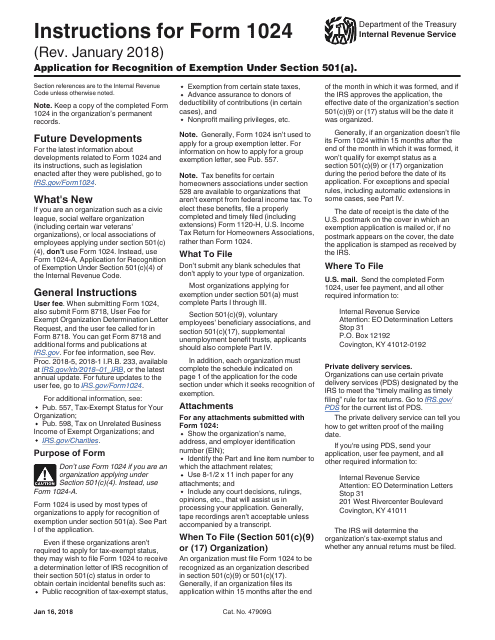

Form 1024 Instructions

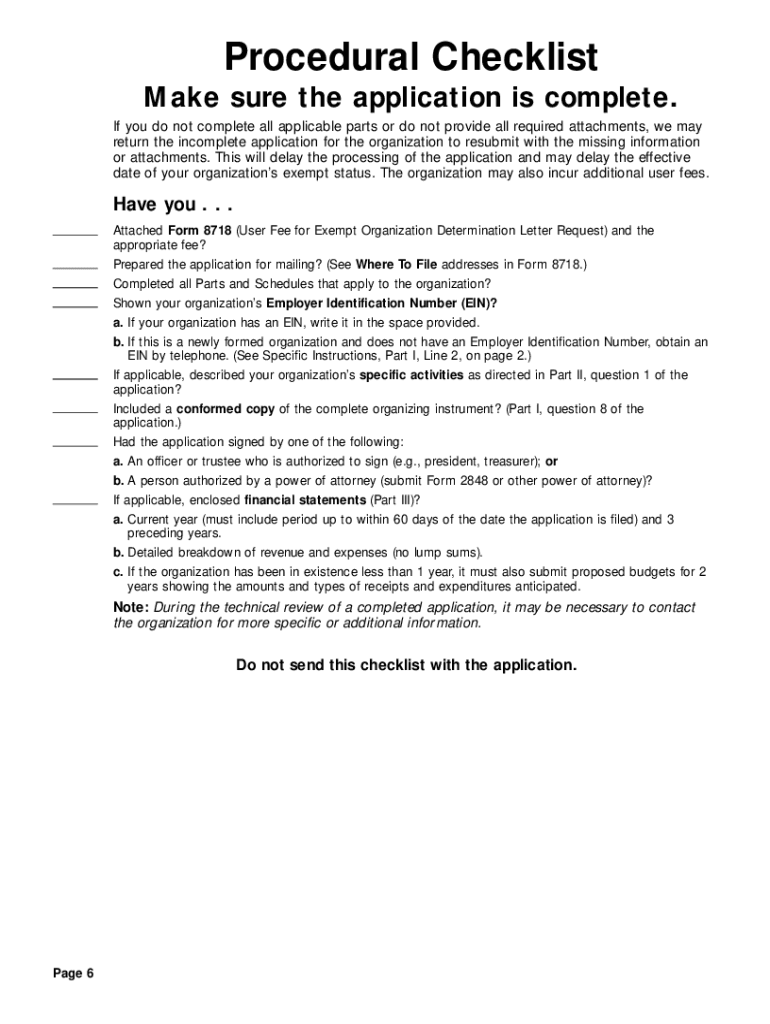

Form 1024 Instructions - Form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc). Organizations file this form to apply for recognition of exemption from federal income tax under section 501 (c) (4). Estimated dues income line 2 “gross contributions, gifts, etc.” : Texas health and human services subject: Form 1024 is used to document the. Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members: Web application for recognition of exemption under section 501(a) go to. More specifically, organizations other than public charities or private foundations need to file irs form. Web download or print the 2022 federal form 1024 (application for recognition of exemption under section 501(a) for determination under section 120 of the internal revenue. Articles of incorporation, if any, or other organizational document;

Ad access irs tax forms. Texas health and human services subject: Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). More specifically, organizations other than public charities or private foundations need to file irs form. See part i of the application. See part i of the application. Estimated dues income line 2 “gross contributions, gifts, etc.” : Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members: The paperwork must be filed with the 1024 application form. Articles of incorporation, if any, or other organizational document;

Form 1024 is used to document the. Statement of revenue and expenses revenue line 1 ^gross dues and assessments of members: Form 1024, individual status summary created date: Complete, edit or print tax forms instantly. Texas health and human services subject: Web you can access the most recent revision of the form at pay.gov. The paperwork must be filed with the 1024 application form. Web the irs now requires electronic filing of form 1024, application for recognition of exemption under section 501 (a) or section 521 of the internal revenue. Each schedule form contains short instructions. For instructions and the latest information.

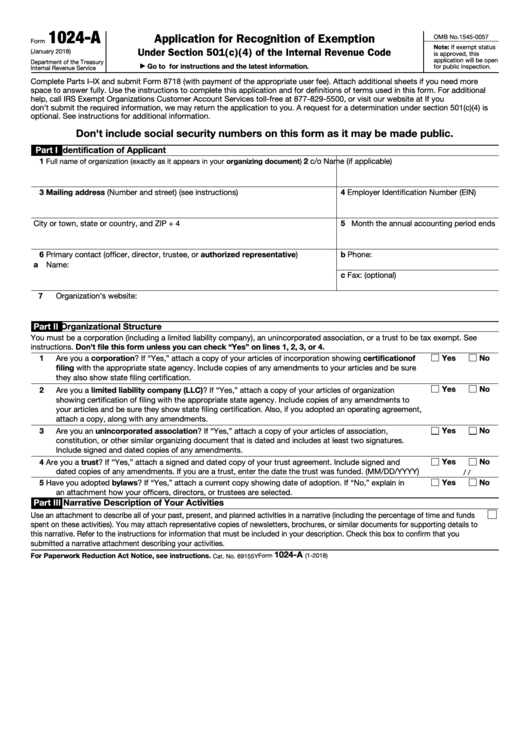

Form 1024 Application for Recognition of Exemption under Section 501

For instructions and the latest information. Ad access irs tax forms. Web form 1024, individual status summary instructions. The paperwork must be filed with the 1024 application form. Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a).

Form 1024 Application for Recognition of Exemption under Section 501

Chuck grassley of iowa on thursday released an internal fbi document containing unverified allegations president joe biden was involved in. Form 1024 is used to document the. Web form 1024, individual status summary instructions. Texas health and human services subject: Complete, edit or print tax forms instantly.

Form 1024 Application for Recognition of Exemption under Section 501

Articles of incorporation, if any, or other organizational document; Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Application for recognition of exemption. Under section 501(c)(4) of the internal. Form 1024 is used to document the waiver benefits that result in an.

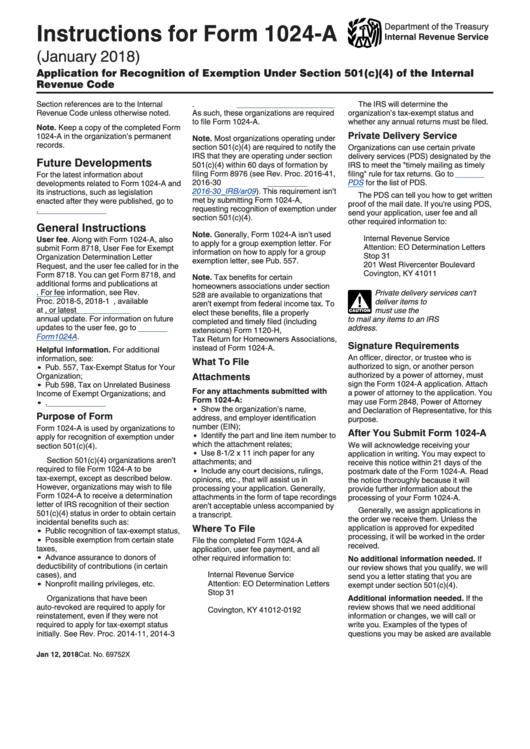

Download Instructions for IRS Form 1024 Application for Recognition of

Web purpose of form form 1024 is used by most types of organizations to apply for recognition of exemption under section 501(a). Articles of incorporation, if any, or other organizational document; More specifically, organizations other than public charities or private foundations need to file irs form. Web information about form 1024, application for recognition of exemption under section 501(a), including.

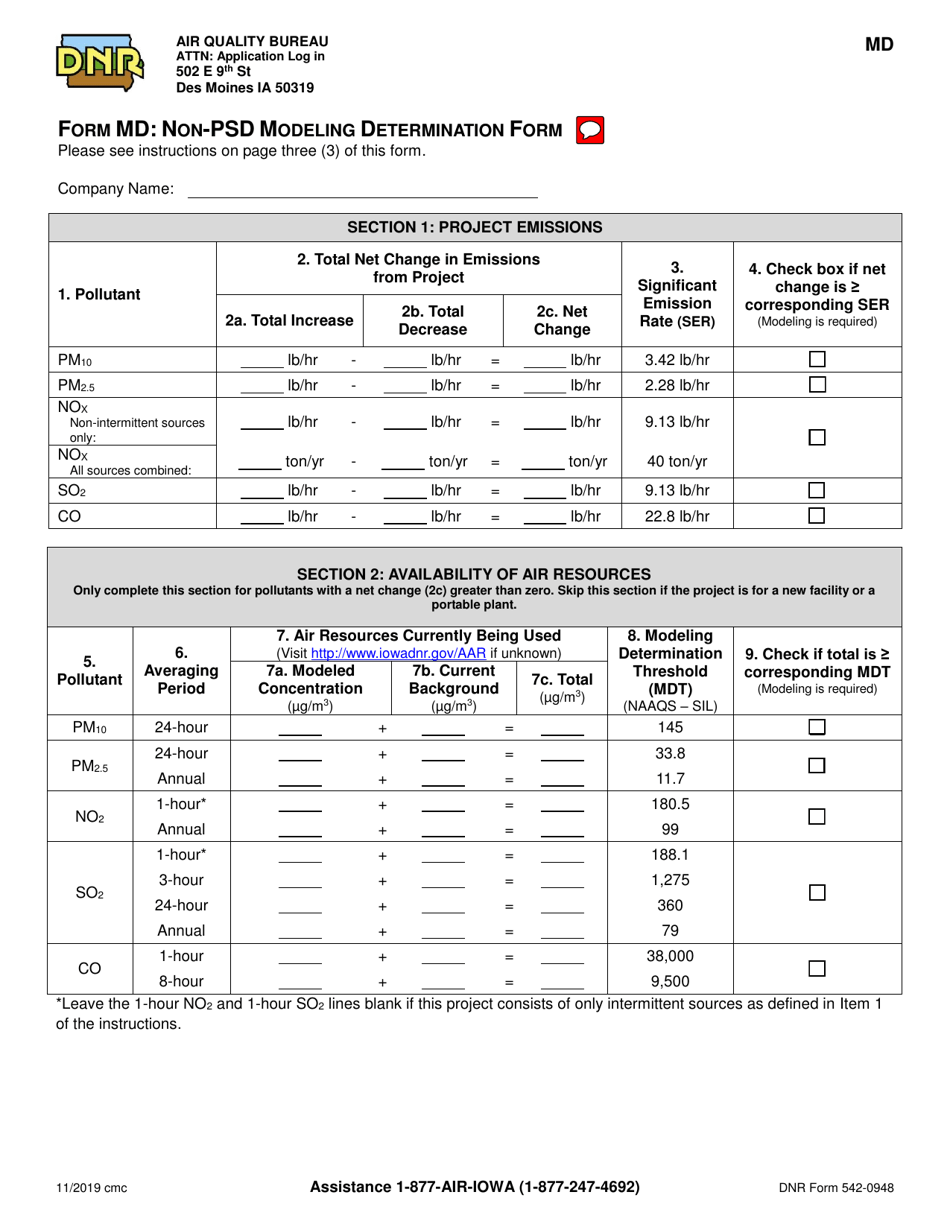

Form MD (DNR Form 5420948) Download Fillable PDF or Fill Online Non

More specifically, organizations other than public charities or private foundations need to file irs form. (january 2018) department of the treasury internal revenue service. Web organizations file this form to apply for recognition of exemption from federal income tax under section 501(a) (other than sections 501(c)(3) or 501(c)(4)) or section 521. Web you can access the most recent revision of.

Form 1024 Edit, Fill, Sign Online Handypdf

Form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc). Web you can access the most recent revision of the form at pay.gov. Under section 501(c)(4) of the internal. Register for an account on pay.gov. Estimated dues income line 2 “gross contributions, gifts, etc.” :

Fill Free fillable Di Form DI (HM Land Registry) PDF form

Web form 1024, individual status summary author: Each schedule form contains short instructions. The paperwork must be filed with the 1024 application form. Web download or print the 2022 federal form 1024 (application for recognition of exemption under section 501(a) for determination under section 120 of the internal revenue. Ad access irs tax forms.

Form 1024 Fill Out and Sign Printable PDF Template signNow

Form 1024, individual status summary created date: Estimated dues income line 2 “gross contributions, gifts, etc.” : Under section 501(c)(4) of the internal. For instructions and the latest information. Web form 1024, individual status summary instructions.

Fillable Form 1024A Application For Recognition Of Exemption

More specifically, organizations other than public charities or private foundations need to file irs form. Web form 1024, individual status summary instructions. Ad access irs tax forms. See part i of the application. Complete, edit or print tax forms instantly.

Instructions For Form 1024A Application For Recognition Of Exemption

Under section 501(c)(4) of the internal. Complete, edit or print tax forms instantly. Texas health and human services subject: Web download or print the 2022 federal form 1024 (application for recognition of exemption under section 501(a) for determination under section 120 of the internal revenue. (january 2018) department of the treasury internal revenue service.

Web Organizations File This Form To Apply For Recognition Of Exemption From Federal Income Tax Under Section 501(A) (Other Than Sections 501(C)(3) Or 501(C)(4)) Or Section 521.

Form 1024 is used to document the. Web you can access the most recent revision of the form at pay.gov. The paperwork must be filed with the 1024 application form. Web there are ten documents to choose from.

Organizations File This Form To Apply For Recognition Of Exemption From Federal Income Tax Under Section 501 (C) (4).

Estimated dues income line 2 “gross contributions, gifts, etc.” : Texas health and human services subject: Form 1024, individual status summary created date: Ad access irs tax forms.

For Instructions And The Latest Information.

Web form 1024, individual status summary instructions. Form 1024 is used to document the waiver benefits that result in an individual service plan (isp) or individual plan of care (ipc). See part i of the application. Chuck grassley of iowa on thursday released an internal fbi document containing unverified allegations president joe biden was involved in.

Web Purpose Of Form Form 1024 Is Used By Most Types Of Organizations To Apply For Recognition Of Exemption Under Section 501(A).

See part i of the application. Under section 501(c)(4) of the internal. Complete, edit or print tax forms instantly. Web form 1024, individual status summary author: