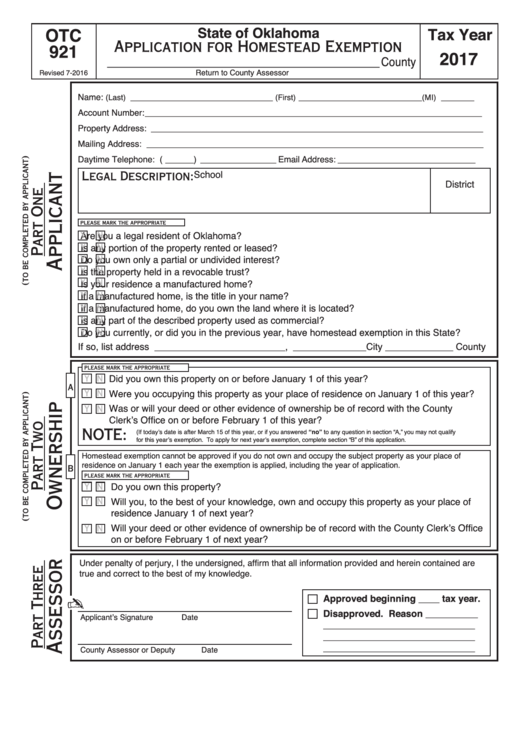

Oklahoma Homestead Exemption Form

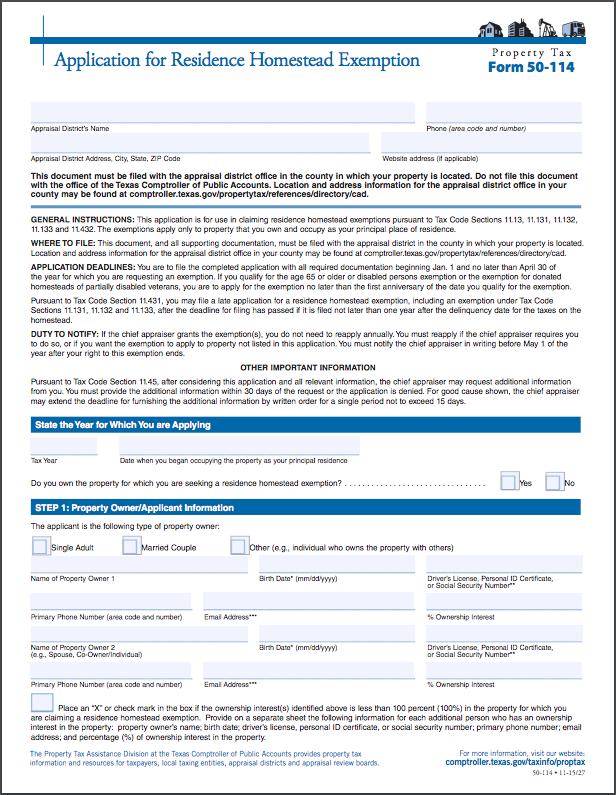

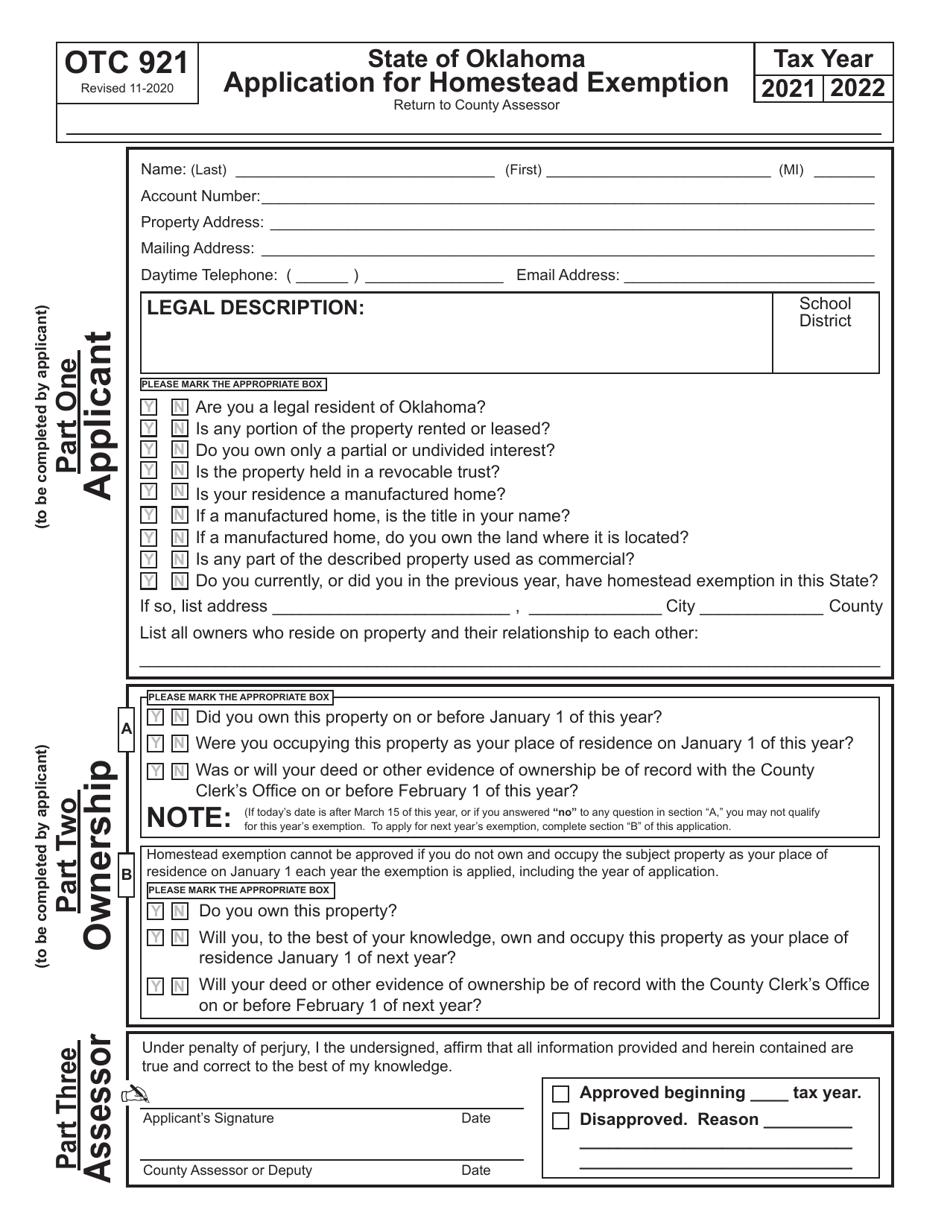

Oklahoma Homestead Exemption Form - At the top of the page, enter the name of the county in which you are filing and the tax year in question. Web you must be a resident of oklahoma. Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web up to 25% cash back in oklahoma, the homestead exemption is automatic—you don't have to file a homestead declaration to claim the homestead. Register and subscribe now to work on your ok otc 921 form tulsa county & more forms. How to apply you can apply for a. Web such application may be filed at any time; Choose the correct version of. Homestead exemption applications are accepted at any time throughout the year. Please provide a copy of your u.s.

Homestead exemption applications are accepted at any time throughout the year. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. However, the application must be filed by. At the top of the page, enter the name of the county in which you are filing and the tax year in question. All household goods, tools, implements and livestock of every veteran. Complete, edit or print tax forms instantly. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Web you must be a resident of oklahoma. Please provide a copy of your u.s. Choose the correct version of.

Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: However, the application must be filed by. All household goods, tools, implements and livestock of every veteran. If you are active duty military, you must claim oklahoma as your home state of residency. In tax year 2019, this was a savings of $91 to $142 depending on. Provided, the county assessor shall, if such applicant otherwise qualifies, grant a homestead exemption for a tax year only if the. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. Web you must be a resident of oklahoma. Web such application may be filed at any time; Web 2023 form 998 application for 100% disabled veterans real property tax exemption county:

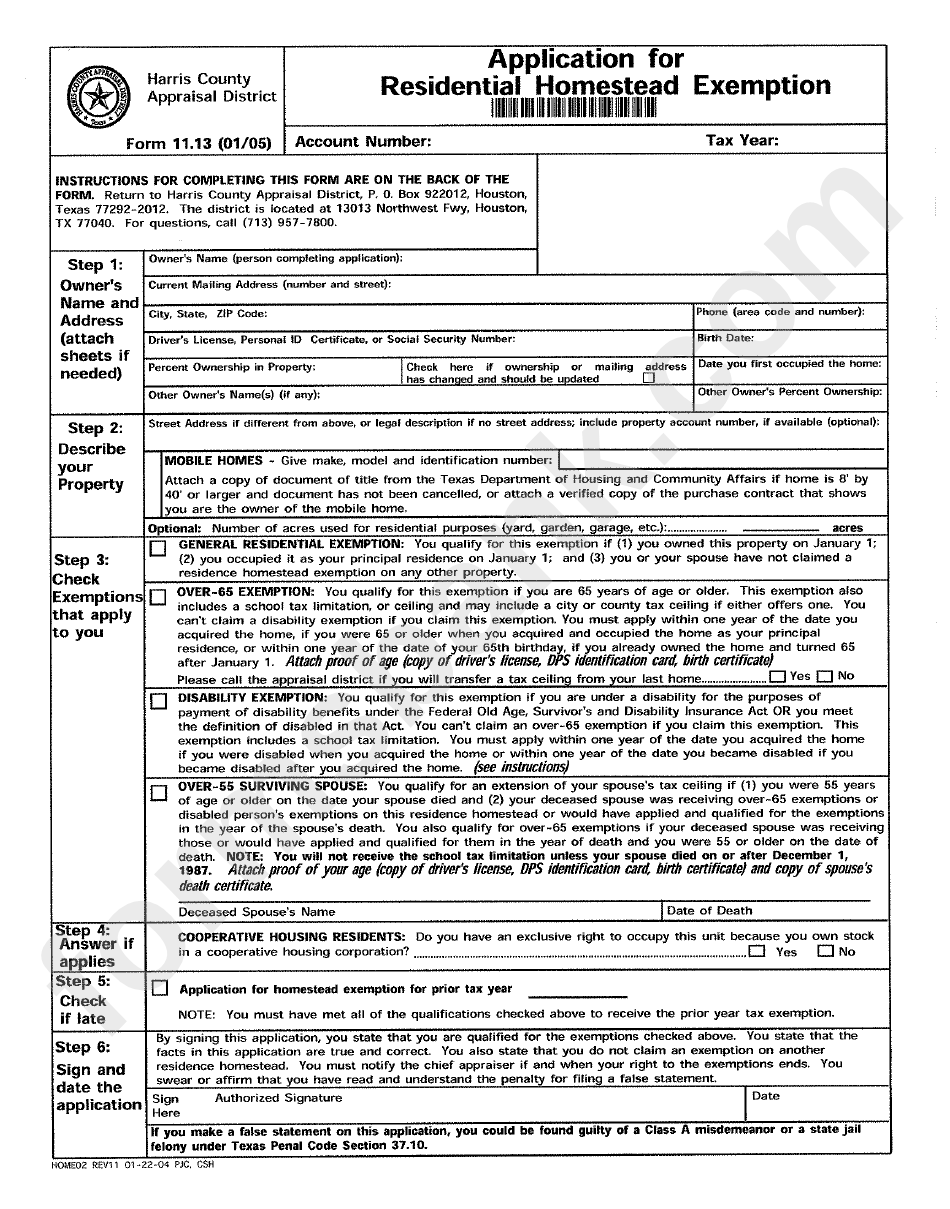

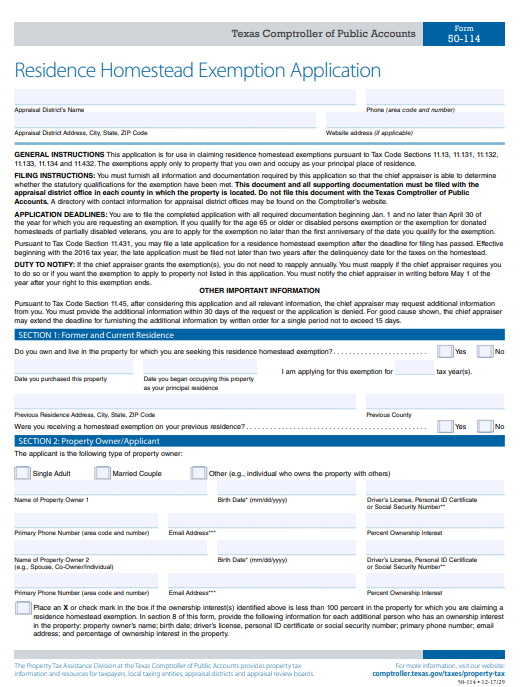

2022 Update Houston Homestead Home Exemptions StepByStep Guide

Homestead exemption applications are accepted at any time throughout the year. Web find and fill out the correct oklahoma homestead exemption file online 2011 form. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Homestead exemption is granted to the homeowner who resides. Web you must be a resident of oklahoma.

An Introduction to the Homestead Exemption Envoy Mortgage

Please provide a copy of your u.s. Web you must be a resident of oklahoma. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. Choose the correct version of. Provided, the county assessor shall, if such applicant otherwise qualifies, grant a homestead exemption for a tax year only if the.

Tax Form For Homestead Exemption

In tax year 2019, this was a savings of $91 to $142 depending on. Web such application may be filed at any time; Homestead exemption applications are accepted at any time throughout the year. Web you must be a resident of oklahoma. At the top of the page, enter the name of the county in which you are filing and.

Homestead Exemptions for Seniors / Fort Myers, Naples / MarkhamNorton

Web up to 25% cash back in oklahoma, the homestead exemption is automatic—you don't have to file a homestead declaration to claim the homestead. How to apply you can apply for a. Web you must be a resident of oklahoma. At the top of the page, enter the name of the county in which you are filing and the tax.

Homestead Exemption YouTube

However, the application must be filed by. Web you must be a resident of oklahoma. Web find and fill out the correct oklahoma homestead exemption file online 2011 form. Provided, the county assessor shall, if such applicant otherwise qualifies, grant a homestead exemption for a tax year only if the. Web a homestead exemption is an exemption of $1,000 of.

Homestead Exemption Form O'Connor Property Tax Reduction Experts

At the top of the page, enter the name of the county in which you are filing and the tax year in question. In tax year 2019, this was a savings of $91 to $142 depending on. Web homestead exemption limitations manufactured home exemption state property tax rankings tax calculator tax exempt entities & corrections tax rates upcoming events. We.

Montgomery Co Tax Bills Are Coming Are You Receiving the Homestead

Choose the correct version of. Web you must be a resident of oklahoma. Web up to 25% cash back in oklahoma, the homestead exemption is automatic—you don't have to file a homestead declaration to claim the homestead. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Web a homestead exemption is an exemption of $1,000.

Montgomery County Homestead Exemption Form by REMAX Integrity Issuu

Register and subscribe now to work on your ok otc 921 form tulsa county & more forms. Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Choose the correct version of. In tax year 2019, this was a savings of $91 to $142 depending on. Homestead exemption applications are accepted at any time throughout the.

915 Oklahoma Tax Forms And Templates free to download in PDF

How to apply you can apply for a. Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web homestead exemption limitations manufactured home exemption state property tax rankings tax calculator tax exempt entities & corrections tax rates upcoming events. Web you must be a resident of oklahoma. Complete, edit or print tax forms.

OTC Form 921 Download Fillable PDF or Fill Online Application for

All household goods, tools, implements and livestock of every veteran. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. In tax year 2019, this was a savings of $91 to $142 depending on. Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: At the top.

Choose The Correct Version Of.

Web 2023 form 998 application for 100% disabled veterans real property tax exemption county: Web the form 921 oklahoma application for homestead exemption form is 1 page long and contains: Web homestead exemption limitations manufactured home exemption state property tax rankings tax calculator tax exempt entities & corrections tax rates upcoming events. How to apply you can apply for a.

However, The Application Must Be Filed By.

Homestead exemption applications are accepted at any time throughout the year. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of your primary residence. All household goods, tools, implements and livestock of every veteran. Register and subscribe now to work on your ok otc 921 form tulsa county & more forms.

Web You Must Be A Resident Of Oklahoma.

Web such application may be filed at any time; We will fill out the form for you and then mail or email it to you to sign and return. Web you must be a resident of oklahoma. If you are active duty military, you must claim oklahoma as your home state of residency.

Web You Must Be A Resident Of Oklahoma.

At the top of the page, enter the name of the county in which you are filing and the tax year in question. Web a homestead exemption is an exemption of $1,000 of the assessed valuation of the homestead property. Homestead exemption is granted to the homeowner who resides. Please provide a copy of your u.s.