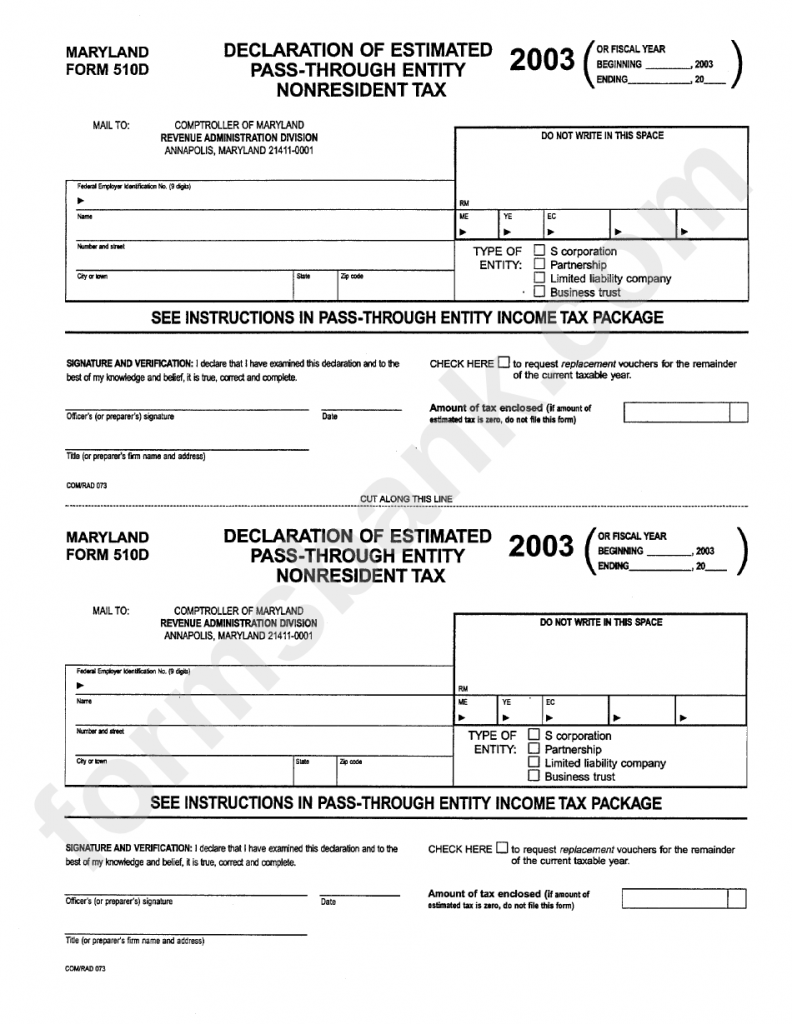

Maryland Estimated Tax Form

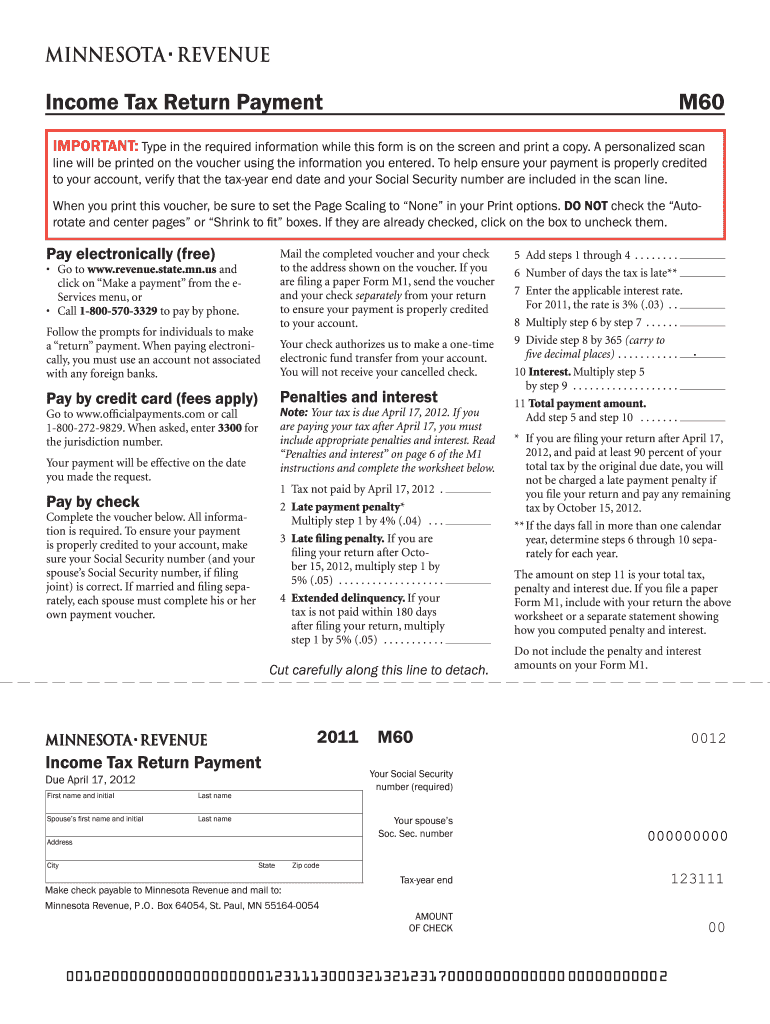

Maryland Estimated Tax Form - Form to be used when claiming dependents. For more information about the maryland income tax, see the maryland income tax page. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax payments and extension payments. For taxpayers filing as single, married filing separately, or as dependent taxpayers. Web individual tax forms and instructions. Web printable maryland income tax form 502d. You do not need to complete this form if you are paying electronically (not sending a check or money order) for your balance due. Total 2021 maryland and local income tax: Use the tax rate schedules below to compute your tax on the amount on line 7. We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government.

Tax rate schedule i if taxable net income is: Total 2021 maryland and local income tax: Use the tax rate schedules below to compute your tax on the amount on line 7. You can make estimated payments online using ifile, which also allows you to review your history of previous payments made through ifile and. Web printable maryland income tax form 502d. Web local or special nonresident income tax: We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax payments and extension payments. This system allows online electronic filing of resident personal income tax returns along with the most commonly associated schedules and forms. Web welcome to the comptroller of maryland's internet tax filing system.

Below you will find links to individual income tax forms and instructions from tax year 2010 through the current year. This form is for income earned in tax year 2022, with tax returns due in april 2023. You must file maryland form pv (declaration of estimated tax) with payment in full within 60 days of receiving $500 or more of income from wagering, awards, prizes, lotteries or raffles, whether paid in cash. What about income from awards or prizes? We will update this page with a new version of the form for 2024 as soon as it is made available by the maryland government. You do not need to complete this form if you are paying electronically (not sending a check or money order) for your balance due. Personal tax payment voucher for form 502/505, estimated tax and extensions For taxpayers filing as single, married filing separately, or as dependent taxpayers. Form 502d is meant to be filed on a quarterly basis. Total 2021 maryland and local income tax:

