E File Form 1120S

E File Form 1120S - Web these cookies are necessary for the service to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Corporation income tax return, including recent updates, related forms and instructions on how to file. If the corporation's principal business, office, or agency is located in: Features 2.1″ display, 3.15 mp primary camera, 820 mah battery, 63 mb storage. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Use this form to report the. Web amended and superseding corporate returns.

Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web amended and superseding corporate returns. If the corporation's principal business, office, or agency is located in: Form 7004 (automatic extension of time to file); Get ready for tax season deadlines by completing any required tax forms today. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web these cookies are necessary for the service to function and cannot be switched off in our systems. Easy guidance & tools for c corporation tax returns. They are usually only set in response to actions made by you which amount to. Features 2.1″ display, 3.15 mp primary camera, 820 mah battery, 63 mb storage.

Web these cookies are necessary for the service to function and cannot be switched off in our systems. Get ready for tax season deadlines by completing any required tax forms today. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web amended and superseding corporate returns. And the total assets at the end of the tax year are: Features 1.52″ display, 800 mah battery. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Features 2.1″ display, 3.15 mp primary camera, 820 mah battery, 63 mb storage. Form 7004 (automatic extension of time to file); Ad access irs tax forms.

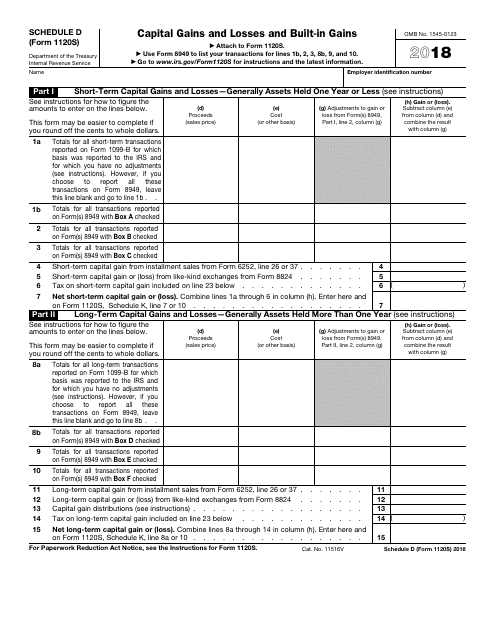

1120s schedule d instructions

Web these cookies are necessary for the service to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to. And the total assets at the end of the tax year are: Features 1.52″ display, 800 mah battery. Web information about form 1120, u.s.

Barbara Johnson Blog Form 1120S Instructions and Who Has to File It

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Use the following irs center address:. Form 7004 (automatic extension of time to file); And the total assets at the end of the tax year are: Easy guidance & tools for c corporation tax returns.

IRS 1120S 2022 Form Printable Blank PDF Online

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Use the following irs center address:. Get ready for tax season deadlines by completing any required tax forms today. Features 2.1″ display, 3.15 mp primary camera, 820 mah battery, 63 mb storage. Ad file heavy vehicle use tax form for.

IRS Form 1120S Schedule D Download Fillable PDF or Fill Online Capital

Use this form to report the. Web information about form 1120, u.s. Easy guidance & tools for c corporation tax returns. Use the following irs center address:. Complete, edit or print tax forms instantly.

