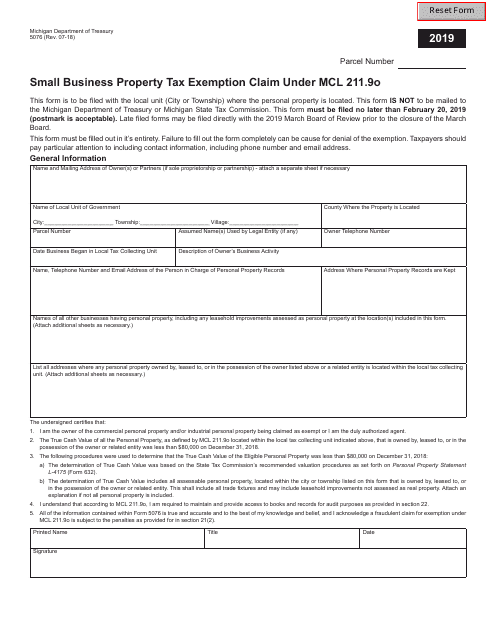

Michigan Form 5076

Michigan Form 5076 - Web february 21st, 2023, the “small business property tax exemption claim under mcl 211.9o,” michigan dept of treasury form 5076, included with this notice. Web businesses with less than $80,000 combined true cash value of personal property owned, leased or used by them (and any related entity) within a municipality may qualify for this. Corporate income tax (cit) city income tax forms; Web $80,000, then you do not need to file this form if the property is classified as commercial or industrial personal property and you timely claim the exemption. For example, if you know the form has the word change in the title,. To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. Personal property statement (2023) michigan form 4175 document seq 1.00 file:227. Web the exemption is only for commercial and industrial personal property. Save or instantly send your ready documents. Web complete the michigan form 5076.

Web form 5076 you are not required to file form 632, unless requested. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and statement for eligible manufacturing personal property and essential. Web the exemption is only for commercial and industrial personal property. Ad download or email mi 5076 & more fillable forms, register and subscribe now! For example, if you know the form has the word change in the title,. If the true cash value of. Web michigan form 5076 document seq 0.00 file:226. To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. The form you use to apply for this exemption is a state of michigan form called the small business property tax exemption claim under.

The form you use to apply for this exemption is a state of michigan form called the small business property tax exemption claim under. Web $80,000, then you do not need to file this form if the property is classified as commercial or industrial personal property and you timely claim the exemption. Web the exemption is only for commercial and industrial personal property. Web complete mi 5076 2023 online with us legal forms. Web the state of michigan offers an exemption for business owners with eligible personal property that falls below a certain true cash value threshold. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and statement for eligible manufacturing personal property and essential. To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. If you feel you qualify for this exemption,. Mcl 211.9c,” michigan department of treasury form 5076,. Web to claim the exemption a taxpayer must file form 5076 small business property tax exemption claim under mcl 211.9o with the local tax collecting unit in which the eligible.

Michigan Default Judgment Form Fill Online, Printable, Fillable

Easily fill out pdf blank, edit, and sign them. Download or email mi form 5076 & more fillable forms, register and subscribe now If the true cash value of. Download or email mi form 5076 & more fillable forms, register and subscribe now Save or instantly send your ready documents.

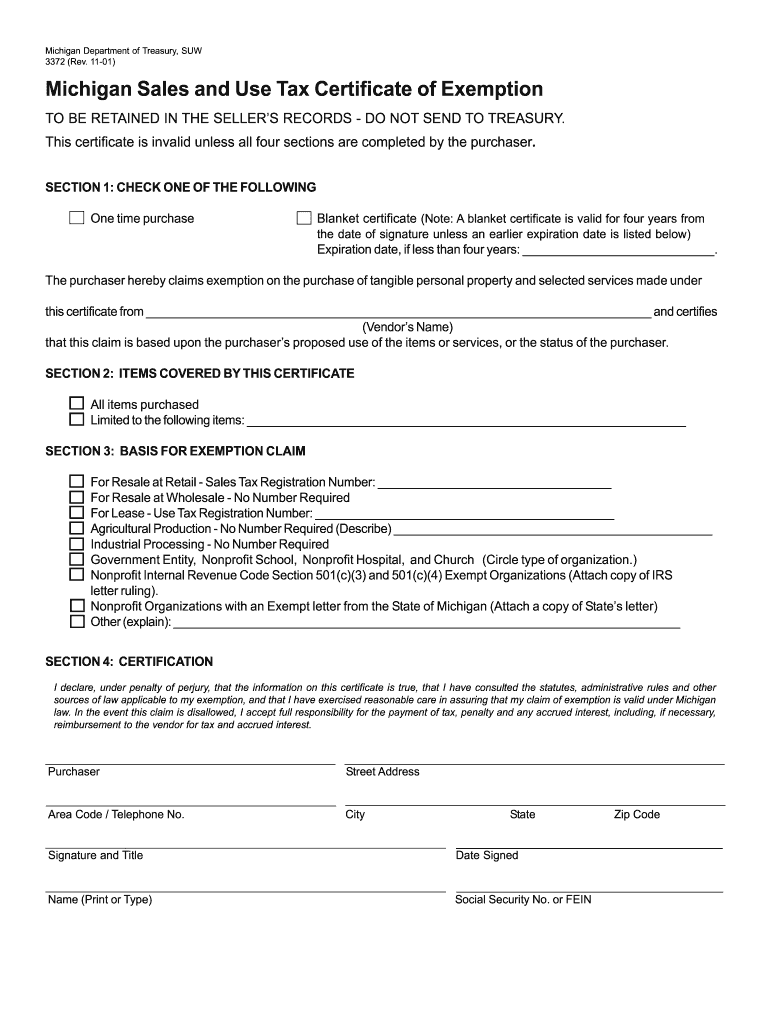

Michigan Form 3372 Fillable Fill Online, Printable, Fillable, Blank

Web shindelrock personal finance tax house bill 5351, approved by michigan governor gretchen whitmer on december 23, 2021, amends mcl 211.9o to increase. Web form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and statement for eligible manufacturing personal property and essential. To claim this exemption, the business must file form 5076, affidavit of owner.

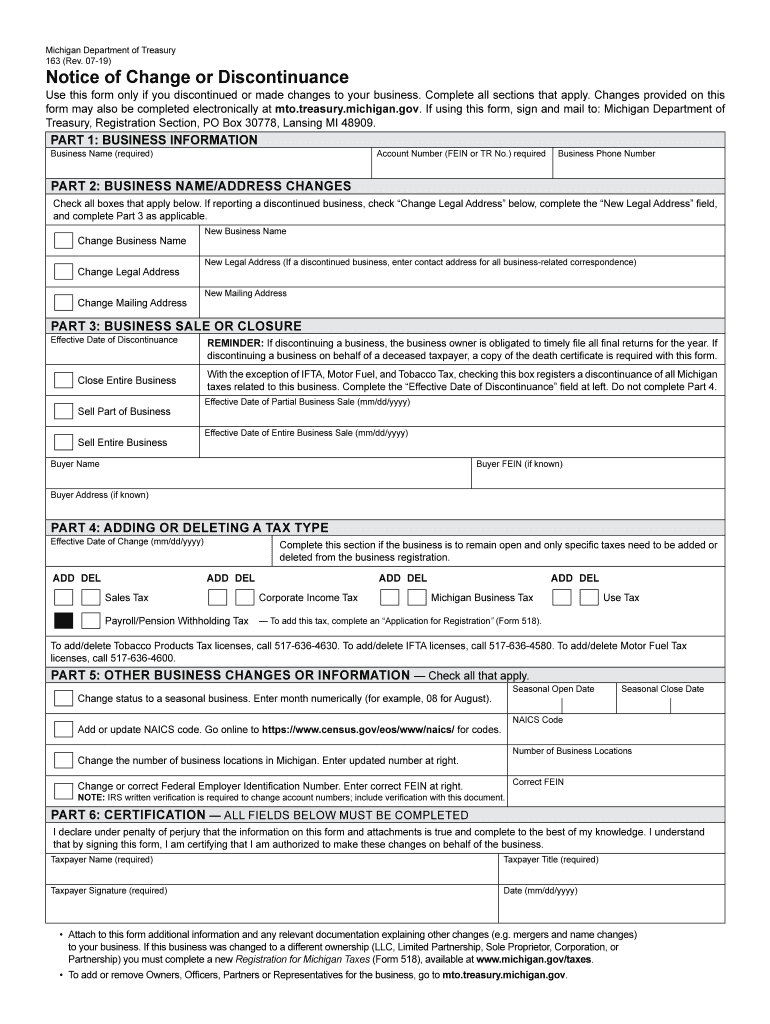

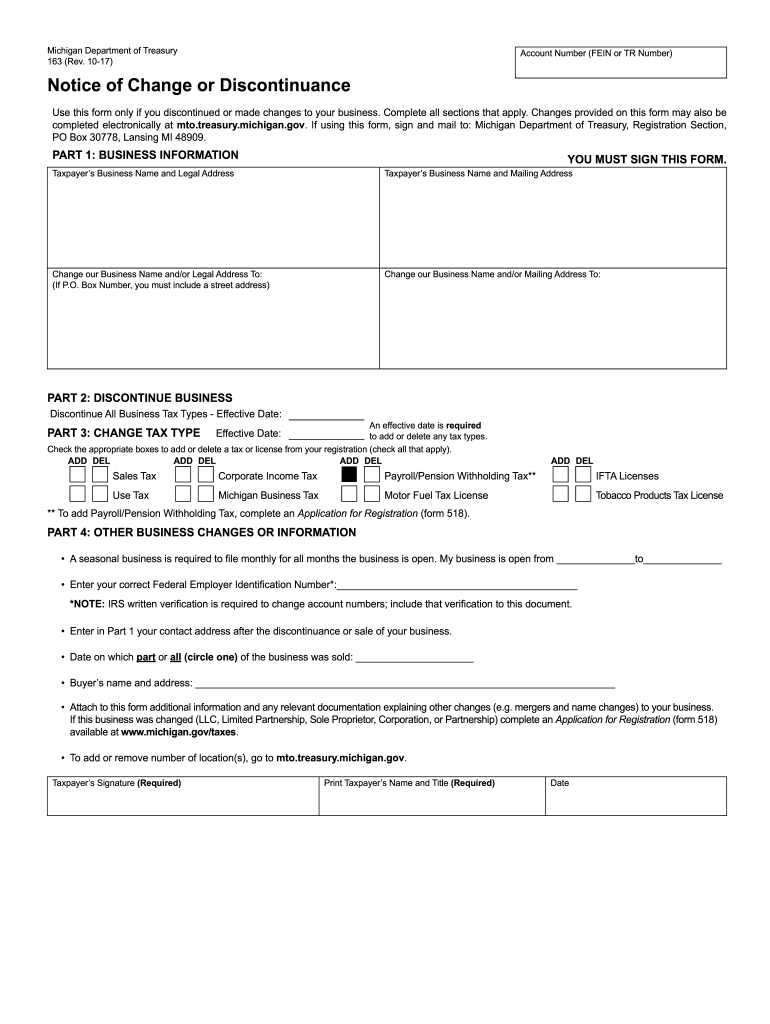

Form 163 michigan Fill out & sign online DocHub

Mcl 211.9c,” michigan department of treasury form 5076,. Web the exemption is only for commercial and industrial personal property. Web the state of michigan offers an exemption for business owners with eligible personal property that falls below a certain true cash value threshold. If the true cash value of. Personal property statement (2023) michigan form 4175 document seq 1.00 file:227.

Michigan Resale Certificate Fill Out and Sign Printable PDF Template

Web shindelrock personal finance tax house bill 5351, approved by michigan governor gretchen whitmer on december 23, 2021, amends mcl 211.9o to increase. Web michigan department of treasury 5076 (rev. Web $80,000, then you do not need to file this form if the property is classified as commercial or industrial personal property and you timely claim the exemption. The form.

FIA Historic Database

Corporate income tax (cit) city income tax forms; To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. Complete, edit or print tax forms instantly. Save or instantly send your ready documents. Personal property statement (2023) michigan form 4175 document seq 1.00 file:227.

Michigan Form 151 mimekodesign

Web to claim the exemption a taxpayer must file form 5076 small business property tax exemption claim under mcl 211.9o with the local tax collecting unit in which the eligible. Download or email mi form 5076 & more fillable forms, register and subscribe now The form you use to apply for this exemption is a state of michigan form called.

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Web complete mi 5076 2023 online with us legal forms. The form you use to apply for this exemption is a state of michigan form called the small business property tax exemption claim under. Web businesses with less than $80,000 combined true cash value of personal property owned, leased or used by them (and any related entity) within a municipality.

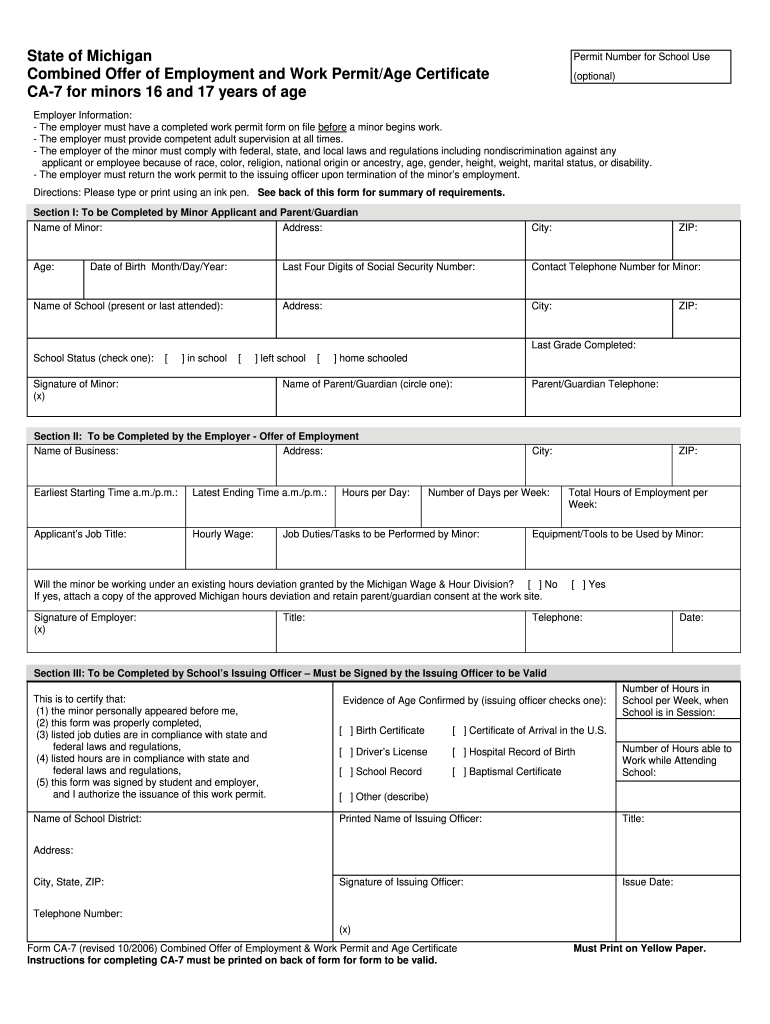

How to Get Work Permit in Michigan Form Fill Out and Sign Printable

Web form 5076 you are not required to file form 632, unless requested. Web shindelrock personal finance tax house bill 5351, approved by michigan governor gretchen whitmer on december 23, 2021, amends mcl 211.9o to increase. Web complete the michigan form 5076. To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. Download or.

2017 Form MI DoT 163 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 5076 you are not required to file form 632, unless requested. Mcl 211.9c,” michigan department of treasury form 5076,. For example, if you know the form has the word change in the title,. Ad download or email mi 5076 & more fillable forms, register and subscribe now! Web february 21st, 2023, the “small business property tax exemption claim.

Form 5076 Right Michigan

Corporate income tax (cit) city income tax forms; Web michigan department of treasury 5076 (rev. Easily fill out pdf blank, edit, and sign them. To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. Web to claim the exemption a taxpayer must file form 5076 small business property tax exemption claim under mcl 211.9o.

Web $80,000, Then You Do Not Need To File This Form If The Property Is Classified As Commercial Or Industrial Personal Property And You Timely Claim The Exemption.

Web businesses with less than $80,000 combined true cash value of personal property owned, leased or used by them (and any related entity) within a municipality may qualify for this. Web the exemption is only for commercial and industrial personal property. Save or instantly send your ready documents. Download or email mi form 5076 & more fillable forms, register and subscribe now

Web Shindelrock Personal Finance Tax House Bill 5351, Approved By Michigan Governor Gretchen Whitmer On December 23, 2021, Amends Mcl 211.9O To Increase.

Web use this option to browse a list of forms by entering a key word or phrase that describes the form you need. To claim this exemption, the business must file form 5076, affidavit of owner of eligible personal. Download or email mi form 5076 & more fillable forms, register and subscribe now For example, if you know the form has the word change in the title,.

Web The State Of Michigan Offers An Exemption For Business Owners With Eligible Personal Property That Falls Below A Certain True Cash Value Threshold.

The form you use to apply for this exemption is a state of michigan form called the small business property tax exemption claim under. Complete, edit or print tax forms instantly. Web michigan department of treasury 5076 (rev. Web complete mi 5076 2023 online with us legal forms.

Corporate Income Tax (Cit) City Income Tax Forms;

Web form 5076 you are not required to file form 632, unless requested. Web the exemption is only for commercial and industrial personal property. Web 5076 small business property tax exemption claim under mcl 2023 use a mi exemption 2023 template to make your document workflow more streamlined. Web michigan form 5076 document seq 0.00 file:226.