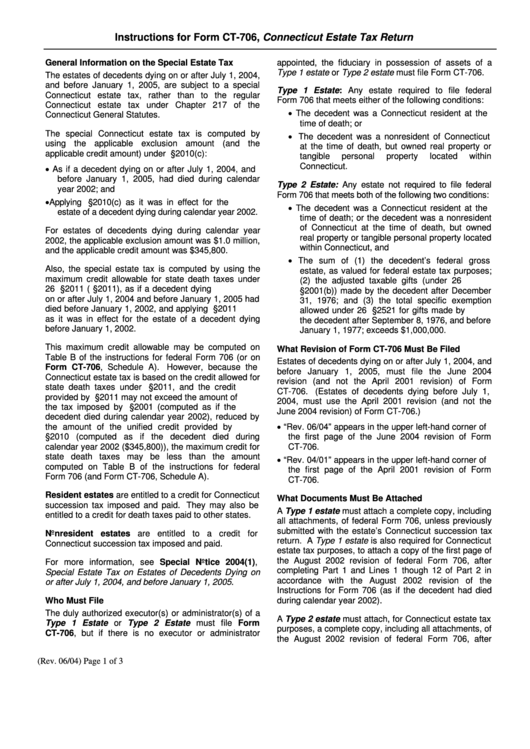

Instructions For Form Ct706, Connecticut Estate Tax Return printable

If there is more than one fiduciary,. Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Web up to $40 cash back related to how to fill out form ct 706 nt ct 706 nt 11. Web follow the simple instructions below: If the tax period started unexpectedly.

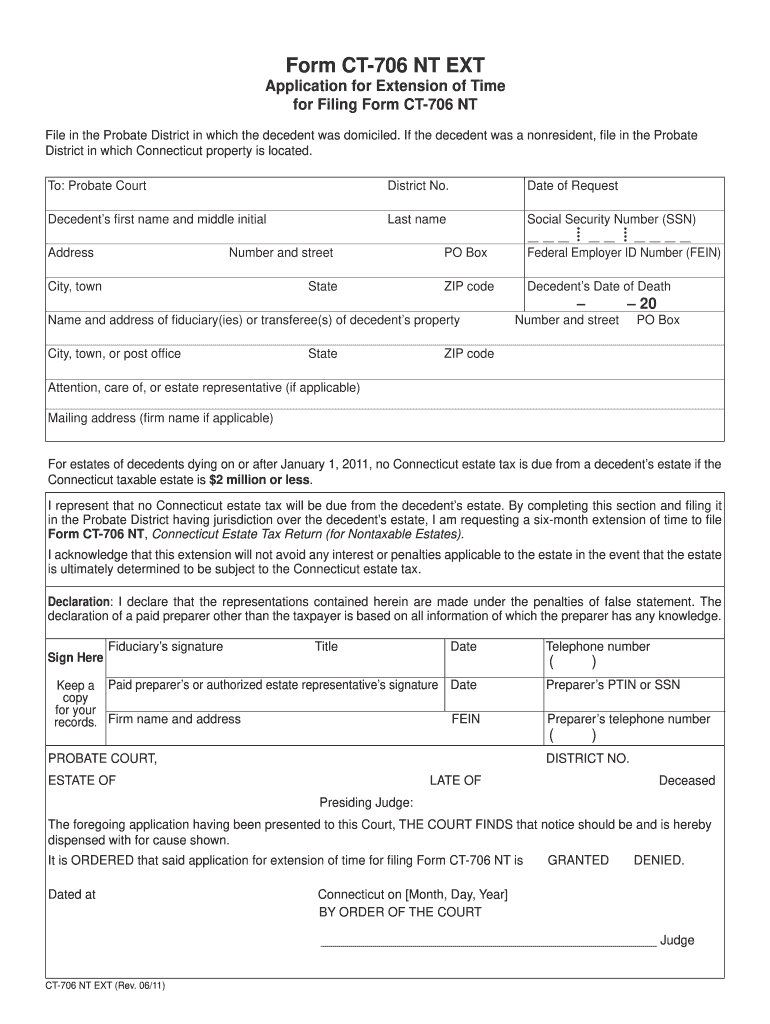

2011 Form CT DRS CT706 NT EXT Fill Online, Printable, Fillable, Blank

If yes, report the a. Web up to $40 cash back related to how to fill out form ct 706 nt ct 706 nt 11. If there is more than one fiduciary,. Web follow the simple instructions below: Was a disclaimer filed in this estate if yes submit a copy of each disclaimer.

Fillable Form Ct706/709 Connecticut Estate And Gift Tax Return

Was a disclaimer filed in this estate if yes submit a copy of each disclaimer. Our platform gives you a rich variety. Web follow the simple instructions below: Real estate yes no b. If the tax period started unexpectedly or maybe you just forgot about it, it could probably cause problems for you.

Form 706QDT U.S. Estate Tax Return for Qualified Domestic Trusts

Web follow the simple instructions below: • each decedent who, at the time of death, was a connecticut resident; Real estate yes no b. Our platform gives you a rich variety. At the time of death, did the decedent own or have an interest in any of the following sole ownership property?

Form 706NA Edit, Fill, Sign Online Handypdf

Web follow the simple instructions below: Recorded deed for any real property. Real estate yes no b. Web follow the simple instructions below: Is the estate required to file a.

2007 Form CT DRS CT706 NT Fill Online, Printable, Fillable, Blank

Web follow the simple instructions below: Web where applicable, the code will link directly to information on the type of probate matter associated with the form. If there is more than one fiduciary,. Was a disclaimer filed in this estate if yes submit a copy of each disclaimer. 2021 application for estate and gift tax return filing extension and for.

Ct 706 Nt 20202021 Fill and Sign Printable Template Online US

If the tax period started unexpectedly or maybe you just forgot about it, it could probably cause problems for you. 2021 application for estate and gift tax return filing extension and for estate tax. If yes, report the a. • each decedent who, at the time of death, was a connecticut resident; Web where applicable, the code will link directly.

Fillable Form Ct706/709 Ext Application For Estate And Gift Tax

If yes, report the a. Is the estate required to file a. Web follow the simple instructions below: Connecticut estate tax return (for nontaxable estates) for estates of decedents dying during calendar year 2017 (read instructions before completing this. Web where applicable, the code will link directly to information on the type of probate matter associated with the form.

Web Up To $40 Cash Back Related To How To Fill Out Form Ct 706 Nt Ct 706 Nt 11.

Web follow the simple instructions below: At the time of death, did the decedent own or have an interest in any of the following sole ownership property? Web follow the simple instructions below: Recorded deed for any real property.

Real Estate Yes No B.

• each decedent who, at the time of death, was a connecticut resident; 2021 application for estate and gift tax return filing extension and for estate tax. Was a disclaimer filed in this estate if yes submit a copy of each disclaimer. Web where applicable, the code will link directly to information on the type of probate matter associated with the form.

If The Tax Period Started Unexpectedly Or Maybe You Just Forgot About It, It Could Probably Cause Problems For You.

Web in order for form ct‐706 nt to be considered a complete return copies of the following documents must be attached: If yes, report the a. Is the estate required to file a. If there is more than one fiduciary,.

Connecticut Estate Tax Return (For Nontaxable Estates) For Estates Of Decedents Dying During Calendar Year 2017 (Read Instructions Before Completing This.

• for each decedent who, at the time of death, was a nonresident. Our platform gives you a rich variety.