Form 8990 Instructions 2020

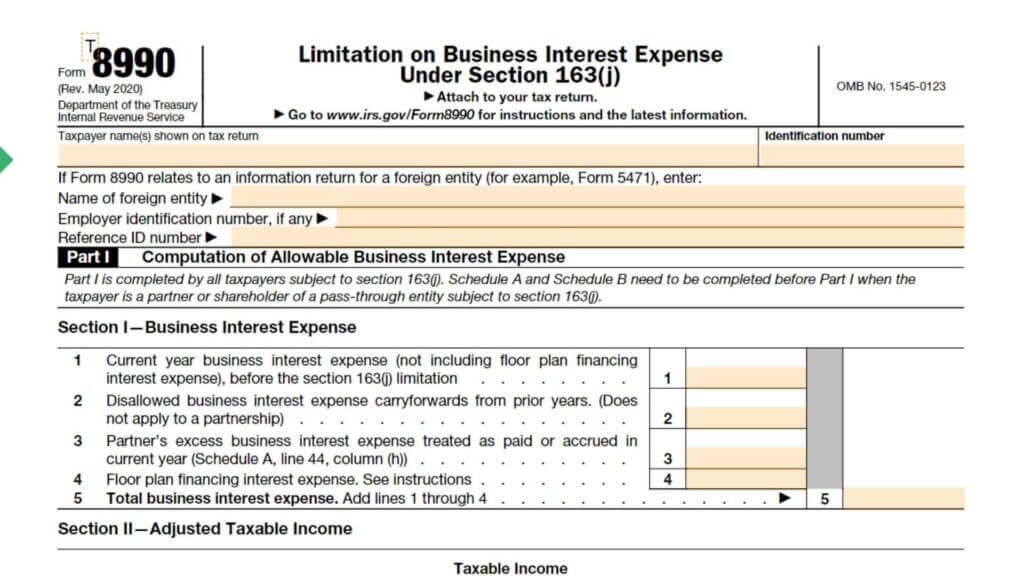

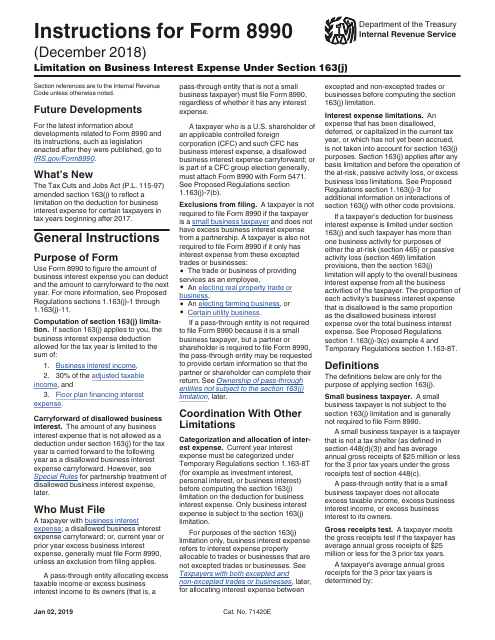

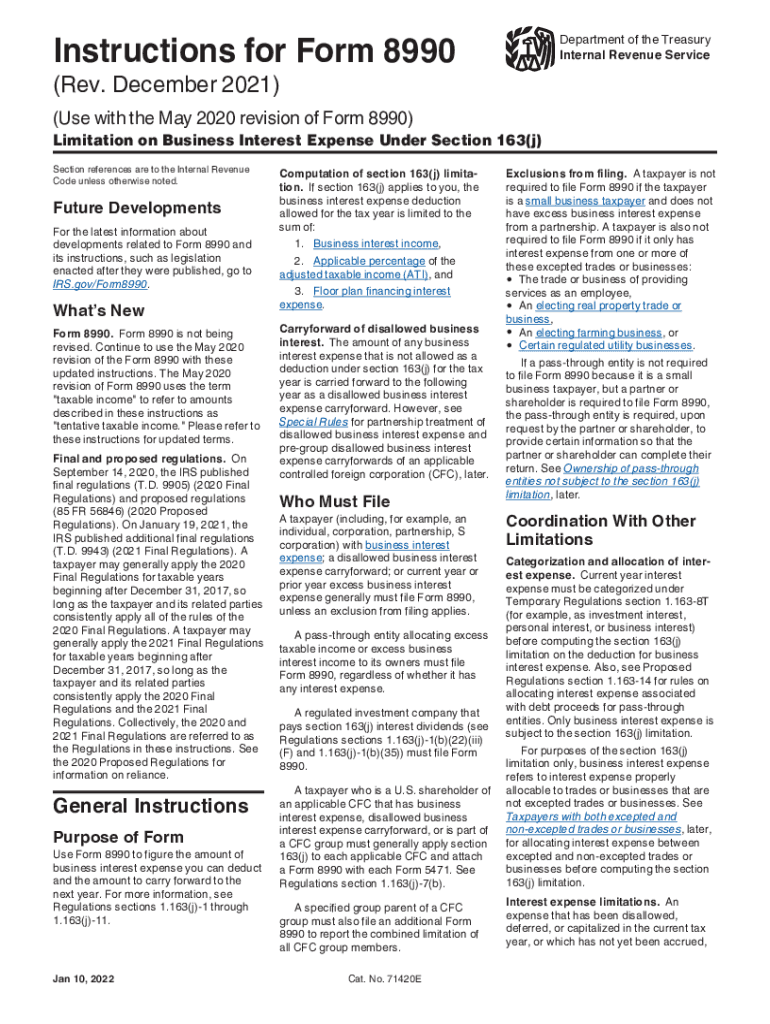

Form 8990 Instructions 2020 - Web let’s start with step by step instructions on how to complete form 8990. Web how it works open the 2022 instructions 8990 and follow the instructions easily sign the instructions 8990 form with your finger send filled & signed irs instructions 8990 or save. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. Note that passthrough entities not subject to the 163. Who must file form 8990? How do i complete irs form 8990? Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Web see the instructions for form 8990 for additional information. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year.

