Form 8621 Irs

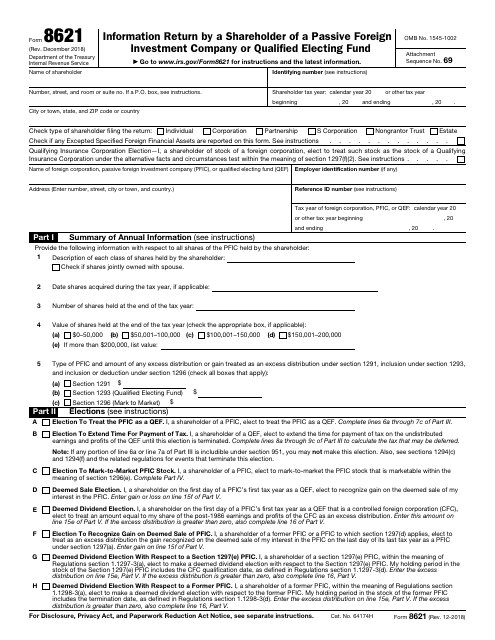

Form 8621 Irs - Get started global industry recognition Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Web what is form 8621 used for? Recognizes gain on a direct or indirect disposition of pfic stock, 3. Web form 8621, file it if you own shares of a passive foreign investment company (pfic). Unlike the fbar for example, the form 8621 is very complex — if for no other reason than. And (4) allow a u.s. Unlike the fbar for example, the form 8621 is very complex — if for no other reason than just trying to decipher whether your foreign investment qualifies as a passive foreign investment company or not. In recent years, the irs has aggressively increased enforcement of offshore reporting. Receives certain direct or indirect distributions from a pfic, 2.

Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Without a doubt, form 8621—information return by a shareholder of a passive foreigninvestment company or qualified electing fund is one of the hardest irs tax forms to fill out. Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year under the following five circumstances if the u.s. Follow line by line 8621 instructions to file. Tax form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, is used to report income from foreign mutual funds, also referred to as passive foreign investment companies (pfics). Unlike the fbar for example, the form 8621 is very complex — if for no other reason than just trying to decipher whether your foreign investment qualifies as a passive foreign investment company or not. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. In the case of a shareholder of a former pfic, after 3 years from the due date, as extended, of the tax return for the tax year that includes the termination date, or Web form 8621, file it if you own shares of a passive foreign investment company (pfic). Get started worldwide representation we represent clients nationwide and worldwide in over 80+ different countries.

What is a passive foreign investment company (pfic)? Part v for each excess distribution and disposition. Web pfic and form 8621 feb 11, 2021 the pfic rules apply to us persons. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund, including recent updates, related forms, and instructions on how to file. In recent years, the irs has aggressively increased enforcement of offshore reporting. Enter your total distributions from the section 1291 fund during the current tax year with respect to the Shareholder to make the election by attaching the form 8621 to its amended federal income tax return for the tax year to which it relates, if the u.s. Web what is irs form 8621 used for? Get started global industry recognition Us citizens living overseas invest in foreign investment vehicles, as that’s where they live.

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding

Get started worldwide representation we represent clients nationwide and worldwide in over 80+ different countries. Web unfiled form 8621 means an incomplete tax return unless a person committed fraud and/or has more than $5000 of unreported foreign income or omitted more than 25% of gross income in the return, the statute of limitations the. Without a doubt, form 8621—information return.

Form 8621A Return by a Shareholder Making Certain Late Elections to

Get started global industry recognition Without a doubt, form 8621—information return by a shareholder of a passive foreigninvestment company or qualified electing fund is one of the hardest irs tax forms to fill out. Web what is irs form 8621 used for? What is a passive foreign investment company (pfic)? Attach form 8621 to the shareholder's tax return (or, if.

Fill Free fillable F8621 Accessible Form 8621 (Rev. December 2018

Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Web when and where to file. Enter your total distributions from the section 1291 fund during the current tax year with respect to the Get started worldwide representation we represent clients nationwide and worldwide in over 80+ different countries. What is a passive foreign investment company (pfic)?

Form 8621 Calculator Introduction YouTube

Enter your total distributions from the section 1291 fund during the current tax year with respect to the When and where to file. Web what is irs form 8621 used for? On average, it takes between 35 to 40 hours. Receives certain direct or indirect distributions from a pfic, 2.

