What Is Form 8453 Used For

What Is Form 8453 Used For - The two forms serve different purposes. Web you need to use form 8453 to mail the brokerage (or other) statements that show the details of your transactions. Get ready for tax season deadlines by completing any required tax forms today. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Complete, edit or print tax forms instantly. Web a signed form 8453, u.s. You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Statements should include the following items for. Authenticate an electronic form 1120s, u.s. Web taxpayers use irs form 8453 to send required paper forms or supporting documentation that cannot be submitted to the internal revenue service via electronic.

You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Authorize the tax professionals to. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Ad access irs tax forms. Web taxpayers use irs form 8453 to send required paper forms or supporting documentation that cannot be submitted to the internal revenue service via electronic. Upload, modify or create forms. Statements should include the following items for.

Complete, edit or print tax forms instantly. You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Get ready for tax season deadlines by completing any required tax forms today. Web you need to use form 8453 to mail the brokerage (or other) statements that show the details of your transactions. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Ad access irs tax forms. Authorize the tax professionals to. Authenticate to file and sign the taxpayers' 94x employment tax return electronically; Web a signed form 8453, u.s. Authenticate an electronic form 1120s, u.s.

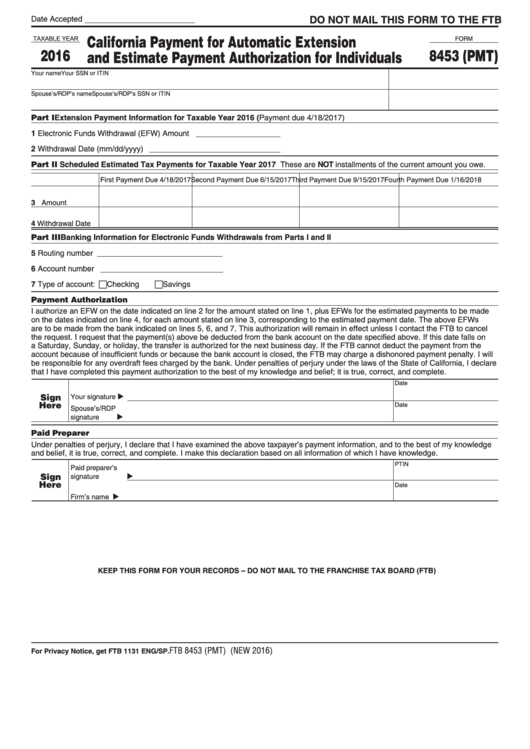

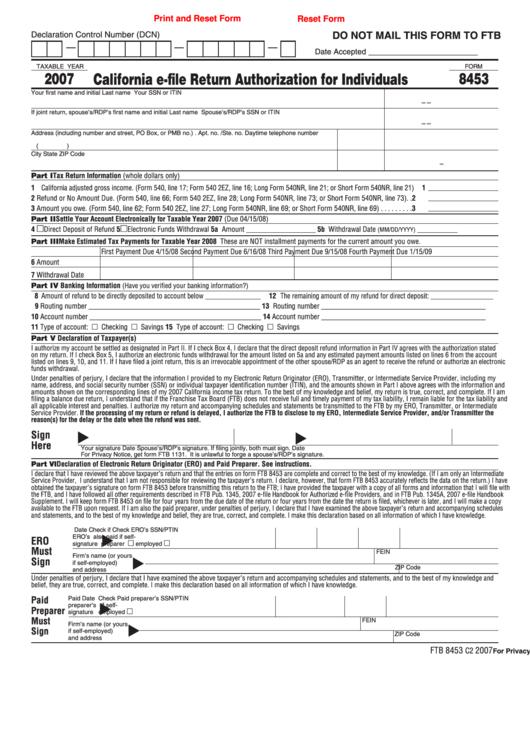

Form 8453 (Pmt) California Payment For Automatic Extension And

Web a signed form 8453, u.s. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Ad access irs tax forms.

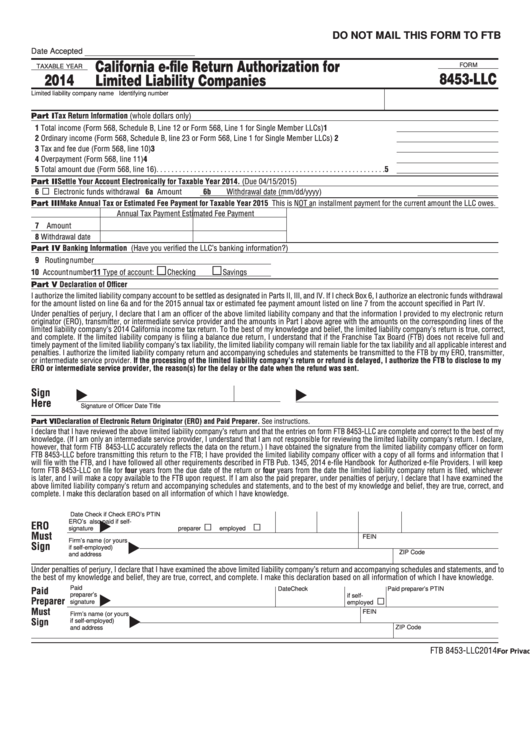

Form 8453Llc California EFile Return Authorization For Limited

Upload, modify or create forms. You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Ad access irs tax forms. Ad access irs tax forms. Try it for free now!

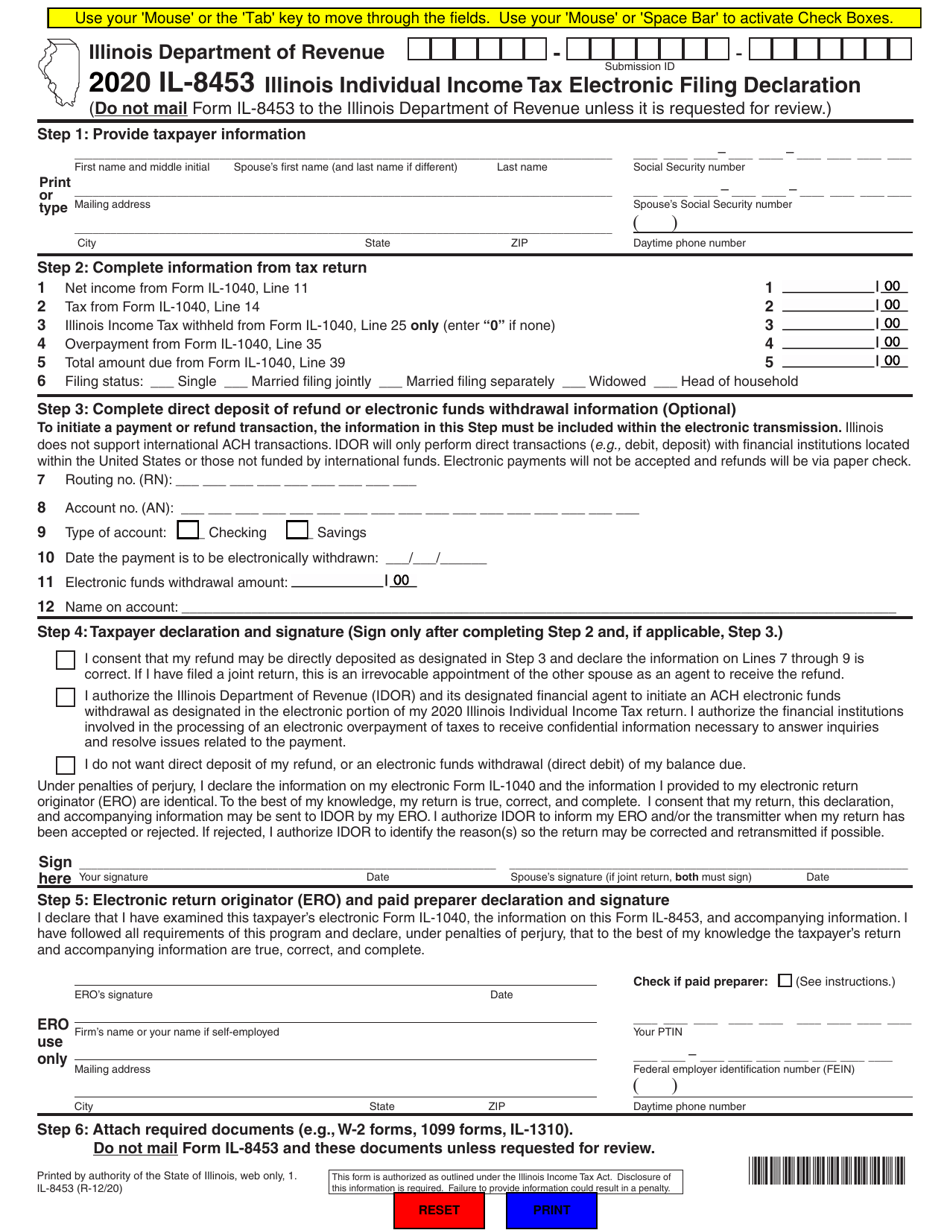

Form Il8453 Individual Tax Electronic Filing Declaration

Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Web you need to use form 8453 to mail the brokerage.

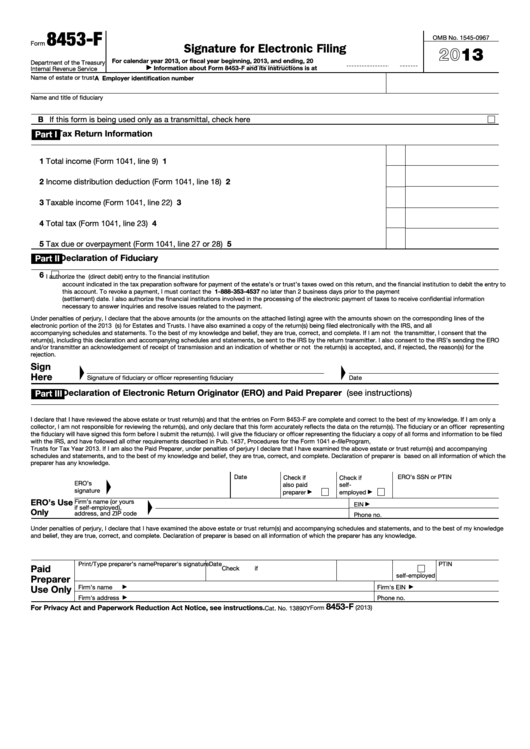

Fillable Form 8453F U.s. Estate Or Trust Tax Declaration And

Complete, edit or print tax forms instantly. Web a signed form 8453, u.s. Try it for free now! The two forms serve different purposes. Complete, edit or print tax forms instantly.

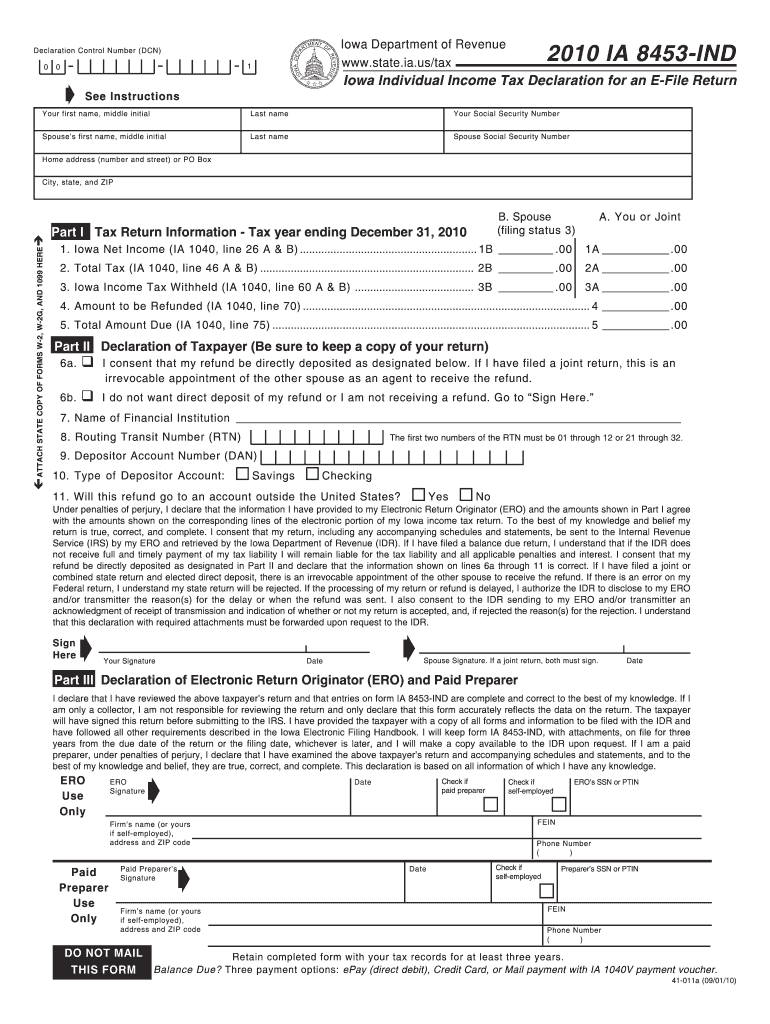

2010 Form IA DoR 8453IND Fill Online, Printable, Fillable, Blank

Web a signed form 8453, u.s. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Statements should include the following items for. Authenticate an electronic form 1120s, u.s.

Form M8453C 2004 Edit, Fill, Sign Online Handypdf

Authorize the tax professionals to. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: The two forms serve different purposes. Try it for free now! Ad access irs tax forms.

Fillable Form 8453 California EFile Return Authorization For

Authorize the tax professionals to. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Web taxpayers use irs form 8453 to send required paper forms or supporting documentation that cannot be submitted to the internal revenue service via electronic. The two forms serve different purposes. Try.

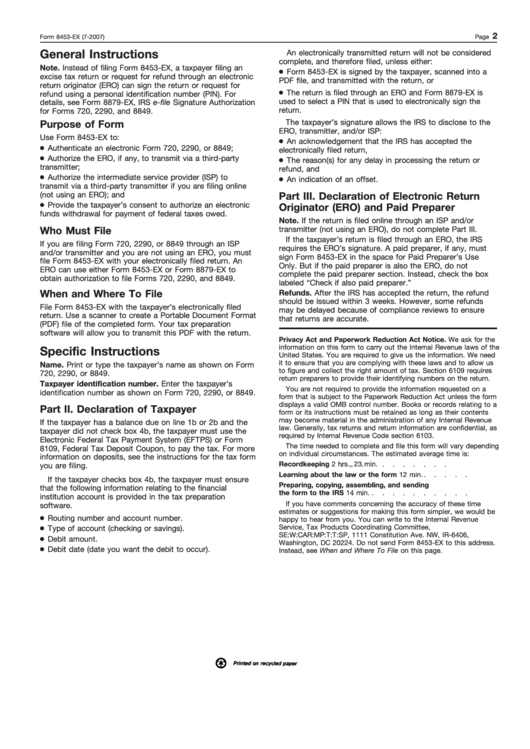

Form 8453Ex General Instructions printable pdf download

Statements should include the following items for. Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: Web taxpayers use irs form 8453 to send required paper forms or supporting documentation that cannot be submitted to the internal revenue service via electronic. Complete, edit or print tax.

Form 8453 Create A Digital Sample in PDF

Try it for free now! Upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Web a signed form 8453, u.s. Authenticate an electronic form 1120s, u.s.

Complete, Edit Or Print Tax Forms Instantly.

Complete, edit or print tax forms instantly. Web you need to use form 8453 to mail the brokerage (or other) statements that show the details of your transactions. Upload, modify or create forms. Authenticate an electronic form 1120s, u.s.

Web A Signed Form 8453, U.s.

Web mail form 8453 to the irs within after you’ve received your acknowledgment that the irs has accepted your return to this address: You do not really need to mail form 8949, but you do need to mail your supporting statements, such as your brokerage statements (form 1099b) and. Web taxpayers use irs form 8453 to send required paper forms or supporting documentation that cannot be submitted to the internal revenue service via electronic. The two forms serve different purposes.

Statements Should Include The Following Items For.

Authenticate to file and sign the taxpayers' 94x employment tax return electronically; Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Authorize the tax professionals to.

Ad Access Irs Tax Forms.

Try it for free now!