Oklahoma Form 504 Extension Instructions

Oklahoma Form 504 Extension Instructions - • the individual income tax rate used to calculate fiduciary income tax was reduced by 0.25% for each. Extension is valid only if 90% of the tax liability is paid by the original due date. Tax commission is requested to: You can make an oklahoma extension payment with form 504, or pay. Tax commission is requested to: Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? Web if you make your extension payment electronically, do not mail form 504. Web an extension of time to file with the irs has been granted to: Extension of time to file with the okla. Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission.

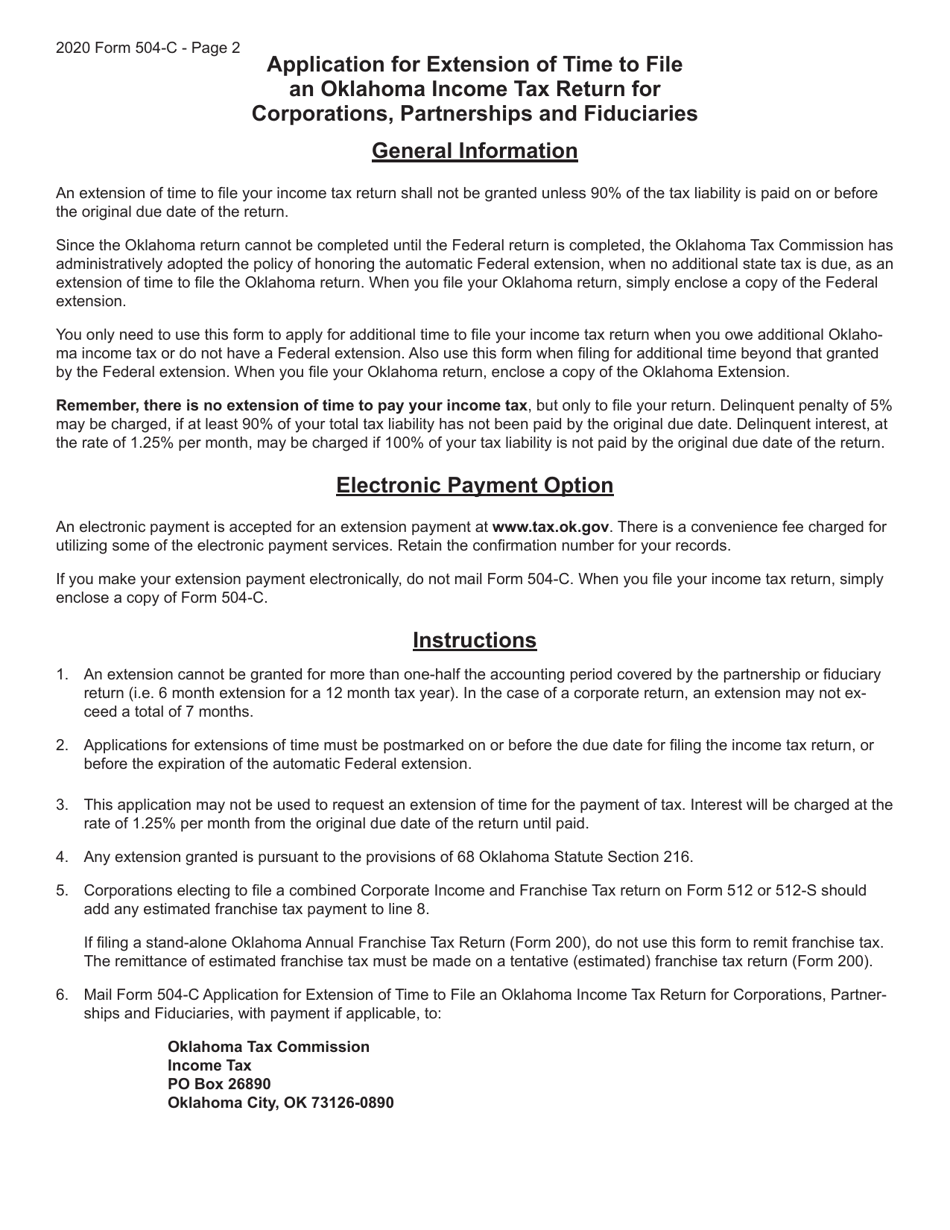

Oklahoma income tax computation 7rwdo lqfrph wd[ oldelolw\ \rx pd\. However, a copy of the federal extension must be provided with your. However, with our preconfigured web templates, things get simpler. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. What form does the state require to file an extension? Tax commission is requested to: At least 90% of the tax. Use fill to complete blank online state of. When you file your income tax return, simply enclose a copy of form 504. • the individual income tax rate used to calculate fiduciary income tax was reduced by 0.25% for each.

Tax commission is requested to: Tax commission is requested to: However, a copy of the federal extension must be provided with your. At least 90% of the tax. Web since the oklahoma return cannot be completed until the federal return is completed, the oklahoma tax commission has administratively adopted the policy of honoring the. Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission. Web extension of time from the irs in which to file your federal return, an oklahoma extension is automatic. Web follow the simple instructions below: Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. When you file your income tax return, simply enclose a copy of form 504.

