Form 5500 For 401K

Form 5500 For 401K - Web the form 5500 is filed with the dol and contains information about a 401(k) plan's financial condition, plan qualifications, and operation. Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Participation contributions vesting nondiscrimination investing 401 (k) monies fiduciary responsibilities disclosing. 31, 2021, according to the latest form 5500. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Posting on the web does not constitute acceptance of the filing by the. Yes, form 5500 is due on july 31st for the previous year. For an explanation of how to file your form 5500 return, in. Web 22 hours agoa federal judge i dismissed a lawsuit against denso international america inc. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024.

31, 2021, according to the latest form 5500. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Yes, form 5500 is due on july 31st for the previous year. The section what to file summarizes what information must be reported for different types of plans and. Web vynm2 • 1 min. The type of plan, or entity submitting the filing, determines who is required to sign the form. Less fees so employees can keep more money where it matters—in their retirement accounts. Ad easy setup, a breeze to manage. Web the form 5500 annual return/reports are a critical enforcement, compliance, and research tool for the dol, the irs, and pbgc. 31, 2022, according to the latest form 5500.

Web the form 5500 annual return/reports are a critical enforcement, compliance, and research tool for the dol, the irs, and pbgc. Web 13 hours agogwa llc 401(k) profit sharing plan, rocky hill, conn., had $91 million in assets as of dec. Participation contributions vesting nondiscrimination investing 401 (k) monies fiduciary responsibilities disclosing. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Large plans, including new plans with 100 or. Southfield, mich., had $2 billion in assets, according to the. Yes, form 5500 is due on july 31st for the previous year. Web elements of a plan that need to be handled include: Ad easy setup, a breeze to manage. Use the rate table or worksheets in chapter 5 of irs publication 560, retirement plans for small.

