Revocable Living Trust Form Florida

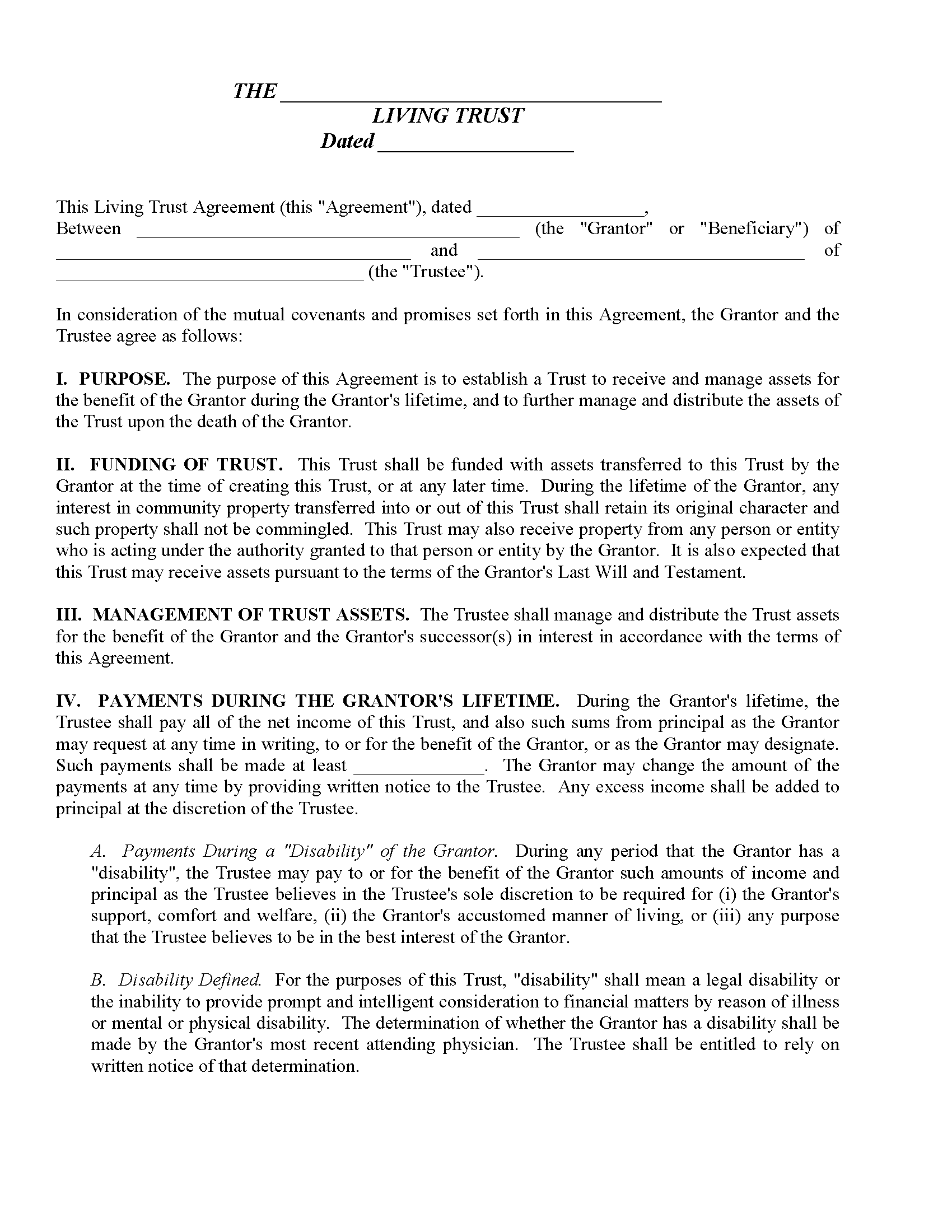

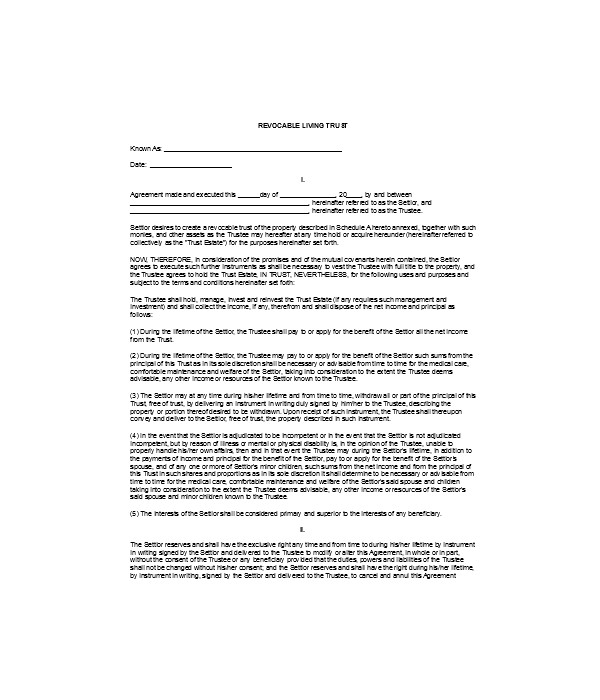

Revocable Living Trust Form Florida - I have always offered both vehicles to my clients since. Include the state and/or county where your living trust was. Choose whether to make an individual or shared trust. Decide what property to include in the trust. Ensure your form includes the following information: Traditional estate planning, to me, includes both the option to draft either a will or a revocable living trust. To create a new profile, follow the. This trust shall be known as the “_____ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living. Web name of the trust: Select popular legal forms & packages of any category.

