Irs Form Cp575

Irs Form Cp575 - An ein is important for businesses that have employees or anticipate having employees. Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually. Your previously filed return should be notated with your ein. The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. In other words, the cp 575 letter confirms that the irs has granted your company an ein. Within a cp 575 letter, taxpayers can access the ein for their new company as well as learn which tax forms must be filed for the business. Web understanding your cp75 notice what this notice is about we're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. 575, such as legislation enacted after it was published, go to irs.gov/pub575. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein.

Web when you first get an ein number, the irs sends you an ein confirmation letter (cp 575). 575, such as legislation enacted after it was published, go to irs.gov/pub575. The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. Web understanding your cp75 notice what this notice is about we're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. In other words, the cp 575 letter confirms that the irs has granted your company an ein. Your previously filed return should be notated with your ein. The ein is sometimes also referred to as fein, or federal employer identification number. Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually.

The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. The ein is sometimes also referred to as fein, or federal employer identification number. Within a cp 575 letter, taxpayers can access the ein for their new company as well as learn which tax forms must be filed for the business. Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. 575, such as legislation enacted after it was published, go to irs.gov/pub575. Your previously filed return should be notated with your ein. What’s new qualified disaster tax relief. Web understanding your cp75 notice what this notice is about we're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. In other words, the cp 575 letter confirms that the irs has granted your company an ein. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein.

What Is Form CP575? Gusto

The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. What’s new qualified disaster tax relief. We are holding the eic, the additional child tax credit (actc) and/or recovery rebate credit (rrc) parts of your refund until we get the results of this audit. Your previously filed return should be notated.

What Is Form CP575? Gusto

What’s new qualified disaster tax relief. An ein is important for businesses that have employees or anticipate having employees. The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. We are holding the eic, the additional child tax credit (actc) and/or recovery rebate credit (rrc) parts of your refund until we.

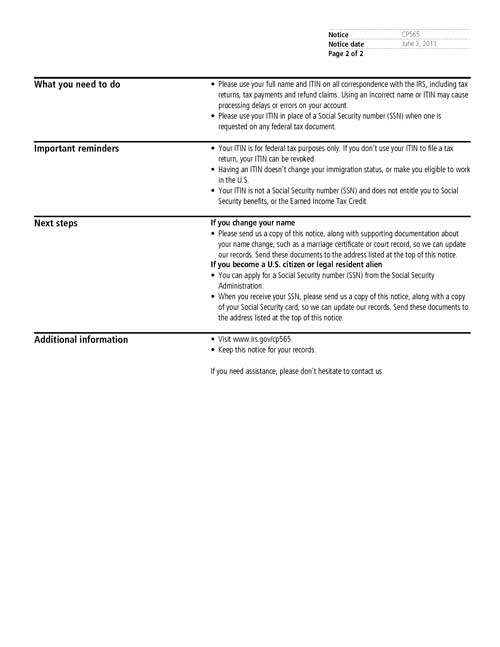

Understanding your CP565 Notice

Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. Your previously filed return should be notated with your ein. What’s new qualified disaster tax relief. An ein is important for businesses that have employees or anticipate having employees..

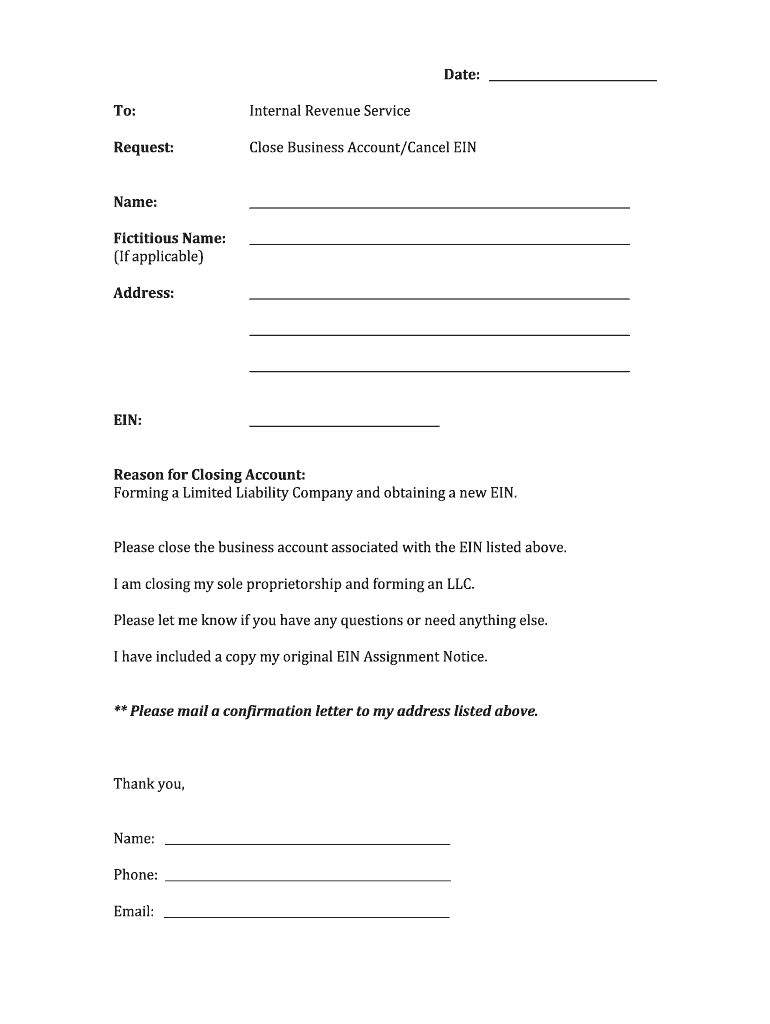

Can I Get A Copy Of My Ein Letter Online

In other words, the cp 575 letter confirms that the irs has granted your company an ein. The ein is sometimes also referred to as fein, or federal employer identification number. Web understanding your cp75 notice what this notice is about we're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. Your previously.

Editable IRS Form CP565 2017 Create A Digital Sample in PDF

Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. In other words, the cp 575 letter confirms that the.

What Is an IRS Form CP 575? Bizfluent

Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. We are holding the eic, the additional child tax credit (actc) and/or recovery rebate credit (rrc) parts of your refund until we get the results of this audit. Web.

How To Change The Address Of My Ein Number

Your previously filed return should be notated with your ein. An ein is important for businesses that have employees or anticipate having employees. Web understanding your cp75 notice what this notice is about we're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed. The ein is sometimes also referred to as fein, or.

What Is Form CP575? Gusto

Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Within a cp 575 letter, taxpayers can access the ein for their new company as well as learn which tax forms must be filed for the business. Web irs form cp 575 is proof.

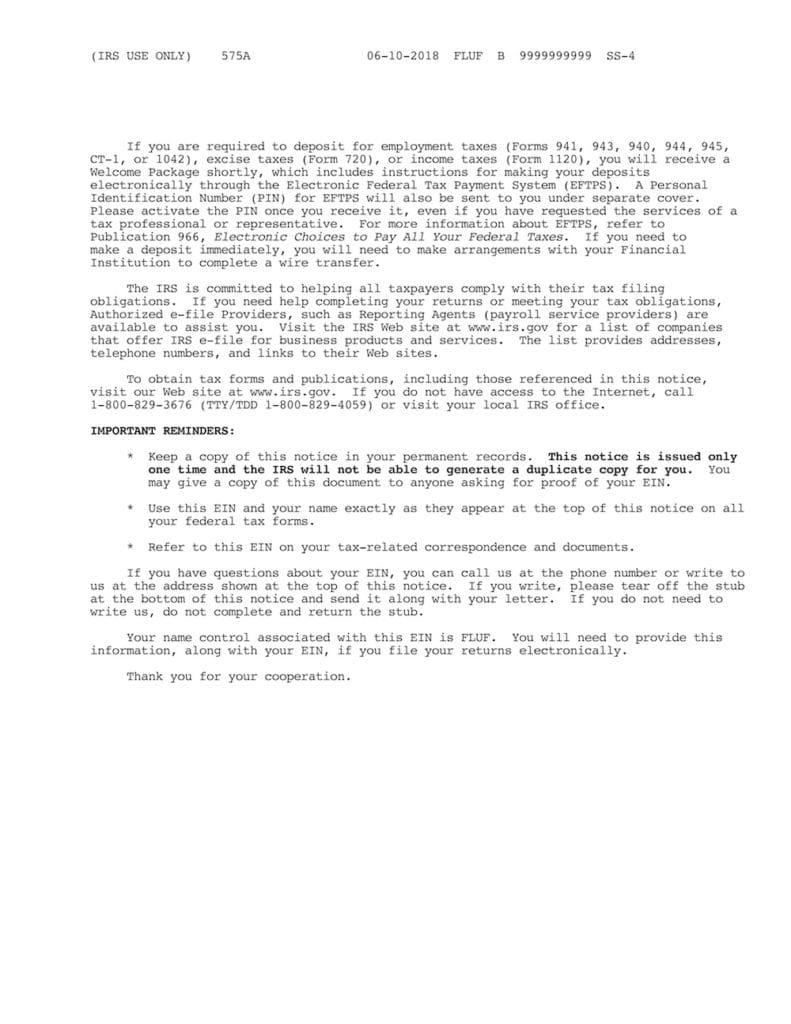

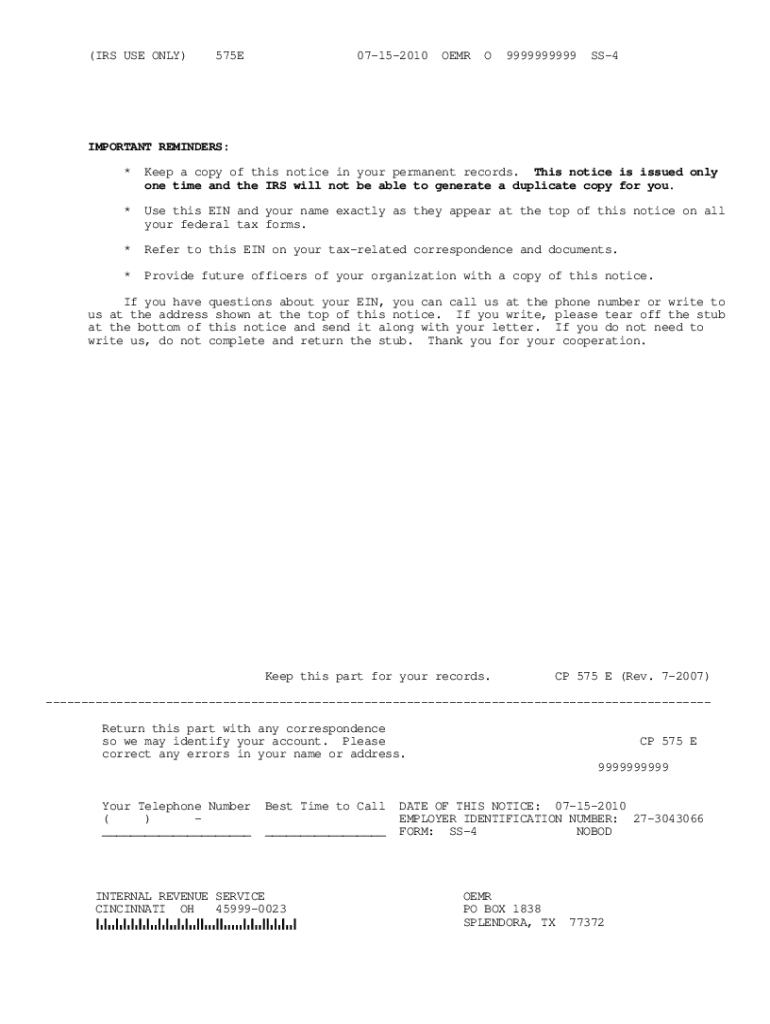

IRS 575E Fill out Tax Template Online US Legal Forms

What’s new qualified disaster tax relief. Web when you first get an ein number, the irs sends you an ein confirmation letter (cp 575). Your previously filed return should be notated with your ein. In other words, the cp 575 letter confirms that the irs has granted your company an ein. 575, such as legislation enacted after it was published,.

irs form 575

Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. An ein is important for businesses that have employees or.

Web When You First Get An Ein Number, The Irs Sends You An Ein Confirmation Letter (Cp 575).

Web in essence, an irs form 575 is an official document issued by the irs confirming a company’s ein representing a unique identification number issued to companies in the united states. Web irs form cp 575 is proof of your ein’s authenticity, and you will receive it after applying for this number online or manually. Within a cp 575 letter, taxpayers can access the ein for their new company as well as learn which tax forms must be filed for the business. We are holding the eic, the additional child tax credit (actc) and/or recovery rebate credit (rrc) parts of your refund until we get the results of this audit.

An Ein Is Important For Businesses That Have Employees Or Anticipate Having Employees.

575, such as legislation enacted after it was published, go to irs.gov/pub575. In other words, the cp 575 letter confirms that the irs has granted your company an ein. The ein is sometimes also referred to as fein, or federal employer identification number. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein.

Your Previously Filed Return Should Be Notated With Your Ein.

The letter’s information can help secure business loans, open a merchant account for your company, and file taxes correctly. What’s new qualified disaster tax relief. Web understanding your cp75 notice what this notice is about we're auditing your tax return and need documentation to verify the earned income credit (eic) you claimed.