Maine State Tax Extension Form

Maine State Tax Extension Form - Tax payments can also be made online via maine ez pay: Maine individual income tax returns are due by april 15, in most years. Extended deadline with maine tax extension: File extension in few minutes no explanation required quick processing. Sign into your efile.com account and check acceptance by the irs. Web the new pslf regulations relax some rules regarding qualifying employment that should allow more borrowers to qualify for student loan forgiveness. This form is for income earned in tax year 2022, with tax returns due in april 2023. Details on how to only prepare and print a maine 2022 tax return. Owe maine taxes option 1: The forms below are not specific to a particular tax type or program.

Web march 18, 2021 governor janet mills announced today that the state of maine will move the deadline for maine individual income tax payments from april 15, 2021 to may 17, 2021. Or you can make a tax payment online via maine ez pay: Web the new pslf regulations relax some rules regarding qualifying employment that should allow more borrowers to qualify for student loan forgiveness. Real estate withholding (rew) worksheets for tax credits. State of maine has moved the. The change aligns with the federal government’s recent extension of the federal tax filing and payment deadline. In addition to interest, a penalty is assessed for late filing. Portal.maine.gov/ezpay for more information, please visit the maine revenue services website: Web maine filing due date: Web maine personal tax return due date is extended to may 17.

File extension in few minutes no explanation required quick processing. Web to make a payment of tax due, complete and submit this voucher by the original due date of your return. Web maine filing due date: At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time. Maine ez pay is an online application that allows maine taxpayers to make payments online, quickly and easily. We will update this page with a new version of the form for 2024 as soon as it is made available by the maine government. And $35,000 for tax years beginning on or after january 1, 2024. Portal.maine.gov/ezpay/welcome for more information, please visit the maine revenue services website: First, the new regulations simplify the. The actual due date to file maine state individual tax extension form is april 15 for calendar year filers (15th day of 4th month after the tax year ends).

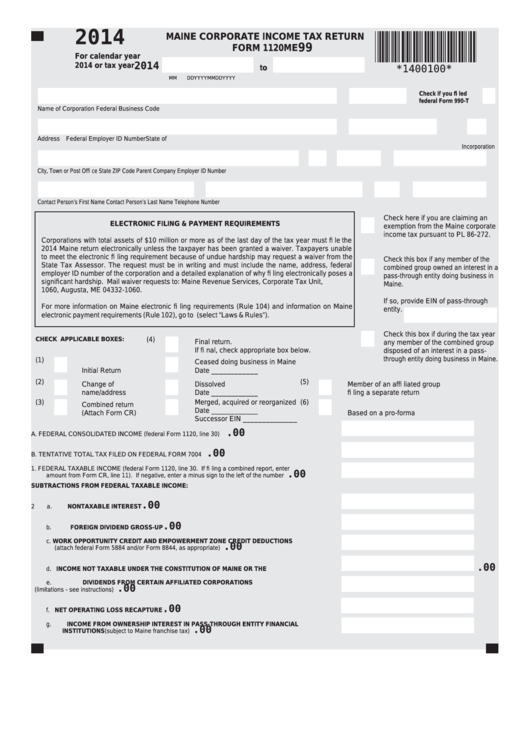

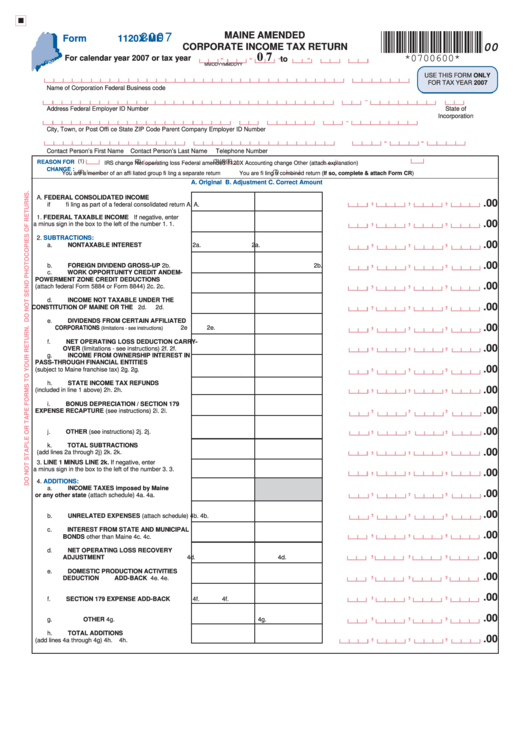

Fillable Form 1120me Maine Corporate Tax Return 2014

Web maine personal tax return due date is extended to may 17. Web march 18, 2021 governor janet mills announced today that the state of maine will move the deadline for maine individual income tax payments from april 15, 2021 to may 17, 2021. It does not allow additional time for payment of tax due or prevent accrual of interest..

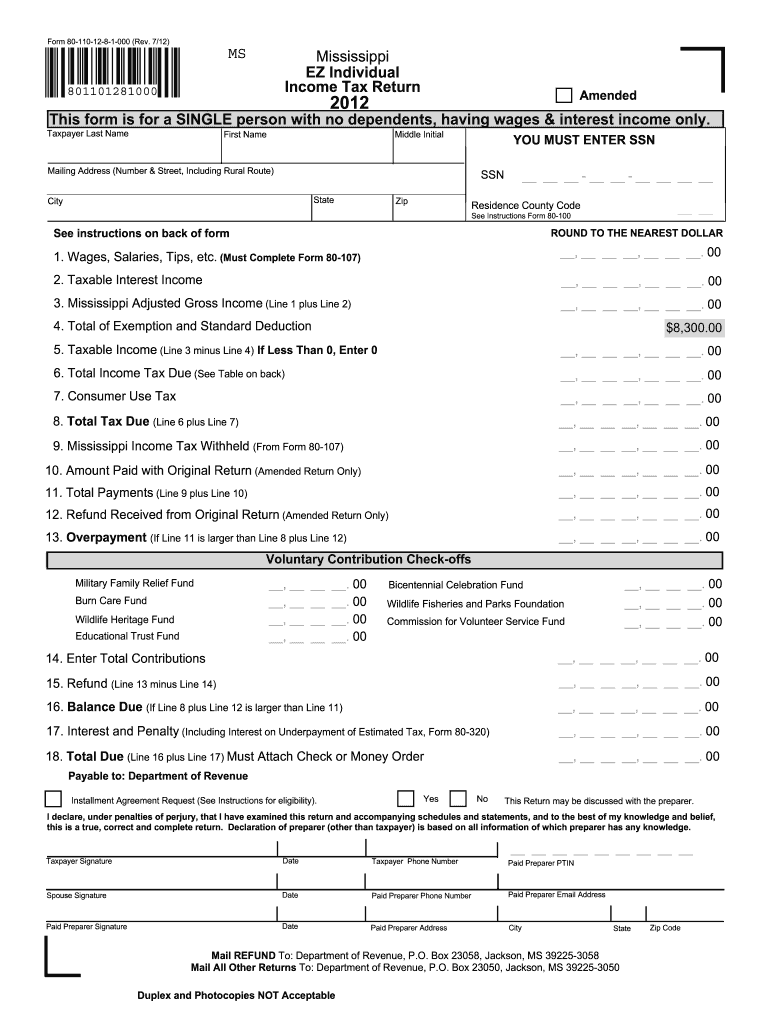

Ms State Tax Form 2022 W4 Form

Web extension of state income tax deadline to may 17, 2021. Maine ez pay is an online application that allows maine taxpayers to make payments online, quickly and easily. Electronic request form to request individual income tax forms. Web mrs’s mission is to fairly and efficiently administer the state’s tax laws with integrity and professionalism. File extension in few minutes.

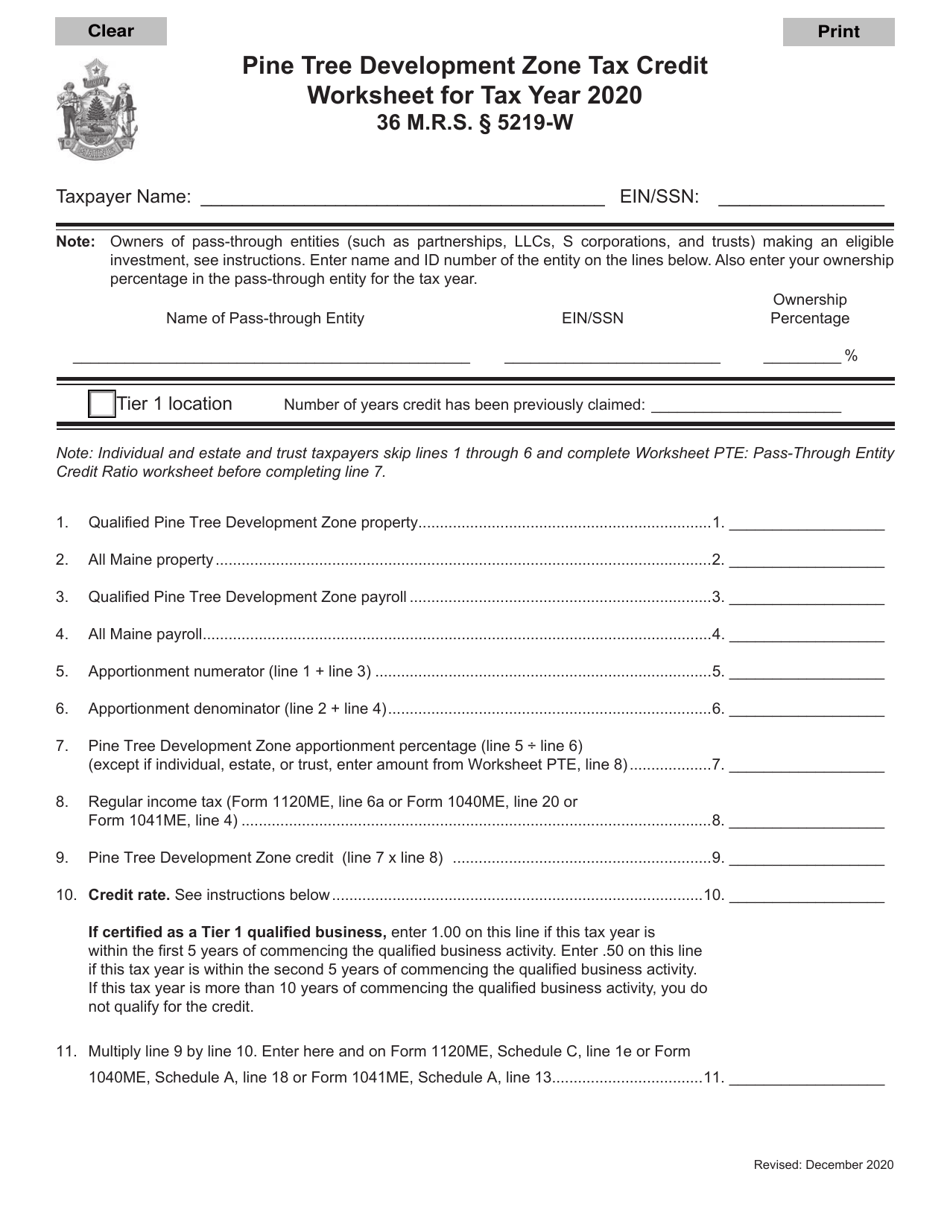

2020 Maine Pine Tree Development Zone Tax Credit Worksheet Download

Explore more file form 7004 and extend your federal business income tax return deadline up to 6 months. Web march 18, 2021 governor janet mills announced today that the state of maine will move the deadline for maine individual income tax payments from april 15, 2021 to may 17, 2021. The change aligns with the federal government’s recent extension of.

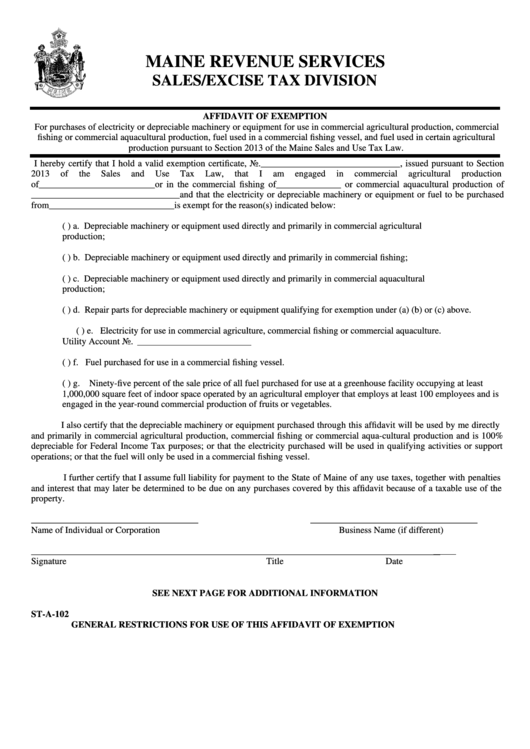

Form StA102 Affidavit Of Exemption Maine Revenue Services

Maine individual income tax returns are due by april 15, in most years. On march 18, 2021, governor janet mills announced that the. Web this form is a voucher for individuals who are in need of an extension of their income tax payments. Web a state of maine extension request form is not necessary. Web extension of state income tax.

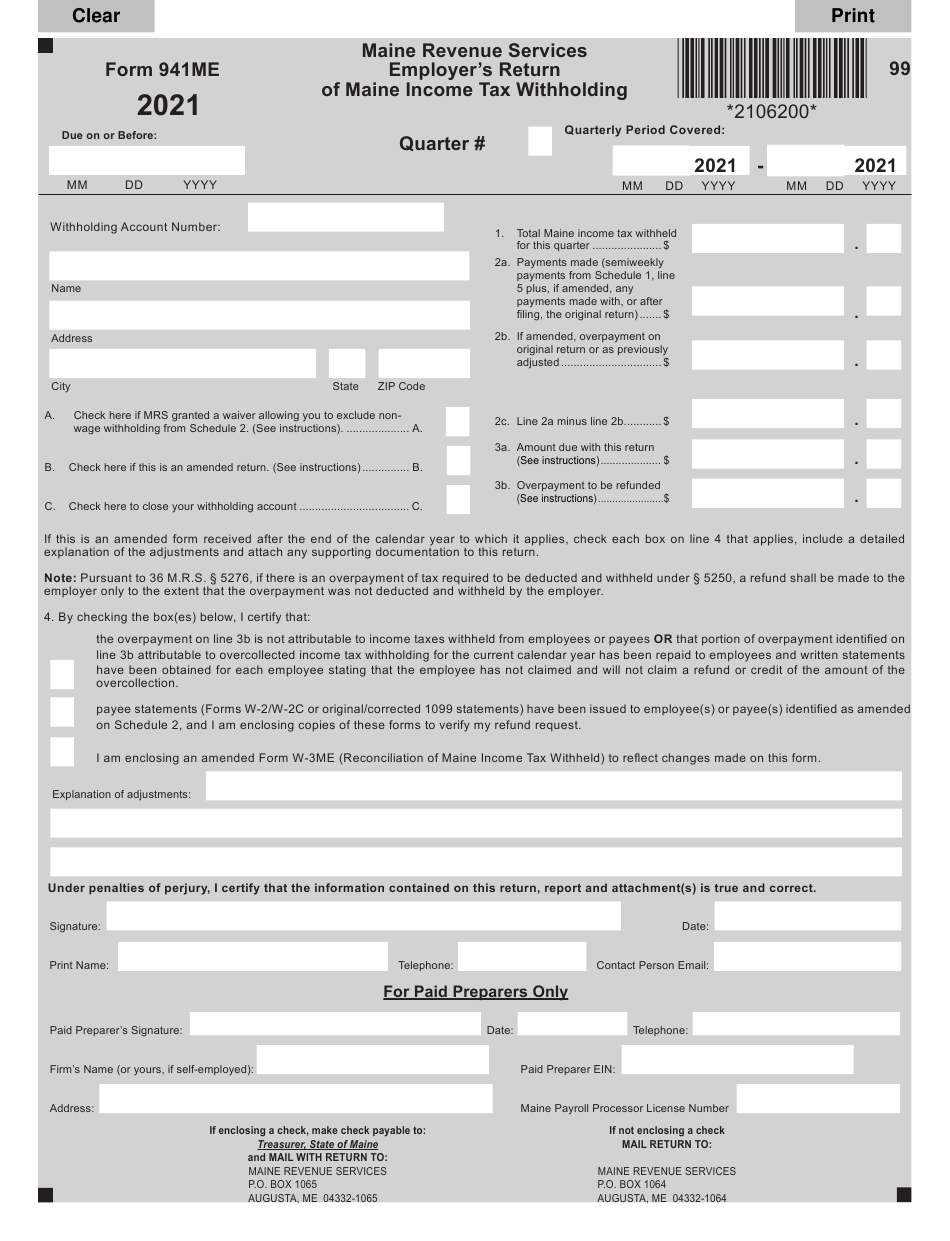

Maine Tax Withholding 2021 2022 W4 Form

The me tax forms are below. Explore more file form 7004 and extend your federal business income tax return deadline up to 6 months. Electronic request form to request individual income tax forms. Web to make a payment of tax due, complete and submit this voucher by the original due date of your return. The forms below are not specific.

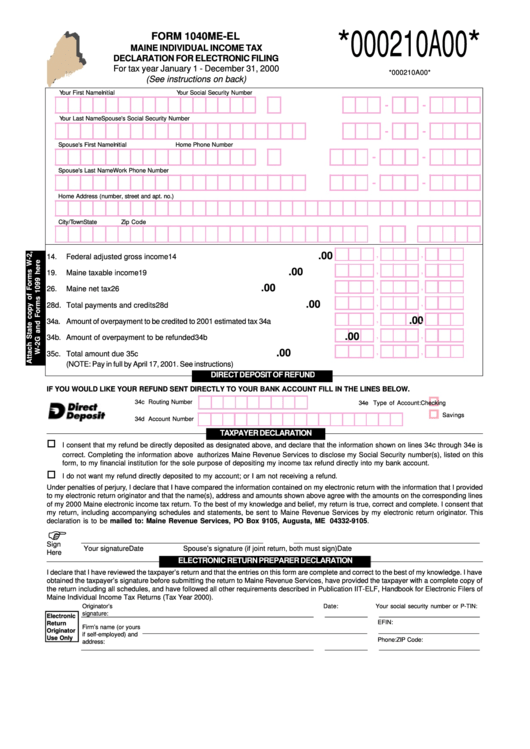

Form 1040meEl Maine Individual Tax Declaration For Electronic

At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time. Web maine personal tax return due date is extended to may 17. Web the new pslf regulations relax some rules regarding qualifying employment that should allow more.

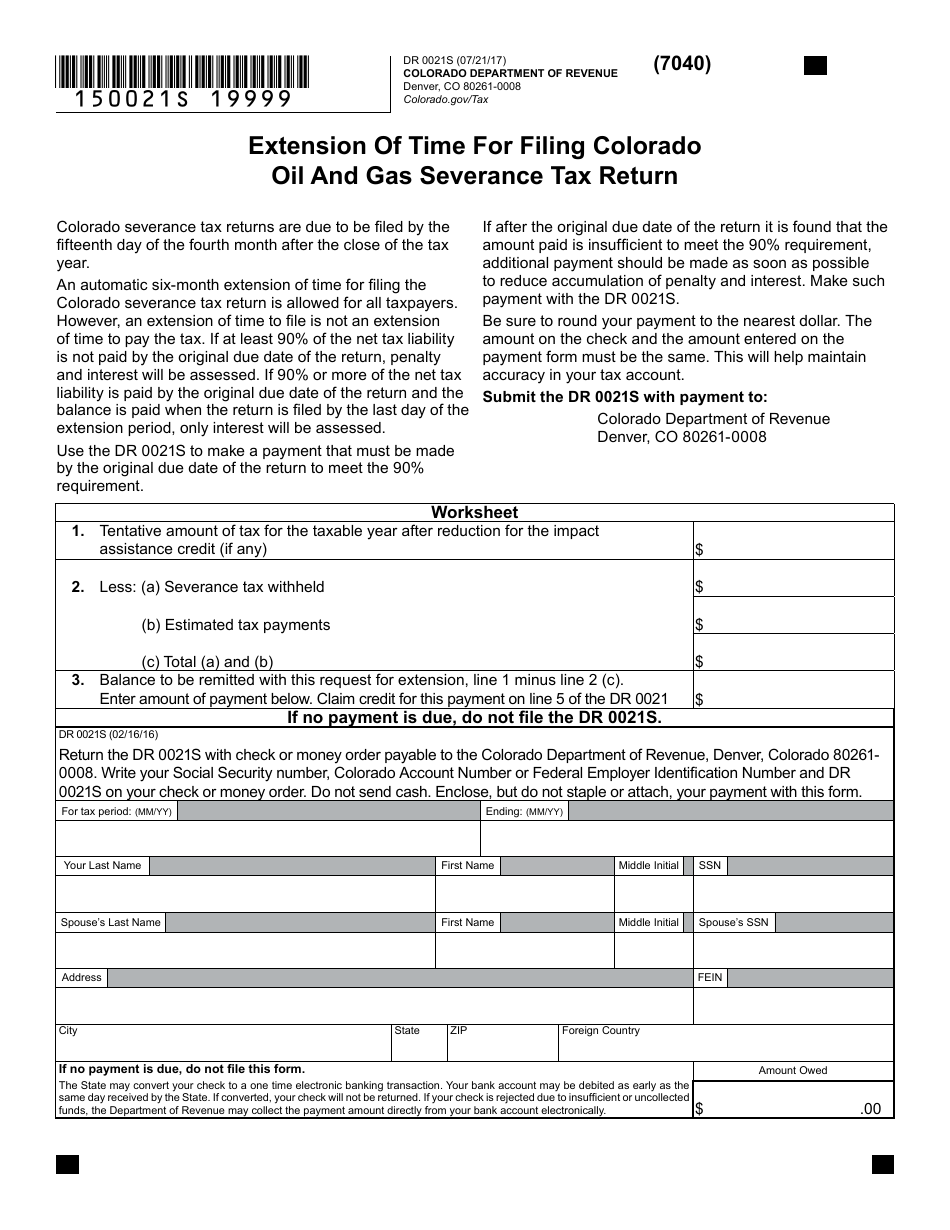

Form DR0021S Download Fillable PDF or Fill Online Extension of Time for

Portal.maine.gov/ezpay for more information, please visit the maine revenue services website: Maine personal extensions are automatic, which means there is no form or application to submit. Application for tax registration (pdf) application for tax registration. At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a.

