Form 668-A

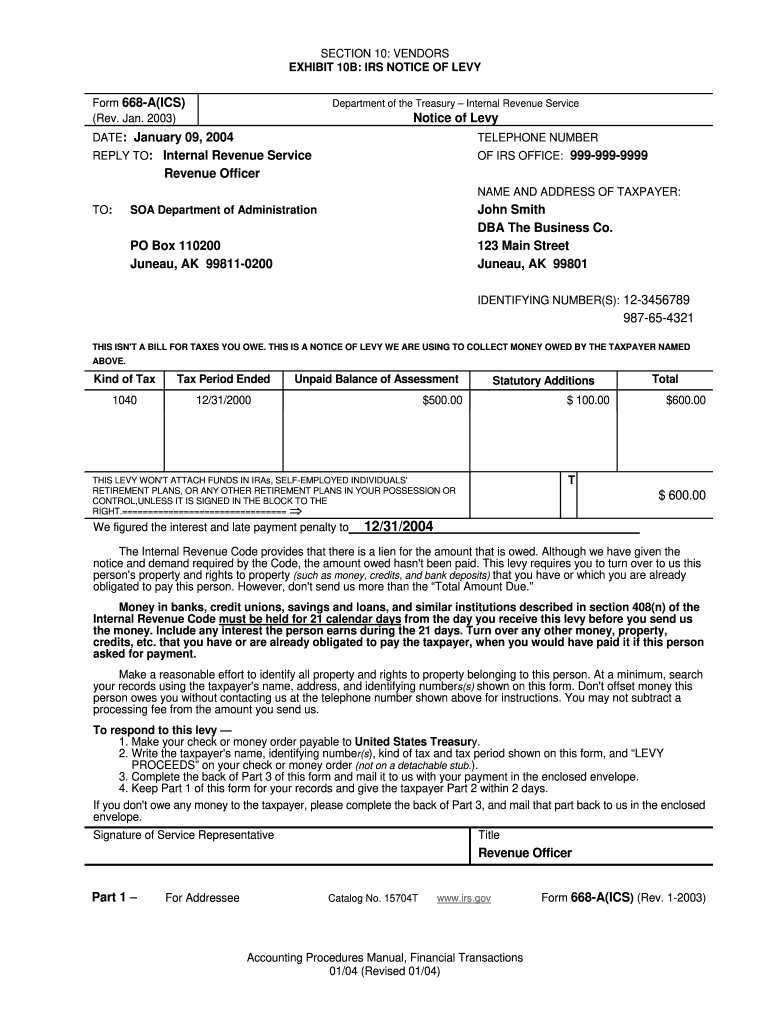

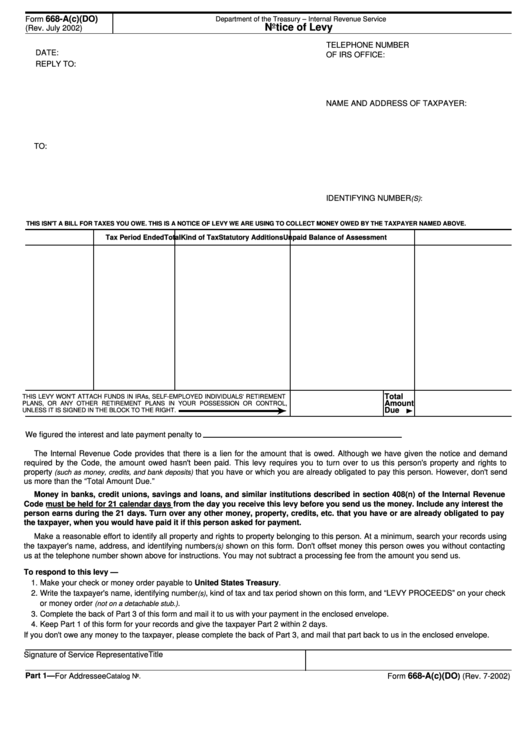

Form 668-A - It’s a notice of an irs wage garnishment. No arrangement was made to resolve the irs back taxes. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. It is most often used for bank accounts. It’s often sent to your. Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? Over the last 20 years we have empowered. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Web you received irs letter 668a because you have unpaid irs back taxes. This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial.

