Transfer Of Stock Ownership Form S Corp

Transfer Of Stock Ownership Form S Corp - Allow corporate losses to pass through to its owners. Avoid double taxation on distributions. Free information and preview, prepared forms for you, trusted by legal professionals Web in order to transfer stock properly, there are several steps that need to be taken: Web how to transfer ownership of stock in a s corporation research your bylaws. A corporate stock transfer agreement, also known as a share purchase agreement or a. Web the two main reasons for electing s corporation status are: Transfer your ownership of the shares to yourself as trustee of your trust. Web request a transfer of stock ownership form from your stockbroker or directly from the brokerage company. Web owns stock in a corporation that is a controlled foreign corporation for an uninterrupted period of 30 days or more during any tax year of the foreign corporation,.

Web follow these steps to enter general information for a change in stock ownership: Transfer your ownership of the shares to yourself as trustee of your trust. Not be an ineligible corporation (i.e. Web how to transfer ownership of stock in a s corporation research your bylaws. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web use a new form for each account and company of stock you are transferring. Once the transaction has closed, the selling party should deliver share certificates to the buying party evidencing their ownership of the shares. Web in order to transfer stock properly, there are several steps that need to be taken: Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Ad get access to the largest online library of legal forms for any state.

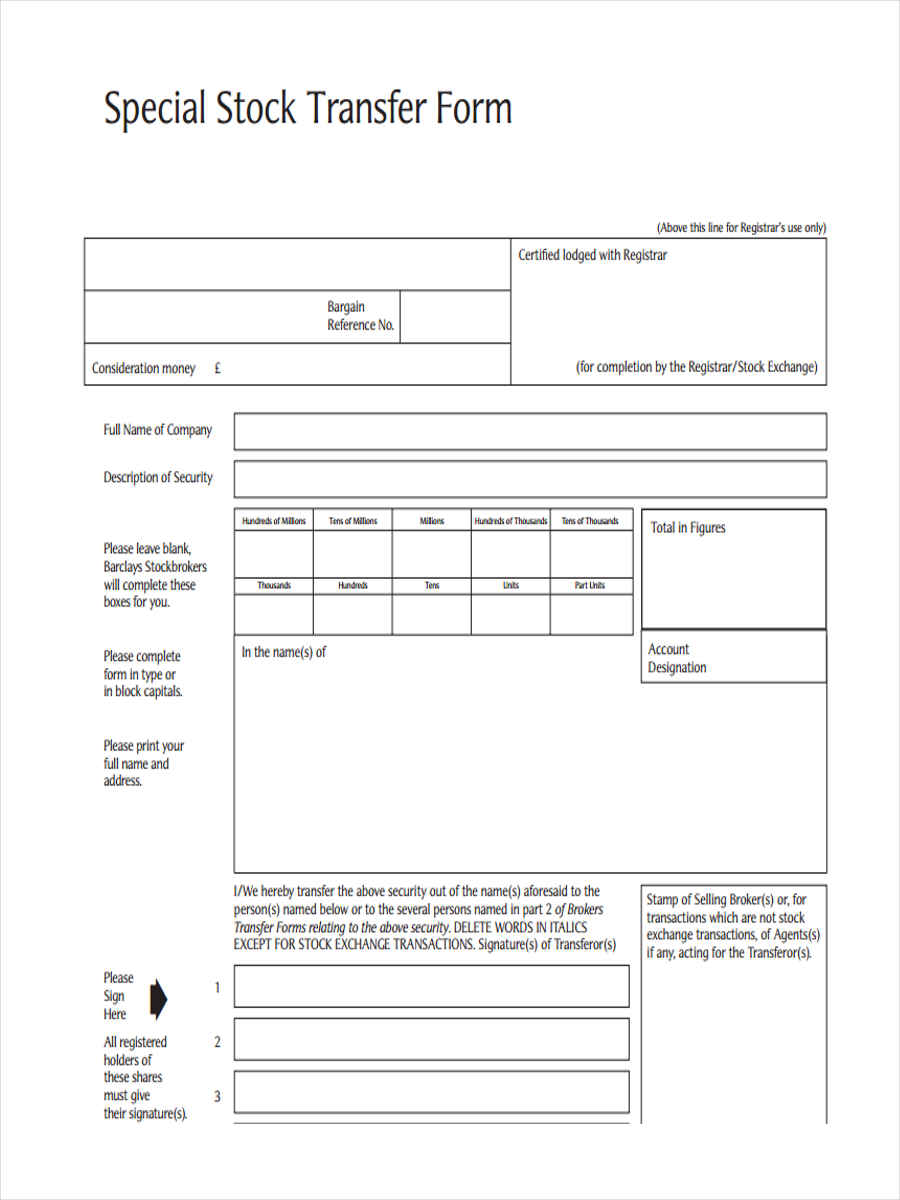

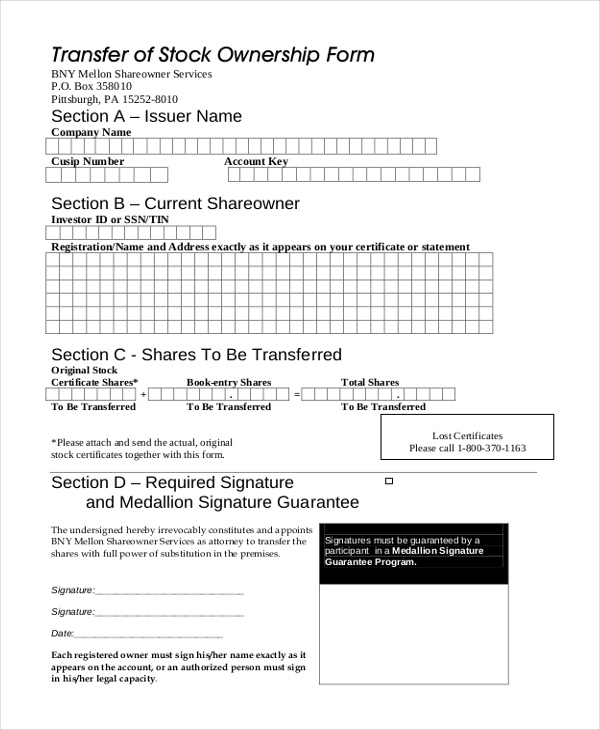

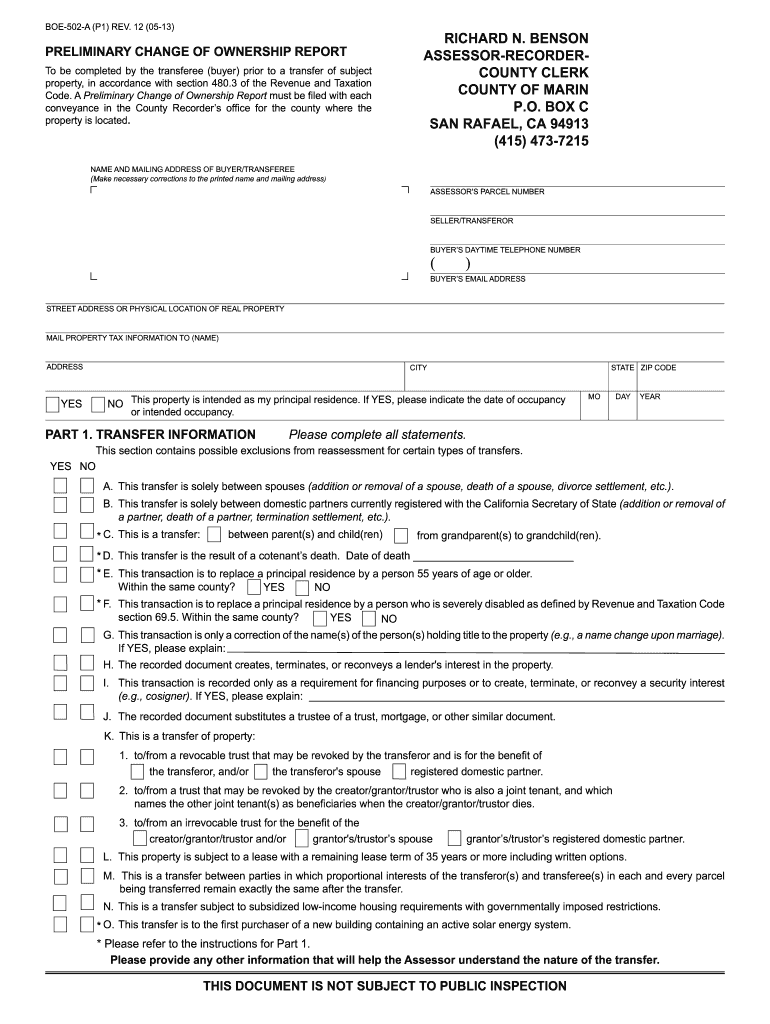

Follow the corporation's explicit stock transfer procedures. Allow corporate losses to pass through to its owners. However, if the change of ownership takes place in. Web a stock transfer form is filled out and submitted to a stock registry agent, whose primary responsibility is to keep a record of the exchange of shares from one investor to another. Web follow these steps to enter general information for a change in stock ownership: Web how to transfer ownership of stock in a s corporation research your bylaws. Select the blue general information section. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Go to screen 7, change in stock ownership. Once the transaction has closed, the selling party should deliver share certificates to the buying party evidencing their ownership of the shares.