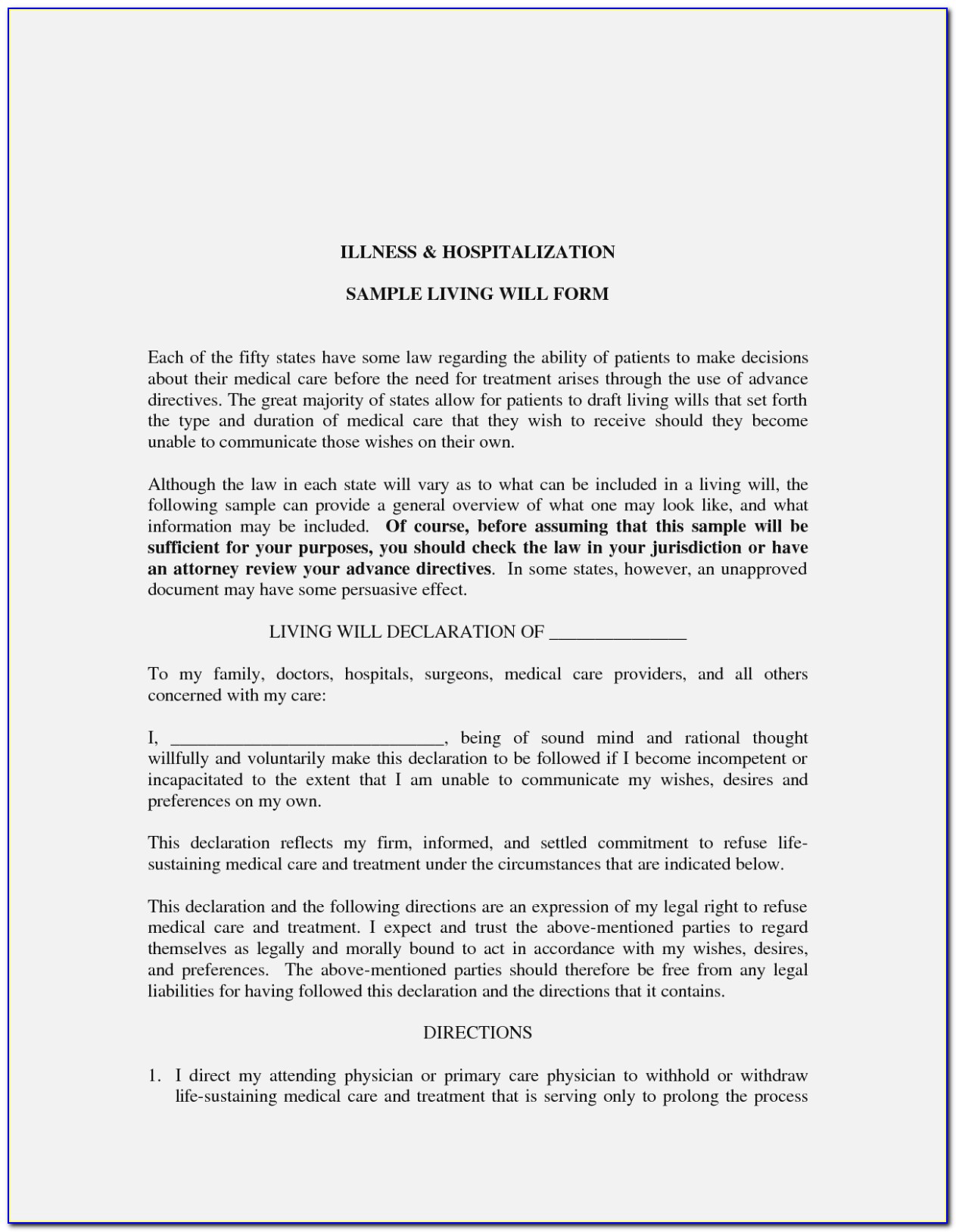

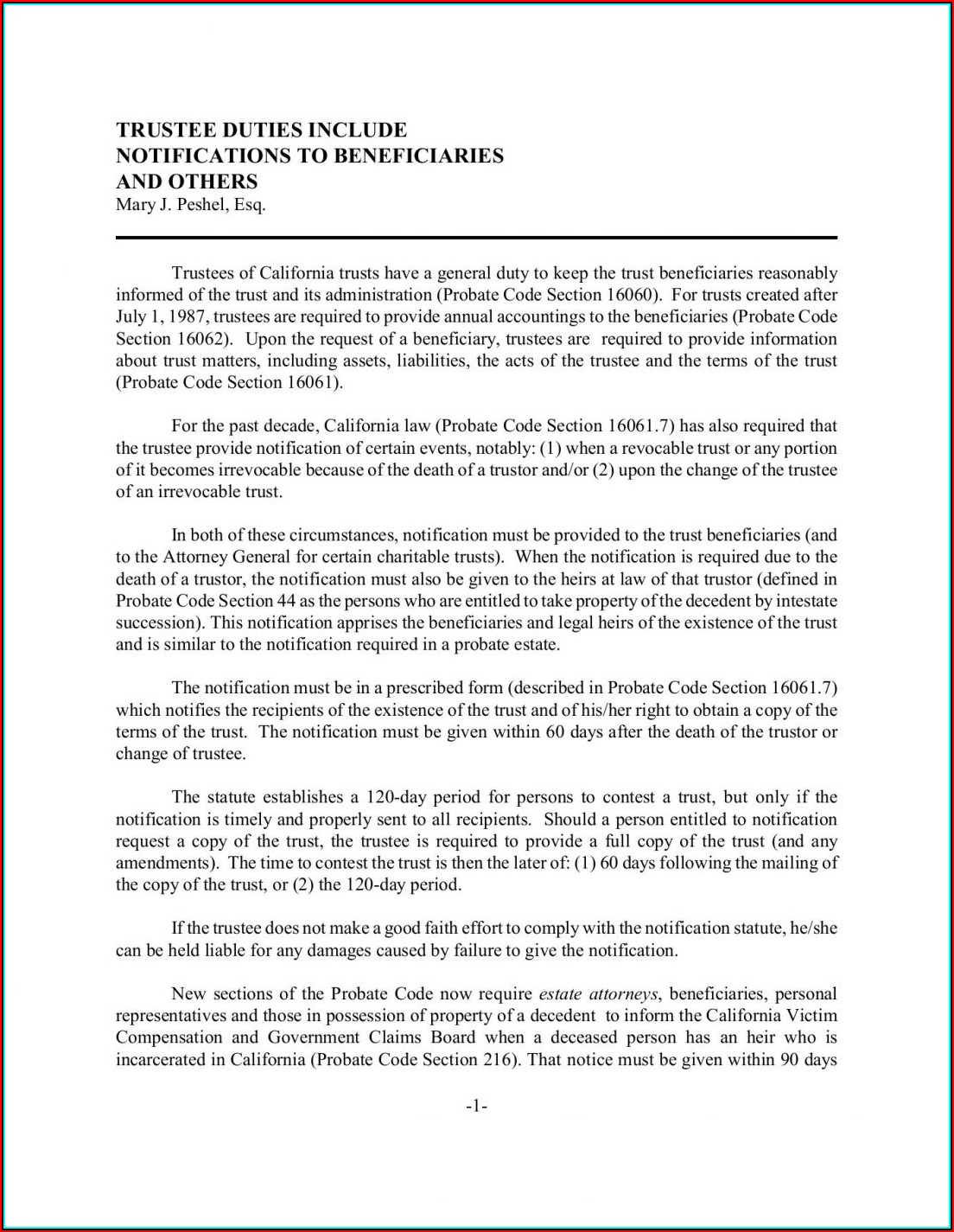

Include the state and/or county where your living trust was. This tax is only levied on estates that are worth more than $12.06 million, or $24.12 million for couples. How do we put our house into the trust? Web the revocable, or “living,” trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736, florida statutes. Traditional estate planning, to me, includes both the option to draft either a will or a revocable living trust. This can be a family member, friend, or professional fiduciary. To create a new profile, follow the. Florida revocable living trust form. Ensure your form includes the following information: Web revocable living trusts in florida.

Unlike wills, living trusts can help you plan for your. This can be a family member, friend, or professional fiduciary. A revocable living trust is one of the most powerful and flexible tools in estate planning. This tax is only levied on estates that are worth more than $12.06 million, or $24.12 million for couples. Web what is a revocable living trust? This trust shall be known as the “_____ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living. Web up to 25% cash back to make a living trust in florida, you: To create a new profile, follow the. Traditional estate planning, to me, includes both the option to draft either a will or a revocable living trust. Ad create a living trust to seamlessly transfer your property or assets to a beneficiary.

