Form 990 Schedule D Instructions

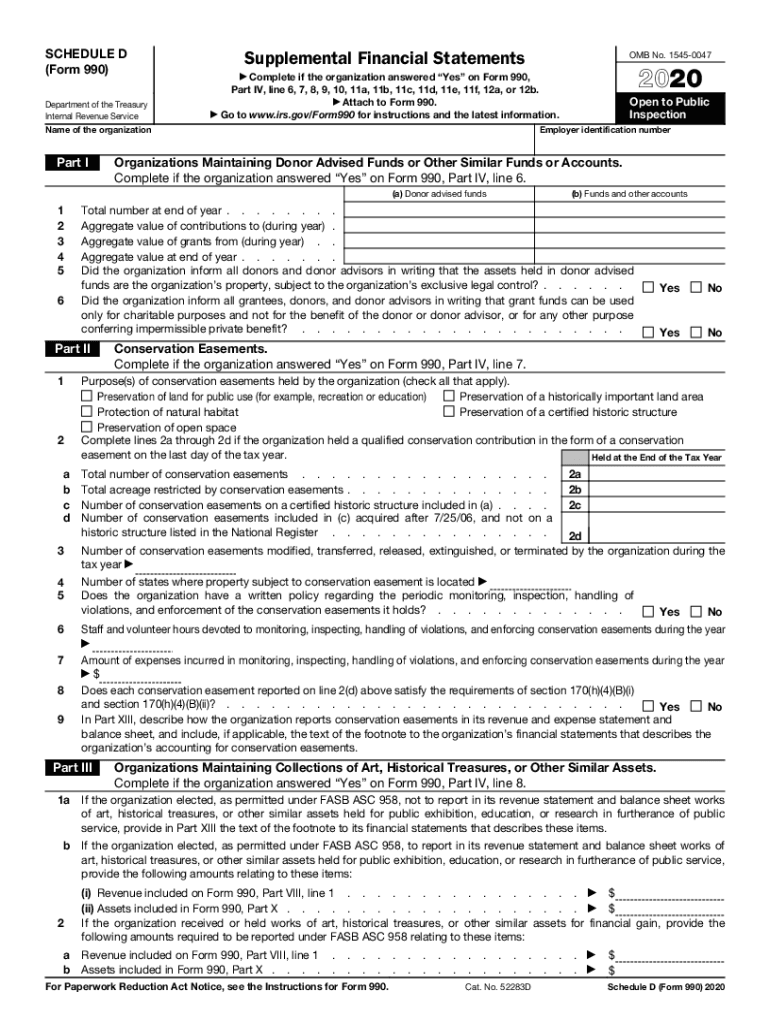

Form 990 Schedule D Instructions - The following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web however, depending on the specific method change, the irs may provide that an adjustment is not required or permitted. Instructions for these schedules are combined with the schedules. Web schedule d of the form 990 was modified to conform to asc 958. As required by section 3101 of the taxpayer first act of 2019, p.l. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b. Web form 990 schedules with instructions. An organization must report any adjustment required by section 481(a) in parts viii through xi and on schedule d (form 990), parts xi and xii, as applicable, and provide an explanation for the change on schedule o (form 990). Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information. According to irs filing requirements, nonprofit organizations that file form 990 may be required to attach schedule d for reporting additional information regarding their financial status.

Web appropriate part(s) of schedule d column (b) the total number of otherin which all of the committee members (form 990) and attach the schedule to similar funds or accounts held by theare appointed by the sponsoring form 990. An organization that organization at the end of the year.organization; Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) An organization must report any adjustment required by section 481(a) in parts viii through xi and on schedule d (form 990), parts xi and xii, as applicable, and provide an explanation for the change on schedule o (form 990). Web schedule d of the form 990 was modified to conform to asc 958. Go to www.irs.gov/form990 for instructions and the latest information. Instructions for these schedules are combined with the schedules. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b.

Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information. Web appropriate part(s) of schedule d column (b) the total number of otherin which all of the committee members (form 990) and attach the schedule to similar funds or accounts held by theare appointed by the sponsoring form 990. According to irs filing requirements, nonprofit organizations that file form 990 may be required to attach schedule d for reporting additional information regarding their financial status. Web schedule d of the form 990 was modified to conform to asc 958. Instructions for these schedules are combined with the schedules. Answered “yes” to form 990, part iv, b. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. As required by section 3101 of the taxpayer first act of 2019, p.l. Web however, depending on the specific method change, the irs may provide that an adjustment is not required or permitted. Web form 990 schedules with instructions.