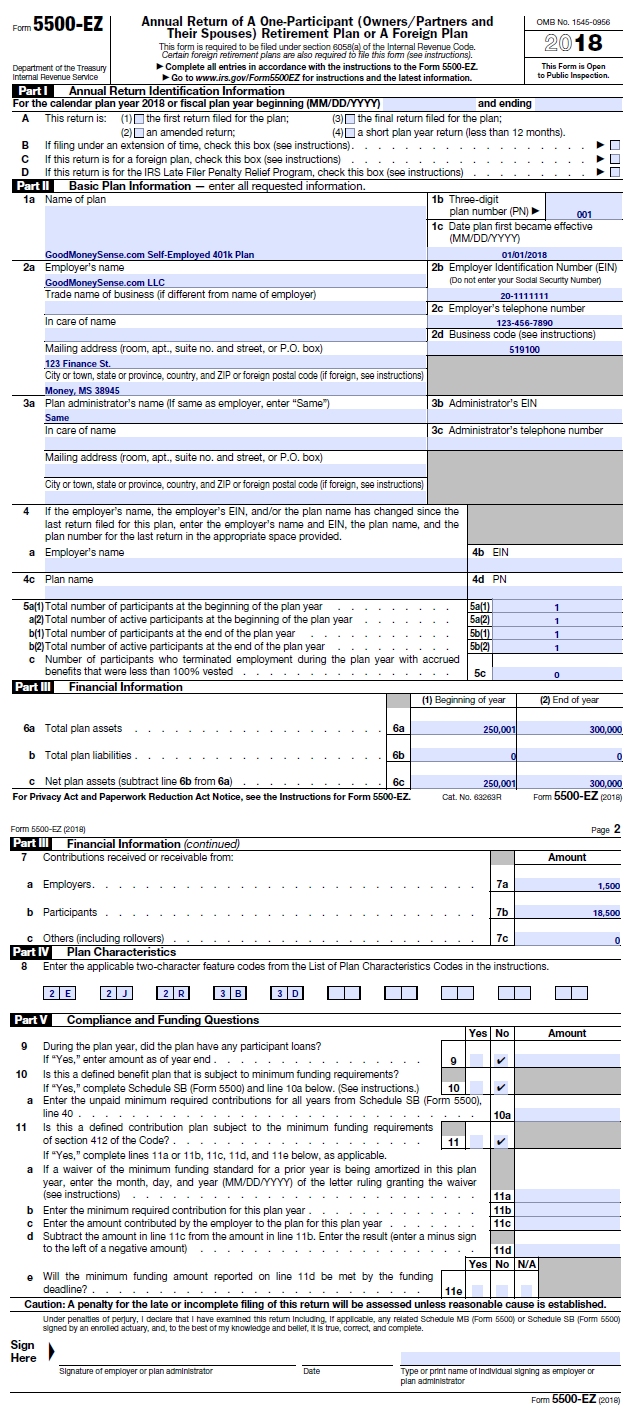

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

The irs has an online fillable form on its website you can complete and print out. The section what to file summarizes what information must be reported for different types of plans and. Less fees so employees can keep more money where it matters—in their retirement accounts. The type of plan, or entity submitting the filing, determines who is required.

2018 Updated Form 5500EZ Guide Solo 401k

Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. 31, 2022, according to the latest form 5500. The purpose of the form is. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Web this search tool allows you to search for form.

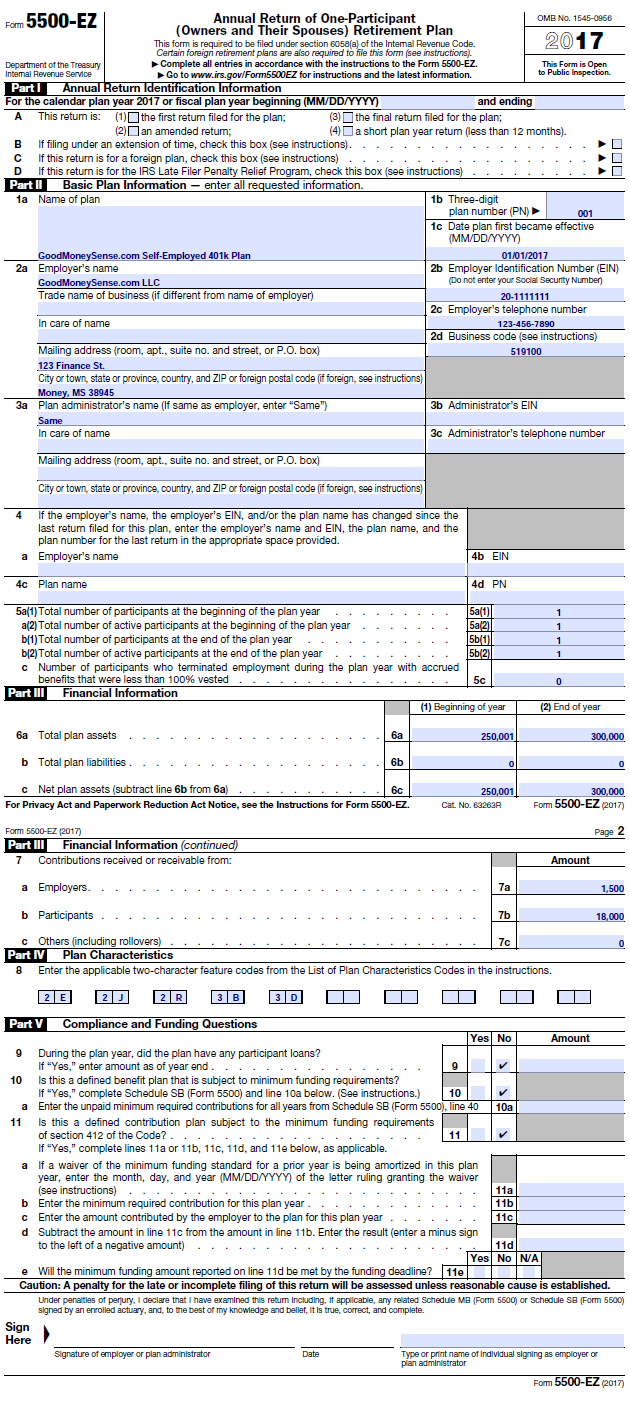

How To File The Form 5500EZ For Your Solo 401k for 2017 Good Money Sense

31, 2021, according to the latest form 5500. Web elements of a plan that need to be handled include: Southfield, mich., had $2 billion in assets, according to the. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. Web vynm2 •.