Revocable Living Trust Forms For Florida Template 2 Resume Examples

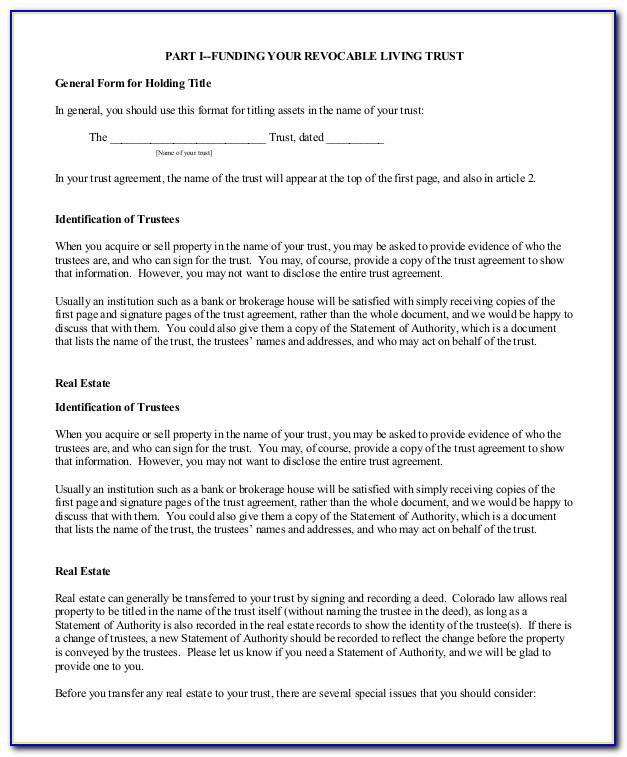

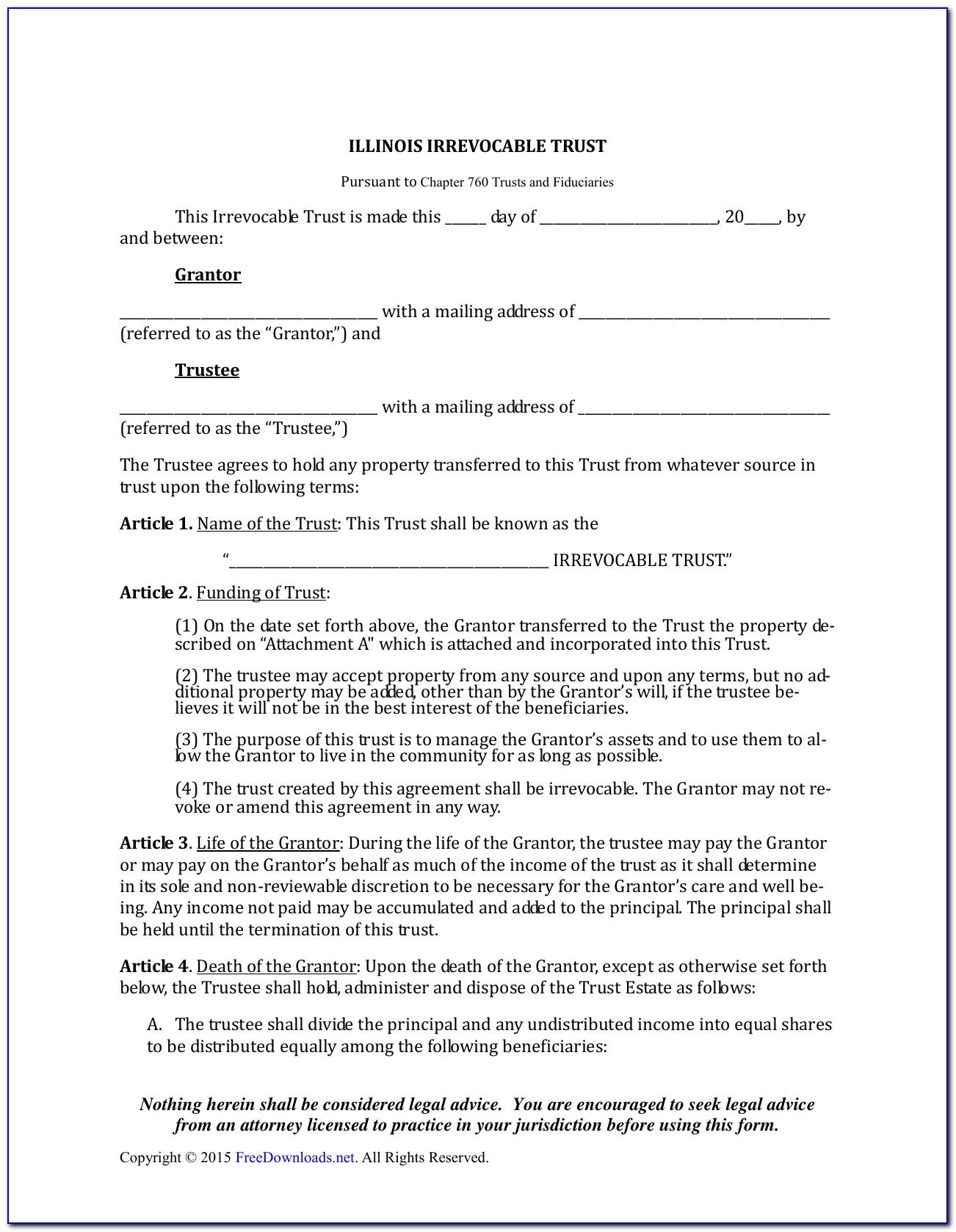

The revocable trust has certain. Web however, the federal estate tax may still apply. Web a revocable living trust can spell out the boundaries within which the surviving spouse must act, limit their control of the trust, prevent them from disinheriting children of. Web name of the trust: Web the trustee agrees to hold any property transferred to this trust,.

Revocable Living Trust Form California

Include the state and/or county where your living trust was. This trust shall be known as the “_____ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living. This tax is only levied on estates that are worth more than $12.06 million, or $24.12 million for couples. Web the trustee.

Free Living Trust Forms Florida

The revocable trust has certain. Decide what property to include in the trust. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: The key word is revocable, which means you have unfettered discretion to alter, change, amend or revoke the trust. A revocable living trust is one of.

Free Florida Revocable Living Trust Form PDF Word eForms Free

The revocable trust has certain. We just created a living trust. Ad answer simple questions to make a living trust on any device in minutes. Web up to 25% cash back to make a living trust in florida, you: How do we put our house into the trust?

Revocable Living Trust Form Florida

Web however, the federal estate tax may still apply. We just created a living trust. Web the revocable, or “living,” trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736, florida statutes. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust.

