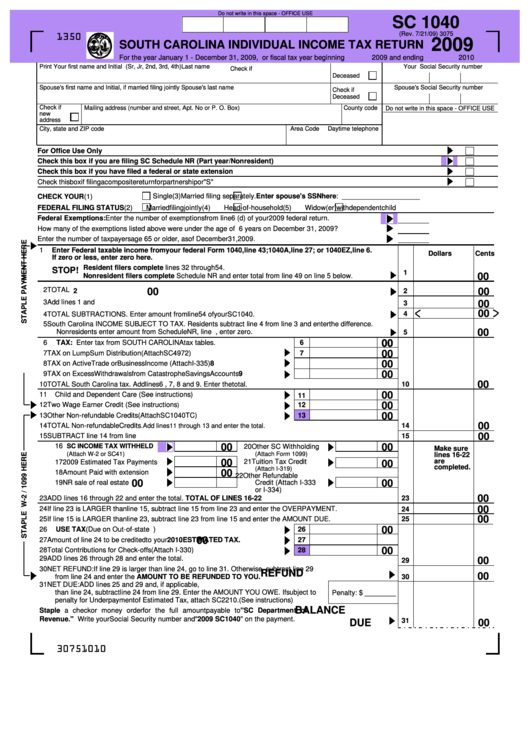

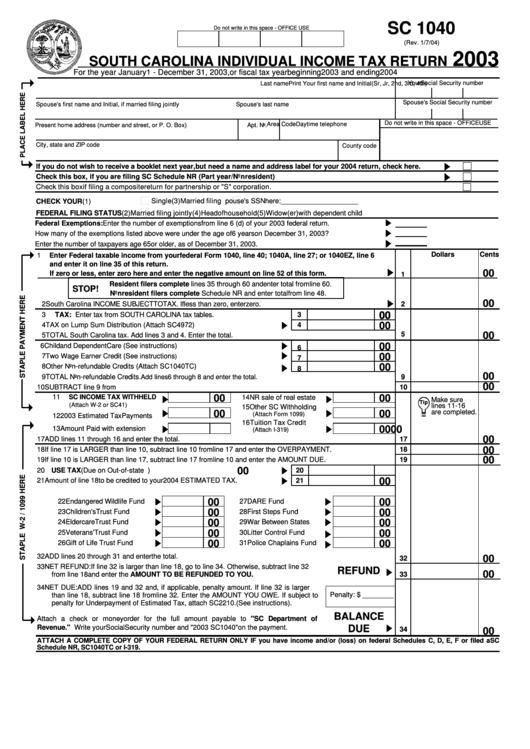

Sc Form 1040

Sc Form 1040 - Things to know before you begin: We last updated the form sc1040 instructional booklet in february 2023, so this is the. We last updated the individual income. Web always sign the sc dor sc1040 instructions. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Web find south carolina form sc1040 instructions at esmart tax today. Iit book 2016 iit book 2015 iit book 2014 iit book 2013 iit book 2012 iit book 2011. † for tax year 2020, unless you have a valid extension, the due date is april 15, 2021and the deadline to claim a refund is april 15, 2024. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Web south carolina tax forms.

Things to know before you begin: This form is for income earned in tax year 2022, with tax returns. Web south carolina tax forms. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. You can download or print current or. We last updated the individual income. How much do you have to make to file taxes in sc? Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in south carolina during calendar year. Estimated tax is the method used to pay tax on income that isn’t subject to withholding. Get, create, make and sign sc1040.

