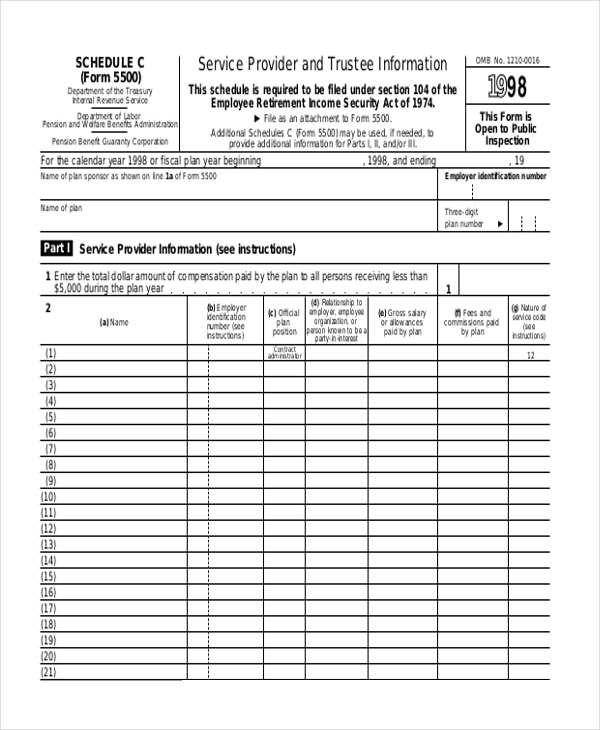

Form 5500 Schedule C

Form 5500 Schedule C - Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web schedule c (form 5500) 2022 page. Web what is form 5500 schedule c? Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Web form 5500 annual return/report of employee benefit plan | instructions; (a) enter name and ein or address of service provider (see. Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the value of the plan’s investment or return on investment. This is effective for plan years beginning in 2009 and is required for all large plan filers. Or an enrolled actuary or accountant. Department of labor pension and welfare benefits administration this form is open to public inspection

The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and form. Web schedule c (form 5500) 2022 page. Or an enrolled actuary or accountant. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Web frequently asked questions what is form 5500? Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the value of the plan’s investment or return on investment. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. (a) enter name and ein or address of service provider (see. See the instructions on your form 1099 for more information about what to report on schedule c.

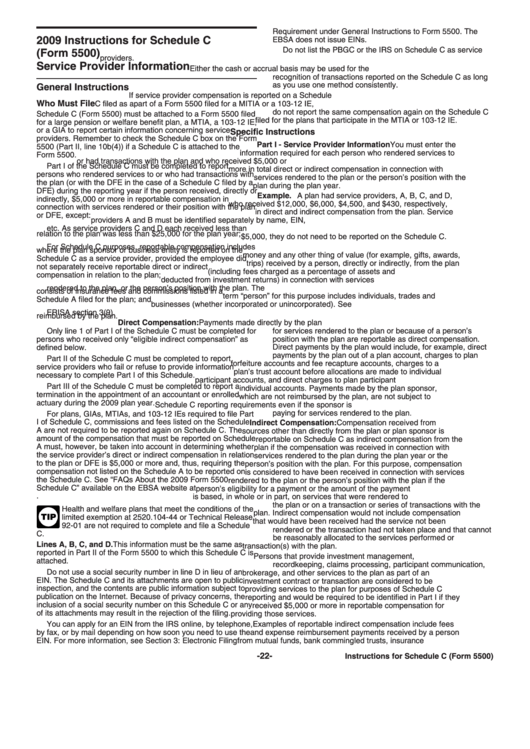

Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the value of the plan’s investment or return on investment. Or an enrolled actuary or accountant. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. The instructions do not further define the term “investment fund” for this purpose. This is effective for plan years beginning in 2009 and is required for all large plan filers. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000 were paid in fees; See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and form. See the instructions on your form 1099 for more information about what to report on schedule c.

