Georgia Form It 560

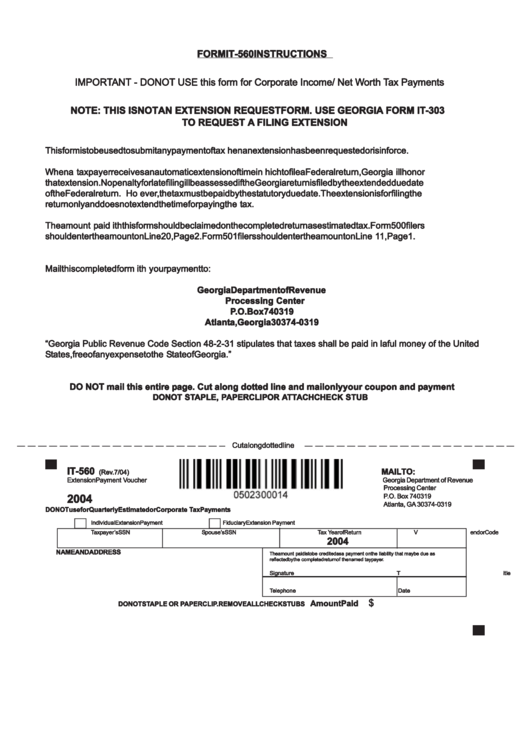

Georgia Form It 560 - Web it 560 individual/fiduciary worksheet 1. Web instructions for form it 560c. This form is for income earned in tax year 2022, with tax returns due in april. Web if the taxpayer receiving an extension of the georgia return due date (either by extending their federal return or by filing georgia form it 303) needs to make a payment, it. Web instructions for form it 560 individual and fiduciary. Web taxpayer files their 2022 georgia income tax return and claims the investment tax credit as provided in paragraph (3)(c)9. 05/29/20) individual and fiduciary payment voucher. Web instructions for form it 560c when a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension. When a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension. Web instructions for form it 560c.

Web instructions for form it 560c. This form is for income earned in tax year 2022, with tax returns due in april. Web instructions for form it 560c. Instructions for form it 560. Web individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal yearending stateissued your. 2.the amount paid with this form should be. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Do not use for quarterly estimate or corpora te tax payments. Web to claim any excess investment tax credit not used on the income tax return against the taxpayer's withholding tax liability, a taxpayer that has received an approved. This form is for income earned in tax year 2022, with tax returns due in april.

When a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension. Web instructions for form it 560c when a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension. Web taxpayer files their 2022 georgia income tax return and claims the investment tax credit as provided in paragraph (3)(c)9. Web if the taxpayer receiving an extension of the georgia return due date (either by extending their federal return or by filing georgia form it 303) needs to make a payment, it. Web it 560 individual/fiduciary worksheet 1. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. This form is for income earned in tax year 2022, with tax returns due in april. 05/29/20) individual and fiduciary payment voucher. 2.the amount paid with this form should be. We last updated the corporate extension.