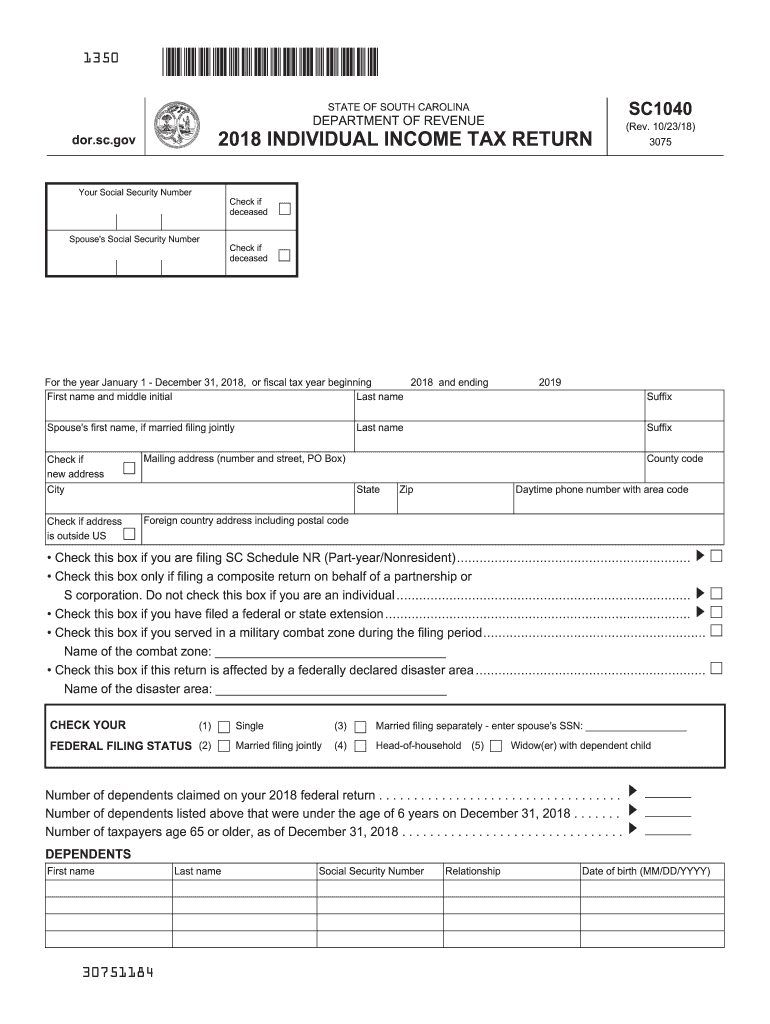

Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in south carolina during calendar year. Web always sign the sc dor sc1040 instructions. This form is for income earned in tax year 2022, with tax returns. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web state of south carolina department of revenue 2020 individual income tax return sc1040 (rev. An activity qualifies as a business if: 2018 individual income tax packet (iit book) for 2016 and older: Click the date field to automatically put in the appropriate date. Get, create, make and sign sc1040. Web we last updated south carolina form sc1040 in january 2023 from the south carolina department of revenue.

Form Sc 1040 South Carolina Individual Tax Return 2009

Get, create, make and sign sc1040. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Get form esign fax email add annotation share this is how it works. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in south.

