Kentucky K-4 Form

Kentucky K-4 Form - Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Pdf (portable document format) is a file format that captures all the. Easily fill out pdf blank, edit, and sign them. If you meet any of the four exemptions you are exempted from kentucky withholding. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. (103 kar 18:150) the paper. Start completing the fillable fields. Edit your kentucky k 4 fillable tax form online. Sign it in a few clicks.

Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. (103 kar 18:150) the paper. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Sign it in a few clicks. Web download the taxpayer bill of rights. After completing and electronically signing the. Start completing the fillable fields. If you meet any of the four exemptions you are exempted from kentucky withholding. Pdf (portable document format) is a file format that captures all the. You may be exempt from withholding if any of the.

Use get form or simply click on the template preview to open it in the editor. Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Type text, add images, blackout confidential details, add comments, highlights and more. You may be exempt from withholding if any of the. (103 kar 18:150) the paper. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Easily fill out pdf blank, edit, and sign them. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. After completing and electronically signing the.

Fillable Online ppiinc Form K4E Commonwealth of Kentucky DEPARTMENT OF

If you meet any of the four exemptions you are exempted from kentucky withholding. Edit your kentucky k 4 fillable tax form online. Start completing the fillable fields. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Type text, add images, blackout confidential details, add comments, highlights and more.

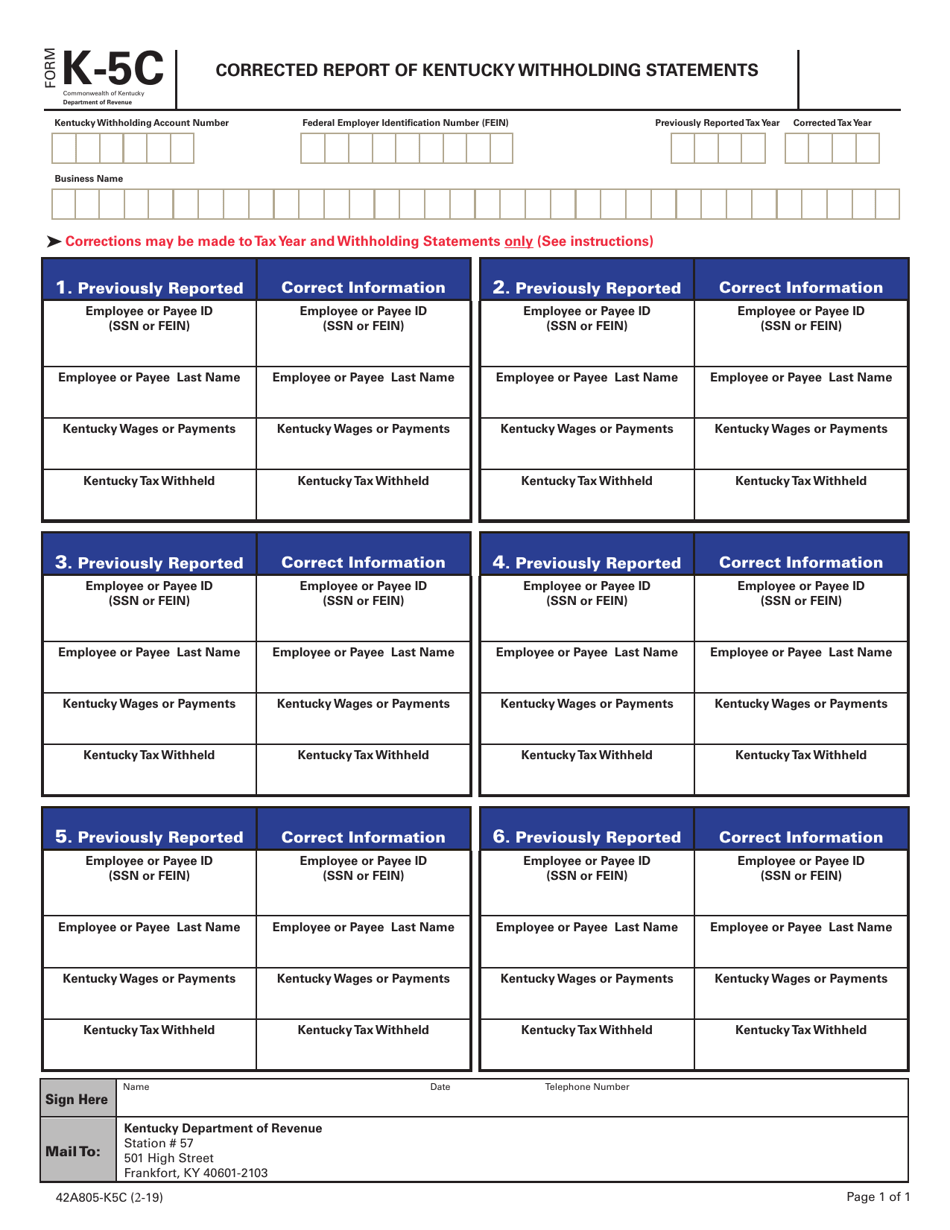

Form K5C Download Fillable PDF or Fill Online Corrected Report of

(103 kar 18:150) the paper. Start completing the fillable fields. Edit your kentucky k 4 fillable tax form online. Use get form or simply click on the template preview to open it in the editor. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online.

Kansas State vs. Kentucky KState pulls a stunner in Sweet 16

Type text, add images, blackout confidential details, add comments, highlights and more. Easily fill out pdf blank, edit, and sign them. Type text, add images, blackout confidential details, add comments, highlights and more. Use get form or simply click on the template preview to open it in the editor. Web download the taxpayer bill of rights.

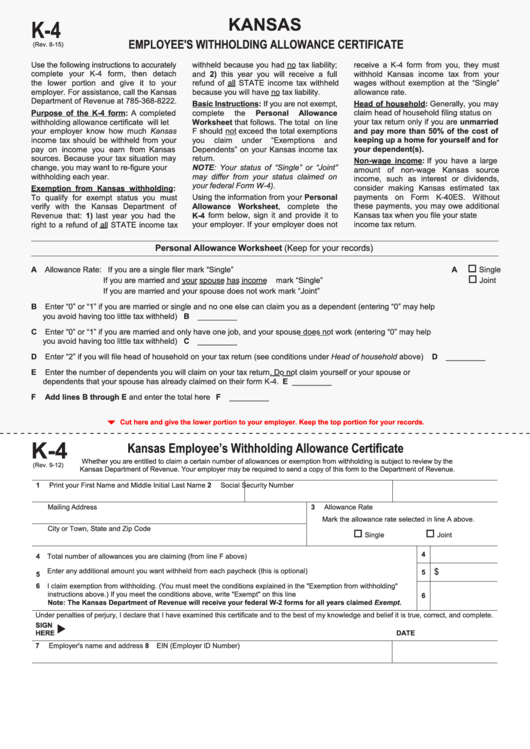

Fillable Form K4 Kansas Employee'S Withholding Allowance Certificate

Web explanation of form fields/questions form: Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Easily fill out pdf blank, edit, and sign them. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. If you meet.

