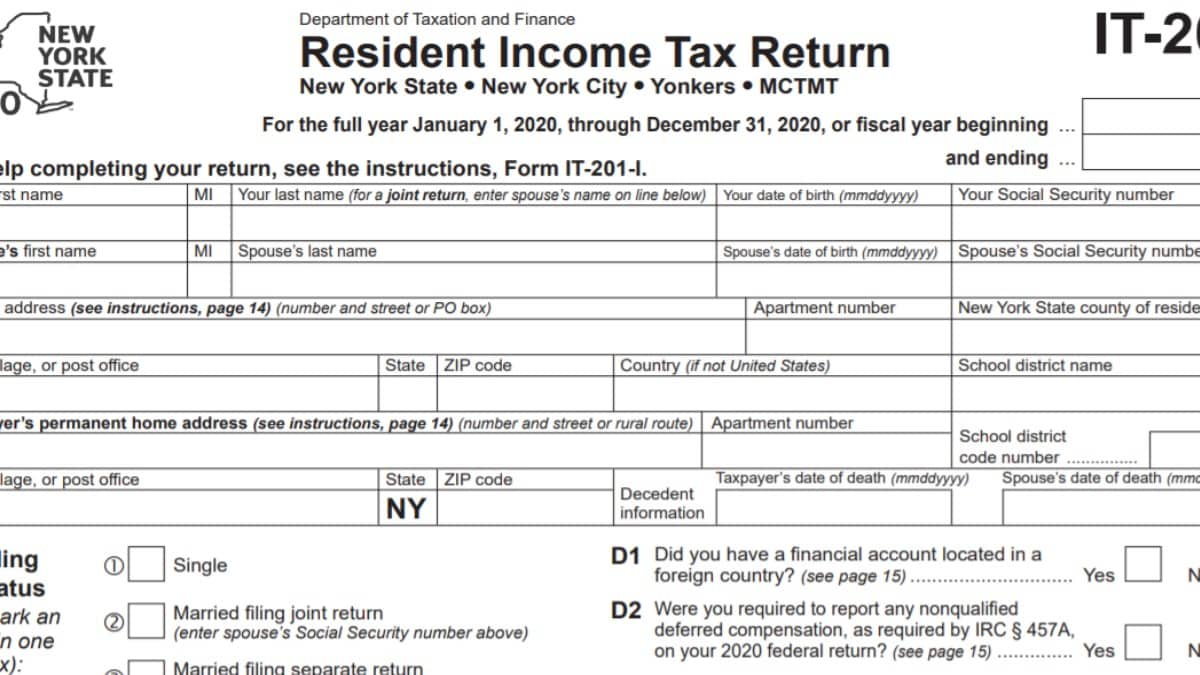

Form It-201 Or It-203

Form It-201 Or It-203 - It is analogous to the us form 1040, but it is four pages long, instead of two pages. The following articles are frequently asked questions. Web find your requested refund amount by form and tax year; Were not a resident of new york state and received income during the tax. Mark an x in the box identifying the return you. If you are filing a joint personal. Nonresident alien income tax return, you may be required. Web complete all parts that apply to you; Nonresident alien for federal income tax. Web you may be eligible for free file using one of the software providers below, if:

The following articles are frequently asked questions. Purposes and are required to file federal form 1040nr,u.s. Web if you are a u.s. Nonresident alien for federal income tax. Web find your requested refund amount by form and tax year; If you filed for tax year your requested refund amount is; Mark an x in the box identifying the return you. Web june 6, 2019 5:22 am. If you are filing a joint personal. Web complete all parts that apply to you;

If you filed for tax year your requested refund amount is; It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web find your requested refund amount by form and tax year; Web june 6, 2019 5:22 am. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web if you are a u.s. The following articles are frequently asked questions. If you are filing a joint personal. Nonresident alien income tax return, you may be required. Web complete all parts that apply to you;

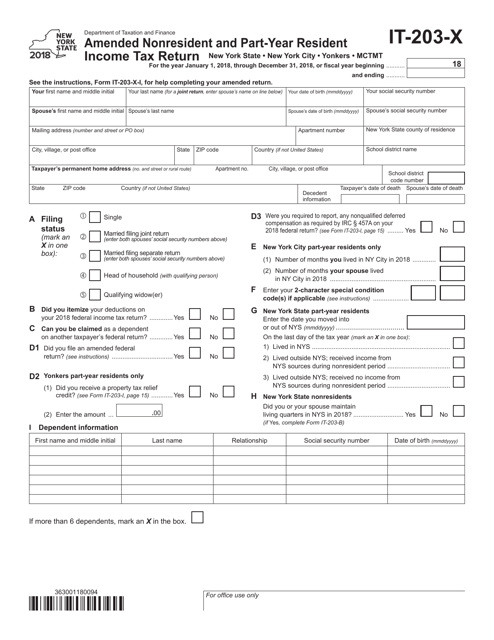

Ny It 203 B Instructions

Nonresident alien for federal income tax. Web you may be eligible for free file using one of the software providers below, if: Web if you are a u.s. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web june 6, 2019 5:22 am.