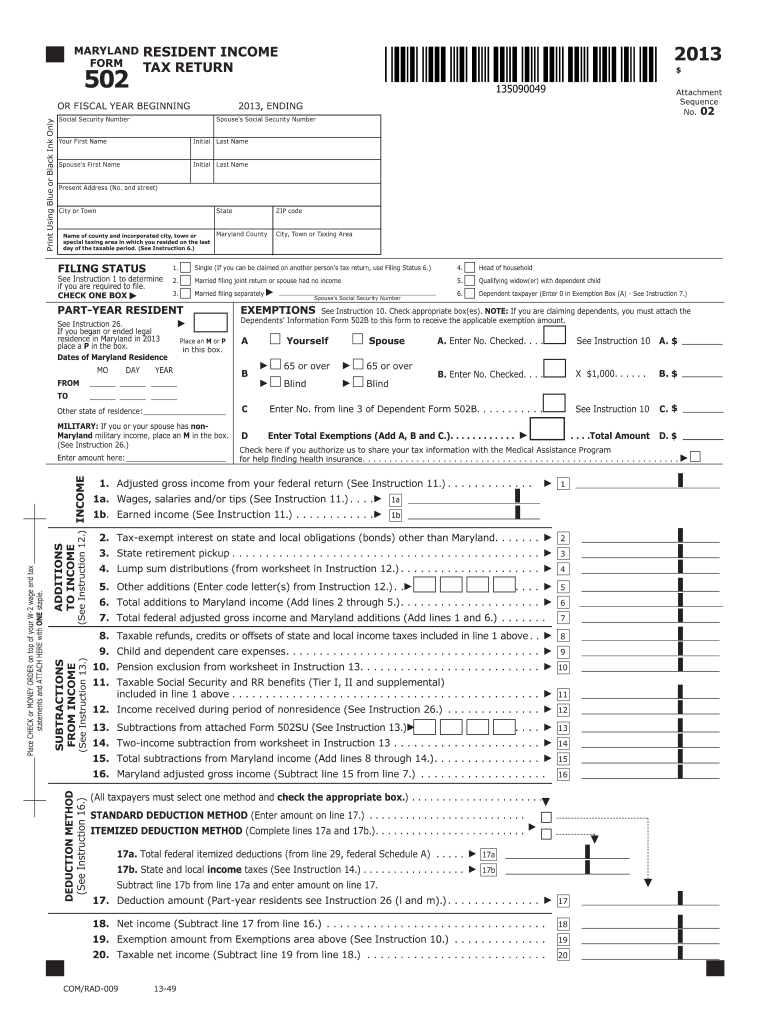

Fillable Md 502 Form Fill Out and Sign Printable PDF Template signNow

You can make estimated payments online using ifile, which also allows you to review your history of previous payments made through ifile and. Use the tax rate schedules below to compute your tax on the amount on line 7. Web local or special nonresident income tax: Maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023.

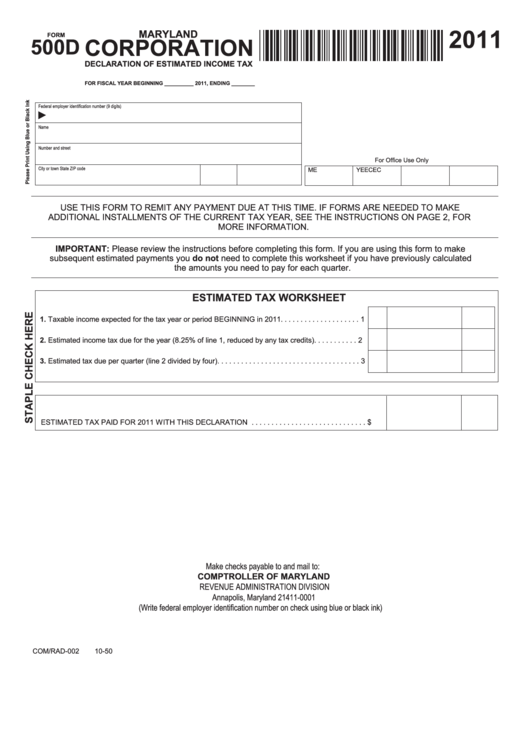

Fillable Form 500d Maryland Corporation Declaration Of Estimated

Web maryland income tax. Credit for tax paid to another state: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web local or special nonresident income tax: What about income from awards or prizes?