It is most often used for bank accounts. Sign online button or tick the preview image of the blank. Once a lien arises, the irs generally can’t release it until. Your bank will hold the money in escrow as. Over the last 20 years we have empowered. Web you received irs letter 668a because you have unpaid irs back taxes. Web how to complete the form 668 aids on the web: Make a reasonable effort to identify all property and rights to property belonging to this person. For example, this form is used to levy bank accounts and business receivables. It’s a notice of an irs wage garnishment.

For example, this form is used to levy bank accounts and business receivables. Web how to complete the form 668 aids on the web: Web an irs employee is required to give you their manager’s name and phone number when requested. No arrangement was made to resolve the irs back taxes. Once a lien arises, the irs generally can’t release it until. As result, the irs has taken collection. Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. Discovering documents is not the difficult component when it comes to web document management;. Your bank will hold the money in escrow as. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications.

Federal Levy Form 668 W 2021 Fill Out and Sign Printable PDF Template

Sign online button or tick the preview image of the blank. Your bank will hold the money in escrow as. It’s often sent to your. Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? To get started on the blank, use the fill camp;

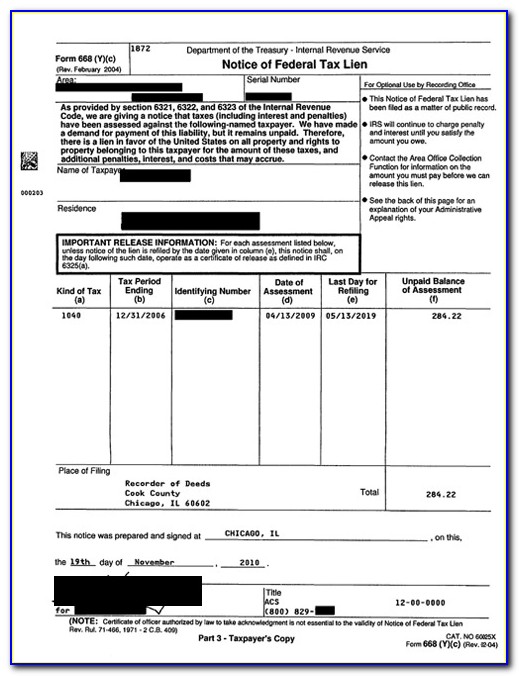

Federal Tax Lien Certificate Of Release Of Federal Tax Lien Form 668

This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial. No arrangement was made to resolve the irs back taxes. It’s often sent to your. Once a lien arises, the irs generally can’t release it until. It’s a notice of an irs.

No download needed irs form 668y pdf Fill out & sign online DocHub

No arrangement was made to resolve the irs back taxes. Web you received irs letter 668a because you have unpaid irs back taxes. Discovering documents is not the difficult component when it comes to web document management;. Sign online button or tick the preview image of the blank. Make a reasonable effort to identify all property and rights to property.