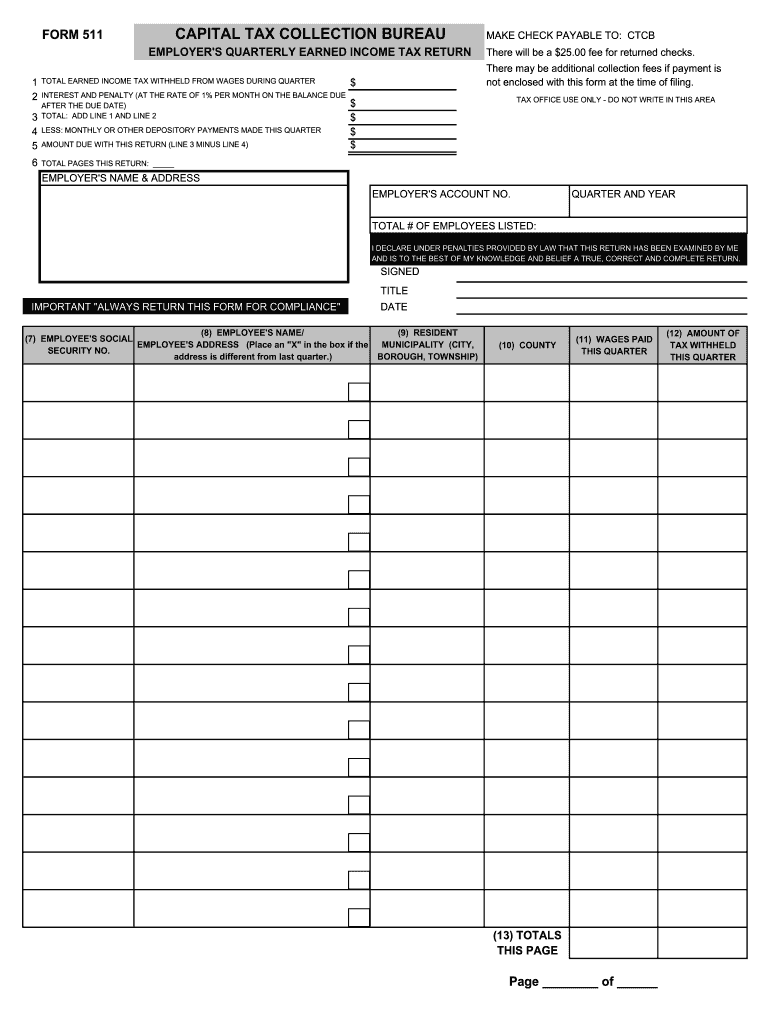

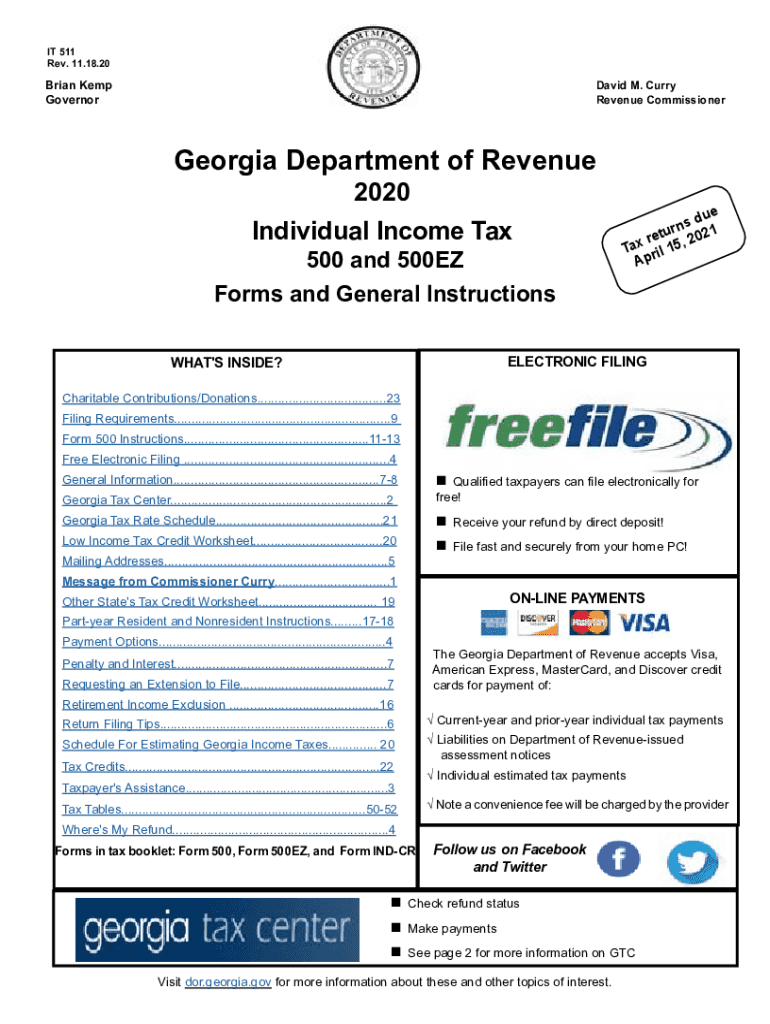

Bureau Form 511 Fill Online, Printable, Fillable, Blank pdfFiller

Of this regulation on september 15, 2023 and taxpayer. Web if the taxpayer receiving an extension of the georgia return due date (either by extending their federal return or by filing georgia form it 303) needs to make a payment, it. Web instructions for form it 560c. Web instructions for form it 560c. No penalty for late filing.