Form 8621 PFIC Reporting Navigating the Highly Complex IRS Passive F…

Unlike the fbar for example, the form 8621 is very complex — if for no other reason than just trying to decipher whether your foreign investment qualifies as a passive foreign investment company or not. Without a doubt, form 8621—information return by a shareholder of a passive foreigninvestment company or qualified electing fund is one of the hardest irs tax.

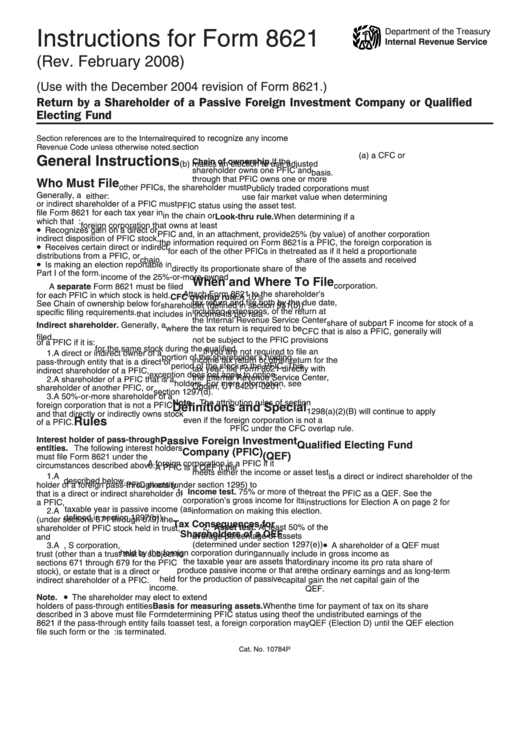

Instructions For Form 8621 (2008) Internal Revenue Service printable

Web when and where to file. Us citizens living overseas invest in foreign investment vehicles, as that’s where they live. The irs would consider a foreign entity a passive foreign investment company (pfic) if it meets either the income or asset test. Tax form 8621, information return by a shareholder of a passive foreign investment company or qualified electing fund,.

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

Without a doubt, form 8621—information return by a shareholder of a passive foreigninvestment company or qualified electing fund is one of the hardest irs tax forms to fill out. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Person is required to recognize any income under section 1291. Web that annual.

