Form 990 Pf Instructions

Form 990 Pf Instructions - See the schedule b instructions to determine the requirements for filing. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Below are solutions to frequently asked questions about entering form 990, form 990. Our matrices include comments and recommendations while indicating the. The form consists of sixteen sections. The instructions include a reminder that form. If the return is not.

Below are solutions to frequently asked questions about entering form 990, form 990. The form consists of sixteen sections. As required by section 3101 of the taxpayer first. Get ready for tax season deadlines by completing any required tax forms today. Our matrices include comments and recommendations while indicating the. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. It is an information return used to calculate the tax based on. If the return is not.

See the schedule b instructions to determine the requirements for filing. Get ready for tax season deadlines by completing any required tax forms today. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: As required by section 3101 of the taxpayer first. It is an information return used to calculate the tax based on. The instructions include a reminder that form. The form consists of sixteen sections. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. If the return is not.

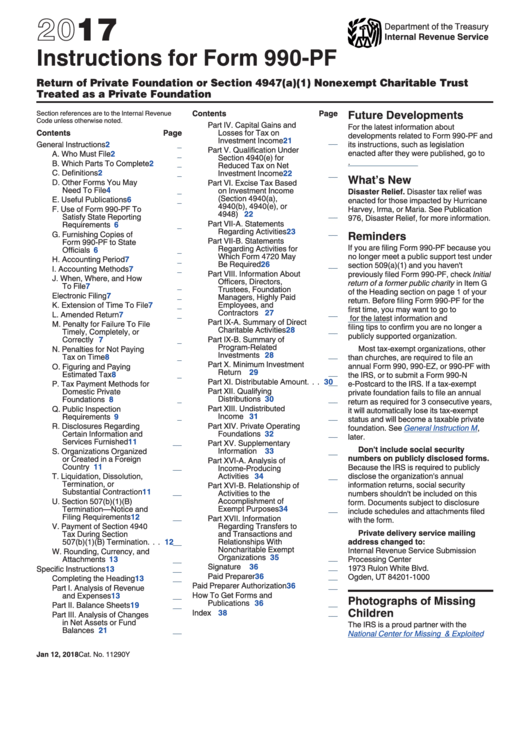

Instructions For Form 990Pf Return Of Private Foundation Or Section

It is an information return used to calculate the tax based on. Below are solutions to frequently asked questions about entering form 990, form 990. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Web form.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Below are solutions to frequently asked questions about entering form 990, form 990. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Our matrices include comments and recommendations while indicating the. See the schedule b instructions to determine the requirements for filing. As.

File 990PF Online Efile 990 PF Form 990PF 2021 Instructions

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Below are solutions to frequently asked questions about entering form 990, form 990. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web information.

Form 990PF Return of Private Foundation (2014) Free Download

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Our matrices include comments and recommendations while indicating the. If the return is not. Below are solutions to frequently asked questions about entering form 990, form 990. It is an information return used to calculate the tax based on.