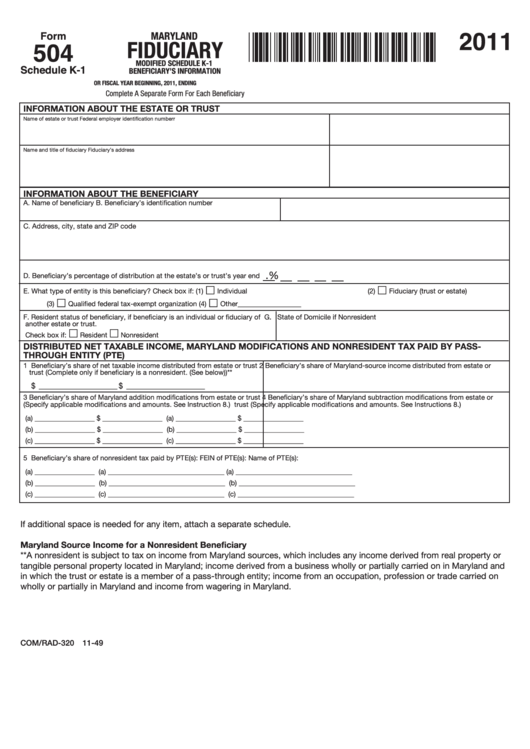

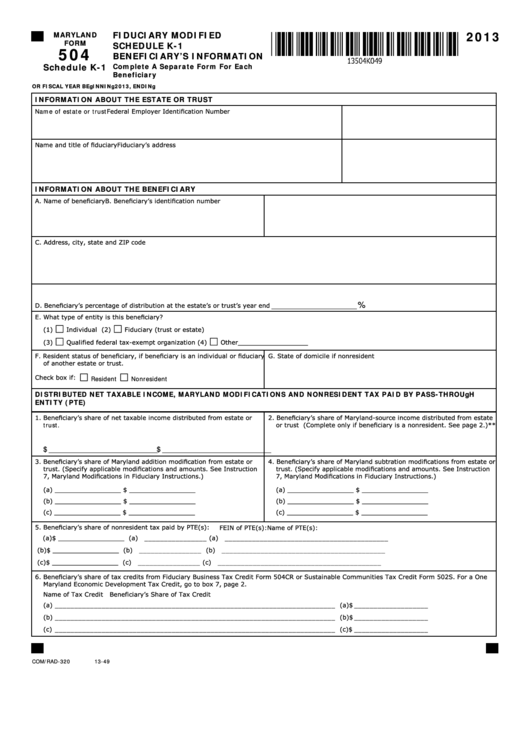

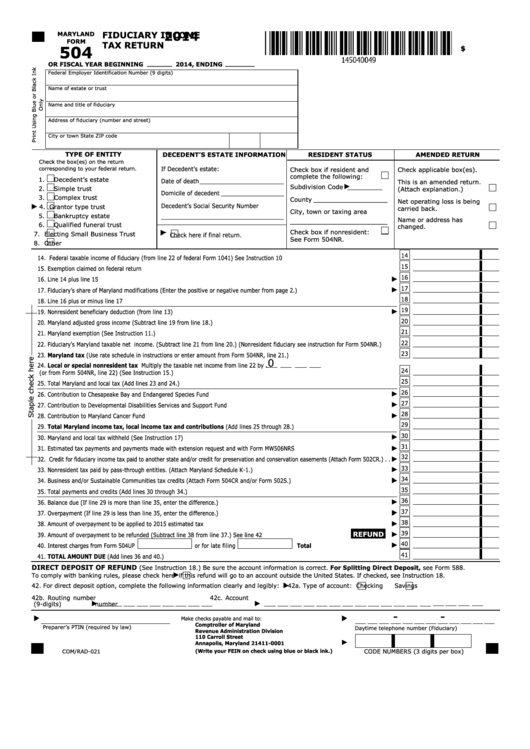

Fillable Form 504 (Schedule K1) Maryland Fiduciary Modified Schedule

15th day of the 4th month after the end of your tax. Use fill to complete blank online state of. Web follow the simple instructions below: Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. Web if you do not have a federal.