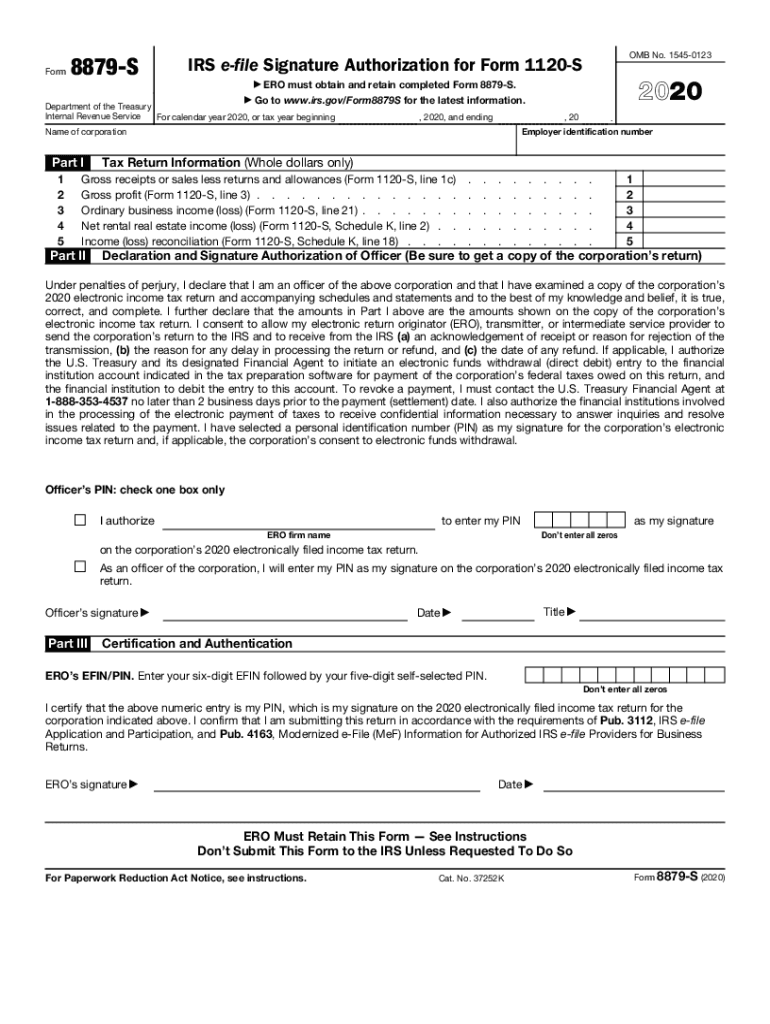

8879 Fill Out and Sign Printable PDF Template signNow

Features 1.52″ display, 800 mah battery. Web amended and superseding corporate returns. Ad access irs tax forms. Easy guidance & tools for c corporation tax returns. Web information about form 1120, u.s.

SCorporations; IRS form 1120S; Corporate Tax Returns Austin & Larson

Easy guidance & tools for c corporation tax returns. Complete, edit or print tax forms instantly. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed.

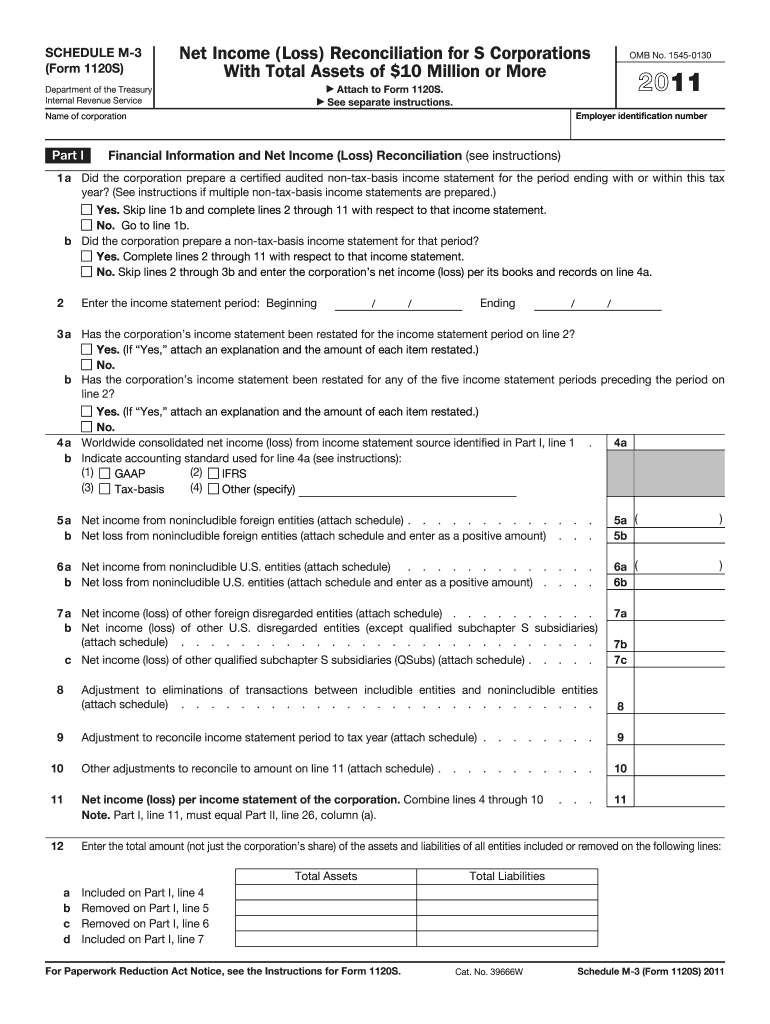

2011 Form IRS 1120S Schedule M3 Fill Online, Printable, Fillable

Form 7004 (automatic extension of time to file); Complete, edit or print tax forms instantly. Web information about form 1120, u.s. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is. Web these cookies are necessary for the service to function and cannot be.

1120S Entering Officer Information Form 1125E

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Complete, edit or print tax forms instantly. Use this form to report the. Web samsung e1120 phone. Easy guidance & tools for c corporation tax returns.