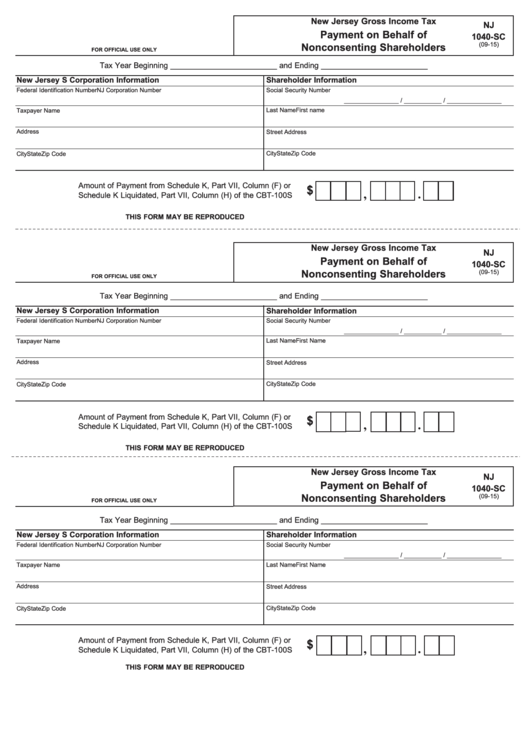

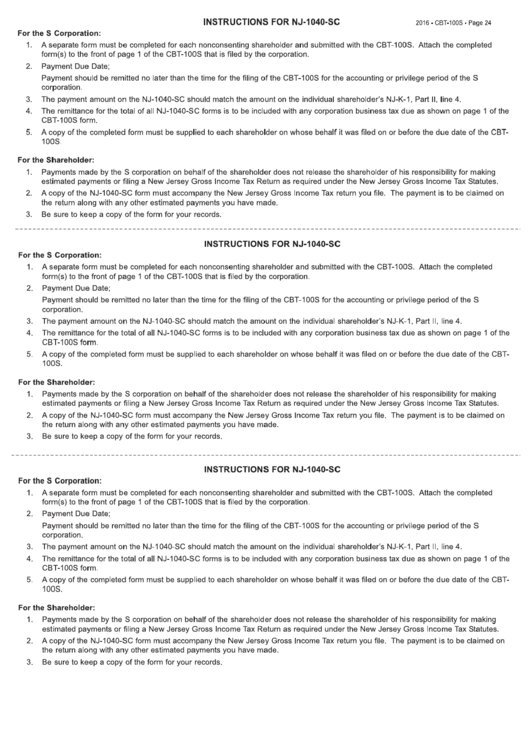

Fillable Form Nj 1040Sc Payment On Behalf Of Nonconsenting

Web always sign the sc dor sc1040 instructions. We last updated the form sc1040 instructional booklet in february 2023, so this is the. Iit book 2016 iit book 2015 iit book 2014 iit book 2013 iit book 2012 iit book 2011. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: An activity qualifies as a business if:

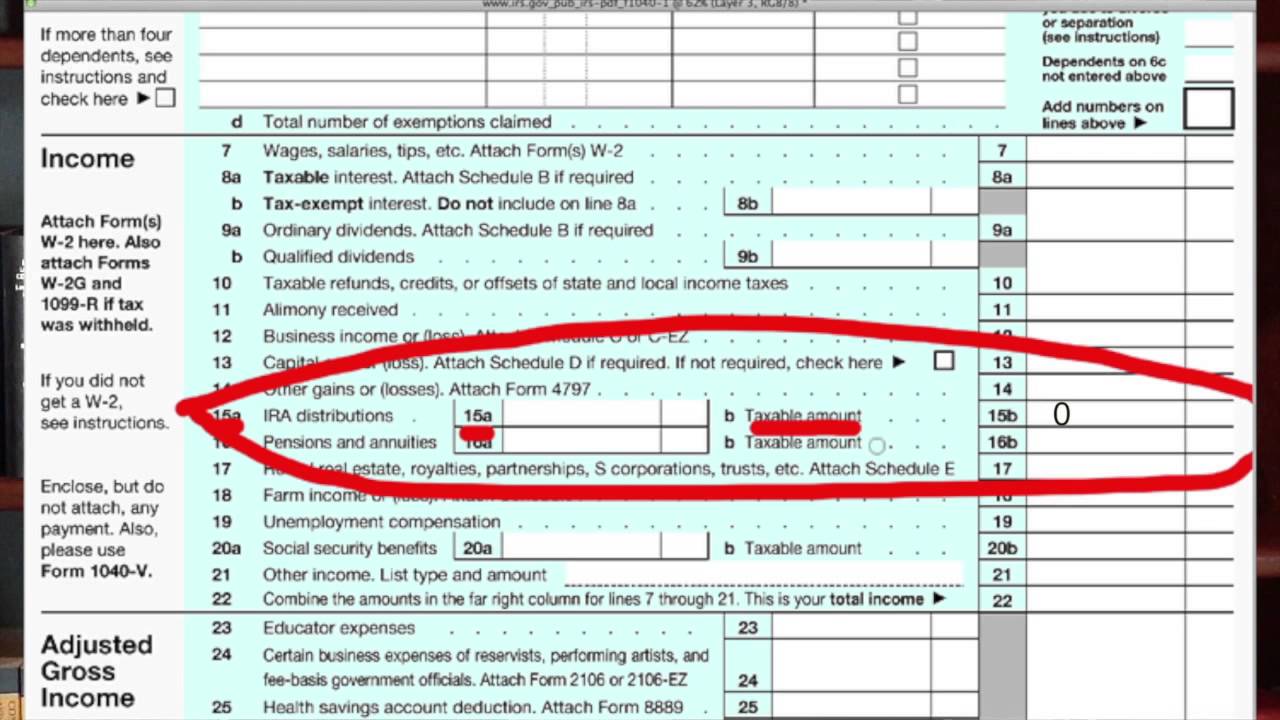

How to report a 1099 R rollover to your self directed 401k YouTube

An activity qualifies as a business if: We last updated the form sc1040 instructional booklet in february 2023, so this is the. We last updated the individual income. Web south carolina tax forms. Web find south carolina form sc1040 instructions at esmart tax today.

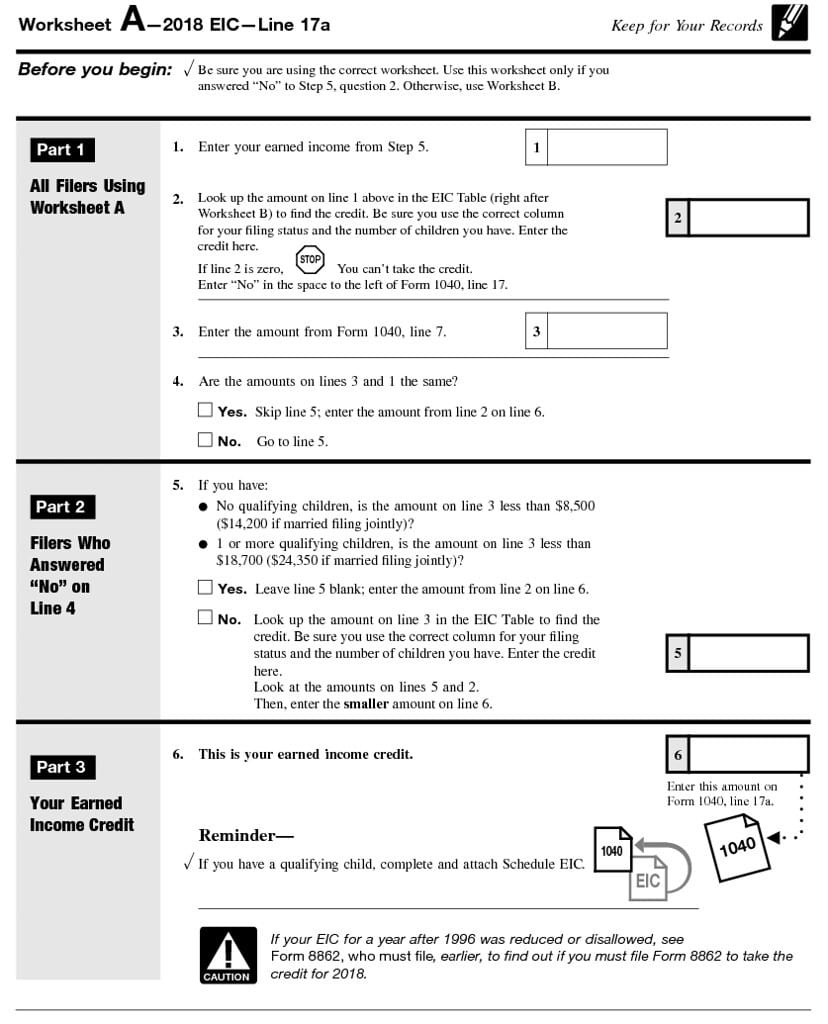

1040 Eic Worksheet Kidz Activities Via Blogger Bitly2Ury —

Click the date field to automatically put in the appropriate date. Things to know before you begin: Web up to $40 cash back form popularity sc 1040 form 2022 pdf. † for tax year 2020, unless you have a valid extension, the due date is april 15, 2021and the deadline to claim a refund is april 15, 2024. Web always.