FREE 8+ Stock Transfer Forms in PDF Ms Word

Easily customize your legal forms. Web to transfer ownership of stock, follow these steps: Ad get access to the largest online library of legal forms for any state. Web in order to transfer stock properly, there are several steps that need to be taken: Web transferring stock ownership in s corporations updated july 10, 2020:

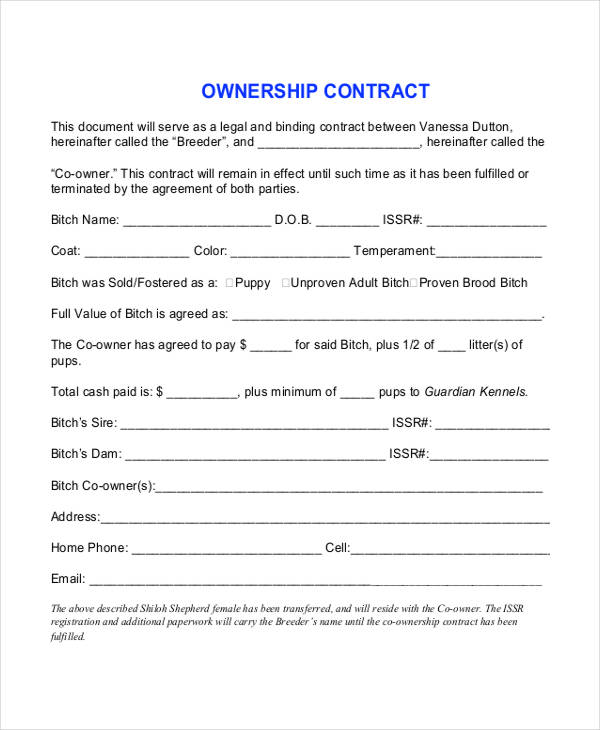

FREE 11+ Legal Ownership Forms in PDF

Not be an ineligible corporation (i.e. Web either way, you'll work directly with the company's transfer agent to change stock ownership. Web s corporations are taxed by having the owners include their share of the income and expenses on their personal returns. Calculate the number of stocks you own and the current number of outstanding stock. Lawdepot has you covered.

FREE 10+ Sample Stock Transfer Forms in PDF Word

Web request a transfer of stock ownership form from your stockbroker or directly from the brokerage company. Not be an ineligible corporation (i.e. Web you need to transfer the stock of the corporation to your name. Company of stock to be transferred: Web transfer the share certificates.

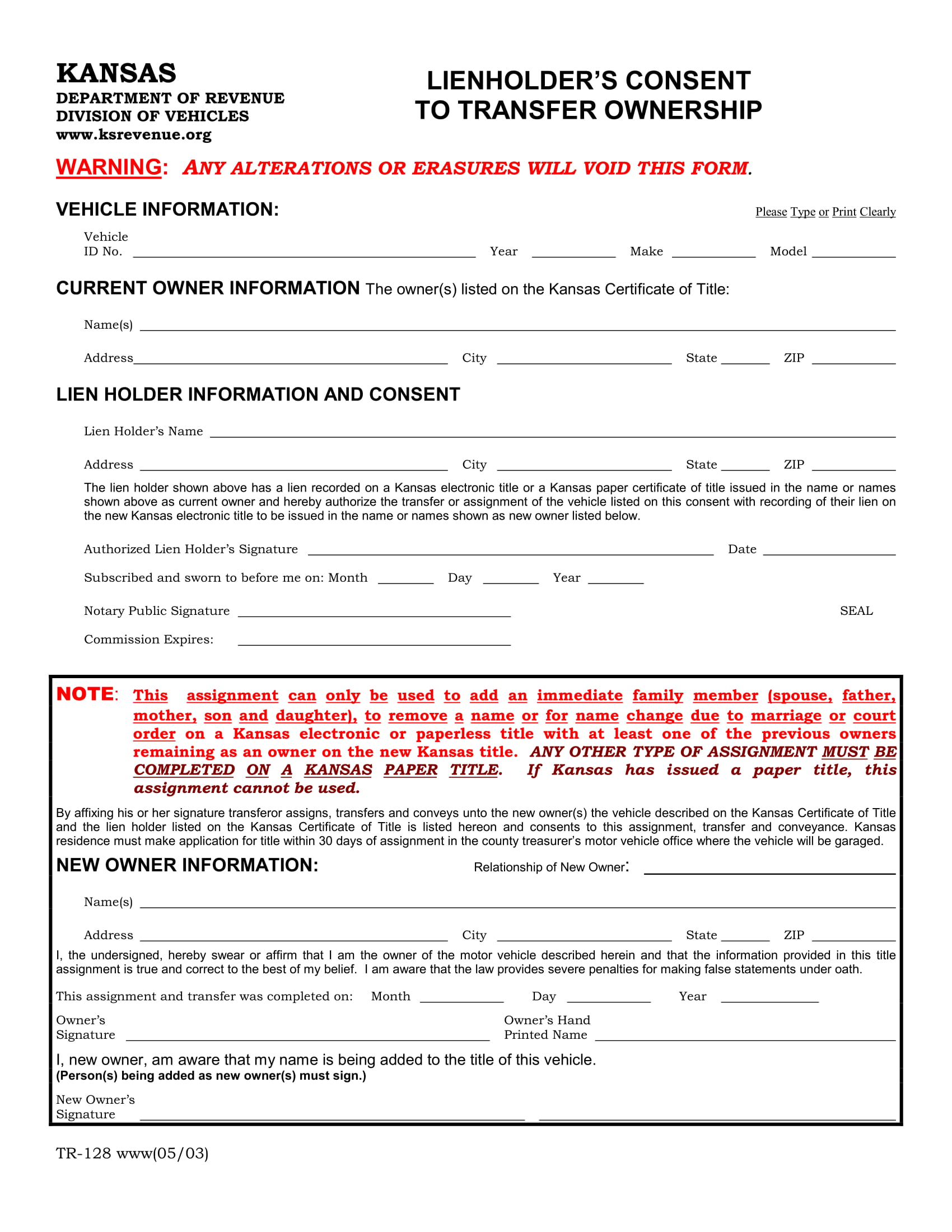

Transfer Of Ownership Form Fill Online, Printable, Fillable, Blank

Web the signature(s) below on this transfer request form must correspond exactly with the name(s) as shown upon the face of the stock certificate or a. The process of changing stock ownership if you own stock in street. Ad answer simple questions to make legal forms on any device in minutes. Web you need to transfer the stock of the.