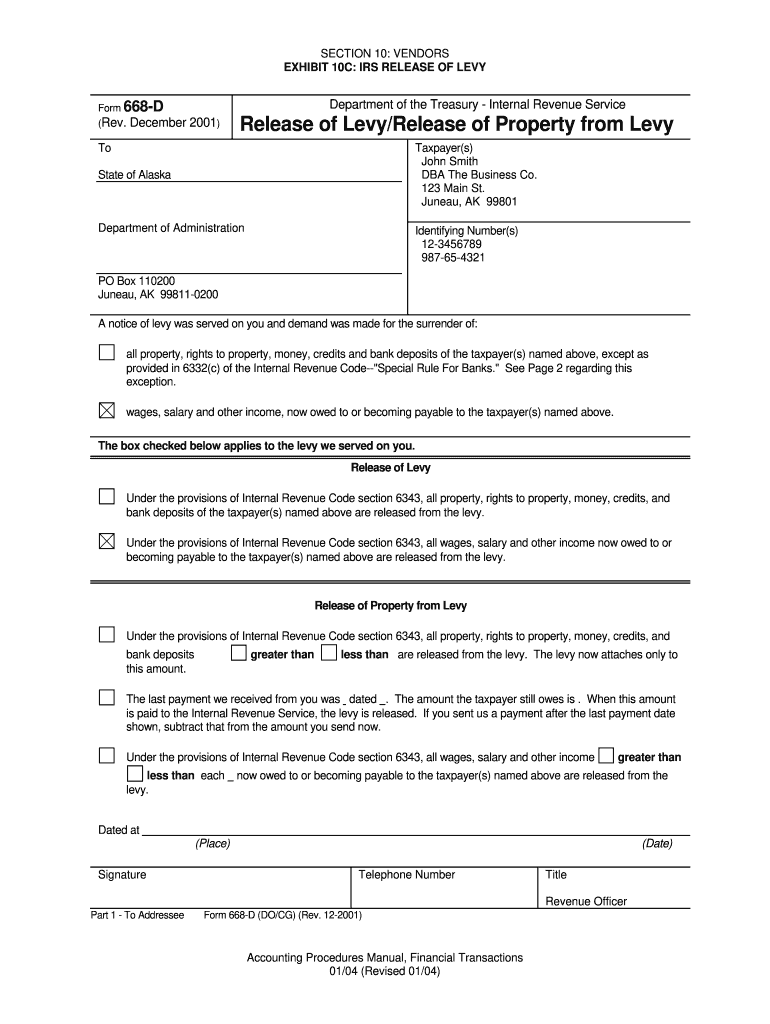

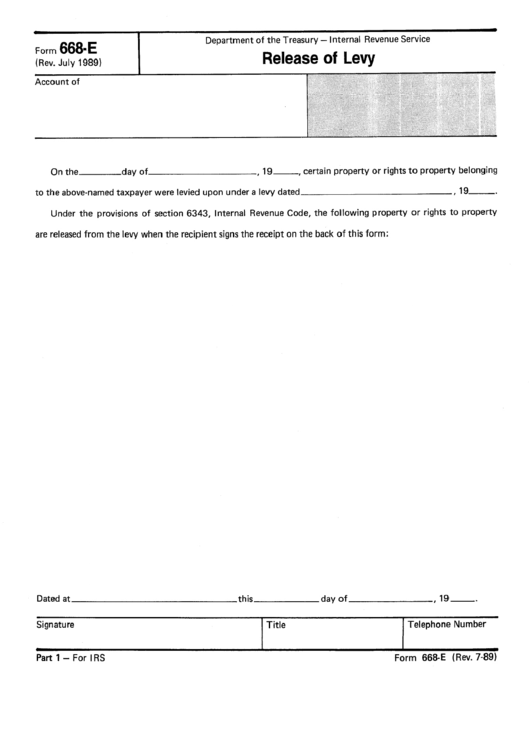

Form 668E Release Of Levy printable pdf download

It’s often sent to your. Web an irs employee is required to give you their manager’s name and phone number when requested. For example, this form is used to levy bank accounts and business receivables. Once a lien arises, the irs generally can’t release it until. Form 4668 for businesses is essentially the same as form 4549 sent to individuals.

Irs Form 668 W Form Resume Examples G28BOqX1gE

Web how to complete the form 668 aids on the web: Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? Discovering documents is not the difficult component when it comes to web document management;. Web an irs employee is required to give you their manager’s name and phone number when requested. For example, this.

Texas Notice Of Intent To Lien Form Form Resume Examples aEDvnpED1Y

This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial. Once a lien arises, the irs generally can’t release it until. Your bank will hold the money in escrow as. It is most often used for bank accounts. As result, the irs.

Irs form 668 a pdf Fill out & sign online DocHub

Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. As result, the irs has taken collection. Sign online button or tick the preview image of the blank. This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such.