U.S. TREAS Form treasirs86212000

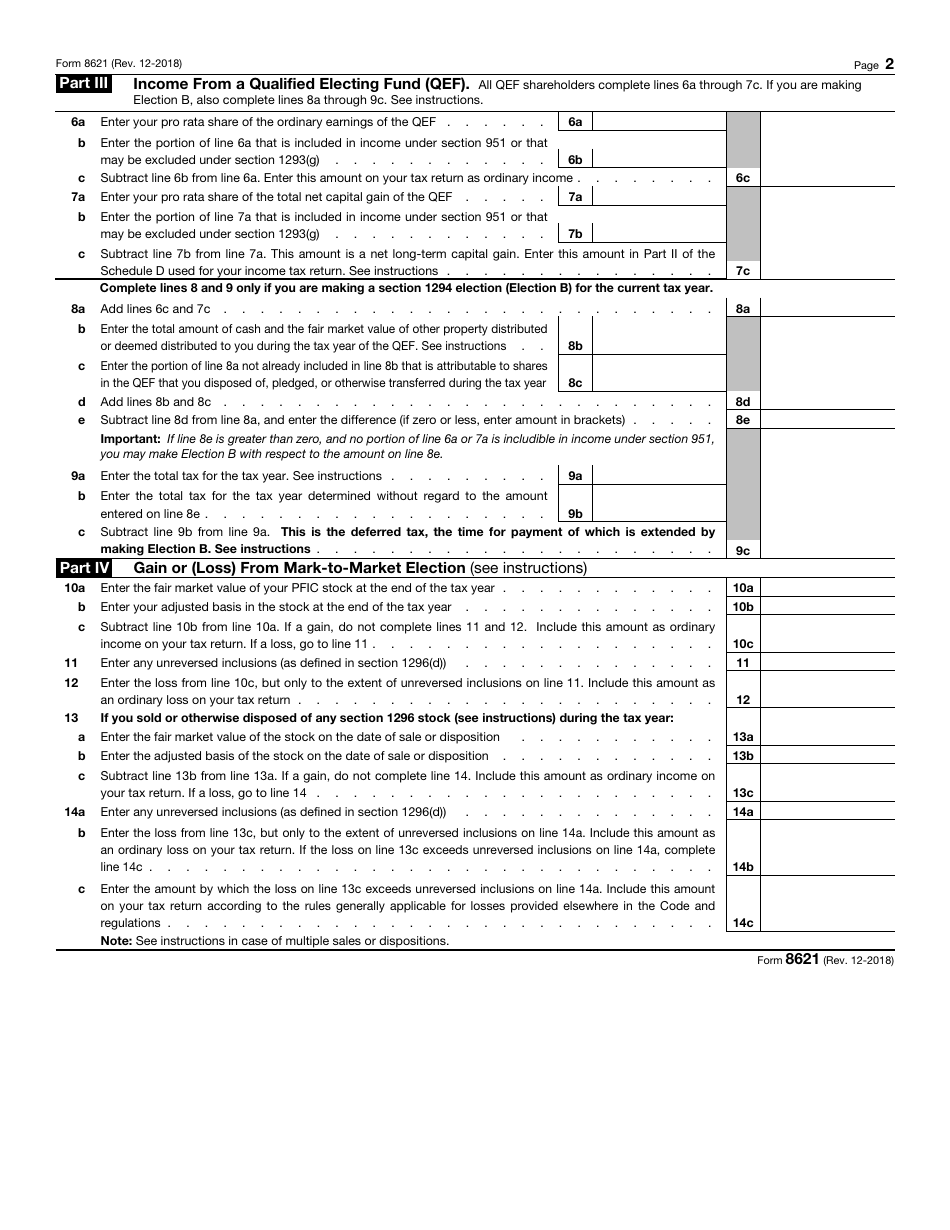

Person that is a direct or indirect shareholder of a pfic must file form 8621 for each tax year under the following five circumstances if the u.s. Receives certain direct or indirect distributions from a pfic, 2. Web what is form 8621 used for? December 2018) department of the treasury internal revenue service information return by a shareholder of a.

IRS Form 8621 Download Fillable PDF or Fill Online Information Return

Without a doubt, form 8621—information return by a shareholder of a passive foreigninvestment company or qualified electing fund is one of the hardest irs tax forms to fill out. Individuals, corporations, estates and trusts who are us residents or us citizens. Web information about form 8621, information return by a shareholder of a passive foreign investment company or qualified electing.

Form 8621 Instructions 2020 2021 IRS Forms

Web what is irs form 8621 used for? The irs would consider a foreign entity a passive foreign investment company (pfic) if it meets either the income or asset test. Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Web the form 8621 is used by us.

Web Pfic And Form 8621 Feb 11, 2021 The Pfic Rules Apply To Us Persons.

Shareholder to make the election by attaching the form 8621 to its amended federal income tax return for the tax year to which it relates, if the u.s. Shareholders file form 8621 if they receive certain pfic direct/indirect distributions. Person is required to recognize any income under section 1291. Such form should be attached to the shareholder’s us income tax return, and may need to be filed even if the shareholder is not required to file a us income tax return or other return for the tax year.

What Is A Passive Foreign Investment Company (Pfic)?

Follow line by line 8621 instructions to file. And (4) allow a u.s. Web what is irs form 8621 used for? Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund).

Enter Your Total Distributions From The Section 1291 Fund During The Current Tax Year With Respect To The

3 part v distributions from and dispositions of stock of a section 1291 fund (see instructions) complete a. Unlike the fbar for example, the form 8621 is very complex — if for no other reason than. Web the form 8621 is used by us person taxpayers to report ownership in passive foreign investment companies. Unlike the fbar for example, the form 8621 is very complex — if for no other reason than just trying to decipher whether your foreign investment qualifies as a passive foreign investment company or not.

A Late Purging Election Is A Purging Election Under Section 1298(B)(1) That Is Made:

On average, it takes between 35 to 40 hours. In the case of a shareholder of a former pfic, after 3 years from the due date, as extended, of the tax return for the tax year that includes the termination date, or Web a single form 8621 may be filed with respect to a pfic to report the information required by section 1298 (f) (that is, part i), as well as to report information on parts iii through vi of the form and to make elections in part ii of the form. When and where to file.