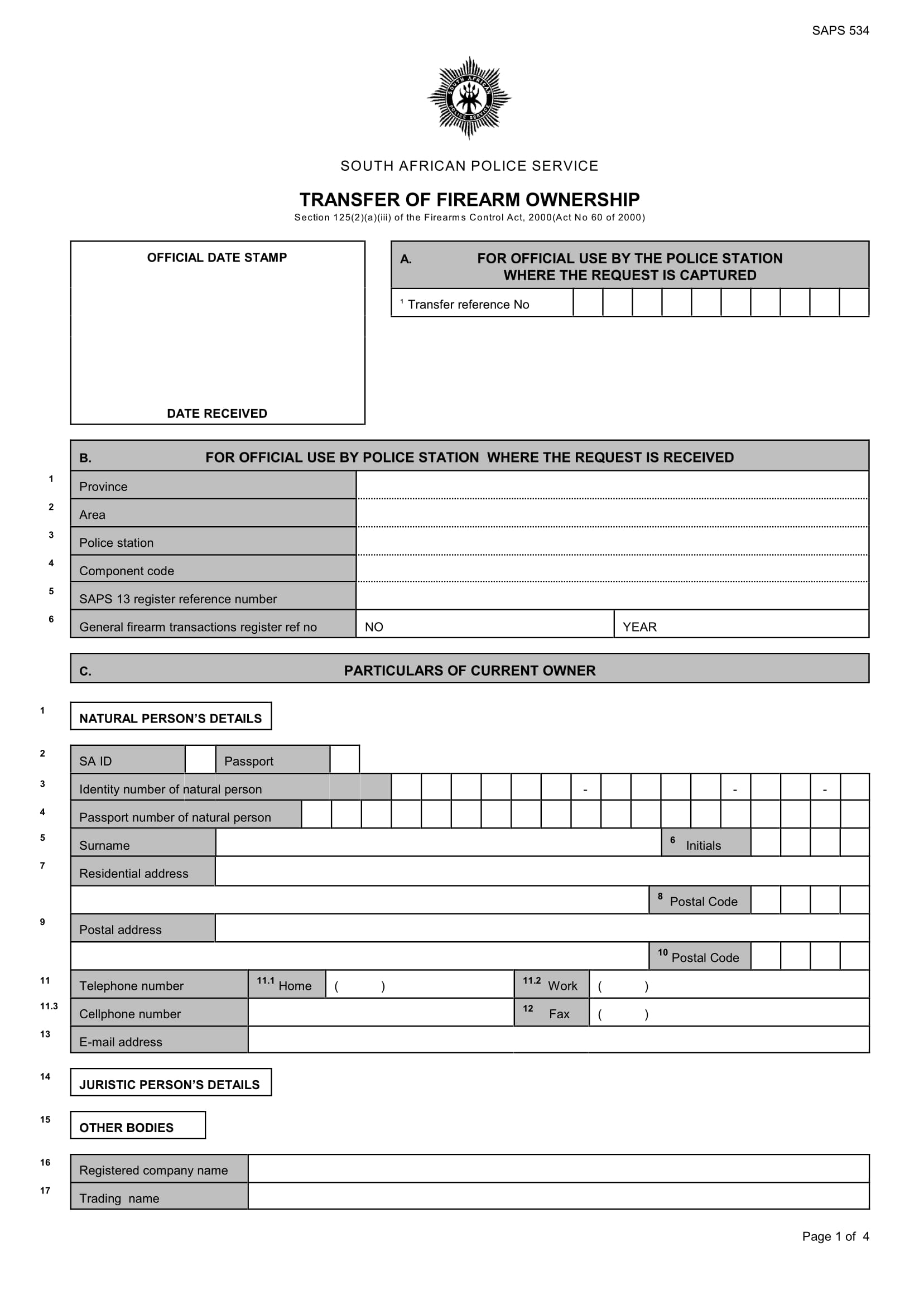

FREE 5+ Transfer Forms for Gun Owners in PDF

Ad answer simple questions to make legal forms on any device in minutes. Web the following is an overview: However, if the change of ownership takes place in. Calculate the number of stocks you own and the current number of outstanding stock. Allow corporate losses to pass through to its owners.