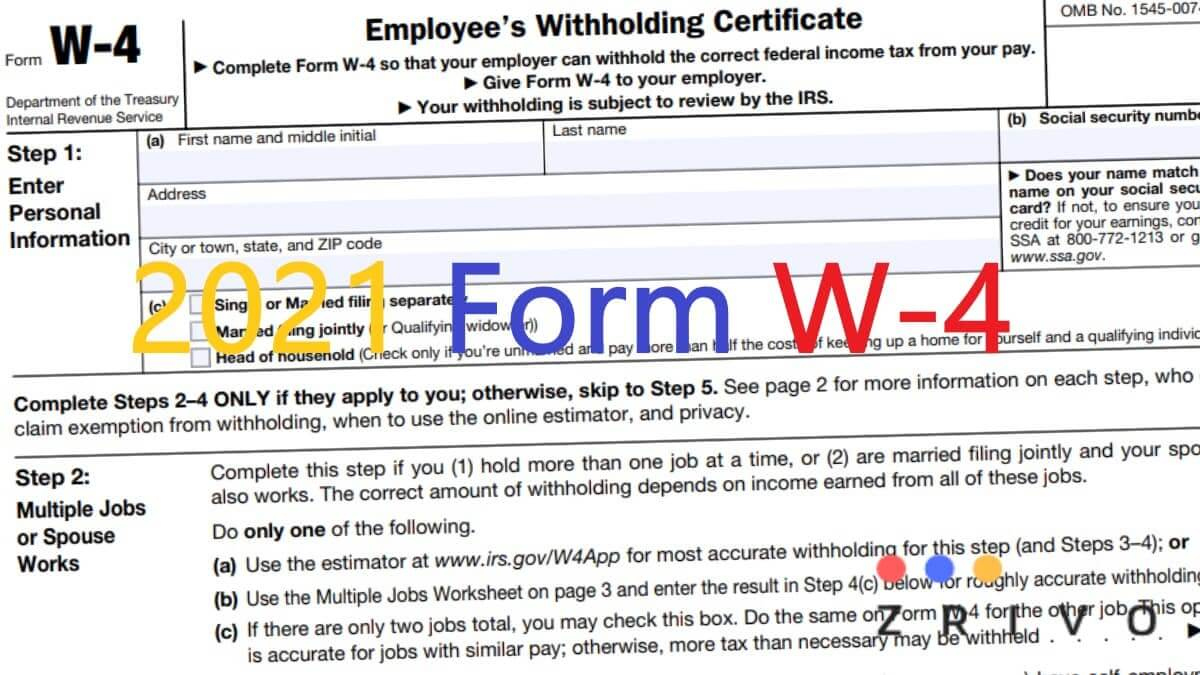

2021 W4 Form Printable State 2022 W4 Form

Web check box 4 if you certify you work in kentucky and reside in a reciprocal state. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Web download the taxpayer bill of rights. Easily fill out pdf blank, edit, and sign them. Pdf (portable document format) is a.