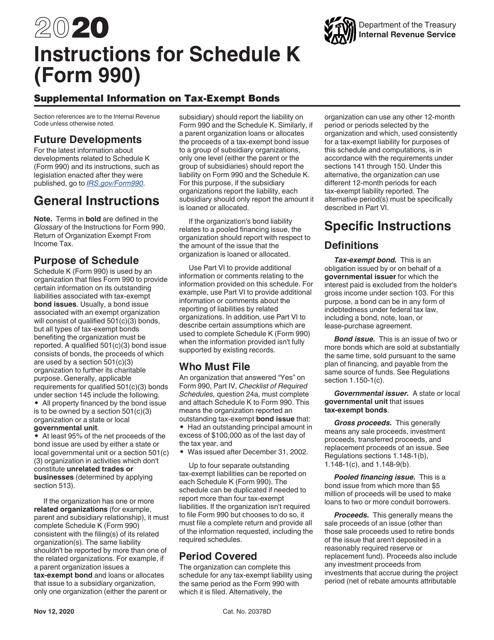

Download Instructions for IRS Form 990 Schedule K Supplemental

According to irs filing requirements, nonprofit organizations that file form 990 may be required to attach schedule d for reporting additional information regarding their financial status. Instructions for these schedules are combined with the schedules. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Go to www.irs.gov/form990 for instructions and the.

IRS Instructions 990 2019 Printable & Fillable Sample in PDF

Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) Web form 990 schedules with instructions. The following schedules to form 990, return of organization.

Schedule D Form 990 Supplemental Financial Statements Fill Out and

Web schedule d of the form 990 was modified to conform to asc 958. An organization that organization at the end of the year.organization; Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web however, depending on the specific method change, the irs may provide that an adjustment is not required.

form 990 schedule m instructions 2017 Fill Online, Printable

Go to www.irs.gov/form990 for instructions and the latest information. Web schedule d of the form 990 was modified to conform to asc 958. Answered “yes” to form 990, part iv, b. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) Web schedule.

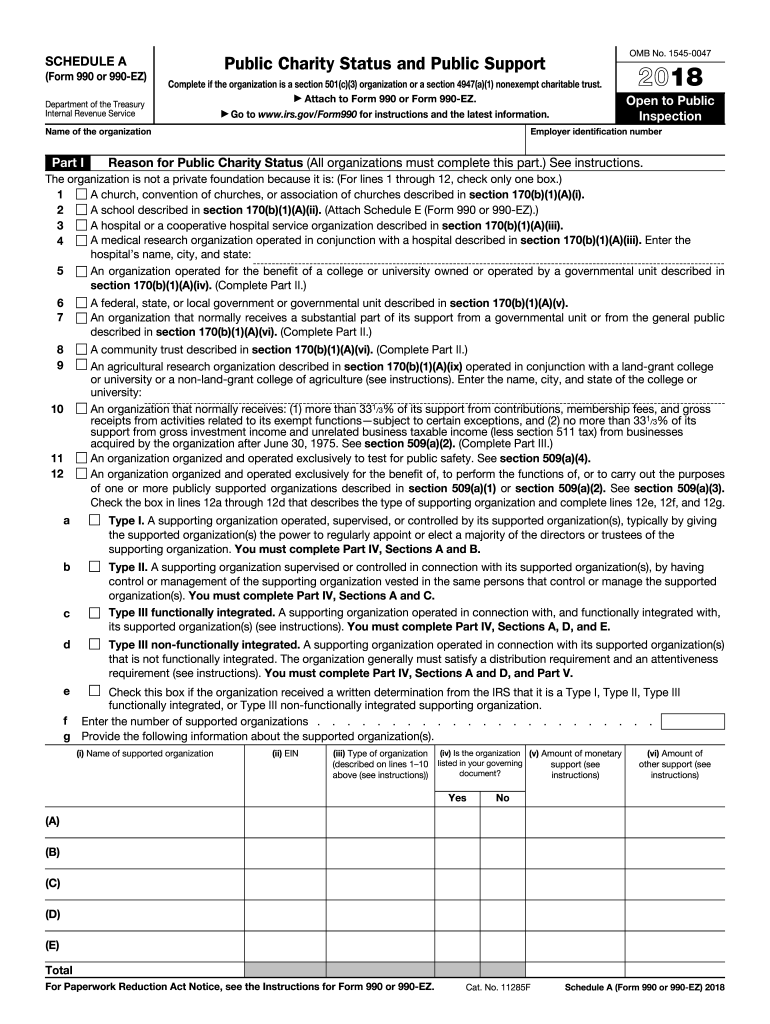

2018 Schedule A Form 990 Or 990 Ez Fill Out and Sign Printable PDF

Web for paperwork reduction act notice, see the instructions for form 990. Answered “yes” to form 990, part iv, b. As required by section 3101 of the taxpayer first act of 2019, p.l. Web schedule d of the form 990 was modified to conform to asc 958. The following schedules to form 990, return of organization exempt from income tax,.