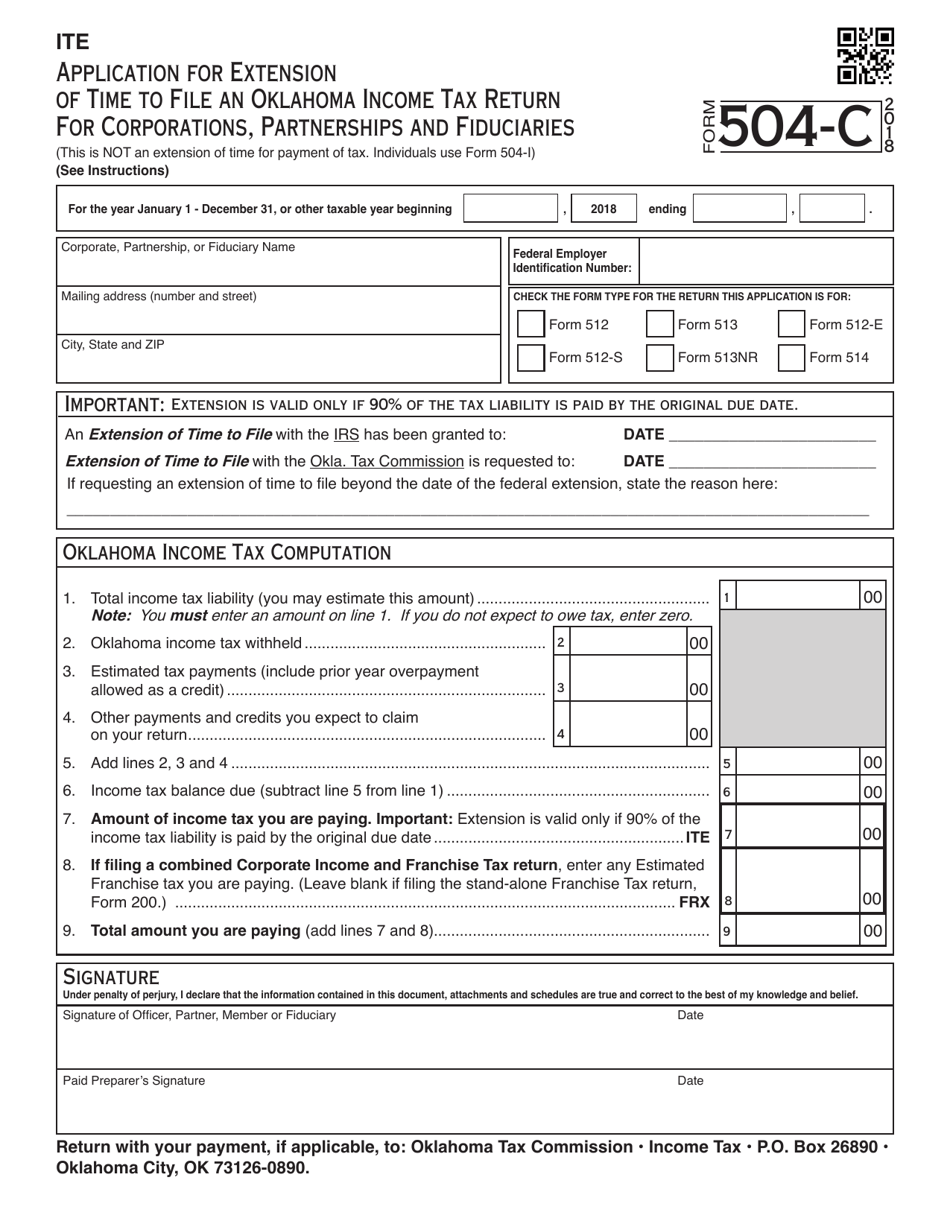

OTC Form 504C Download Fillable PDF or Fill Online Application for

Extension is valid only if 90% of the tax liability is paid by the original due date. Oklahoma income tax computation 7rwdo lqfrph wd[ oldelolw\ \rx pd\. The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension form. Web follow the simple instructions below: Does oklahoma support tax.

DD Form 504 Download Fillable PDF, Request and Receipt for Health and

You can make an oklahoma extension payment with form 504, or pay. Web if you do not have a federal extension, or if you owe oklahoma income tax, you can request an oklahoma tax extension with form 504 (application for extension of time. Web in order to get an oklahoma tax extension, at least 90% of your state tax liability.

