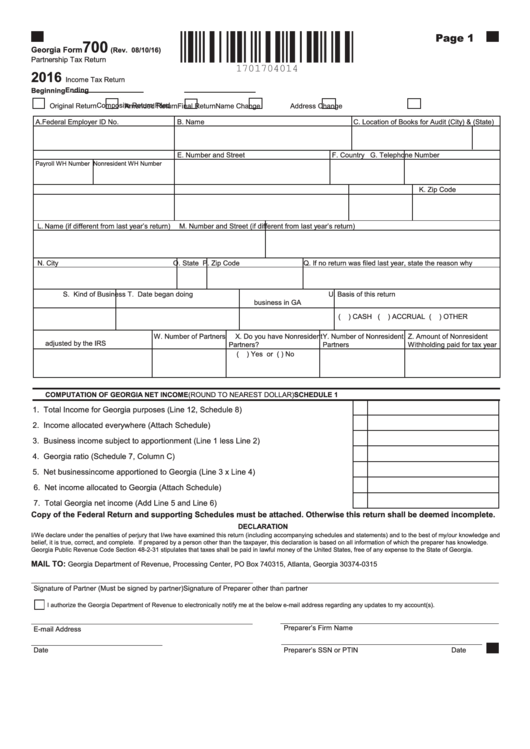

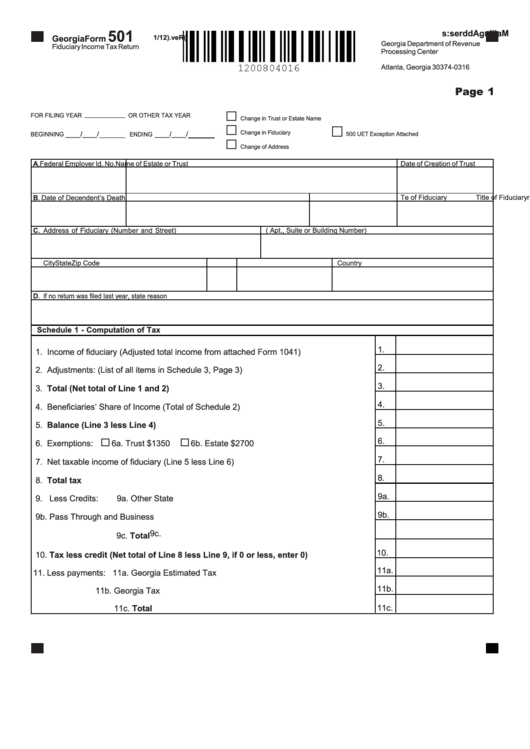

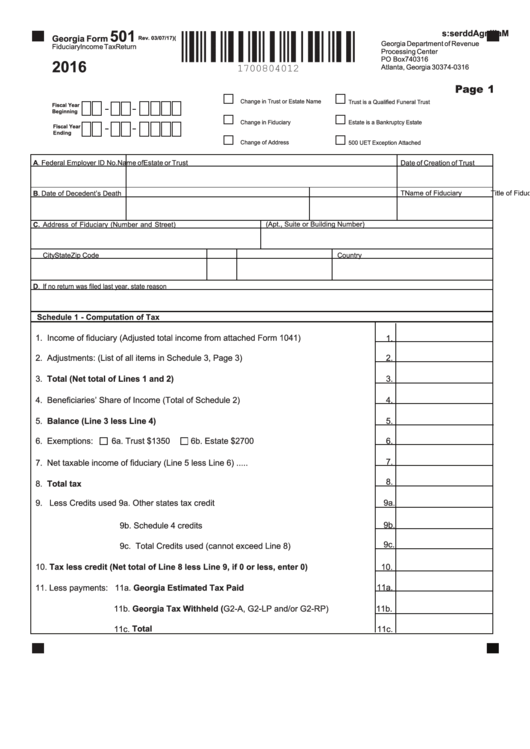

Georgia Form 501

Georgia Form 501 - Web sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a georgia income tax return on form 501 (see our website for. Web georgia does not accept the form 990n. Web return on form 501 (see our website for information regarding the u.s. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. Web georgia form 501 (rev. Web form 501/501x, page 3 is used to calculate adjustments to income. Returns are required to be filed by the 15th day of the 4th month Web print blank form > georgia department of revenue save form. Georgia form georgia department of revenue processing center po box 740316 atlanta, georgia. Web sources within georgia oranaging fund m s or property for the benefit of a residenthiofs tstate s i requiredo fil te a georgia income tax losses return on form 501 (see our.