Form 990 Schedule D Edit, Fill, Sign Online Handypdf

An organization must report any adjustment required by section 481(a) in parts viii through xi and on schedule d (form 990), parts xi and xii, as applicable, and provide an explanation for the change on schedule o (form 990). Go to www.irs.gov/form990 for instructions and the latest information. Web for paperwork reduction act notice, see the instructions for form 990..

Form 990 (Schedule F) and Form 990 Schedule D Main Differences

Web schedule d of the form 990 was modified to conform to asc 958. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Answered “yes” to form 990, part iv, b. Web however, depending on the specific method change, the irs may provide that an adjustment is not required or permitted..

IRS Form 990 Schedule B 2018 2019 Printable & Fillable Sample in PDF

Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b. Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting.

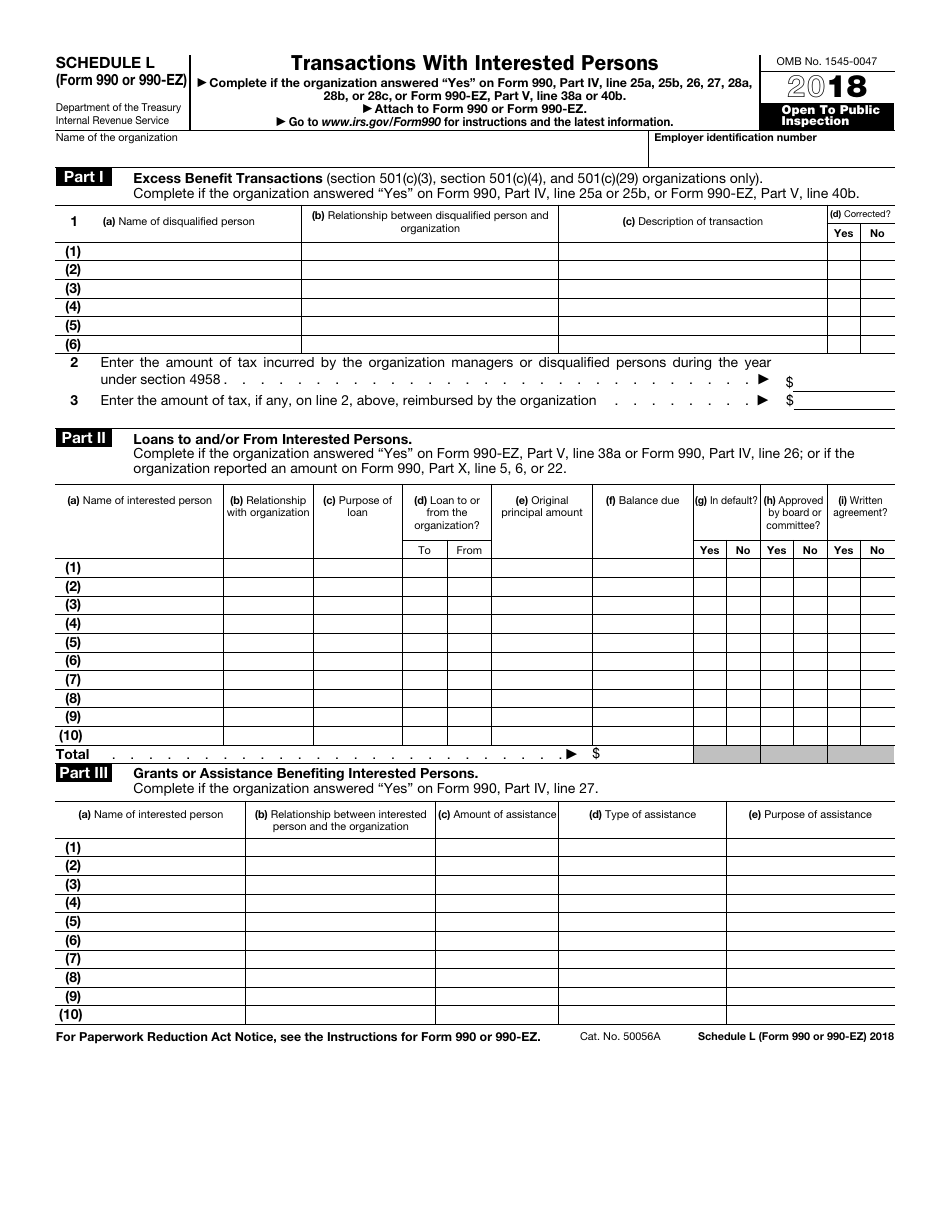

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

Web for paperwork reduction act notice, see the instructions for form 990. Instructions for these schedules are combined with the schedules. An organization must report any adjustment required by section 481(a) in parts viii through xi and on schedule d (form 990), parts xi and xii, as applicable, and provide an explanation for the change on schedule o (form 990)..

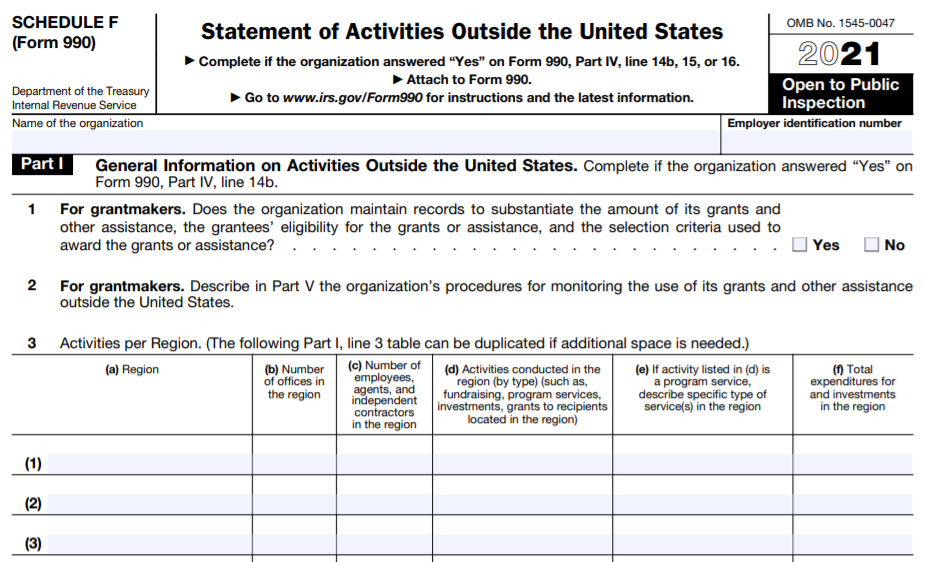

IRS Form 990 Schedule F Instructions Statement of Activities Outside

Web appropriate part(s) of schedule d column (b) the total number of otherin which all of the committee members (form 990) and attach the schedule to similar funds or accounts held by theare appointed by the sponsoring form 990. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate.

Web Schedule D Of The Form 990 Was Modified To Conform To Asc 958.

Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b. Web form 990 schedules with instructions. Go to www.irs.gov/form990 for instructions and the latest information. Web for paperwork reduction act notice, see the instructions for form 990.

Web Schedule D (Form 990) Is Used By An Organization That Files Form 990 To Provide The Required Reporting For Donor Advised Funds, Conservation Easements, Certain Art And Museum Collections, Escrow Or Custodial Accounts Or Arrangements, Endowment Funds, And Supplemental Financial Information.

Answered “yes” to form 990, part iv, b. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web appropriate part(s) of schedule d column (b) the total number of otherin which all of the committee members (form 990) and attach the schedule to similar funds or accounts held by theare appointed by the sponsoring form 990. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year)

The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Instructions for these schedules are combined with the schedules. As required by section 3101 of the taxpayer first act of 2019, p.l. According to irs filing requirements, nonprofit organizations that file form 990 may be required to attach schedule d for reporting additional information regarding their financial status. Web however, depending on the specific method change, the irs may provide that an adjustment is not required or permitted.

An Organization Must Report Any Adjustment Required By Section 481(A) In Parts Viii Through Xi And On Schedule D (Form 990), Parts Xi And Xii, As Applicable, And Provide An Explanation For The Change On Schedule O (Form 990).

An organization that organization at the end of the year.organization;