California Revocable Living Trust Form Pdf Form Resume Examples

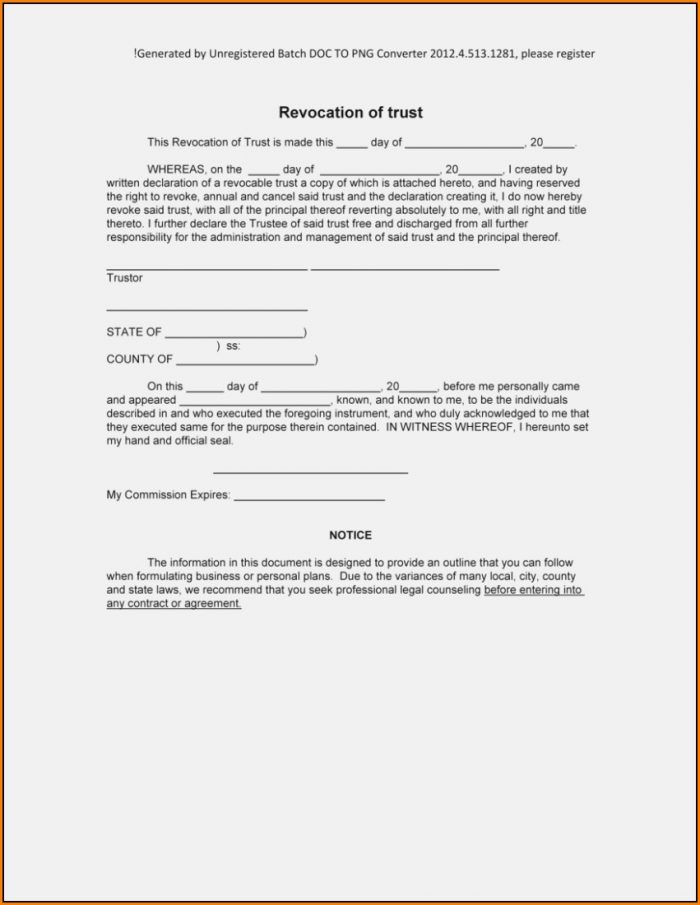

Web the florida revocation of living trust file will immediately get kept in the my forms tab (a tab for every form you download on us legal forms). This trust shall be known. Web what is a revocable living trust? Web to set up a revocable living trust in florida, you will need to: Web name of the trust:

Revocable Living Trust Form Pdf Form Resume Examples kLYr6mbY6a

Choose whether to make an individual or shared trust. Unlike wills, living trusts can help you plan for your. Web revocable living trust forms updated june 29, 2022 a revocable living trust is created by an individual (the grantor) for the purpose of holding their assets and. This can be a family member, friend, or professional fiduciary. Web a revocable.

Florida Revocable Living Trust Form Free Printable Legal Forms

Florida revocable living trust form. I agree with my colleague that you've started out well in justia (you can find pa lawyers who have done many in pa, as have i). I have always offered both vehicles to my clients since. Web however, the federal estate tax may still apply. Web a revocable living trust can spell out the boundaries.

FREE 6+ Revocable Living Trust Forms in PDF MS Word

This tax is only levied on estates that are worth more than $12.06 million, or $24.12 million for couples. Ensure your form includes the following information: Web to set up a revocable living trust in florida, you will need to: Web revocable living trusts in florida. The revocable trust has certain.

Revocable Living Trust Forms For Florida Template 2 Resume Examples

Easily customize your living trust. This trust shall be known as the “_____ revocable living trust” hereinafter known as the “trust” and ☐ is ☐ is not an amendment to a prior living. The revocable trust has certain. Web name of the trust: How do we put our house into the trust?

Web What Is A Revocable Living Trust?

Web however, the federal estate tax may still apply. A revocable living trust is one of the most powerful and flexible tools in estate planning. The revocable trust has certain. Web the revocable, or “living,” trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736, florida statutes.

Web Name Of The Trust:

Select popular legal forms & packages of any category. Florida revocable living trust form. Decide what property to include in the trust. Ad answer simple questions to make a living trust on any device in minutes.

Traditional Estate Planning, To Me, Includes Both The Option To Draft Either A Will Or A Revocable Living Trust.

Ad create a living trust to seamlessly transfer your property or assets to a beneficiary. Save time and money by creating and downloading any legally binding agreement in minutes. Web the trustee agrees to hold any property transferred to this trust, from whatever source, in trust under the following terms: To create a new profile, follow the.

Web Up To 25% Cash Back To Make A Living Trust In Florida, You:

I have always offered both vehicles to my clients since. Web a revocable living trust can spell out the boundaries within which the surviving spouse must act, limit their control of the trust, prevent them from disinheriting children of. This can be a family member, friend, or professional fiduciary. Web revocable living trust forms updated june 29, 2022 a revocable living trust is created by an individual (the grantor) for the purpose of holding their assets and.