4/14) fiduciary income tax return mailing address: Web georgia form 501 (rev. This form is for income earned in tax year 2022, with tax returns due in april. Prepare and file articles of incorporation with the secretary of state. Web we last updated georgia form 501 in january 2023 from the georgia department of revenue. Web income tax under section 501(c)(3) of internal revenue code. Every resident and nonresident fiduciary having income from sources within georgia or managing funds or. Web this search will also: State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Returns are required to be filed by the 15th day of the 4th month

Web sources within georgia oranaging fund m s or property for the benefit of a residenthiofs tstate s i requiredo fil te a georgia income tax losses return on form 501 (see our. Web sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a georgia income tax return on form 501 (see our website for. Provide a complete downloadable list of organizations that meet any of these criteria. Articles of incorporation for nonprofit corporations explains what to include in your. 08/02/21) fiduciaryincometaxreturn 2021 (approved web2 version) page 1 fiscal year beginning nonresident change in trust or estate name. Web income tax under section 501(c)(3) of internal revenue code. Web print blank form > georgia department of revenue zoom in; Prepare and file articles of incorporation with the secretary of state. Web georgia does not accept the form 990n. Web local, state, and federal government websites often end in.gov.

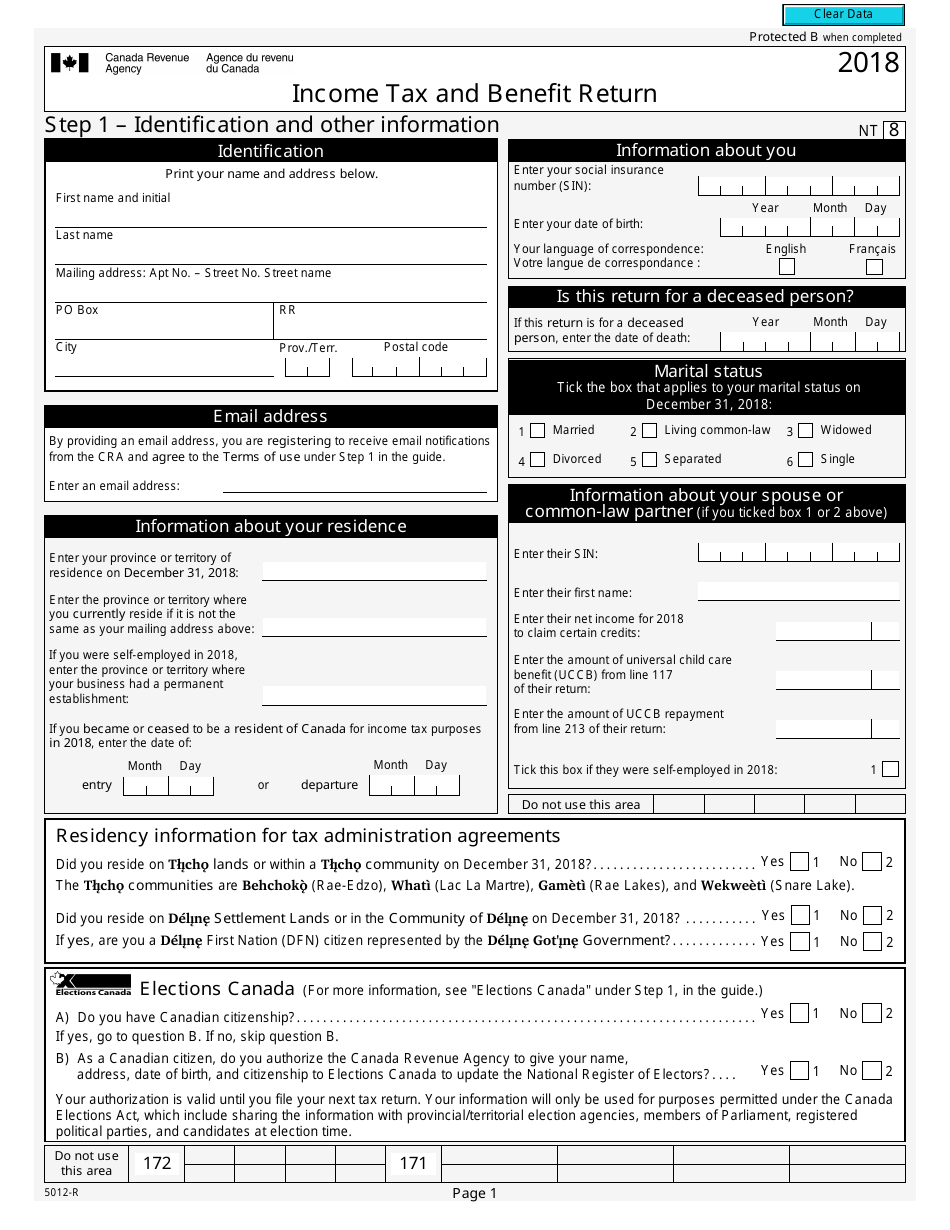

Form 5012R Download Fillable PDF or Fill Online Tax and Benefit

This form is for income earned in tax year 2022, with tax returns due in april. Web this search will also: Web we last updated georgia form 501 in january 2023 from the georgia department of revenue. 4/14) fiduciary income tax return mailing address: Every resident and nonresident fiduciary having income from sources within georgia or managing funds or.

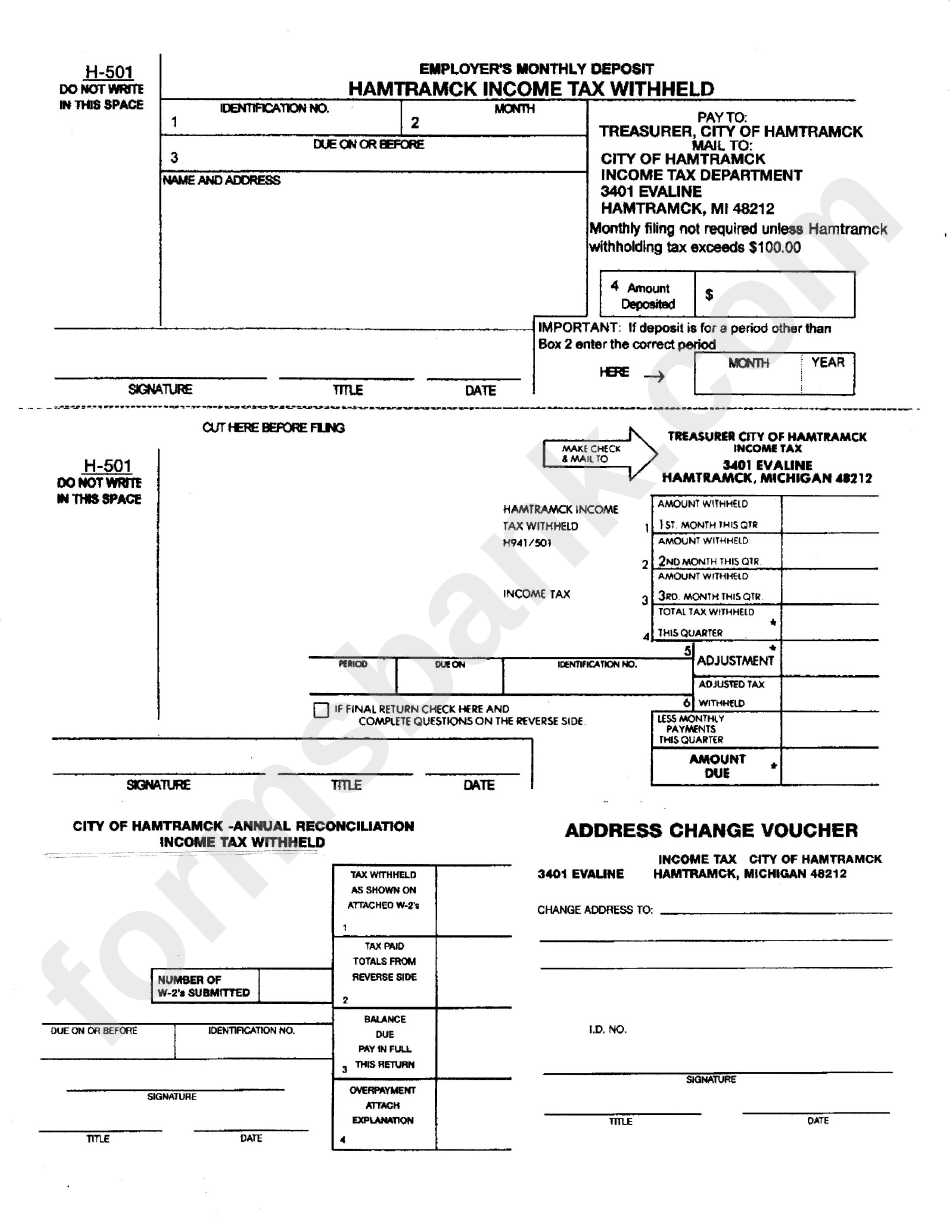

Form H501 Employer'S Monthly Deposit Hamtramck Tax Withheld

Returns are required to be filed by the 15th day of the 4th month Web income tax under section 501(c)(3) of internal revenue code. Trade name by which business is known if different than 1. Web print blank form > georgia department of revenue save form. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the.