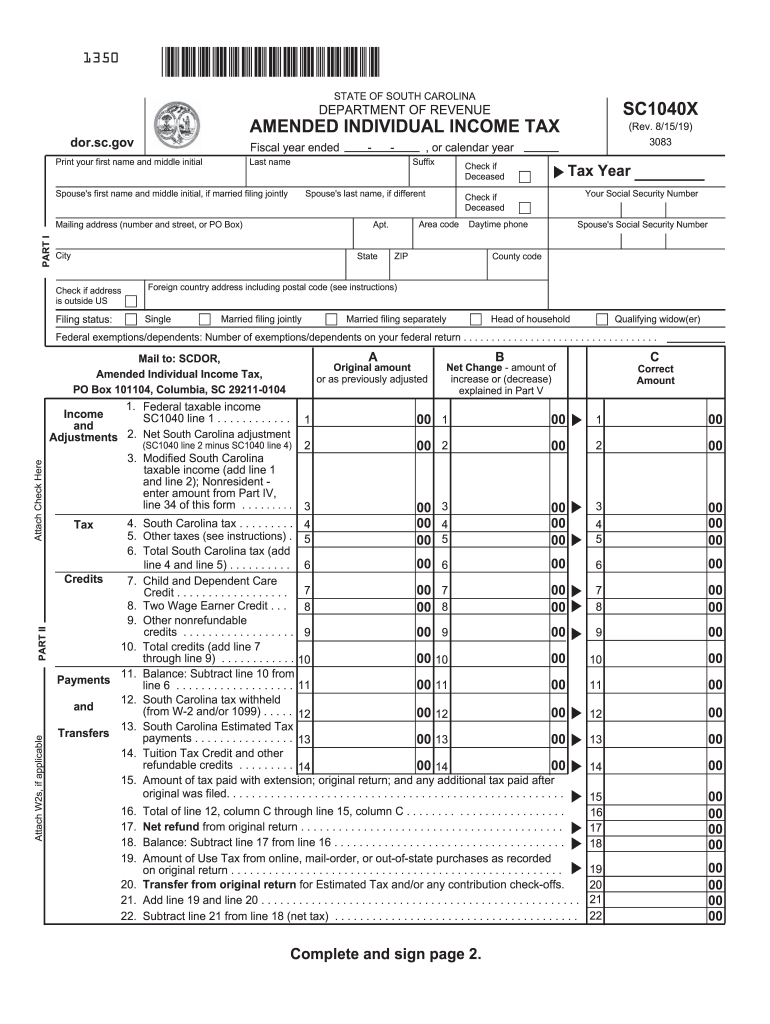

Sc Revenue Tax Fill Out and Sign Printable PDF Template signNow

Things to know before you begin: Web state of south carolina department of revenue 2020 individual income tax return sc1040 (rev. Web always sign the sc dor sc1040 instructions. Web we last updated south carolina form sc1040 in january 2023 from the south carolina department of revenue. Get, create, make and sign sc1040.

Form Nj1040Sc Instructions S Corporation Business Tax Return

Web this booklet includes instructions for filling out and filing your sc1040 income tax return. Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web always sign the sc dor sc1040 instructions. Estimated tax is the method used to pay tax on income that.

Sc Tax Forms Fill Out and Sign Printable PDF Template signNow

Web this booklet includes instructions for filling out and filing your sc1040 income tax return. We last updated the individual income. $12,000 for single filers and those married filing separately. Web always sign the sc dor sc1040 instructions. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec.

Federal Tax Table 2017 Single 1040ez Awesome Home

Get, create, make and sign sc1040. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: An activity qualifies as a business if: Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in south carolina during calendar year. We last updated the individual income.

No itemizing needed to claim these 23 tax deductions Don't Mess With

2018 individual income tax packet (iit book) for 2016 and older: An activity qualifies as a business if: Web always sign the sc dor sc1040 instructions. Get form esign fax email add annotation share this is how it works. Web we last updated south carolina form sc1040 in january 2023 from the south carolina department of revenue.

fthompsondesigns Home Tax Senior South Carolina

For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. You can download or print current or. This form is for income earned in tax year 2022, with tax returns. † for tax year 2020, unless you have a valid extension, the due date is april 15, 2021and the deadline to claim.