IT201 Instructions 2022 2023 State Taxes TaxUni

The following articles are frequently asked questions. If you filed for tax year your requested refund amount is; Web find your requested refund amount by form and tax year; To see if your client qualifies for the. Web you may be eligible for free file using one of the software providers below, if:

Form IT 203 Nonresident and Part Year Resident Tax Return YouTube

If you filed for tax year your requested refund amount is; Web you may be eligible for free file using one of the software providers below, if: Mark an x in the box identifying the return you. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Were not a resident of new york state and.

2018 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

If you filed for tax year your requested refund amount is; Were not a resident of new york state and received income during the tax. To see if your client qualifies for the. Nonresident alien for federal income tax. Mark an x in the box identifying the return you.

Form IT 203 X Amended Nonresident and Part Year Resident Tax

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web find your requested refund amount by form and tax year; Were not a resident of new york state and received income during the tax. Nonresident alien for federal income tax. Mark an x in the box identifying the return you.

Form IT203X Download Fillable PDF or Fill Online Amended Nonresident

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. To see if your client qualifies for the. Web complete all parts that apply to you; Web you may be eligible for free file using one of the software providers below, if: It is analogous to the us form 1040, but it is four pages long,.

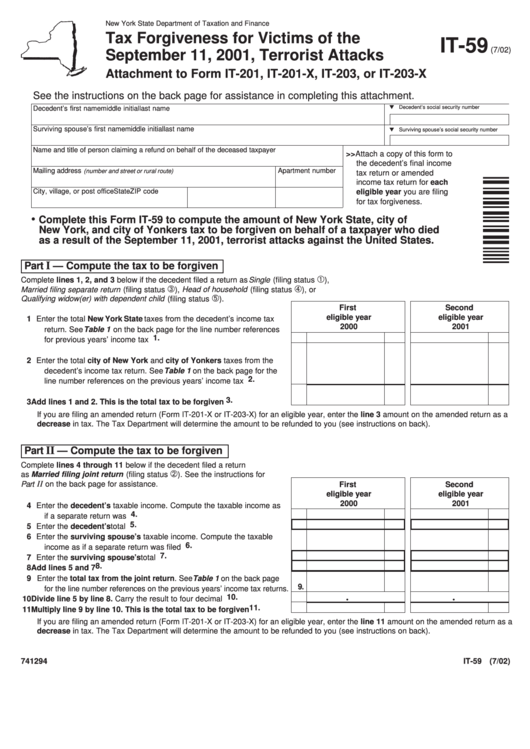

Fillable Form It59 Tax For Victims Of The September 11

Web complete all parts that apply to you; Web find your requested refund amount by form and tax year; To see if your client qualifies for the. If you filed for tax year your requested refund amount is; Web you may be eligible for free file using one of the software providers below, if:

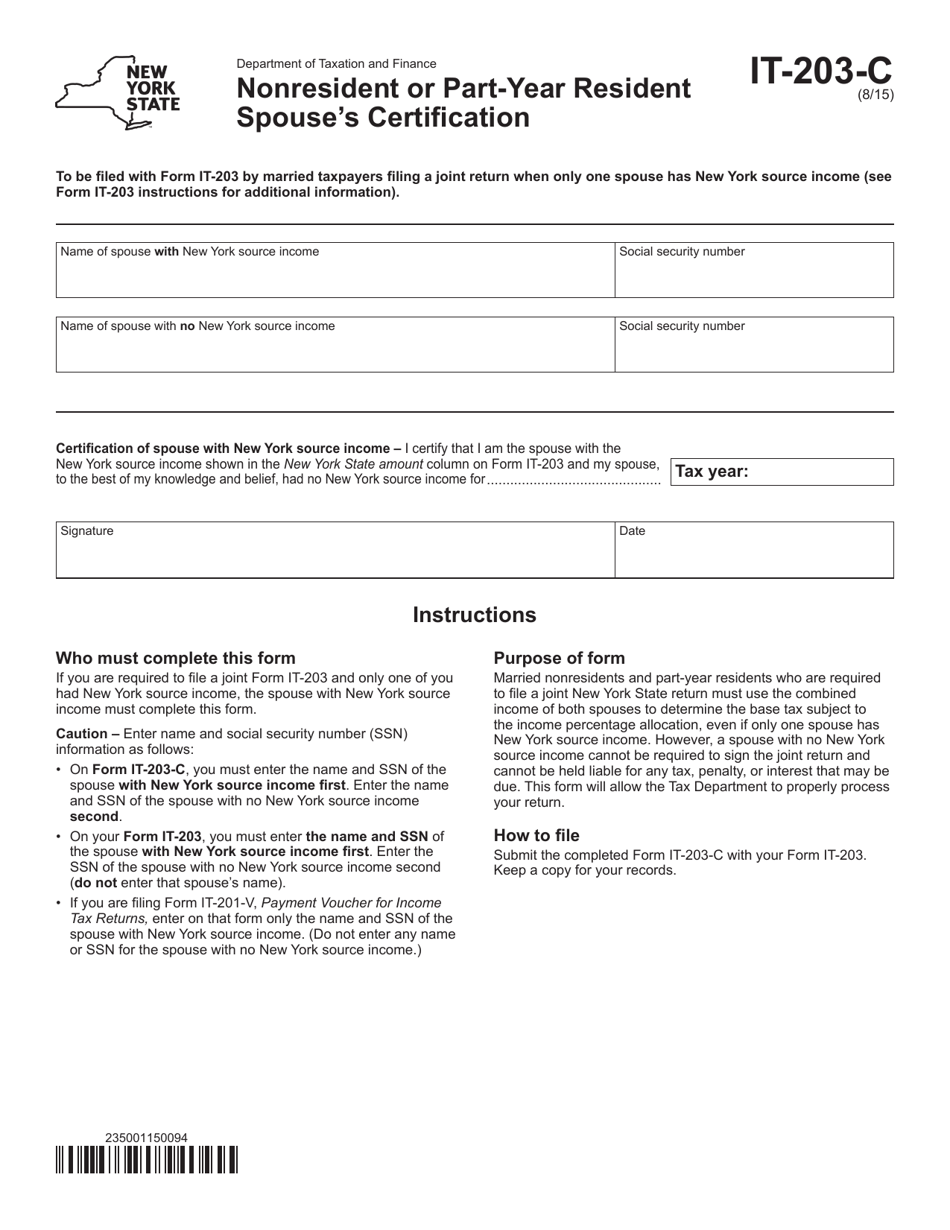

Form IT203C Download Fillable PDF or Fill Online Nonresident or Part

Web you may be eligible for free file using one of the software providers below, if: If you are filing a joint personal. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Nonresident alien income tax return, you may be required. Mark an x in the box identifying the return you.

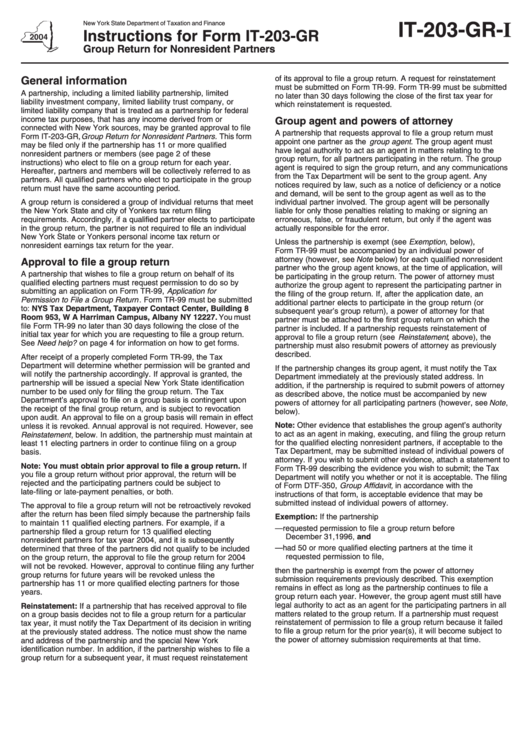

Instructions For Form It203Gr Group Return For Nonresident Partners

Web june 6, 2019 5:22 am. Nonresident alien for federal income tax. Web if you are a u.s. Nonresident alien income tax return, you may be required. Web find your requested refund amount by form and tax year;

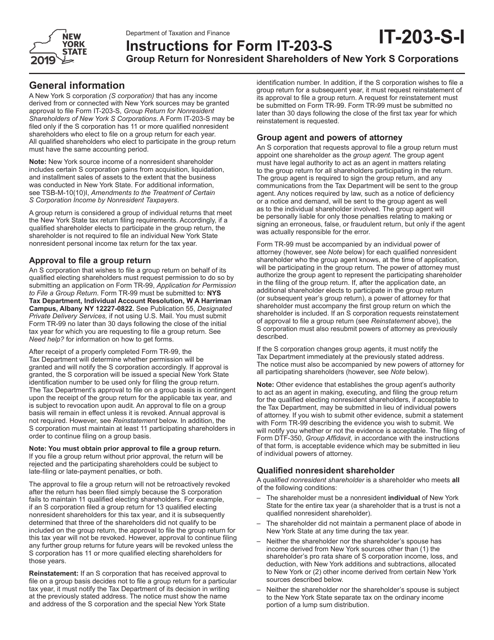

Download Instructions for Form IT203S Group Return for Nonresident

Web complete all parts that apply to you; If you filed for tax year your requested refund amount is; Web june 6, 2019 5:22 am. Nonresident alien for federal income tax. Web you may be eligible for free file using one of the software providers below, if:

Purposes And Are Required To File Federal Form 1040Nr,U.s.

If you are filing a joint personal. To see if your client qualifies for the. Web you may be eligible for free file using one of the software providers below, if: The following articles are frequently asked questions.

Were Not A Resident Of New York State And Received Income During The Tax.

Web june 6, 2019 5:22 am. Mark an x in the box identifying the return you. If you filed for tax year your requested refund amount is; Web find your requested refund amount by form and tax year;

Nonresident Alien Income Tax Return, You May Be Required.

Web complete all parts that apply to you; Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web if you are a u.s.