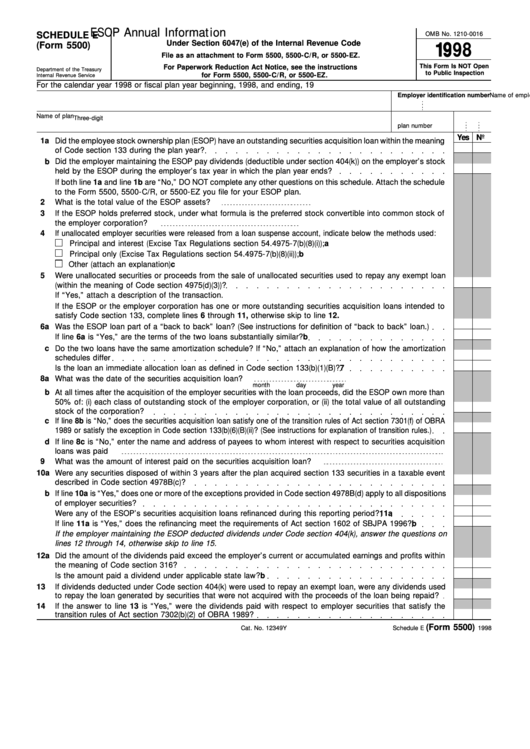

Fillable Schedule E (Form 5500) Esop Annual Information 1998

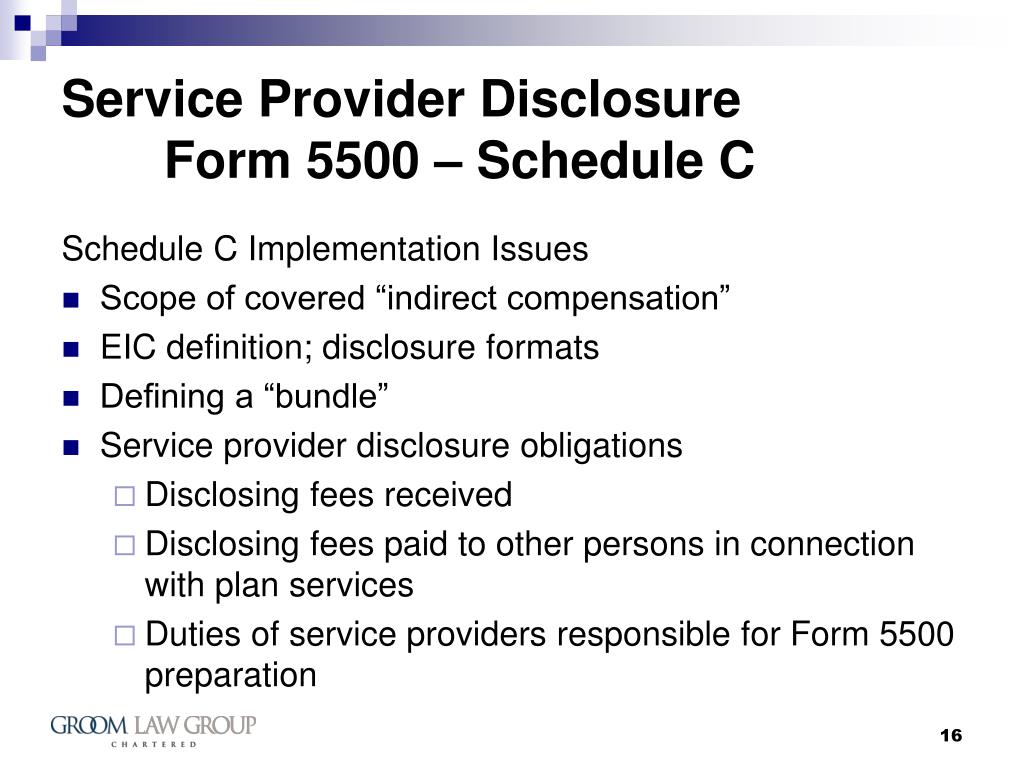

See the instructions on your form 1099 for more information about what to report on schedule c. The instructions do not further define the term “investment fund” for this purpose. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation. Web what is form 5500 schedule c? Web schedule c.