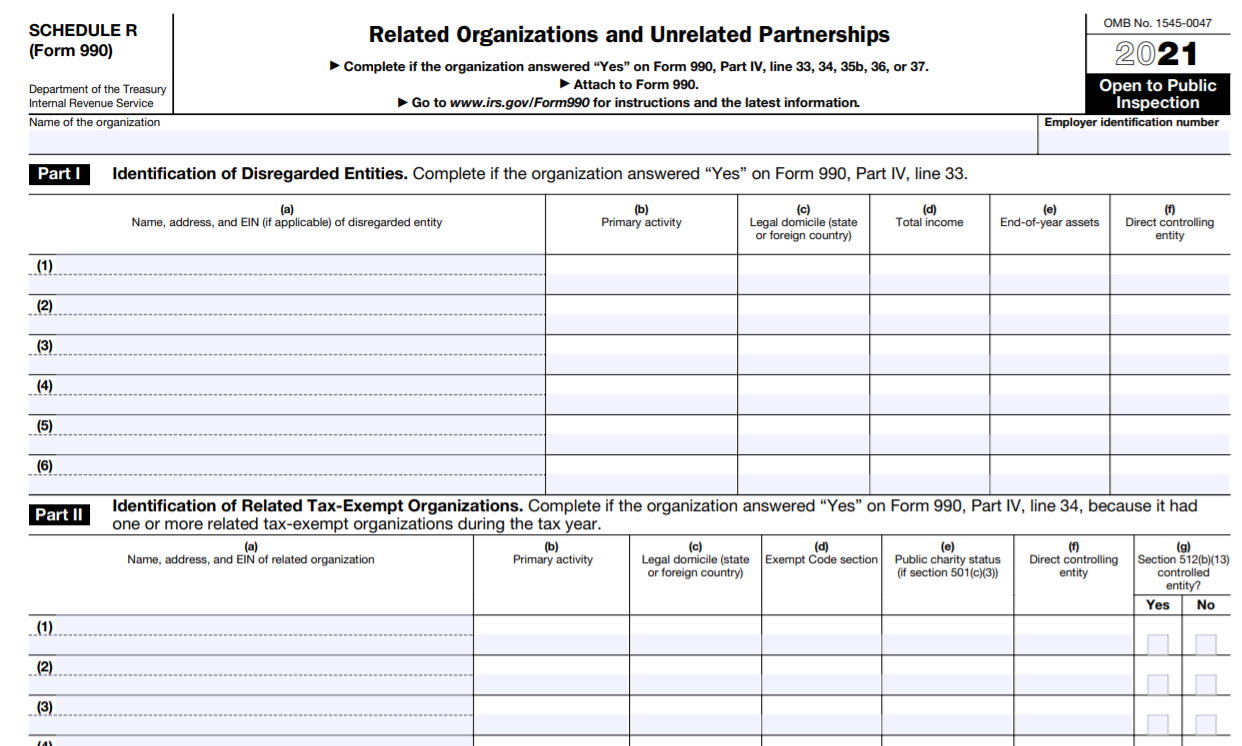

IRS Form 990 Schedule R Instructions Related Organizations and

Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Our matrices include comments and recommendations while indicating the. The form consists of sixteen sections. It is an information return used to calculate the tax based on. If the return is not.

Form 990 Filing Instructions Fill Out and Sign Printable PDF Template

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: See the schedule b instructions to determine the requirements for filing. The instructions include a reminder that form. Below are solutions to frequently asked questions about entering form 990, form 990. As required by section 3101 of the taxpayer first.

File 990PF online Form 990PF efiling Software

Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Below are solutions to frequently asked questions about entering form 990, form 990. The instructions include a reminder.

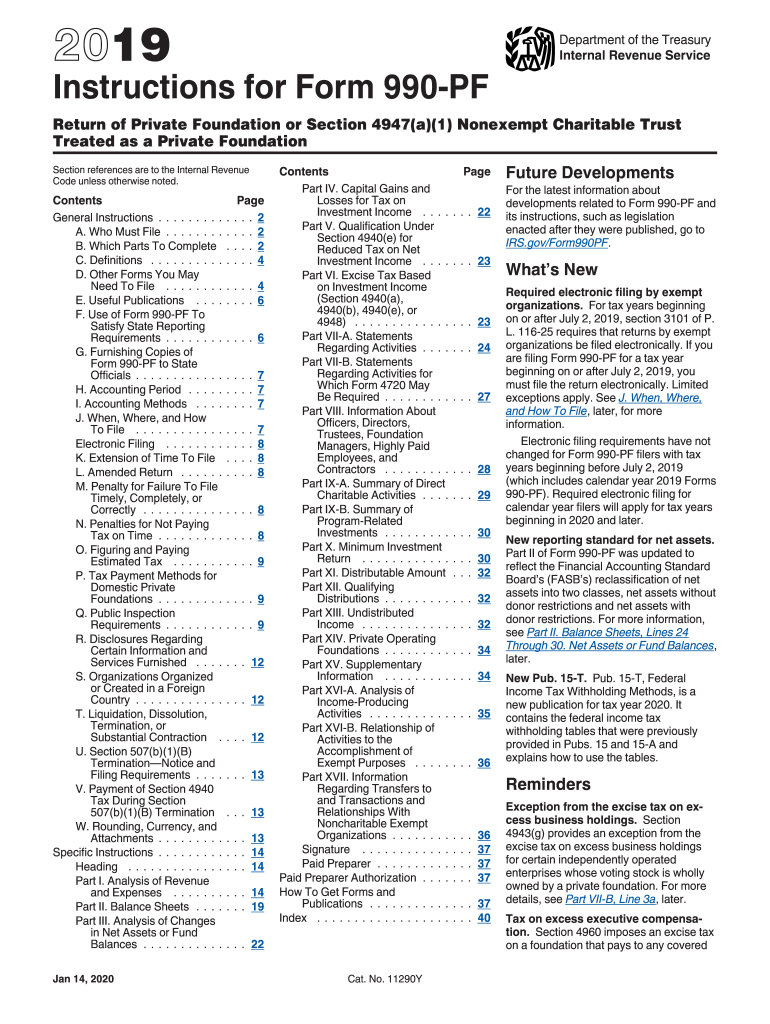

Instructions to file your Form 990PF A Complete Guide

As required by section 3101 of the taxpayer first. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes: Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Get ready for tax season deadlines by completing any.

Form 990PF Return of Private Foundation (2014) Free Download

Below are solutions to frequently asked questions about entering form 990, form 990. If the return is not. The form consists of sixteen sections. It is an information return used to calculate the tax based on. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a.

Form 990PF Return of Private Foundation (2014) Free Download

If the return is not. Below are solutions to frequently asked questions about entering form 990, form 990. See the schedule b instructions to determine the requirements for filing. The form consists of sixteen sections. Get ready for tax season deadlines by completing any required tax forms today.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

The form consists of sixteen sections. As required by section 3101 of the taxpayer first. Instructions were updated to remind filers that, under the cares act, ppp loan amounts that are forgiven should be reported as contributions from a governmental unit in the tax year when the amounts. Web the 2020 form 990, return of organization exempt from income tax, and instructions contain the following notable changes:

If The Return Is Not.

Below are solutions to frequently asked questions about entering form 990, form 990. Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Our matrices include comments and recommendations while indicating the. It is an information return used to calculate the tax based on.

The Instructions Include A Reminder That Form.

See the schedule b instructions to determine the requirements for filing. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.