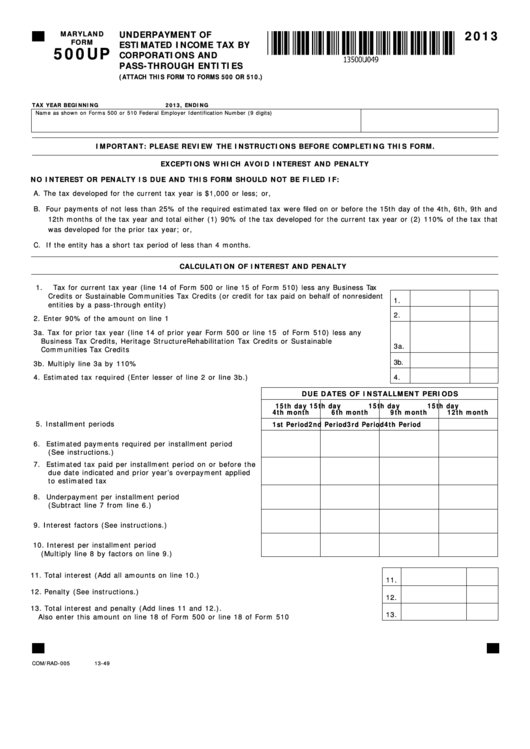

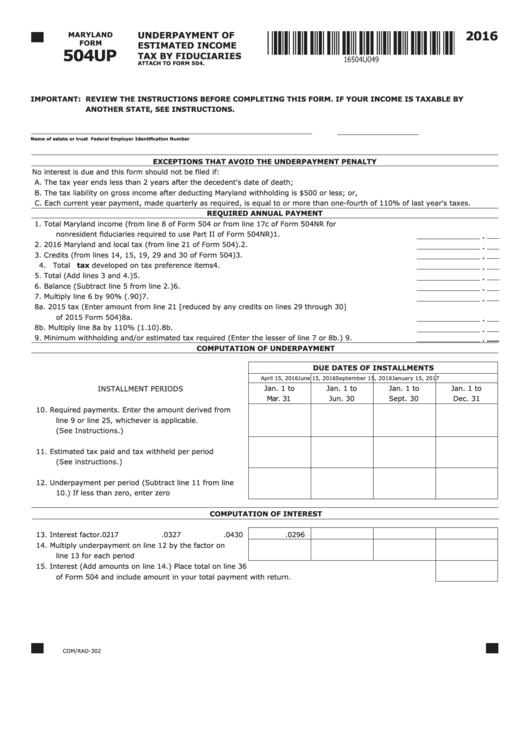

Fillable Maryland Form 500up Underpayment Of Estimated Tax By

Credit for tax paid to another state: You must file maryland form pv (declaration of estimated tax) with payment in full within 60 days of receiving $500 or more of income from wagering, awards, prizes, lotteries or raffles, whether paid in cash. Web maryland income tax. Web the form pv is a payment voucher you will send with your check.

Maryland Estimated Tax Form 2020

Web more about the maryland form pv estimated. Web maryland resident income tax return: Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax payments and extension payments. For taxpayers filing as single, married filing.

Maryland Printable Tax Forms Printable Form 2022

Web individual tax forms and instructions. Form to be used when claiming dependents. You can make estimated payments online using ifile, which also allows you to review your history of previous payments made through ifile and. Form 502d is meant to be filed on a quarterly basis. Maryland will begin processing personal income tax returns for tax year 2022 on.

Maryland Estimated Tax Form 2020

For taxpayers filing as single, married filing separately, or as dependent taxpayers. Web local or special nonresident income tax: Maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier. This form is for income earned in tax year 2022, with tax returns due in april 2023. Personal tax payment voucher for form 502/505, estimated.

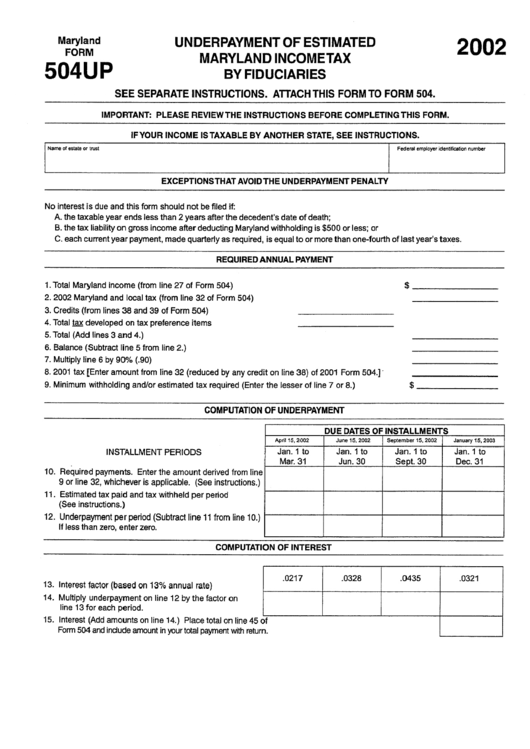

Fillable Maryland Form 504up Underpayment Of Estimated Tax By

Web printable maryland income tax form 502d. This form is for income earned in tax year 2022, with tax returns due in april 2023. Total estimated tax to be paid by. Form 502d is meant to be filed on a quarterly basis. What about income from awards or prizes?

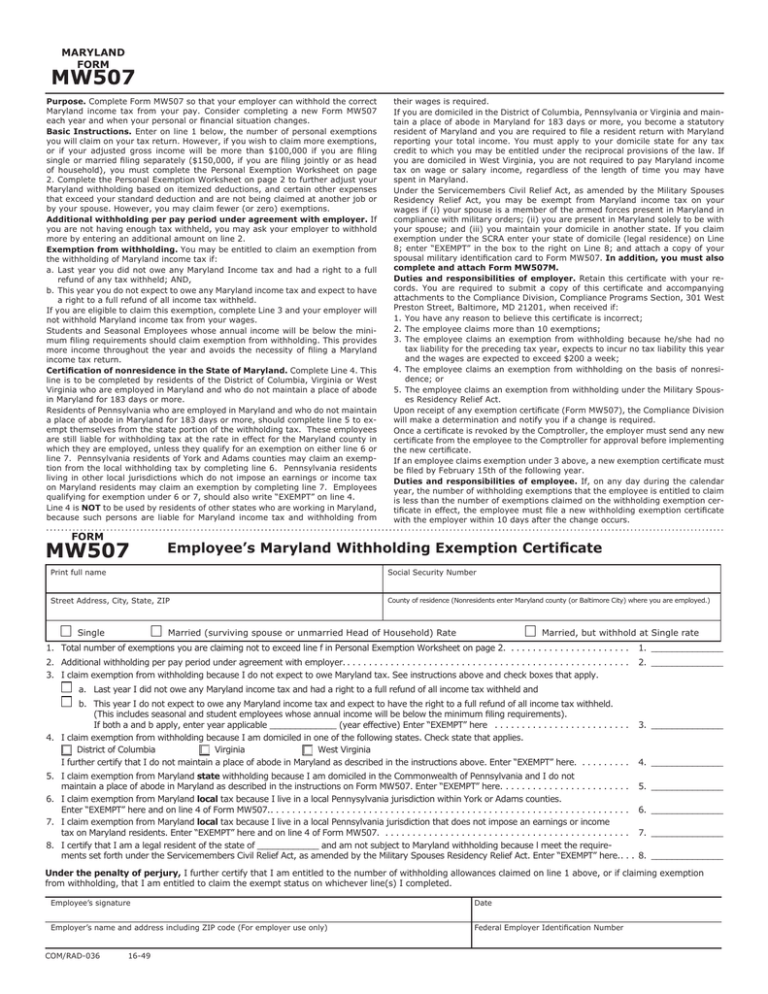

MW507 MARYLAND FORM

Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax payments and extension payments. For more information about the maryland income tax, see the maryland income tax page. Web local or special nonresident income tax:.

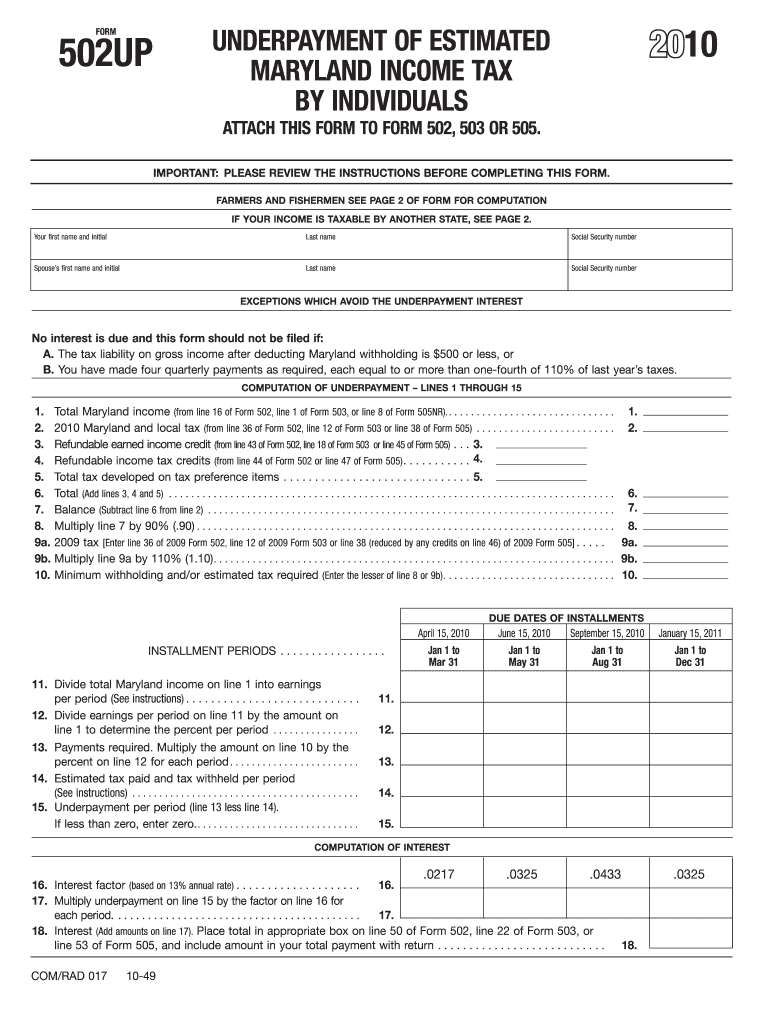

Form 502Up Fill Out and Sign Printable PDF Template signNow

Tax rate schedule i if taxable net income is: Form 502d is meant to be filed on a quarterly basis. You must file maryland form pv (declaration of estimated tax) with payment in full within 60 days of receiving $500 or more of income from wagering, awards, prizes, lotteries or raffles, whether paid in cash. Maryland will begin processing personal.

Maryland Estimated Tax Form 2020

Income tax to be withheld from wages by employers during year 2021: You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding. You must file maryland form pv (declaration of estimated tax) with payment in full within 60 days of receiving $500 or more of income from wagering, awards, prizes, lotteries.

Below You Will Find Links To Individual Income Tax Forms And Instructions From Tax Year 2010 Through The Current Year.

Web maryland resident income tax return: Total 2021 maryland and local income tax: Web more about the maryland form pv estimated. Form 502d is meant to be filed on a quarterly basis.

This System Allows Online Electronic Filing Of Resident Personal Income Tax Returns Along With The Most Commonly Associated Schedules And Forms.

Tax rate schedule i if taxable net income is: Use the tax rate schedules below to compute your tax on the amount on line 7. We last updated maryland form pv in february 2023 from the maryland comptroller of maryland. Income tax to be withheld from wages by employers during year 2021:

Web Printable Maryland Income Tax Form 502D.

What about income from awards or prizes? You must file maryland form pv (declaration of estimated tax) with payment in full within 60 days of receiving $500 or more of income from wagering, awards, prizes, lotteries or raffles, whether paid in cash. For more information about the maryland income tax, see the maryland income tax page. Maryland will begin processing personal income tax returns for tax year 2022 on 01/25/2023 or earlier.

Web Maryland Income Tax.

Web individual tax forms and instructions. For taxpayers filing as single, married filing separately, or as dependent taxpayers. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web than $500 in excess of any withholding, then you must file and pay estimated taxes to maryland.