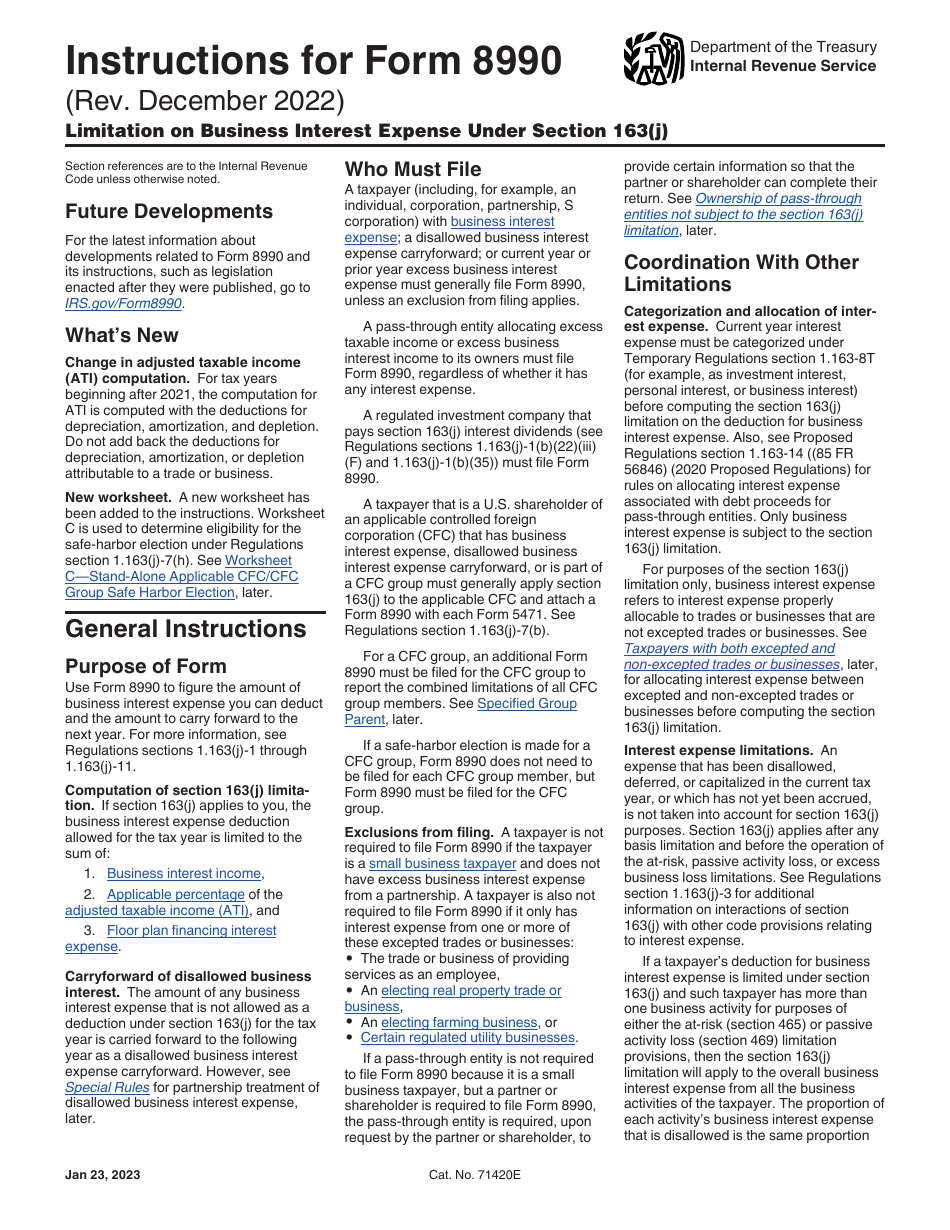

Web revised instructions for irs form 8990, limitation on business interest expense under section 163(j), released jan. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. There are 3 parts to this 3 page form, and two schedules. Web 2 years ago fed returns generally what is form 8990? December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your tax return. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j). Web how it works open the 2022 instructions 8990 and follow the instructions easily sign the instructions 8990 form with your finger send filled & signed irs instructions 8990 or save. Web let’s start with step by step instructions on how to complete form 8990.

Choosing a legal expert, creating an appointment and coming to the business office for a personal meeting makes completing a irs 8990 from. Web see the instructions for form 8990 for additional information. For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j). Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. How do i complete irs form 8990? Web let’s start with step by step instructions on how to complete form 8990. Web how it works open the 2022 instructions 8990 and follow the instructions easily sign the instructions 8990 form with your finger send filled & signed irs instructions 8990 or save. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically.

Form 8990 Instructions 2023

Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. 20 noting that the instructions should be. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically..

8990 Fill out & sign online DocHub

Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. Who must file form 8990? Note that passthrough entities not subject to the 163. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j). Web revised instructions for.

Instructions for Form 8990 (12/2021) Internal Revenue Service

Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. Web 2 years ago fed returns generally what is form 8990? December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your tax return. Web form 8990 calculates the business interest expense deduction.