Changes R&D Tax Credit Process for Companies Warren Averett

Web instructions for form it 560c. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. We last updated the corporate extension. Web if the taxpayer receiving an extension of the georgia return due date (either by extending their federal return or by filing georgia form it 303) needs to make.

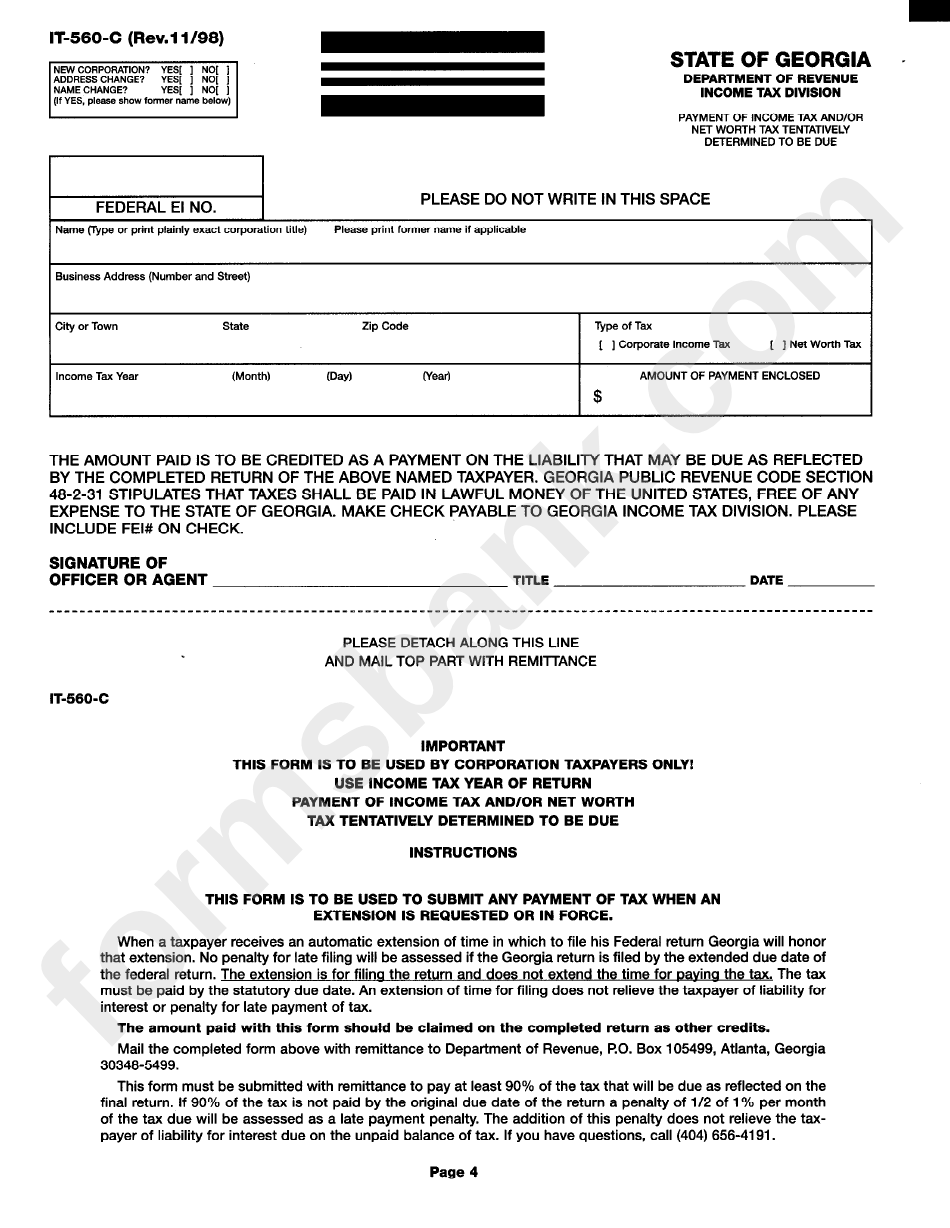

Form It560 Extension Payment Voucher Department Of Revenue

This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Web it 560 individual/fiduciary worksheet 1. No penalty for.