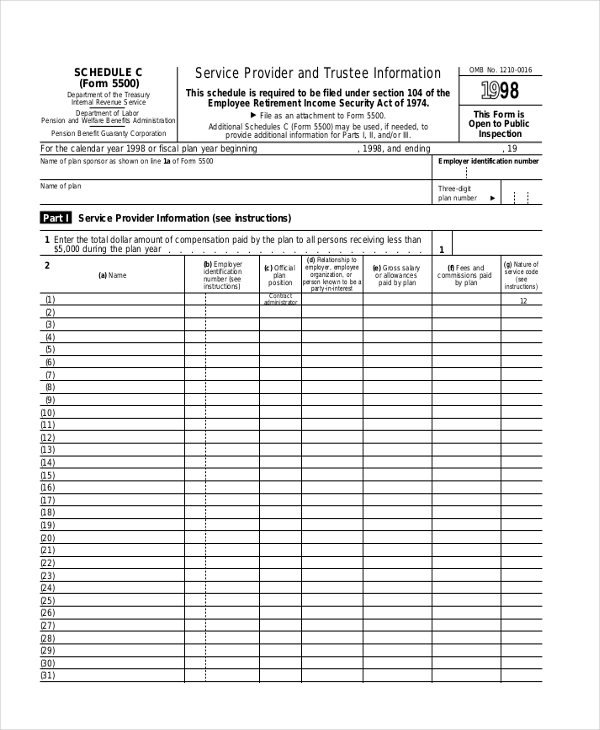

FREE 9+ Sample Schedule C Forms in PDF MS Word

Web frequently asked questions what is form 5500? Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the value of the plan’s investment or return on investment. Or an enrolled actuary or accountant. Web schedule c (form 5500) 2022 page. See the instructions on your form.

preparing form 5500 schedule c

The instructions do not further define the term “investment fund” for this purpose. See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and form. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation..

Department of labour salary schedule form 2021

Department of labor pension and welfare benefits administration this form is open to public inspection Web schedule c (form 5500) 2022 page. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. See the instructions on your form.

2009 Instructions For Schedule C (Form 5500) Service Provider

The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. (a) enter name and ein or address of service provider (see. Web frequently asked questions what is form 5500? For large plans form 5500 schedule c must be.

Form 5500 Is Due by July 31 for Calendar Year Plans

For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000 were paid in fees; (a) enter name and ein or address of service provider (see. Web form 5500 annual return/report of employee benefit plan | instructions; Web also, use schedule c to report (a) wages and expenses.

FREE 9+ Sample Schedule C Forms in PDF MS Word

See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and form. Provide, to the extent possible, the following information for each service provider who failed or refused to provide the information necessary to complete this schedule. See the instructions on your form 1099 for.

PPT 401(k) Plan Fee Disclosure and 5500 Reporting PowerPoint

The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. See the instructions on your form 1099 for more information about what to report on schedule c. For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to.

Form 5500 Instructions 5 Steps to Filing Correctly

(a) enter name and ein or address of service provider (see. The quick reference chart of form 5500, schedules and attachments, gives a brief guide to the annual return/report requirements of the 2019 form 5500. Provide, to the extent possible, the following information for each service provider who failed or refused to provide the information necessary to complete this schedule..

Form 5500 Instructions 5 Steps to Filing Correctly

The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web the schedule c instructions state that “eligible indirect compensation” includes fees or expense reimbursement payments charged to “investment funds” and reflected in the value of the plan’s.

This Is Effective For Plan Years Beginning In 2009 And Is Required For All Large Plan Filers.

The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Or an enrolled actuary or accountant. Plan sponsors must generally file the return on the last day of the seventh month after their plan year ends. Web the department of labor (dol) has implemented new reporting requirements on form 5500 schedule c relating to plan fees/compensation.

The Quick Reference Chart Of Form 5500, Schedules And Attachments, Gives A Brief Guide To The Annual Return/Report Requirements Of The 2019 Form 5500.

The instructions do not further define the term “investment fund” for this purpose. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Web schedule c (form 5500) service provider and trustee information omb no. Provide, to the extent possible, the following information for each service provider who failed or refused to provide the information necessary to complete this schedule.

(B) Income And Deductions Of Certain Qualified Joint Ventures;

See also the “troubleshooters guide to filing the erisa annual reports” available on www.dol.gov/ebsa, which is intended to help filers comply with the form 5500 and form. See the instructions on your form 1099 for more information about what to report on schedule c. Department of labor pension and welfare benefits administration this form is open to public inspection For large plans form 5500 schedule c must be filed which outlines service providers utilized by the plan to whom more than $5,000 were paid in fees;

Web The Schedule C Instructions State That “Eligible Indirect Compensation” Includes Fees Or Expense Reimbursement Payments Charged To “Investment Funds” And Reflected In The Value Of The Plan’s Investment Or Return On Investment.

Web what is form 5500 schedule c? Web schedule c (form 5500) 2022 page. Web form 5500 annual return/report of employee benefit plan | instructions; Web frequently asked questions what is form 5500?