Does A Single Member Llc Need To File Form 568

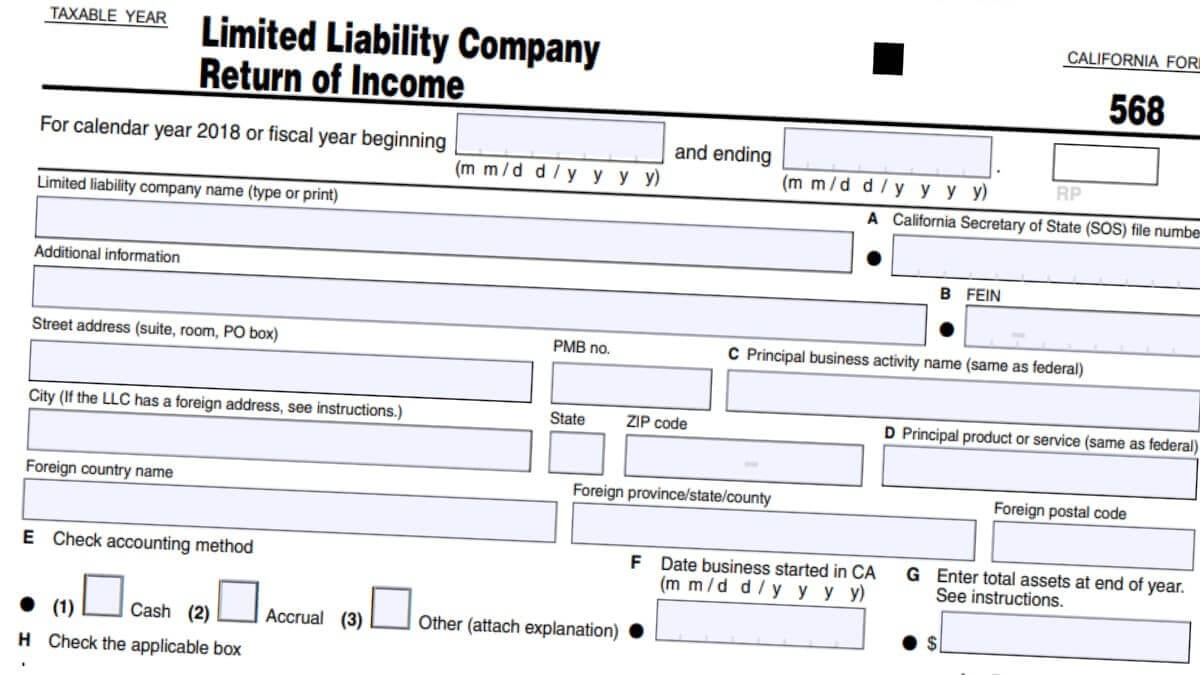

Does A Single Member Llc Need To File Form 568 - Web disregarded single member limited liability companies still must file form 568, although they only need to complete a small portion of it. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web file a tax return (form 568) pay the llc annual tax. Web common questions about partnership ca form 568 for single member llcs. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web form 568 is a tax return that many california limited liability companies (llcs) must file. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If you are married, you and your spouse are considered one owner and can. An llc may be classified for tax purposes as a partnership, a.

While similar to a sole proprietorship, this llc provides additional tax benefits and. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web the llc’s taxable year is 15 days or less. If you are married, you and your spouse are considered one owner and can. Web if your llc has one owner, you're a single member limited liability company (smllc). Ad protect your personal assets with a free llc—just pay state filing fees. Pay the llc fee (if applicable) items of income, deduction, and credit (after applying appropriate limitations) from the smllc. Web form 568 is a tax return that many california limited liability companies (llcs) must file. Open the federal information worksheet.; Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t.

However, in california, smllcs are considered separate legal. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web form 568 is a tax return that many california limited liability companies (llcs) must file. However, a single member llc only needs to. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Per the ca ftb limited liability. If you are married, you and your spouse are considered one owner and can. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Ad protect your personal assets with a free llc—just pay state filing fees.

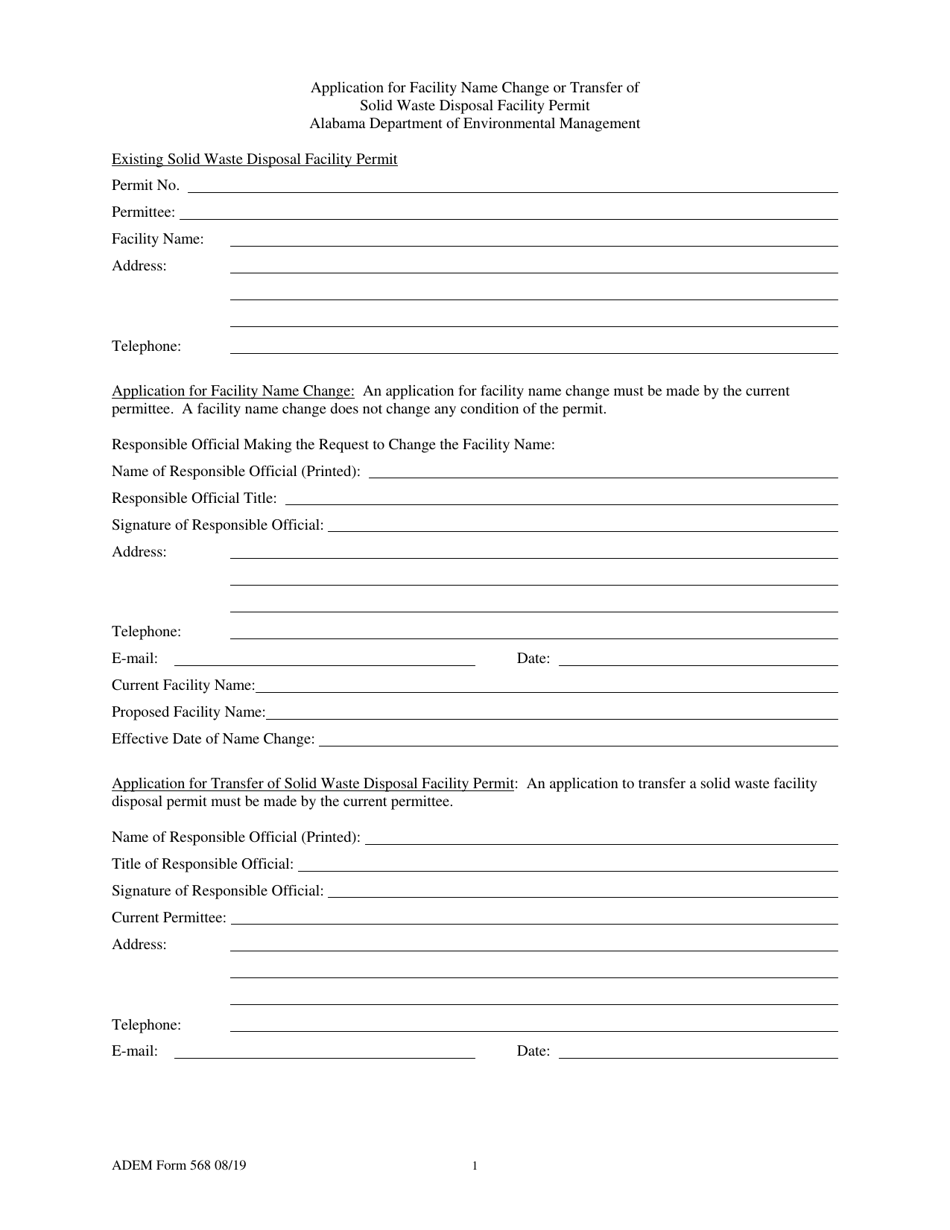

ADEM Form 568 Download Printable PDF or Fill Online Application for

To complete california form 568 for a partnership, from the. Below are solutions to frequently. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Complete schedule iw, llc income worksheet (on. An llc may be classified for tax purposes as a partnership, a.