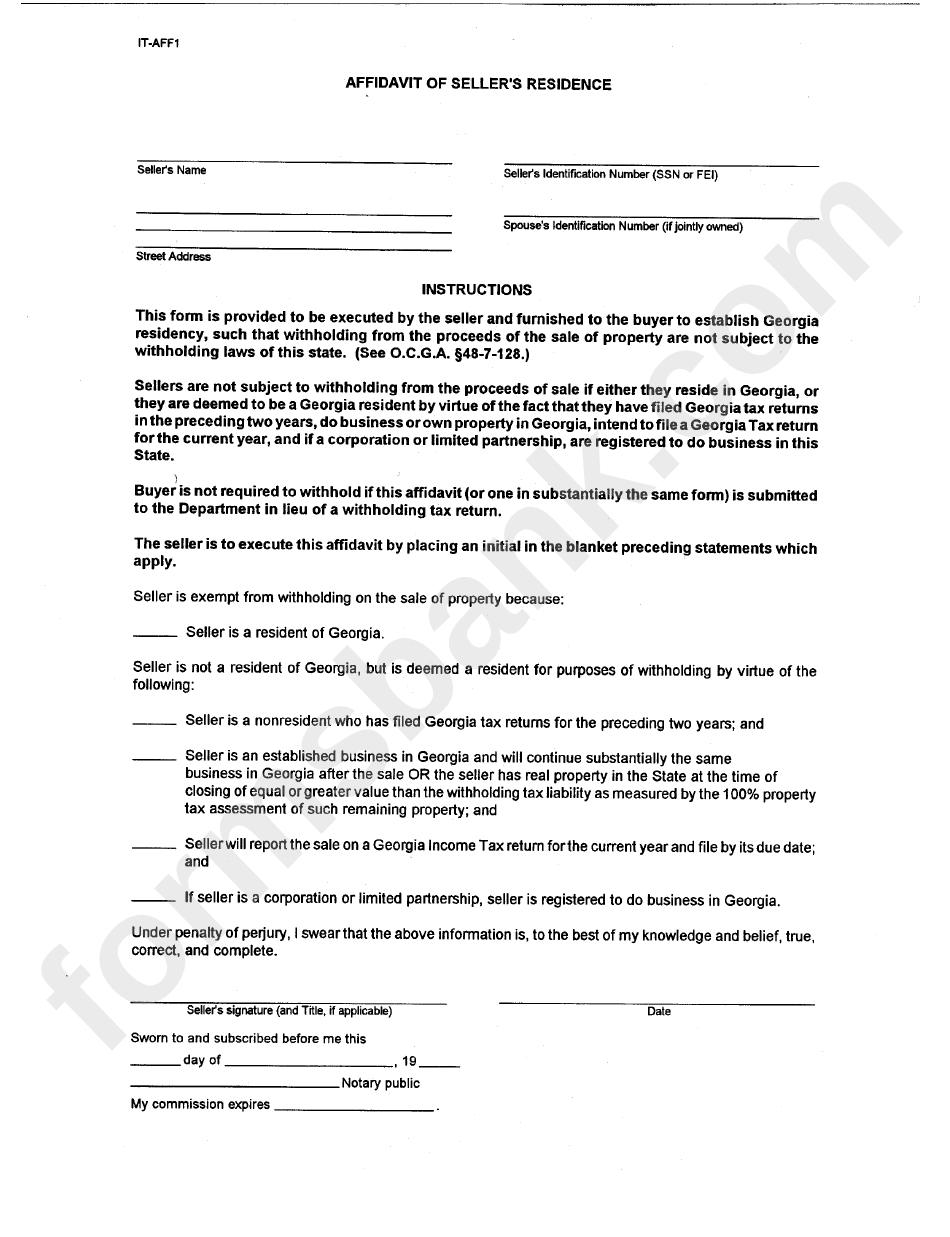

Form ItAff1 Affidavit Of Seller'S Residence printable pdf download

Web taxpayer files their 2022 georgia income tax return and claims the investment tax credit as provided in paragraph (3)(c)9. Web to claim any excess investment tax credit not used on the income tax return against the taxpayer's withholding tax liability, a taxpayer that has received an approved. No penalty for late filing. Web instructions for form it 560c. When.

2016 extension form for taxes paaszap

Web instructions for form it 560c. Web instructions for form it 560c when a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension. We last updated the corporate extension. Web if the taxpayer receiving an extension of the georgia return due date (either by extending their federal return or by.

Fillable Form It560C Payment Of Tax And/or Net Worth Tax

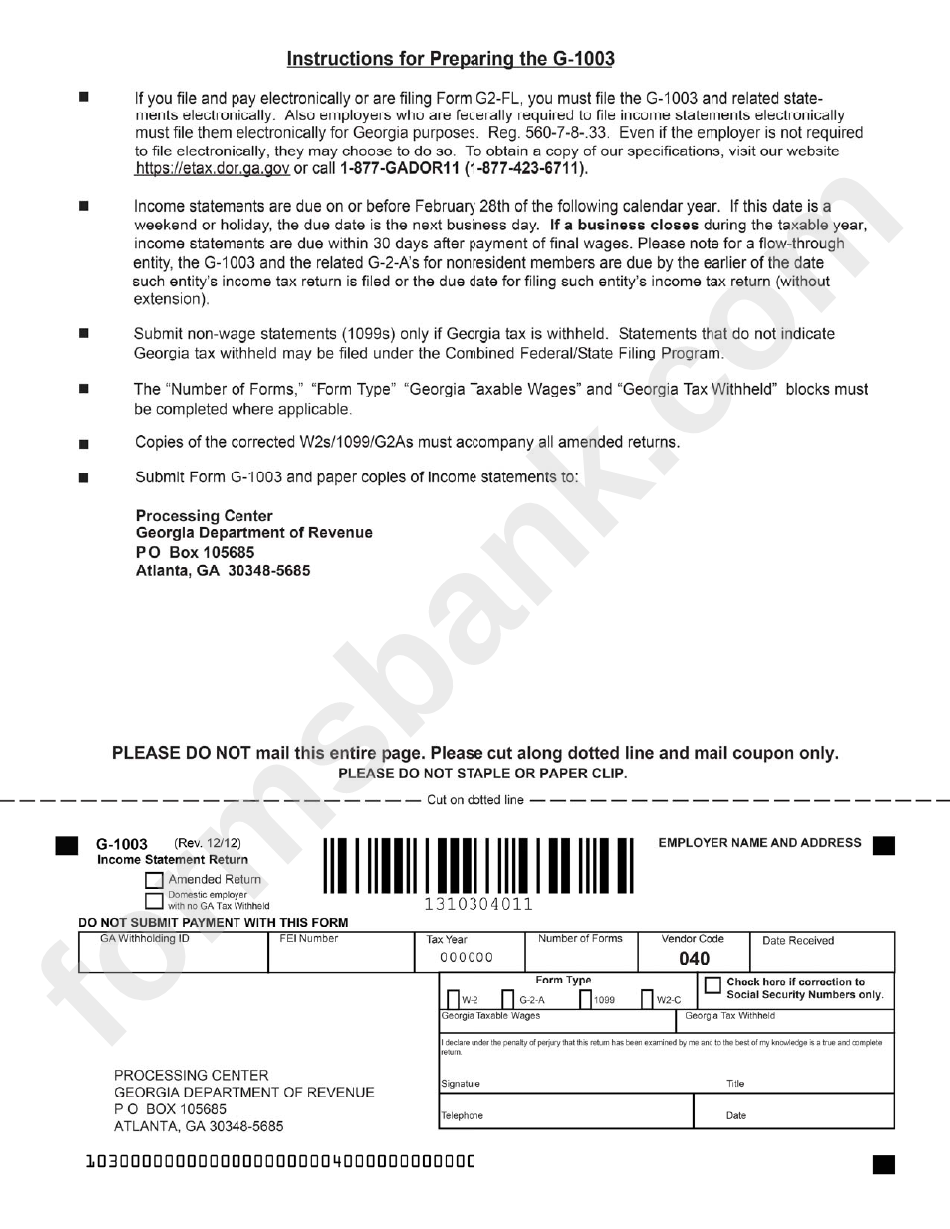

Of this regulation on september 15, 2023 and taxpayer. Georgia department of revenue processing center. Instructions for form it 560. Web instructions for form it 560c. Web instructions for form it 560 individual and fiduciary.

Form It 560 C Payment Of Tax / Net Worth Payment

Georgia department of revenue processing center. We last updated the corporate extension. Do not use for quarterly estimate or corpora te tax payments. Web individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal yearending stateissued your. No penalty for late filing.

500 Form Fill Out and Sign Printable PDF Template signNow

1.this form is to be used to submit any payment of tax when an extension is requested or enforced. We last updated the corporate extension. Web taxpayer files their 2022 georgia income tax return and claims the investment tax credit as provided in paragraph (3)(c)9. Do not use for quarterly estimate or corpora te tax payments. 05/29/20) individual and fiduciary.

500 Ez Tax Form

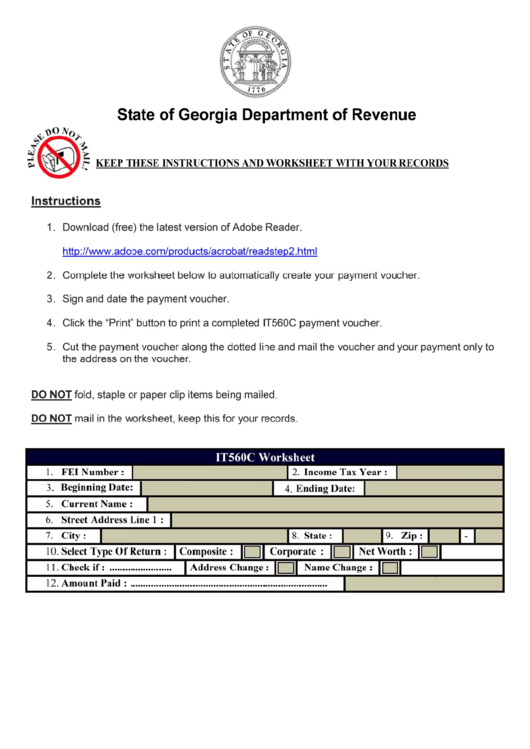

Web if the taxpayer receiving an extension of the georgia return due date (either by extending their federal return or by filing georgia form it 303) needs to make a payment, it. State of georgia department of revenue p l e a s e d o n o t m a i l! This form is for income earned in.

Web If The Taxpayer Receiving An Extension Of The Georgia Return Due Date (Either By Extending Their Federal Return Or By Filing Georgia Form It 303) Needs To Make A Payment, It.

We last updated the corporate extension. Web to claim any excess investment tax credit not used on the income tax return against the taxpayer's withholding tax liability, a taxpayer that has received an approved. Web individual income tax return georgia department of revenue 2021 (approved web version) page1 fiscal yearbeginning rsion)fiscal yearending stateissued your. When a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension.

No Penalty For Late Filing.

Web it 560 individual/fiduciary worksheet 1. Web instructions for form it 560c. No penalty for late filing. Of this regulation on september 15, 2023 and taxpayer.

05/29/20) Individual And Fiduciary Payment Voucher.

Web instructions for form it 560c. 1.this form is to be used to submit any payment of tax when an extension is requested or enforced. Web taxpayer files their 2022 georgia income tax return and claims the investment tax credit as provided in paragraph (3)(c)9. Instructions for form it 560.

Georgia Department Of Revenue Processing Center.

Web instructions for form it 560c when a taxpayer receives an automatic extension of time in which to file a federal return, georgia will honor that extension. Do not use for quarterly estimate or corpora te tax payments. This form is for income earned in tax year 2022, with tax returns due in april. State of georgia department of revenue p l e a s e d o n o t m a i l!