What Is Sale/gross Receipts Of Business In Itr 5 Tabitha Corral's

Note that passthrough entities not subject to the 163. Web how it works open the 2022 instructions 8990 and follow the instructions easily sign the instructions 8990 form with your finger send filled & signed irs instructions 8990 or save. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct.

K1 Excess Business Interest Expense ubisenss

How do i complete irs form 8990? Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. Web 2 years ago fed returns generally what is form 8990? Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file..

Download Instructions for IRS Form 8990 Limitation on Business Interest

Web revised instructions for irs form 8990, limitation on business interest expense under section 163(j), released jan. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j). Per the irs, form 8990 is used to calculate the amount of business interest expense that can be. Web how it works.

IRS Form 8990 Instructions Business Interest Expense Limitation

There are 3 parts to this 3 page form, and two schedules. Web 2 years ago fed returns generally what is form 8990? Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. How do i complete irs form 8990? Web.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Note that passthrough entities not subject to the 163. For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax. Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web see the instructions for form 8990 for.

Irs Instructions 8990 Fill Out and Sign Printable PDF Template signNow

Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Web see the instructions for form 8990 for additional information. Web form 8990 calculates the business interest expense deduction and carryover amounts.the form utilizes the section 163(j) limitation on business interest. Web let’s start with step by step instructions on how to complete.