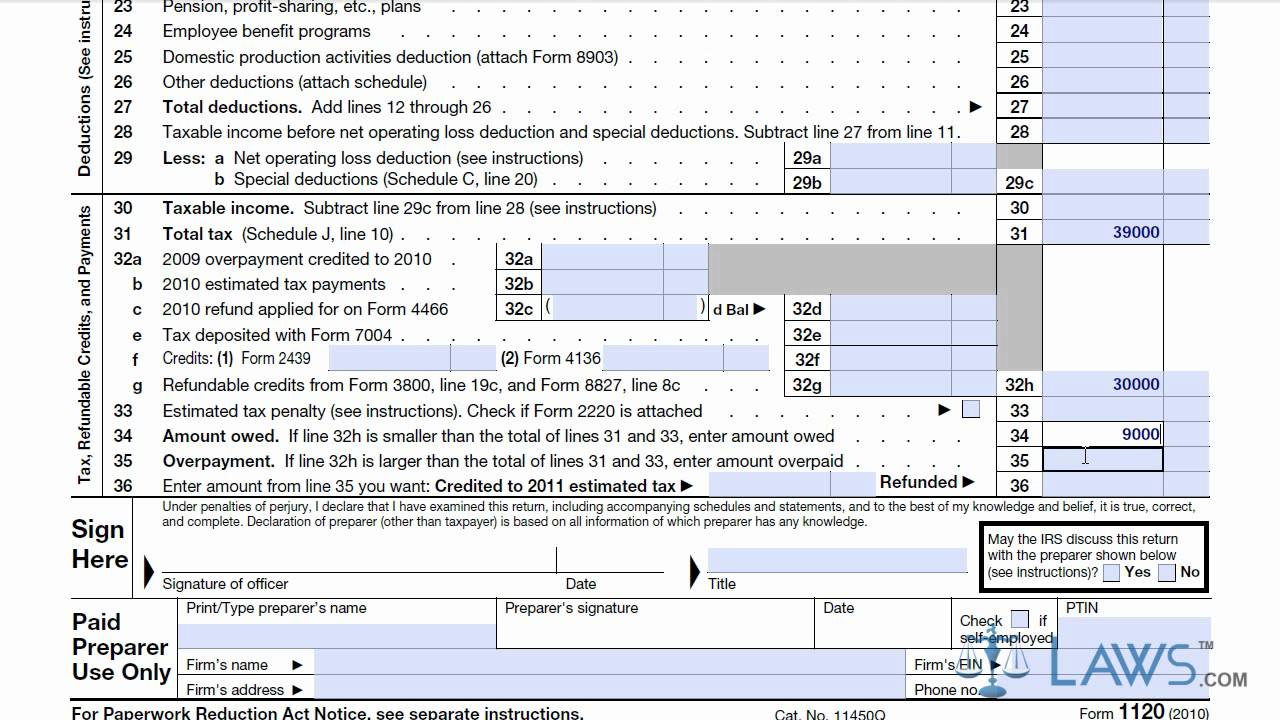

Form 1120 YouTube

Form 7004 (automatic extension of time to file); Complete, edit or print tax forms instantly. Features 2.1″ display, 3.15 mp primary camera, 820 mah battery, 63 mb storage. Easy guidance & tools for c corporation tax returns. Web these cookies are necessary for the service to function and cannot be switched off in our systems.

Fill out the 1120S Form including the M1 & M2

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web information about form 1120, u.s. Get ready for tax season deadlines by completing any required tax forms today. Use this form to report the. Web amended and superseding corporate returns.

Corporation Income Tax Return, Including Recent Updates, Related Forms And Instructions On How To File.

Features 2.1″ display, 3.15 mp primary camera, 820 mah battery, 63 mb storage. Form 7004 (automatic extension of time to file); Web information about form 1120, u.s. Easy guidance & tools for c corporation tax returns.

Web Amended And Superseding Corporate Returns.

Ad access irs tax forms. Use this form to report the. And the total assets at the end of the tax year are: Get ready for tax season deadlines by completing any required tax forms today.

Features 1.52″ Display, 800 Mah Battery.

Use the following irs center address:. Ad file heavy vehicle use tax form for vehicles weighing over 55,000 pounds. Web these cookies are necessary for the service to function and cannot be switched off in our systems. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.

Income Tax Return For An S Corporation Department Of The Treasury Internal Revenue Service Do Not File This Form Unless The Corporation Has Filed Or Is.

They are usually only set in response to actions made by you which amount to. Easy guidance & tools for c corporation tax returns. If the corporation's principal business, office, or agency is located in: Web samsung e1120 phone.