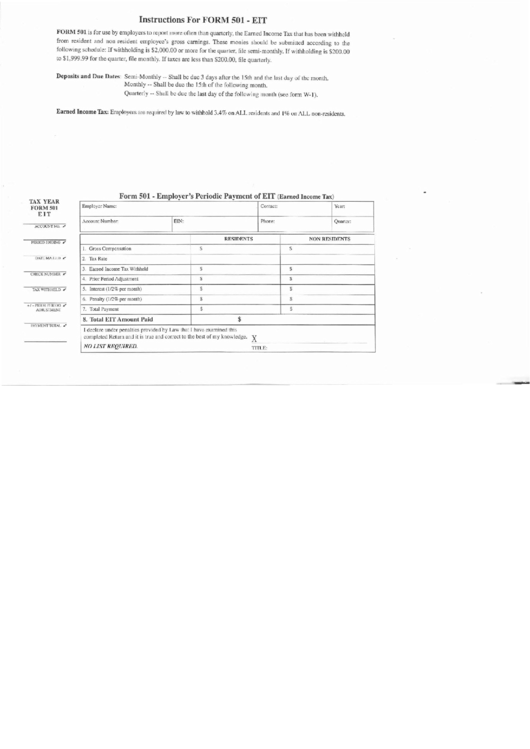

Form 501 Employer'S Periodic Payment Of Eit (Earned Tax

Web this search will also: Physical location of business, farm or household. Web form 501/501x, page 3 is used to calculate adjustments to income. Additions and subtractions for nonresidents are calculated on the ga nonresident estate or trust. Web return on form 501 (see our website for information regarding the u.s.

Top 92 Tax Forms And Templates free to download in PDF

Every resident and nonresident fiduciary having income from sources within georgia or managing funds or. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. Print blank form > georgia department of revenue. Web georgia does not accept the form 990n. Web sources.

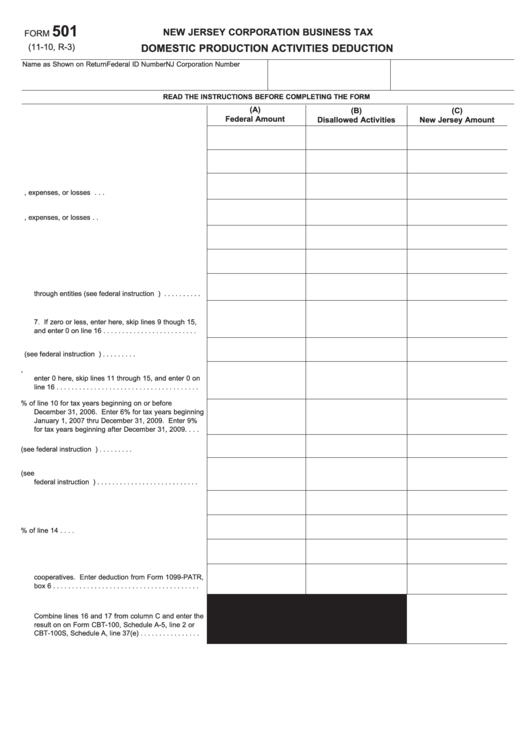

Fillable Form 501 New Jersey Corporation Business Tax Domestic

Trade name by which business is known if different than 1. State of georgia government websites and email systems use “georgia.gov” or “ga.gov” at the end of the. Web sources within georgia oranaging fund m s or property for the benefit of a residenthiofs tstate s i requiredo fil te a georgia income tax losses return on form 501 (see.

Fillable Form 501 Fiduciary Tax Return printable pdf

Physical location of business, farm or household. Prepare and file articles of incorporation with the secretary of state. Web this search will also: Web georgia form 501 (rev. Trade name by which business is known if different than 1.

Form 501 Fill Out and Sign Printable PDF Template signNow

Provide a complete downloadable list of organizations that meet any of these criteria. This form is for income earned in tax year 2022, with tax returns due in april. You can download or print current. Irs determination letter for 501 (c) (3) tax exemption. Web local, state, and federal government websites often end in.gov.

Fillable Form 501 Fiduciary Tax Return 2016

Prepare and file articles of incorporation with the secretary of state. You can download or print current. Web this search will also: This form is for income earned in tax year 2022, with tax returns due in april. Web sources within georgia or managing funds or property for the benefit of a resident of this state is required to file.