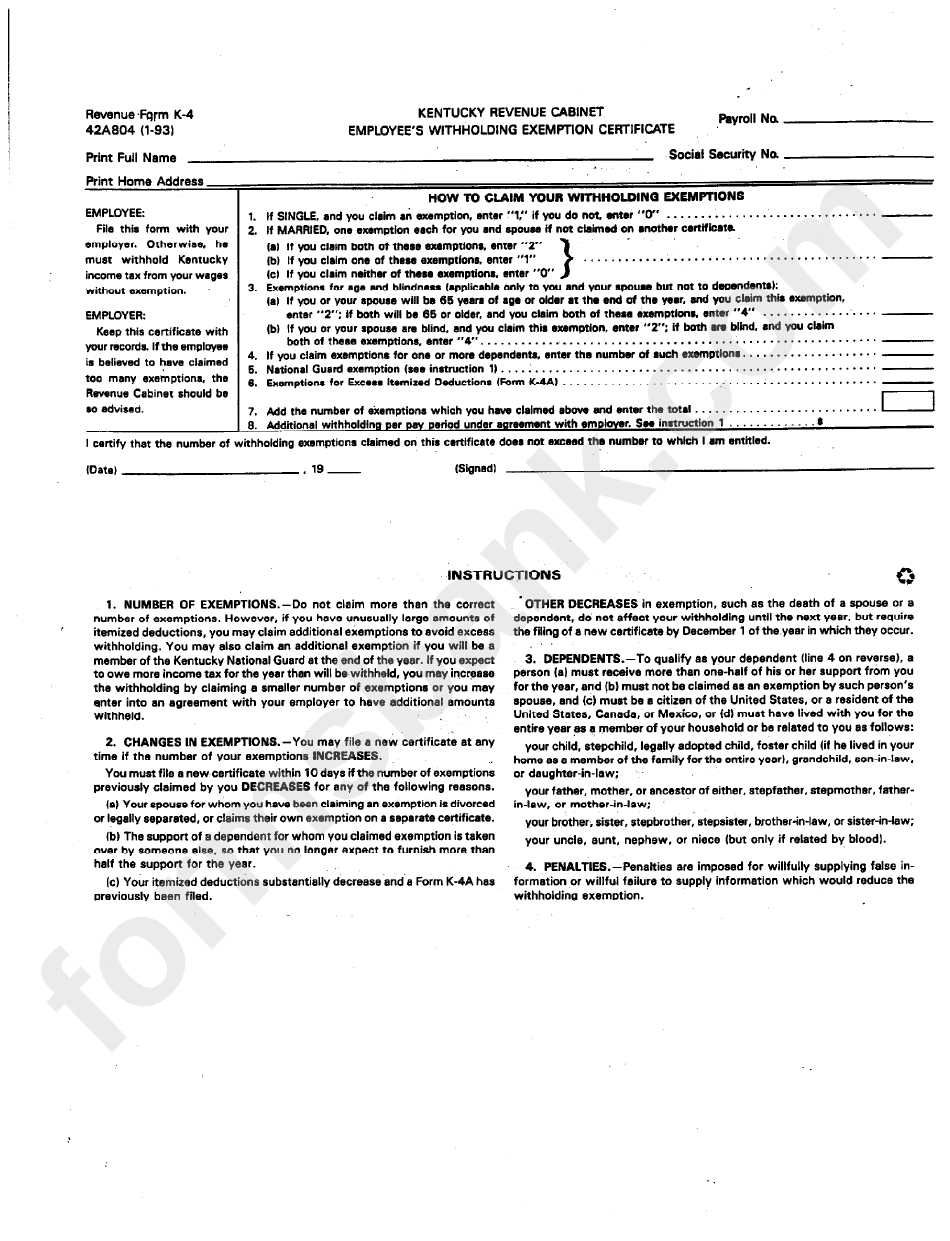

Fillable Form K4 Employee'S Withholding Exemption Certificate

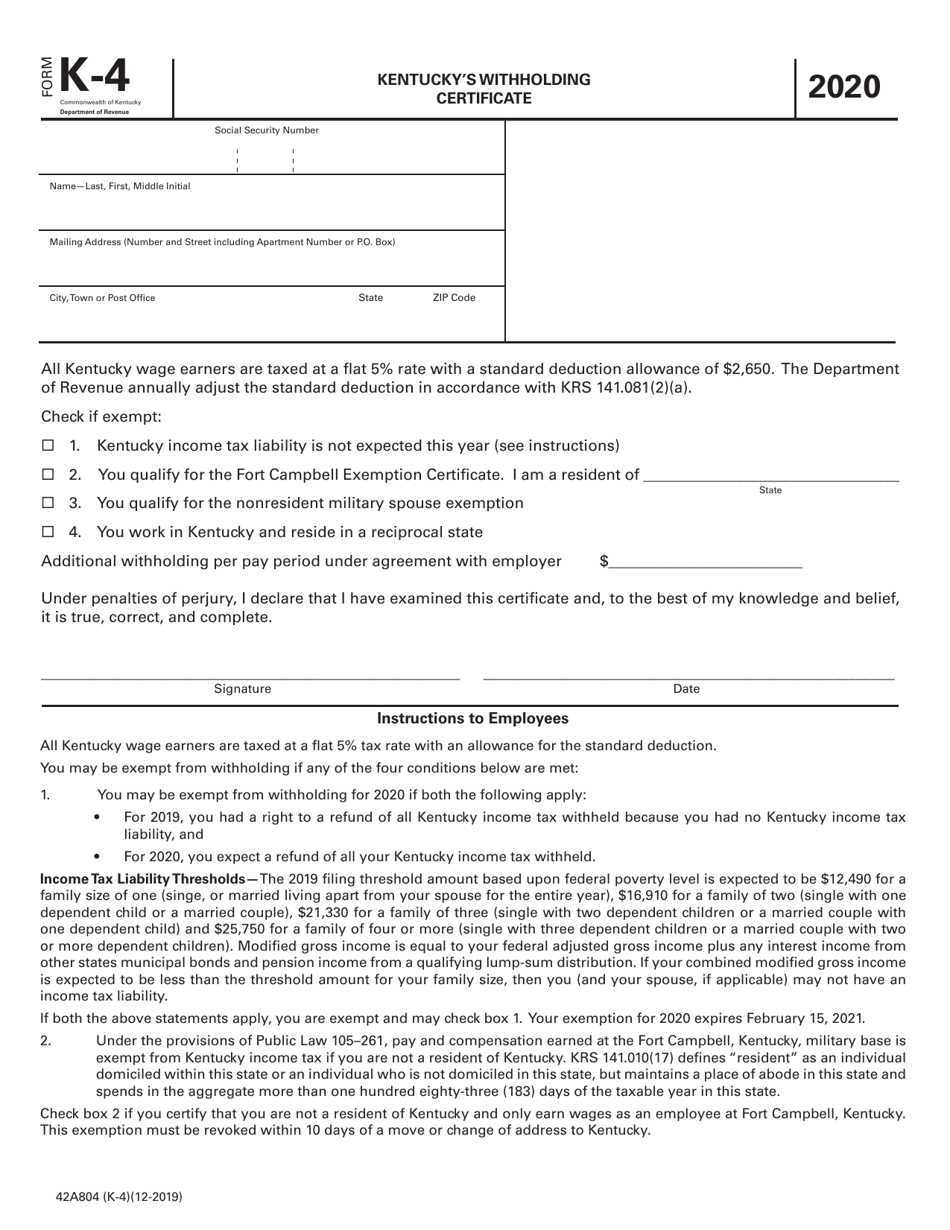

Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. Web explanation of form fields/questions form: Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. If you meet any of the.

Kentucky K4 App

Type text, add images, blackout confidential details, add comments, highlights and more. Save or instantly send your ready documents. (103 kar 18:150) the paper. Draw your signature, type it,. Type text, add images, blackout confidential details, add comments, highlights and more.

Form K4 (42A804) Download Printable PDF or Fill Online Kentucky's

You may be exempt from withholding if any of the. After completing and electronically signing the. Save or instantly send your ready documents. Draw your signature, type it,. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet.

imperialpricedesign K 4 Form Kentucky

Edit your kentucky k 4 fillable tax form online. (103 kar 18:150) the paper. After completing and electronically signing the. Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning.

Kentucky K4 App

Web explanation of form fields/questions form: Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. Start completing the fillable fields. Type text, add images, blackout confidential details, add comments, highlights and more. After completing and electronically signing the.

Web Explanation Of Form Fields/Questions Form:

If you meet any of the four exemptions you are exempted from kentucky withholding. Web all employer filing frequencies are required to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2022. You may be exempt from withholding if any of the. Edit your ky 4 online.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Sign it in a few clicks. Web download the taxpayer bill of rights. Web instructions to employees all kentucky wage earners are taxed at a flat 5% tax rate with an allowance for the standard deduction. After completing and electronically signing the.

Edit Your Kentucky K 4 Fillable Tax Form Online.

Pdf (portable document format) is a file format that captures all the. Type text, add images, blackout confidential details, add comments, highlights and more. Easily fill out pdf blank, edit, and sign them. Draw your signature, type it,.

Sign It In A Few Clicks.

Web a kentucky form k 4 is a pdf form that can be filled out, edited or modified by anyone online. Type text, add images, blackout confidential details, add comments, highlights and more. Start completing the fillable fields. (103 kar 18:150) the paper.

/cdn.vox-cdn.com/uploads/chorus_image/image/59131619/936740394.jpg.0.jpg)