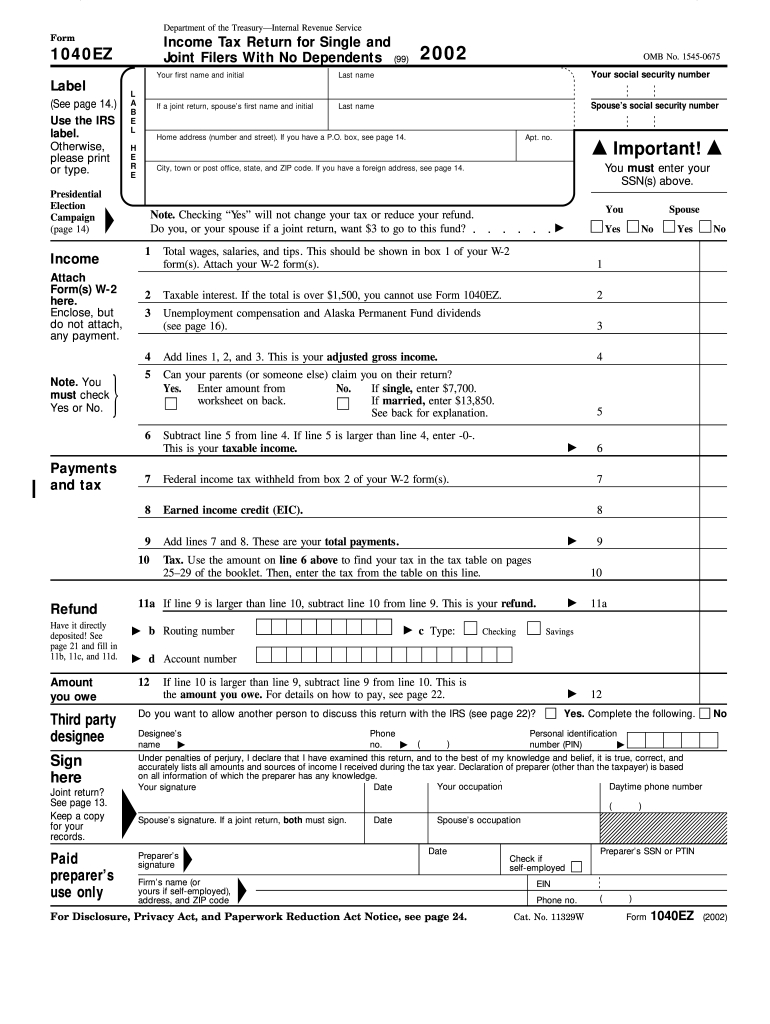

Estimated Tax Is The Method Used To Pay Tax On Income That Isn’t Subject To Withholding.

Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for. Web we last updated the sc1040 tax tables in january 2023, so this is the latest version of form sc1040tt, fully updated for tax year 2022. Web this booklet includes instructions for filling out and filing your sc1040 income tax return. Web always sign the sc dor sc1040 instructions.

2018 Individual Income Tax Packet (Iit Book) For 2016 And Older:

† for tax year 2020, unless you have a valid extension, the due date is april 15, 2021and the deadline to claim a refund is april 15, 2024. Web south carolina legislature business one stop registration sba.gov's business licenses and permits search tool allows you to get a listing of federal, state. Iit book 2016 iit book 2015 iit book 2014 iit book 2013 iit book 2012 iit book 2011. We last updated the form sc1040 instructional booklet in february 2023, so this is the.

Web Up To $40 Cash Back Form Popularity Sc 1040 Form 2022 Pdf.

An activity qualifies as a business if: Web find south carolina form sc1040 instructions at esmart tax today. For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the. Click the date field to automatically put in the appropriate date.

Get, Create, Make And Sign Sc1040.

Web use schedule c (form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Web south carolina tax forms. This form is for income earned in tax year 2022, with tax returns. How much do you have to make to file taxes in sc?