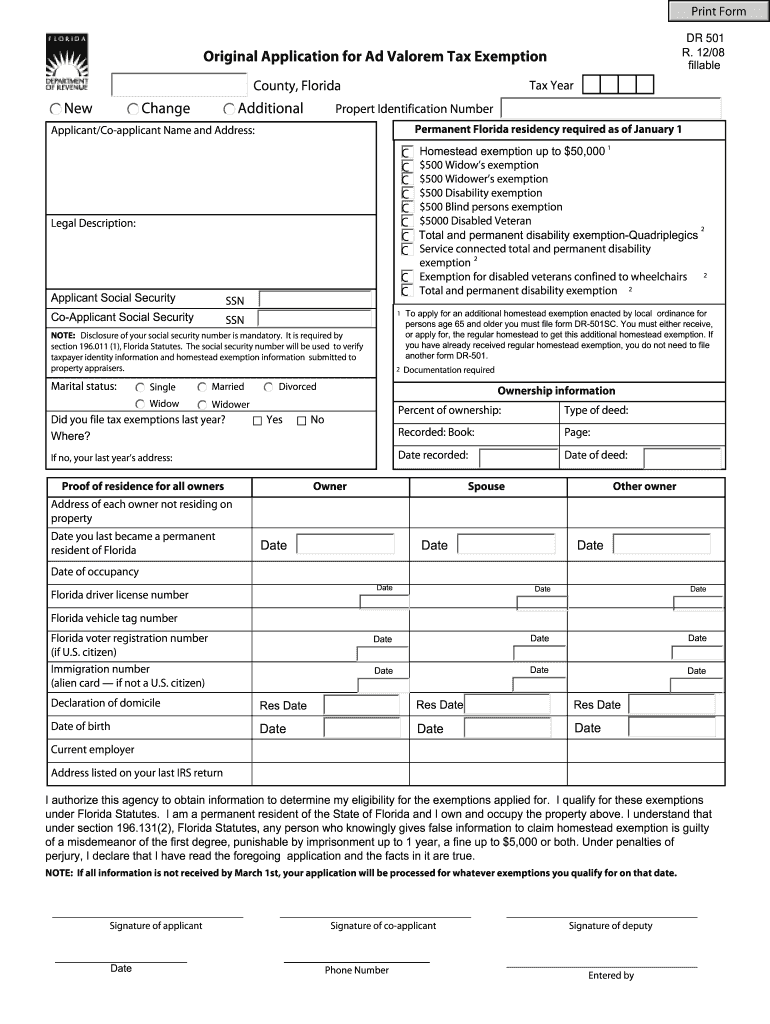

Dr 501 Form Fill Out and Sign Printable PDF Template signNow

Web form 501/501x, page 3 is used to calculate adjustments to income. You can download or print current. Web sources within georgia oranaging fund m s or property for the benefit of a residenthiofs tstate s i requiredo fil te a georgia income tax losses return on form 501 (see our. Georgia form georgia department of revenue processing center po.

Do Not Resuscitate (dnr) Form Universal Network

Web sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a georgia income tax return on form 501 (see our website for. This form is for income earned in tax year 2022, with tax returns due in april. Articles of incorporation for nonprofit corporations explains what to include.

State Of Georgia Government Websites And Email Systems Use “Georgia.gov” Or “Ga.gov” At The End Of The.

Web income tax under section 501(c)(3) of internal revenue code. Web return on form 501 (see our website for information regarding the u.s. Prepare and file articles of incorporation with the secretary of state. Print blank form > georgia department of revenue.

Web This Search Will Also:

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. Web print blank form > georgia department of revenue save form. 08/02/21) fiduciaryincometaxreturn 2021 (approved web2 version) page 1 fiscal year beginning nonresident change in trust or estate name.

Web Local, State, And Federal Government Websites Often End In.gov.

Physical location of business, farm or household. Every resident and nonresident fiduciary having income from sources within georgia or managing funds or. Web georgia does not accept the form 990n. You can download or print current.

Georgia Form Georgia Department Of Revenue Processing Center Po Box 740316 Atlanta, Georgia.

Web georgia form 501 (rev. Returns are required to be filed by the 15th day of the 4th month Provide a complete downloadable list of organizations that meet any of these criteria. Web sources within georgia oranaging fund m s or property for the benefit of a residenthiofs tstate s i requiredo fil te a georgia income tax losses return on form 501 (see our.