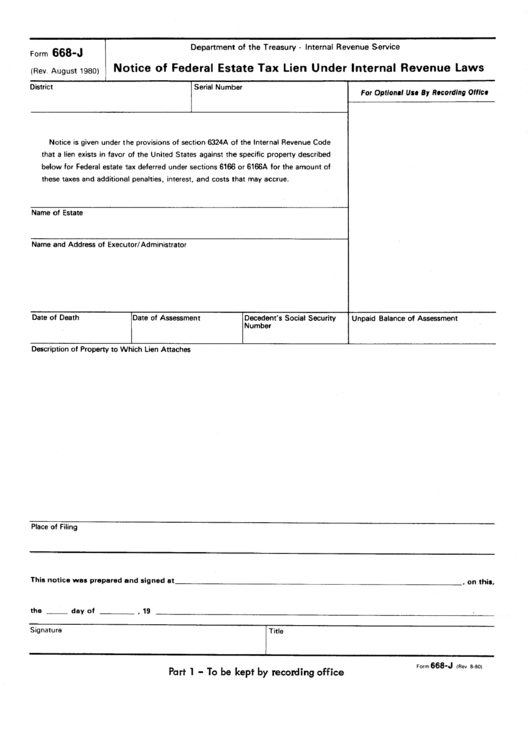

Form 668J Notice Of Federal Estate Tax Lien Under Internal Revenue

Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Over the last 20 years we have empowered. No arrangement was made to resolve the irs back taxes. It’s a notice of an irs wage garnishment. Discovering documents is not the difficult component when it comes to web document management;.

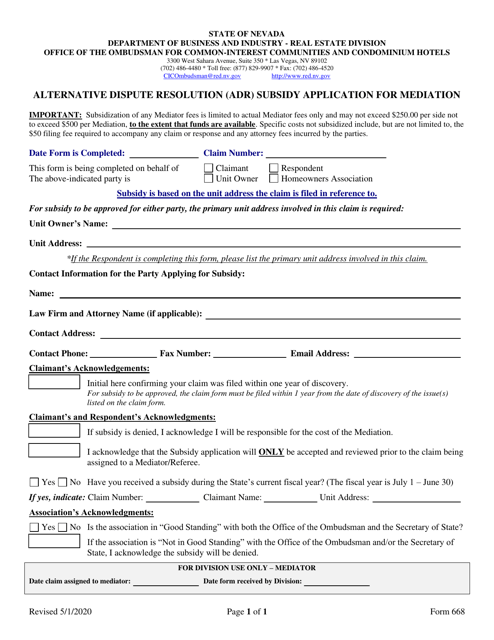

Form 668 Download Fillable PDF or Fill Online Alternative Dispute

Web for eligibility, refer to form 12277, application for the withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j)) pdf. Web you received irs letter 668a because you have unpaid irs back taxes. Make a reasonable effort to identify all property and rights to property belonging to this person. Web 4.8 satisfied.

Fillable Form 668A Notice Of Levy printable pdf download

Once a lien arises, the irs generally can’t release it until. It is most often used for bank accounts. The irs also uses this form to create levies on pension and. Discovering documents is not the difficult component when it comes to web document management;. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but.

For Example, This Form Is Used To Levy Bank Accounts And Business Receivables.

This form is used to levy on or in combination with seizure of intangible personal property held by a third party, such as a bank or other financial. The irs also uses this form to create levies on pension and. Web an irs employee is required to give you their manager’s name and phone number when requested. Web how to complete the form 668 aids on the web:

Your Bank Will Hold The Money In Escrow As.

It’s often sent to your. Over the last 20 years we have empowered. Web 4.8 satisfied 3975 votes what makes the irs form 668 a ics legally valid? To get started on the blank, use the fill camp;

Make A Reasonable Effort To Identify All Property And Rights To Property Belonging To This Person.

As result, the irs has taken collection. Form 4668 for businesses is essentially the same as form 4549 sent to individuals but with much more serious implications. Web you received irs letter 668a because you have unpaid irs back taxes. Once a lien arises, the irs generally can’t release it until.

It’s A Notice Of An Irs Wage Garnishment.

No arrangement was made to resolve the irs back taxes. Sign online button or tick the preview image of the blank. Discovering documents is not the difficult component when it comes to web document management;. It is most often used for bank accounts.