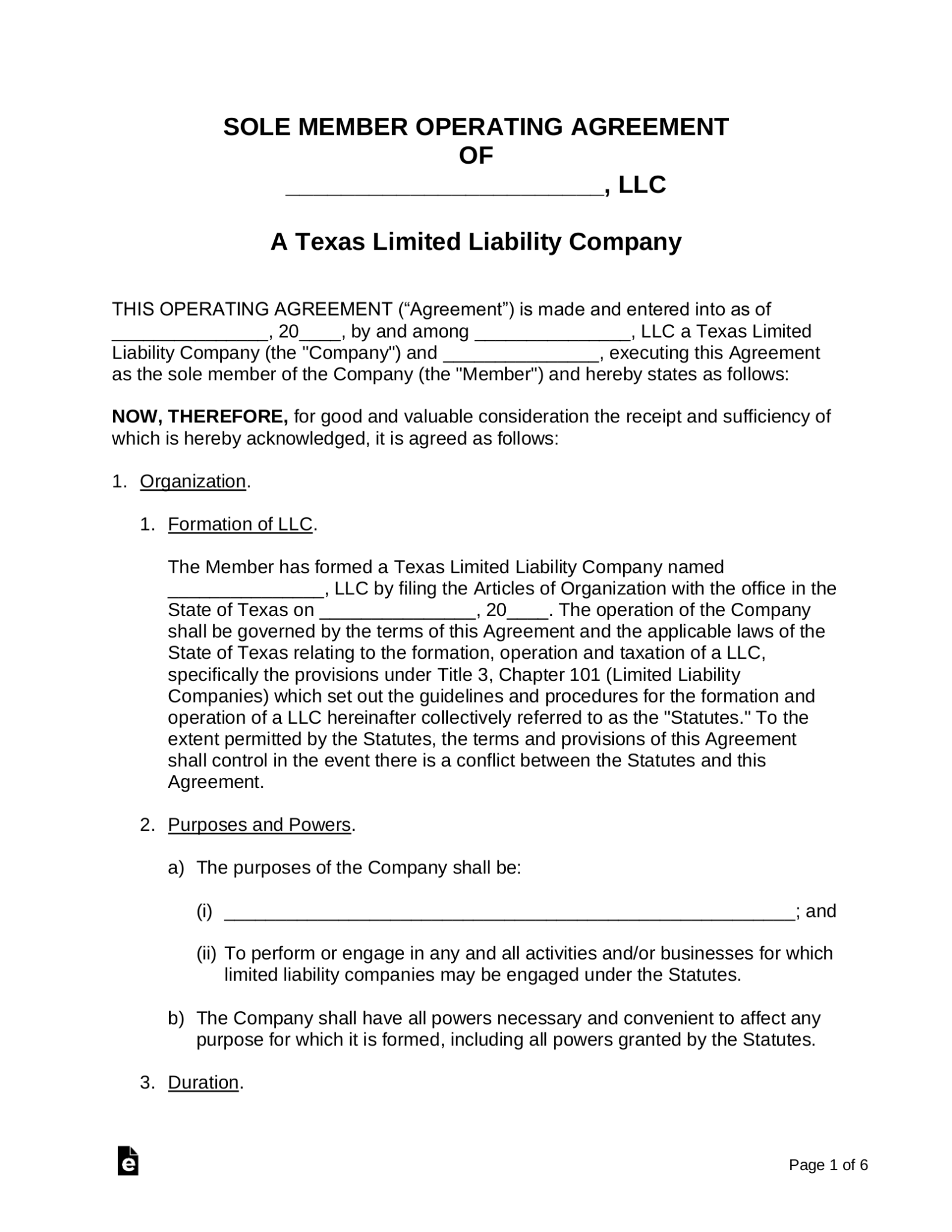

Free Texas Single Member LLC Operating Agreement Form PDF Word eForms

Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Per the ca ftb limited liability. Llcs classified as a disregarded entity or. Web llc is still subject to the annual franchise tax and the gross receipts tax. This llc is owned and operated by a.

How Does Single Member Llc File Taxes Tax Walls

Complete schedule iw, llc income worksheet (on. Web file a tax return (form 568) pay the llc annual tax. Web the llc’s taxable year is 15 days or less. Just pay state filing fees. Below are solutions to frequently.