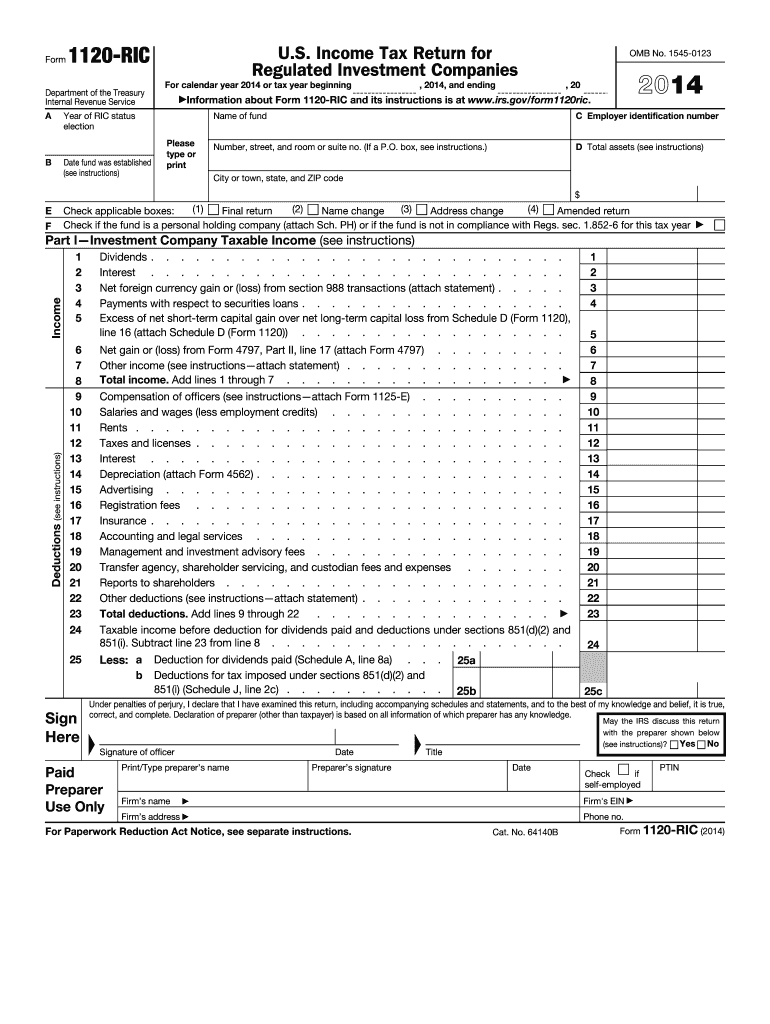

2014 Form IRS 1120RIC Fill Online, Printable, Fillable, Blank pdfFiller

Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. Choosing a legal expert, creating an appointment and coming to the business office.

20 Noting That The Instructions Should Be.

Web 2 years ago fed returns generally what is form 8990? There are 3 parts to this 3 page form, and two schedules. 2 section iv—section 163(j) limitation. Per the irs, form 8990 is used to calculate the amount of business interest expense that can be.

Web Let’s Start With Step By Step Instructions On How To Complete Form 8990.

How do i complete irs form 8990? Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web form 8990 instructions for details on the gross receipts test and other exclusions for excepted businesses. December 2022) limitation on business interest expense under section 163(j) department of the treasury internal revenue service attach to your tax return.

Choosing A Legal Expert, Creating An Appointment And Coming To The Business Office For A Personal Meeting Makes Completing A Irs 8990 From.

Web how it works open the 2022 instructions 8990 and follow the instructions easily sign the instructions 8990 form with your finger send filled & signed irs instructions 8990 or save. Web the 2020 form 990 instructions contain reminders that, starting with tax years beginning on or after july 2, 2019, all organizations must file form 990 series returns electronically. Web general instructions purpose of form use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Web overview this article provides information about how ultratax/1065 calculates form 8990, limitation on business interest expense under section 163 (j).

Web For Paperwork Reduction Act Notice, See The Instructions.

Who must file form 8990? Web information about form 8990, limitation on business interest expense under section 163(j), including recent updates, related forms and instructions on how to file. Web see the instructions for form 8990 for additional information. For tax years beginning after 2017, the partner’s basis in its partnership interest at the end of the tax.