The 401(k) Form 5500 Frequently Asked Questions (FAQ)

Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. You can set up a guideline 401(k) in 20 min. Posting on the web does not constitute acceptance of the filing by the. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. The.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

The irs has an online fillable form on its website you can complete and print out. Web vynm2 • 1 min. 31, 2022, according to the latest form 5500. Web item explanation due to: The section what to file summarizes what information must be reported for different types of plans and.

How To File The Form 5500EZ For Your Solo 401k in 2022 Good Money Sense

Less fees so employees can keep more money where it matters—in their retirement accounts. 31, 2022, according to the latest form 5500. Large plans, including new plans with 100 or. The type of plan, or entity submitting the filing, determines who is required to sign the form. Web 15 hours agocobham united states 401k plan, san jose, calif., had $970.

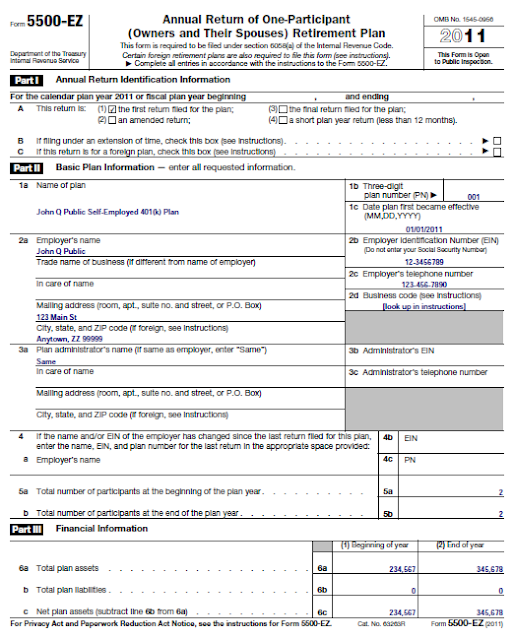

How to File Form 5500EZ Solo 401k

Ad easy setup, a breeze to manage. The section what to file summarizes what information must be reported for different types of plans and. The type of plan, or entity submitting the filing, determines who is required to sign the form. Participation contributions vesting nondiscrimination investing 401 (k) monies fiduciary responsibilities disclosing. 31, 2021, according to the latest form 5500.

Form 5500EZ How To Fill It Out For Your Solo 401k

Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Large plans, including new plans with 100 or. Participation contributions vesting nondiscrimination investing 401 (k) monies fiduciary responsibilities disclosing. Ad easy setup, a breeze to.

How to File Form 5500EZ Solo 401k

Web 15 hours agocobham united states 401k plan, san jose, calif., had $970 million in assets as of dec. You can set up a guideline 401(k) in 20 min. So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. The section what to file summarizes what information must be reported.

Form 5500EZ For Your Solo 401k

Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. The type of plan, or entity submitting the filing, determines who is required to sign the form. So, if you didn't open your 401k until sometime in 2023, you won't need to.

31, 2021, According To The Latest Form 5500.

Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the. Large plans, including new plans with 100 or. The irs has an online fillable form on its website you can complete and print out. Web vynm2 • 1 min.

Ad Easy Setup, A Breeze To Manage.

The type of plan, or entity submitting the filing, determines who is required to sign the form. The section what to file summarizes what information must be reported for different types of plans and. Participation contributions vesting nondiscrimination investing 401 (k) monies fiduciary responsibilities disclosing. Web 15 hours agocobham united states 401k plan, san jose, calif., had $970 million in assets as of dec.

Web The Form 5500 Annual Return/Reports Are A Critical Enforcement, Compliance, And Research Tool For The Dol, The Irs, And Pbgc.

For an explanation of how to file your form 5500 return, in. Web item explanation due to: The purpose of the form is. Use the rate table or worksheets in chapter 5 of irs publication 560, retirement plans for small.

Yes, Form 5500 Is Due On July 31St For The Previous Year.

Web most 401(k) plan sponsors are required to file an annual form 5500, annual return/report of employee benefit plan. Web form 5500 will vary according to the type of plan or arrangement. Web elements of a plan that need to be handled include: 31, 2022, according to the latest form 5500.