Solved Does Turbo tax Business efile CA FORM 568 for single member LLC

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Solved • by intuit • 3 • updated july 14, 2022. Web open the federal 1040 return.; Web disregarded single member limited liability companies still must file form 568, although they only need to complete a small portion of it. Complete schedule iw, llc income.

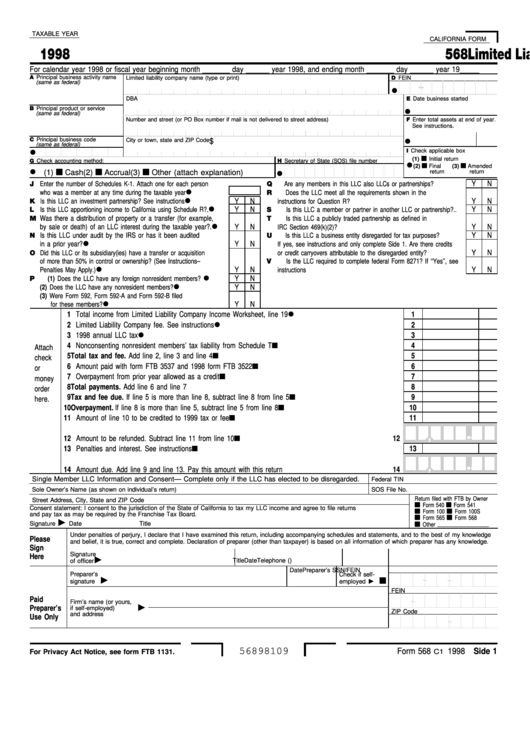

Fillable Form 568 Limited Liability Company Return Of 1998

Llcs classified as disregarded corporations or partnerships must file. Web a single member limited liability company (smllc) is considered disregarded for federal income tax purposes. Web disregarded single member limited liability companies still must file form 568, although they only need to complete a small portion of it. However, in california, smllcs are considered separate legal. Web catch the top.

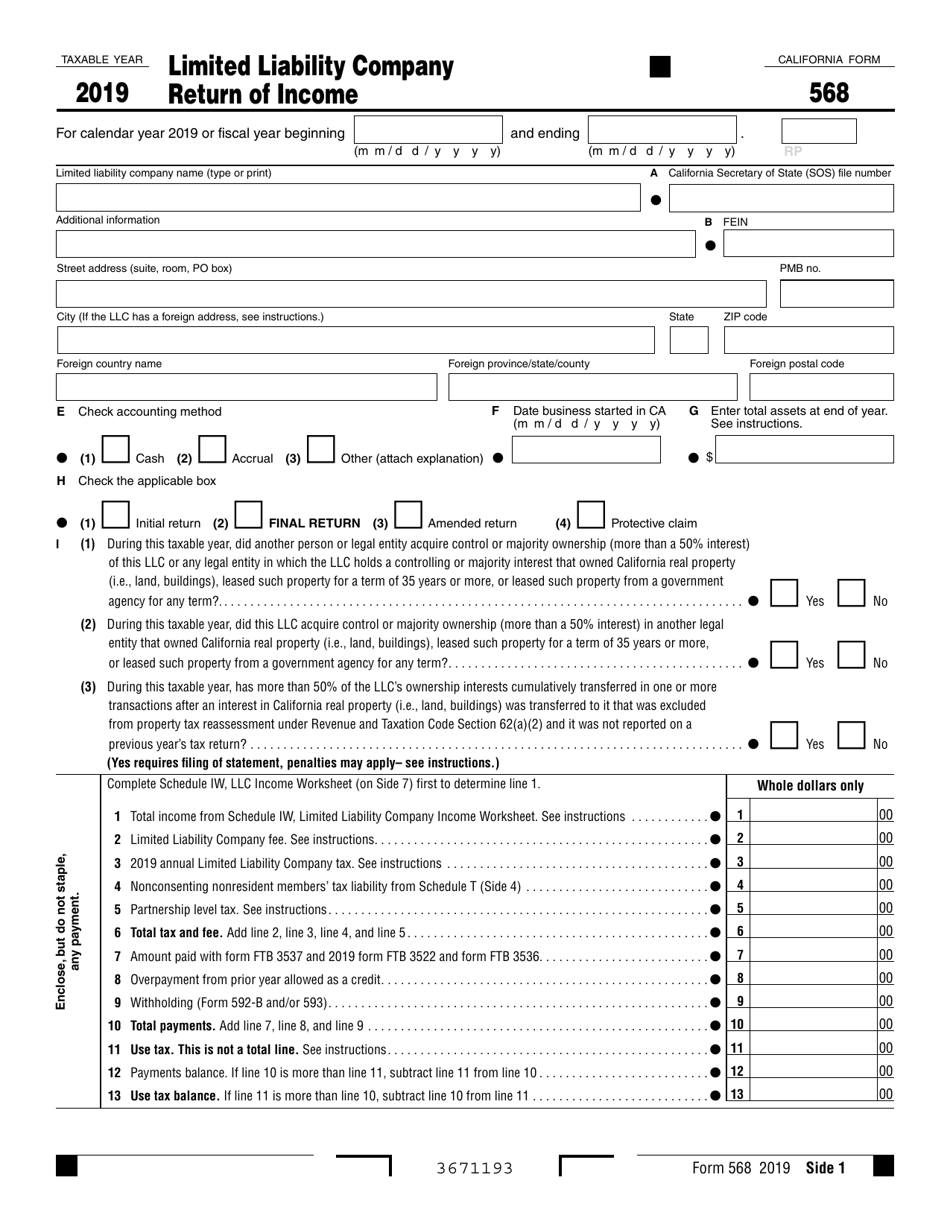

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Below are solutions to frequently. Web common questions about partnership ca form 568 for single member llcs. Just pay state filing fees. Per the ca ftb limited liability. However, a single member llc only needs to.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Below are solutions to frequently. Web common questions about partnership ca form 568 for single member llcs. While similar to a sole proprietorship, this llc provides additional tax benefits and. Fast, simple, and free with a 100% satisfaction guarantee. Llcs classified as disregarded corporations or partnerships must file.

ftb form 568 instructions LLC Bible

However, in california, smllcs are considered separate legal. If you are married, you and your spouse are considered one owner and can. Web open the federal 1040 return.; Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web if your llc has one owner, you're a.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Llcs classified as a disregarded entity or. Web form 568 is a tax return that many california limited liability companies (llcs) must file. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Web file a tax return (form 568) pay the llc annual tax. If.

SingleMember LLCs and Operating Agreements

Per the ca website limited liability. Fast, simple, and free with a 100% satisfaction guarantee. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. If you are married, you and your spouse are considered one owner and can. Solved • by intuit • 3 • updated.

Just Pay State Filing Fees.

Pay the llc fee (if applicable) items of income, deduction, and credit (after applying appropriate limitations) from the smllc. Web llc is still subject to the annual franchise tax and the gross receipts tax. If you are married, you and your spouse are considered one owner and can. Llcs classified as a disregarded entity or.

Web Form 568 Accounts For The Income, Withholding, Coverages, Taxes, And Additional Financial Elements Of Your Private Limited Liability Company, Or Llc.

Web form 568 is a tax return that many california limited liability companies (llcs) must file. An llc may be classified for tax purposes as a partnership, a. Solved • by intuit • 3 • updated july 14, 2022. Per the ca website limited liability.

Per The Ca Ftb Limited Liability.

However, a single member llc only needs to. Therefore, all llcs must file franchise tax board form 568. This llc is owned and operated by a single person. The llc did not conduct business in the state during the 15 day period.

Web File A Tax Return (Form 568) Pay The Llc Annual Tax.

Open the federal information worksheet.; Web open the federal 1040 return.; Complete schedule iw, llc income worksheet (on. However, in california, smllcs are considered separate legal.

/GettyImages-519519433-1--574b242b3df78ccee1f0c3f8.jpg)