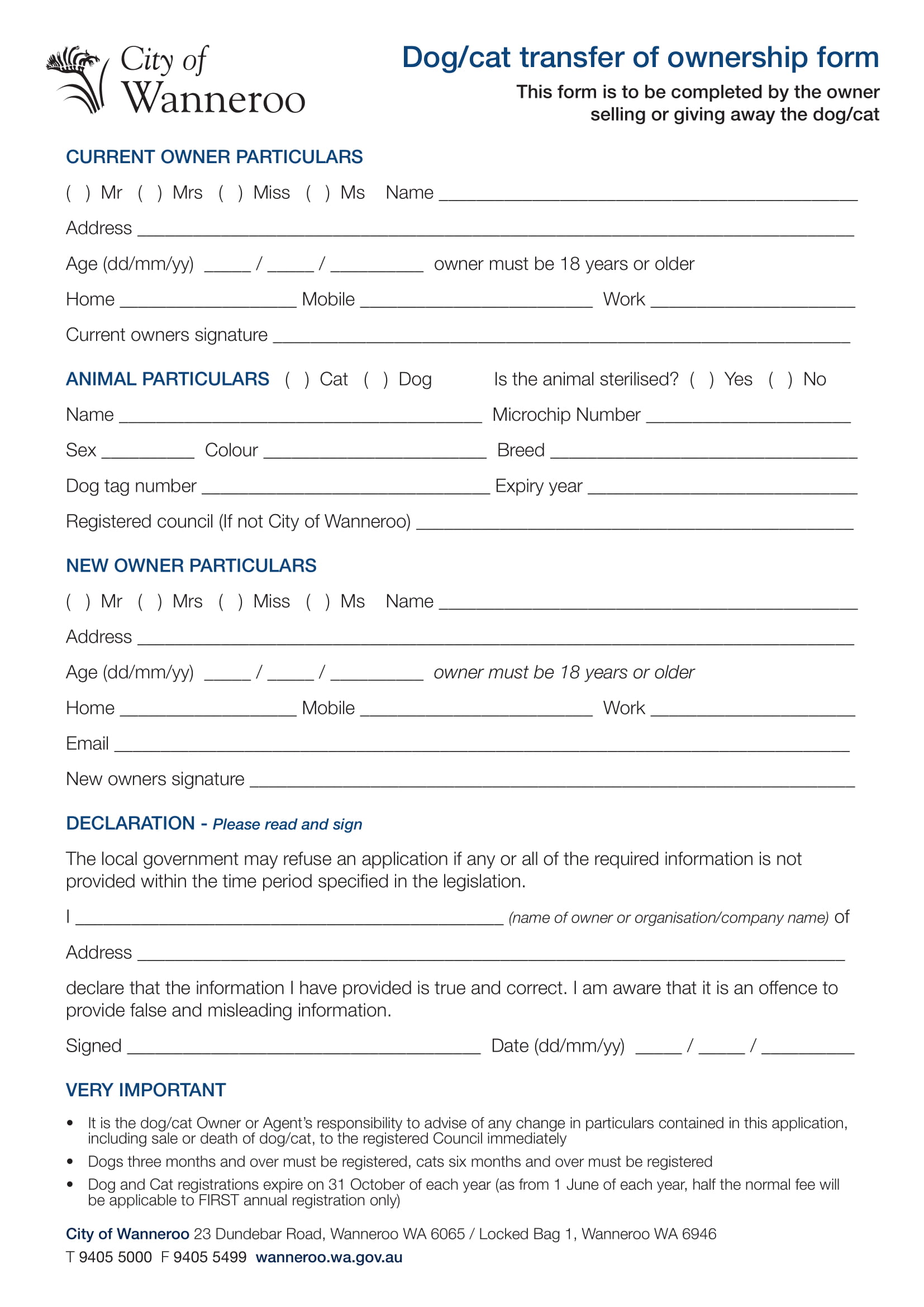

Home Again Microchip Transfer Ownership Form Fill Online, Printable

Web how to transfer ownership of stock in a s corporation research your bylaws. Web either way, you'll work directly with the company's transfer agent to change stock ownership. Easily customize your legal forms. Calculate the number of stocks you own and the current number of outstanding stock. Web the two main reasons for electing s corporation status are:

Transfer of Ownership Form.pdf

Web use a new form for each account and company of stock you are transferring. Web in order to transfer stock properly, there are several steps that need to be taken: Web follow these steps to enter general information for a change in stock ownership: Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023).

12+ Company Contract Templates Word, PDF, Google Docs, Apple Pages

Web use a new form for each account and company of stock you are transferring. Ad answer simple questions to make legal forms on any device in minutes. Transfer your ownership of the shares to yourself as trustee of your trust. Select the blue general information section. Web transferring stock ownership in s corporations updated july 10, 2020:

FREE 11+ Legal Ownership Forms in PDF

Web the following is an overview: Go to screen 7, change in stock ownership. Web to transfer ownership of stock, follow these steps: Web either way, you'll work directly with the company's transfer agent to change stock ownership. Web follow these steps to enter general information for a change in stock ownership:

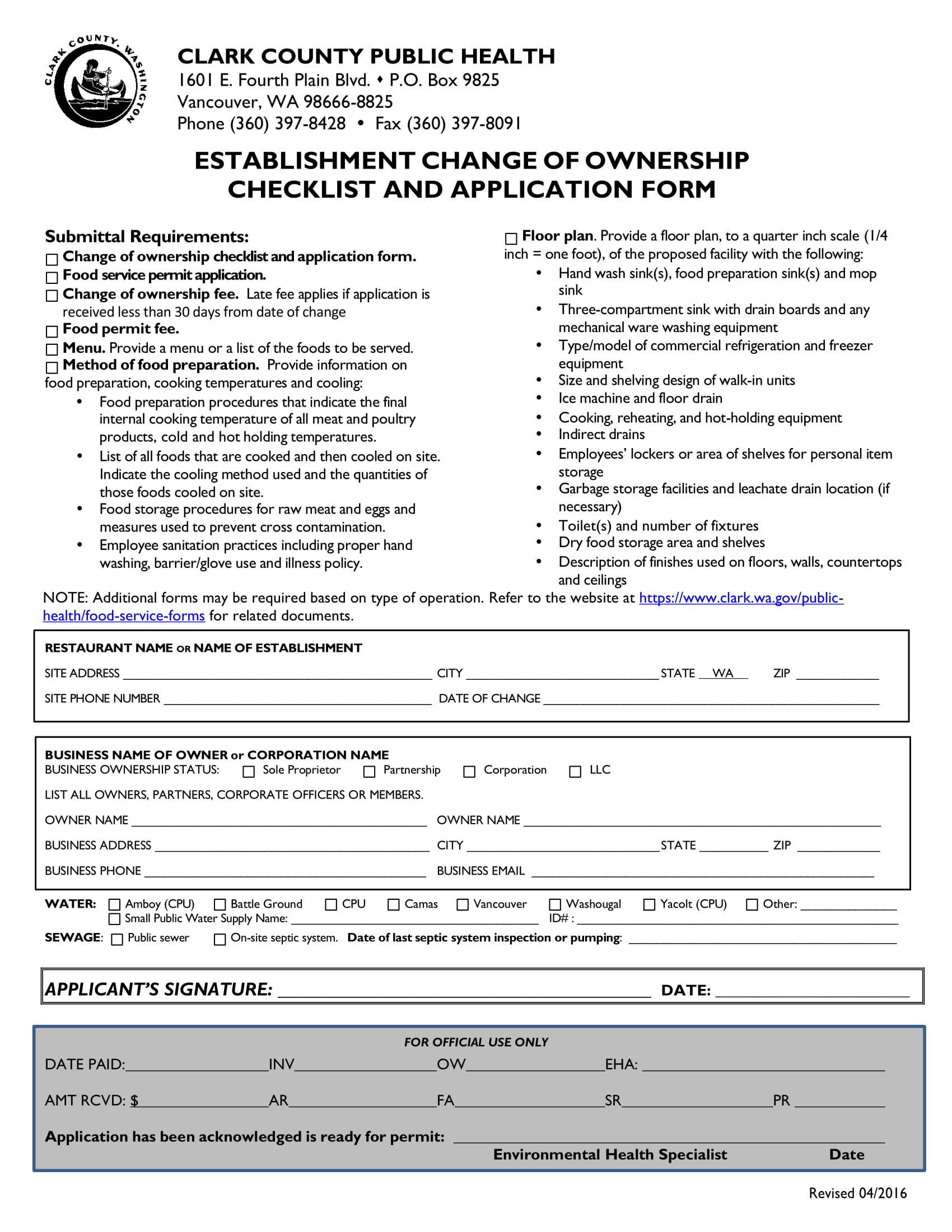

FREE 4+ Restaurant Transfer of Ownership Forms in PDF MS Word

Web transfer the share certificates. Web the signature(s) below on this transfer request form must correspond exactly with the name(s) as shown upon the face of the stock certificate or a. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), including recent updates, related. Web to transfer ownership of stock, follow.

Web In Order To Transfer Stock Properly, There Are Several Steps That Need To Be Taken:

Web have only one class of stock; Allow corporate losses to pass through to its owners. Easily customize your legal forms. Ad get access to the largest online library of legal forms for any state.

Ad Follow Simple Instructions To Create A Legally Binding Share Transfer Agreement Online.

Ad answer simple questions to make legal forms on any device in minutes. Web follow these steps to enter general information for a change in stock ownership: Not be an ineligible corporation (i.e. Web you need to transfer the stock of the corporation to your name.

Web A Stock Transfer Form Is Filled Out And Submitted To A Stock Registry Agent, Whose Primary Responsibility Is To Keep A Record Of The Exchange Of Shares From One Investor To Another.

Web the two main reasons for electing s corporation status are: You can issues new shares of company stock by by creating a bill of sale—but make sure. Web owns stock in a corporation that is a controlled foreign corporation for an uninterrupted period of 30 days or more during any tax year of the foreign corporation,. Lawdepot has you covered with a wide variety of legal documents.

Web S Corporations Are Taxed By Having The Owners Include Their Share Of The Income And Expenses On Their Personal Returns.

Web to transfer ownership of stock, follow these steps: Web the signature(s) below on this transfer request form must correspond exactly with the name(s) as shown upon the face of the stock certificate or a. Web transfer ownership via gifts or bequests when considering how to transfer business ownership, you should realize that ownership transfers have legal and. Web the following is an overview: