Proof Of Loss Form Template

Proof Of Loss Form Template - A proof of loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim. Web 6 steps to fill out a proof of loss document the date and cause of the loss. Web this form is provided to comply with the insurance act, and without prejudice to the liability of the insurer. Open the sworn statement in proof of loss example and follow the instructions. Turn on the wizard mode in the top toolbar to acquire additional tips. Web master proof of loss. 151.9 kb | 105.9 kb Make sure the info you fill in proof of. Please refer to your custom filing instructions from citizenpath for the uscis mailing address, filing fee and requisite supporting documents. Written proof of loss must be furnished to the company at its said office, within ninety days after the date of such loss.

Documents that support the value of your. Web master proof of loss. Web sworn statement in proof of loss any person who knowingly and with intent to injure, defraud or deceive any insurance company,. Web select the get form option to start filling out. Ad proof of loss & more fillable forms, register and subscribe now! 105.9 kb (2 pages) ( 4.3, 7 votes ) Web proof of loss template doc: 151.9 kb | 105.9 kb Make sure the info you fill in proof of. Fill out every fillable field.

Turn on the wizard mode in the top toolbar to acquire additional tips. Web proof of loss template filetype: Written proof of loss must be furnished to the company at its said office, within ninety days after the date of such loss. Web what is a proof of loss form? Open the sworn statement in proof of loss example and follow the instructions. Web select the get form option to start filling out. Please refer to your custom filing instructions from citizenpath for the uscis mailing address, filing fee and requisite supporting documents. Web proof of loss template doc: Policyholders use this form to provide a proof of loss to their insurer, which is the policyholder’s statement of the amount of money. A proof of loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim.

Understanding Proof of Loss Declarations Avner Gat Public Adjusters

Web proof of loss template doc: Web what is a proof of loss form? Policyholders use this form to provide a proof of loss to their insurer, which is the policyholder’s statement of the amount of money. Open the sworn statement in proof of loss example and follow the instructions. Use get form or simply click on the template preview.

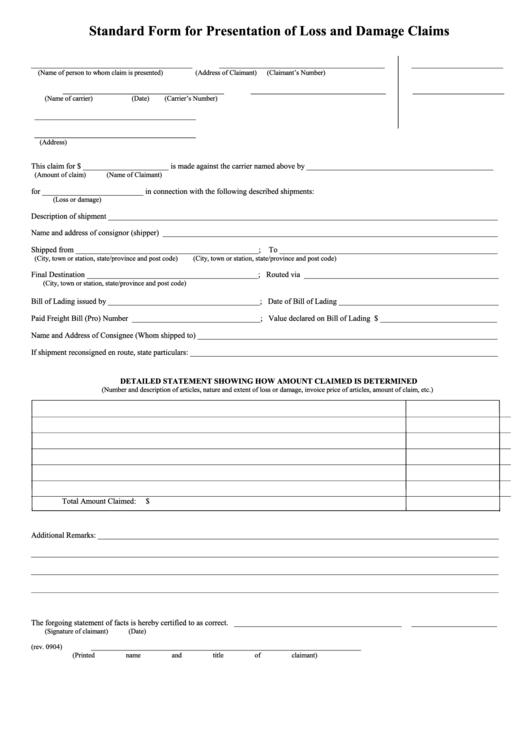

Standard Form For Presentation Of Loss And Damage Claims printable pdf

Save or instantly send your ready documents. Please refer to your custom filing instructions from citizenpath for the uscis mailing address, filing fee and requisite supporting documents. Easily fill out pdf blank, edit, and sign them. Web sworn statement in proof of loss any person who knowingly and with intent to injure, defraud or deceive any insurance company,. Ad proof.

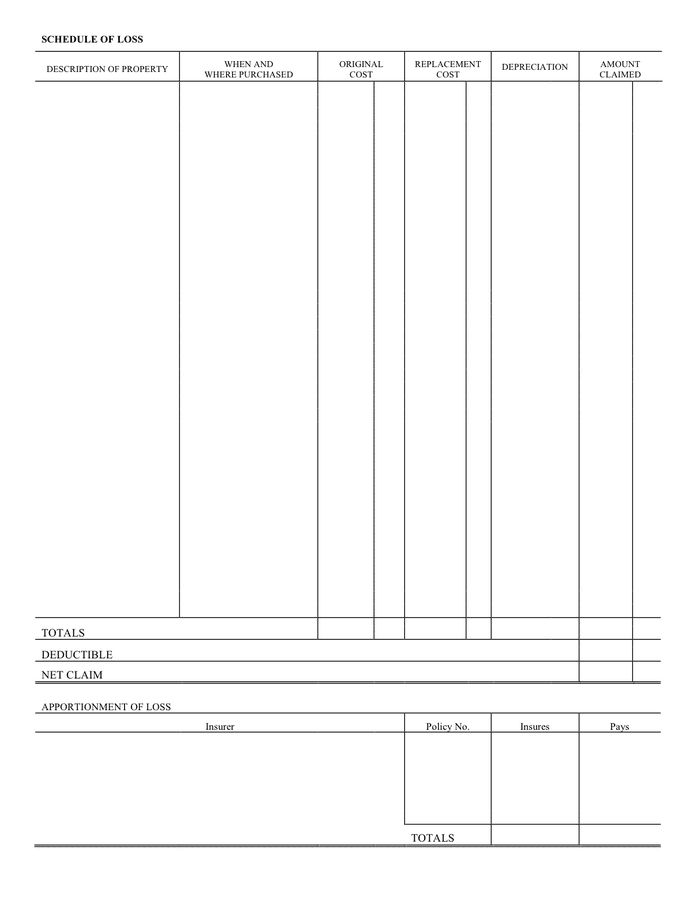

Proof of loss template in Word and Pdf formats page 2 of 2

Web select the get form option to start filling out. Please refer to your custom filing instructions from citizenpath for the uscis mailing address, filing fee and requisite supporting documents. Make sure the info you fill in proof of. Use get form or simply click on the template preview to open it in the editor. Policyholders use this form to.

Proof of Loss Homeowners Insurance

Web proof of loss template filetype: Web master proof of loss. Policyholders use this form to provide a proof of loss to their insurer, which is the policyholder’s statement of the amount of money. Easily fill out pdf blank, edit, and sign them. Web sworn statement in proof of loss any person who knowingly and with intent to injure, defraud.

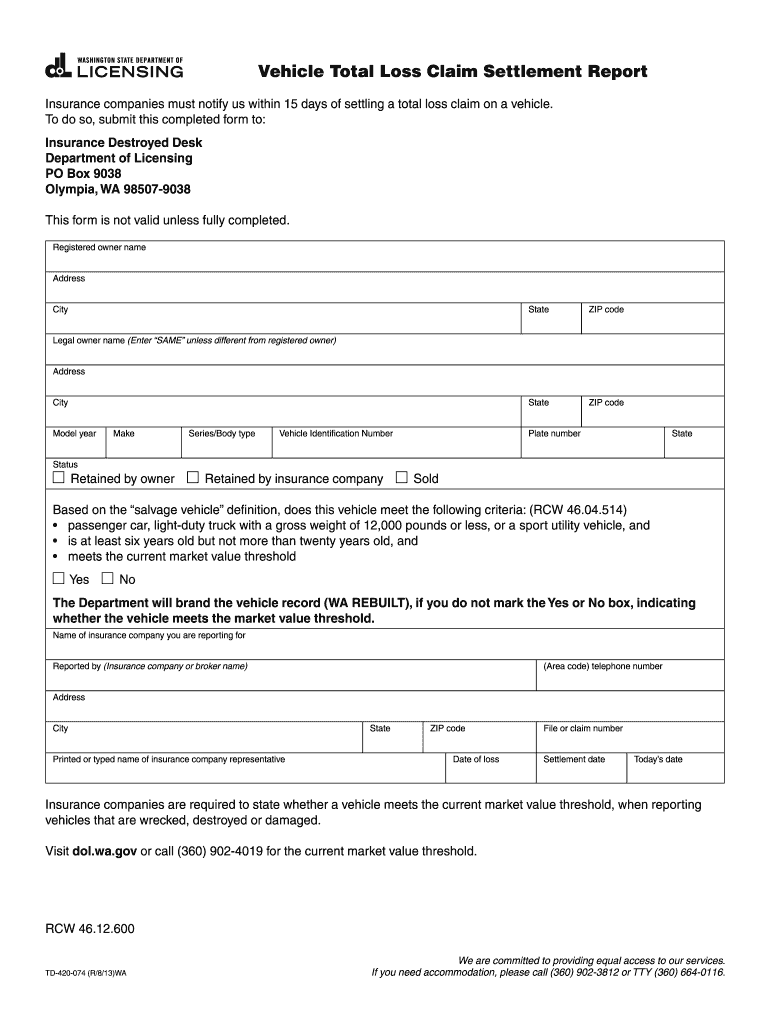

Vehicle Total Loss Letter Sample Fill Online, Printable, Fillable

Easily sign the automobile proof of loss form ontario sample with your. Web this form is provided to comply with the insurance act, and without prejudice to the liability of the insurer. Fill out every fillable field. Turn on the wizard mode in the top toolbar to acquire additional tips. Web select the get form option to start filling out.

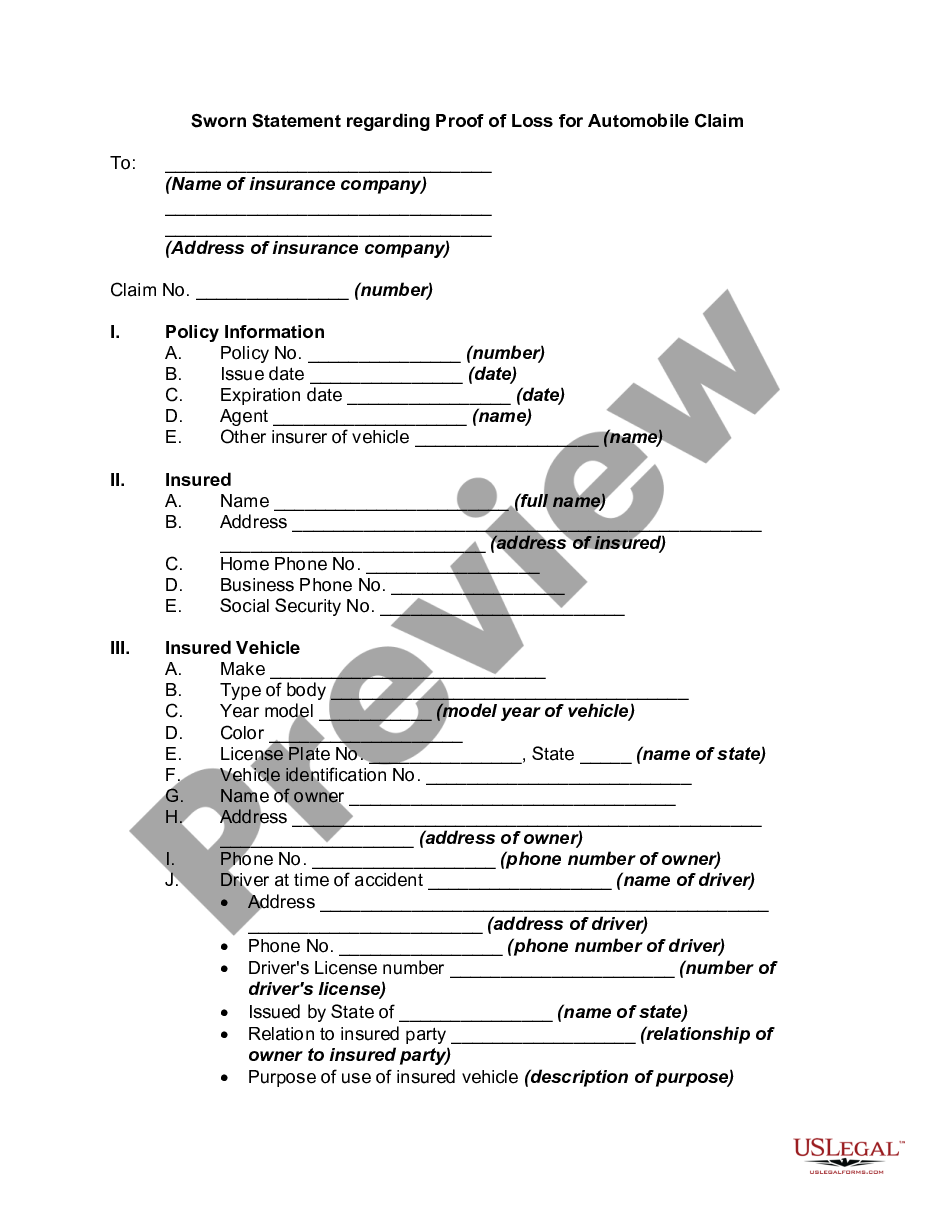

Queens New York Sworn Statement regarding Proof of Loss for Automobile

Easily sign the automobile proof of loss form ontario sample with your. 151.9 kb | 105.9 kb Make sure the info you fill in proof of. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents.

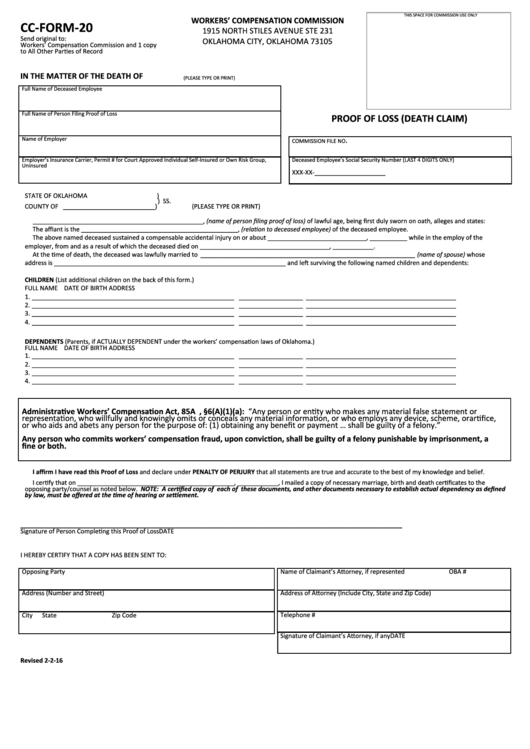

Fillable CcForm20 Proof Of Loss (Death Claim) printable pdf download

Documents that support the value of your. Web 6 steps to fill out a proof of loss document the date and cause of the loss. Completing proof of loss form does not have to be confusing any. Web complete proof of loss form online with us legal forms. Web proof of loss template doc:

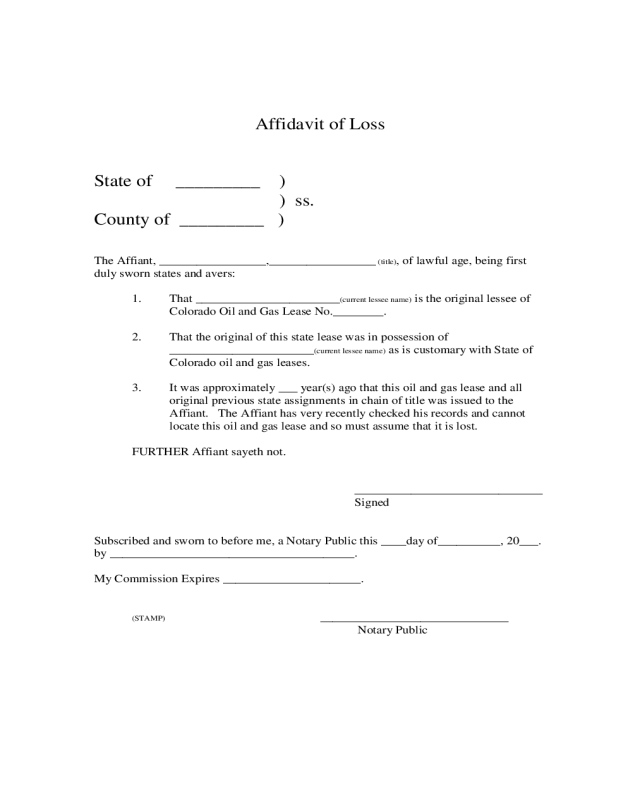

2023 Affidavit of Loss Fillable, Printable PDF & Forms Handypdf

Use get form or simply click on the template preview to open it in the editor. Written proof of loss must be furnished to the company at its said office, within ninety days after the date of such loss. Make sure the info you fill in proof of. Web sworn statement in proof of loss any person who knowingly and.

Homeowners' Insurers Must Furnish Blank Proof Of Loss Forms Within 60

Use get form or simply click on the template preview to open it in the editor. Please refer to your custom filing instructions from citizenpath for the uscis mailing address, filing fee and requisite supporting documents. Easily fill out pdf blank, edit, and sign them. Easily sign the automobile proof of loss form ontario sample with your. Web proof of.

Ibc Fire Proof of Loss Fill Out and Sign Printable PDF Template signNow

Web proof of loss template doc: Web 6 steps to fill out a proof of loss document the date and cause of the loss. 105.9 kb (2 pages) ( 4.3, 7 votes ) Documents that support the value of your. Easily sign the automobile proof of loss form ontario sample with your.

Web What Is A Proof Of Loss Form?

Completing proof of loss form does not have to be confusing any. Make sure the info you fill in proof of. Web download sample sworn statement. Written proof of loss must be furnished to the company at its said office, within ninety days after the date of such loss.

105.9 Kb (2 Pages) ( 4.3, 7 Votes )

Web download the filled out template to your computer by clicking done. Use get form or simply click on the template preview to open it in the editor. Web select the get form option to start filling out. Turn on the wizard mode in the top toolbar to acquire additional tips.

Web 6 Steps To Fill Out A Proof Of Loss Document The Date And Cause Of The Loss.

Policyholders use this form to provide a proof of loss to their insurer, which is the policyholder’s statement of the amount of money. Ad proof of loss & more fillable forms, register and subscribe now! Open the sworn statement in proof of loss example and follow the instructions. Save or instantly send your ready documents.

Easily Sign The Automobile Proof Of Loss Form Ontario Sample With Your.

Web master proof of loss. Sample 1 sample 2 sample 3 see all ( 5). A proof of loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim. Coverage amounts at the time the loss occurred.