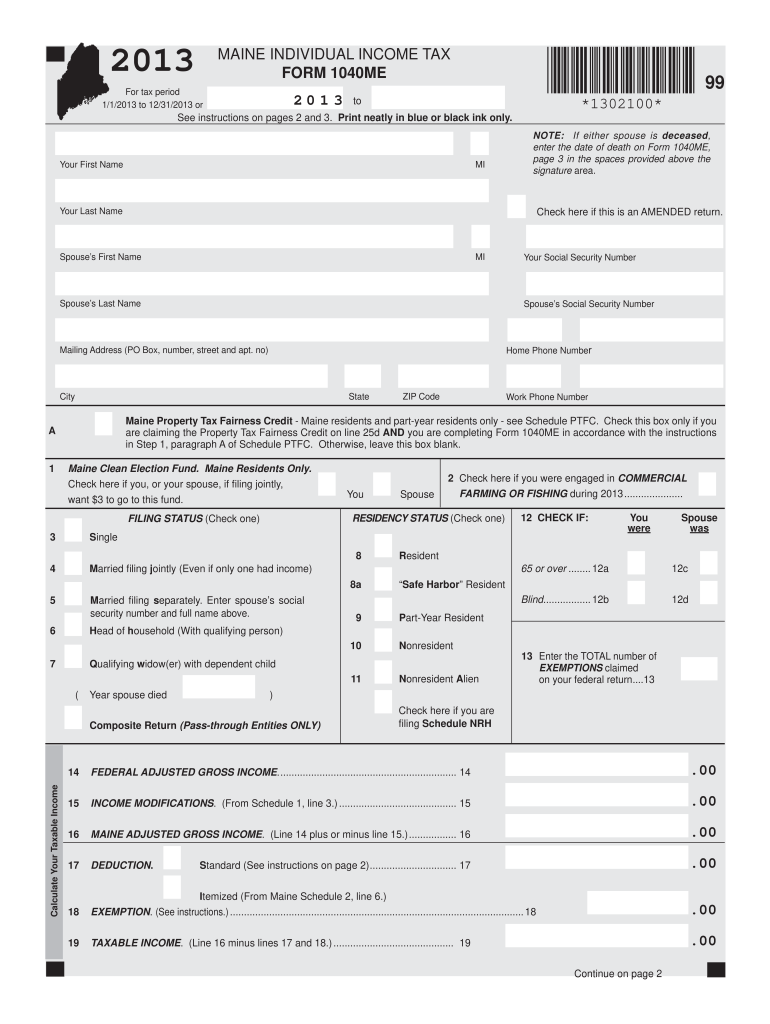

MAINE INDIVIDUAL TAX FORM 1040ME *1302100* 00 Fill Out and

Web an extension allows only additional time to file; Web in order to receive an automatic extension for your maine tax return, you must pay at least 90% of your state tax liability by the original due date. Web this form is a voucher for individuals who are in need of an extension of their income tax payments. Tax payments.

Form 1120xMe Maine Amended Corporate Tax Return 2007

Electronic request form to request individual income tax forms. Check your irs tax refund status. Web to make a payment of tax due, complete and submit this voucher by the original due date of your return. Maine personal extensions are automatic, which means there is no form or application to submit. State of maine has moved the.

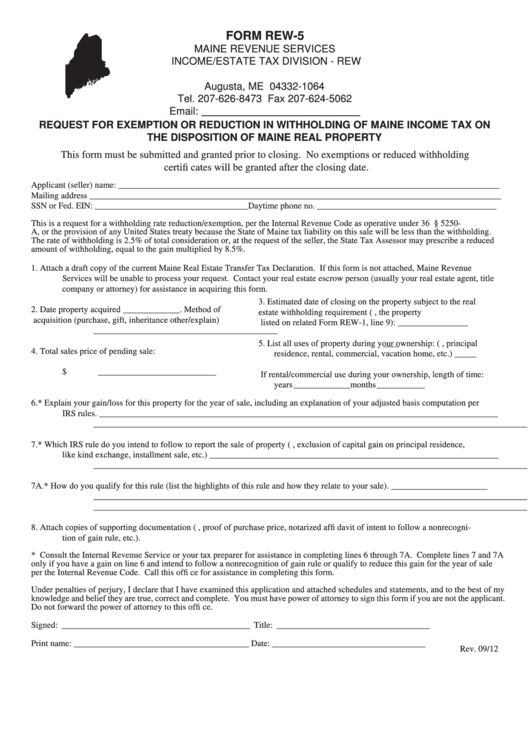

Form Rew5 Request For Exemption Or Reduction In Withholding Of Maine

At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time. Web a state of maine extension request form is not necessary. Web to make a payment of tax due, complete and submit this voucher by the original.

Explore More File Form 7004 And Extend Your Federal Business Income Tax Return Deadline Up To 6 Months.

Portal.maine.gov/ezpay/welcome for more information, please visit the maine revenue services website: Web file your personal tax extension now! Web maine personal tax return due date is extended to may 17. In addition to interest, a penalty is assessed for late filing.

On March 18, 2021, Governor Janet Mills Announced That The.

Portal.maine.gov/ezpay for more information, please visit the maine revenue services website: At least 90% of your maine franchise tax liability must be paid by the original due date of your return in order to avoid a penalty for failure to pay tax on time. State of maine has moved the. Details on how to only prepare and print a maine 2022 tax return.

At Least 90% Of Your Maine Franchise Tax Liability Must Be Paid By The Original Due Date Of Your Return In Order To Avoid A Penalty For Failure To Pay Tax On Time.

Web maine filing due date: Web to make a payment of tax due, complete and submit this voucher by the original due date of your return. Extended deadline with maine tax extension: The penalty for late filing is $25 or 10% of the tax due, whichever is.

The Change Aligns With The Federal Government’s Recent Extension Of The Federal Tax Filing And Payment Deadline.

Web march 18, 2021 governor janet mills announced today that the state of maine will move the deadline for maine individual income tax payments from april 15, 2021 to may 17, 2021. Application for tax registration (pdf) application for tax registration. Owe maine taxes option 1: The actual due date to file maine state individual tax extension form is april 15 for calendar year filers (15th day of 4th month after the tax year ends).