Form 504C Download Fillable PDF or Fill Online Application for

Tax commission is requested to: Web an extension of time to file with the irs has been granted to: However, with our preconfigured web templates, things get simpler. Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. Does oklahoma support tax extensions for.

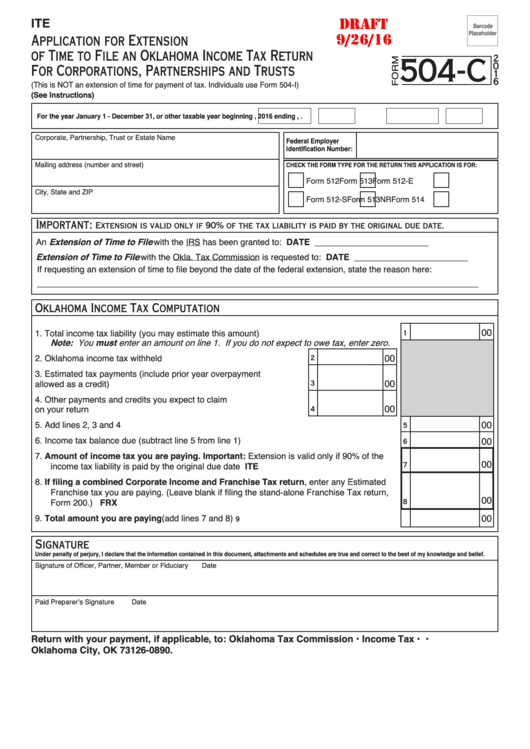

Form 504C Draft Application For Extension Of Time To File An

Web an extension of time to file with the irs has been granted to: Web if you make your extension payment electronically, do not mail form 504. Tax commission is requested to: However, a copy of the federal extension must be provided with your. Web follow the simple instructions below:

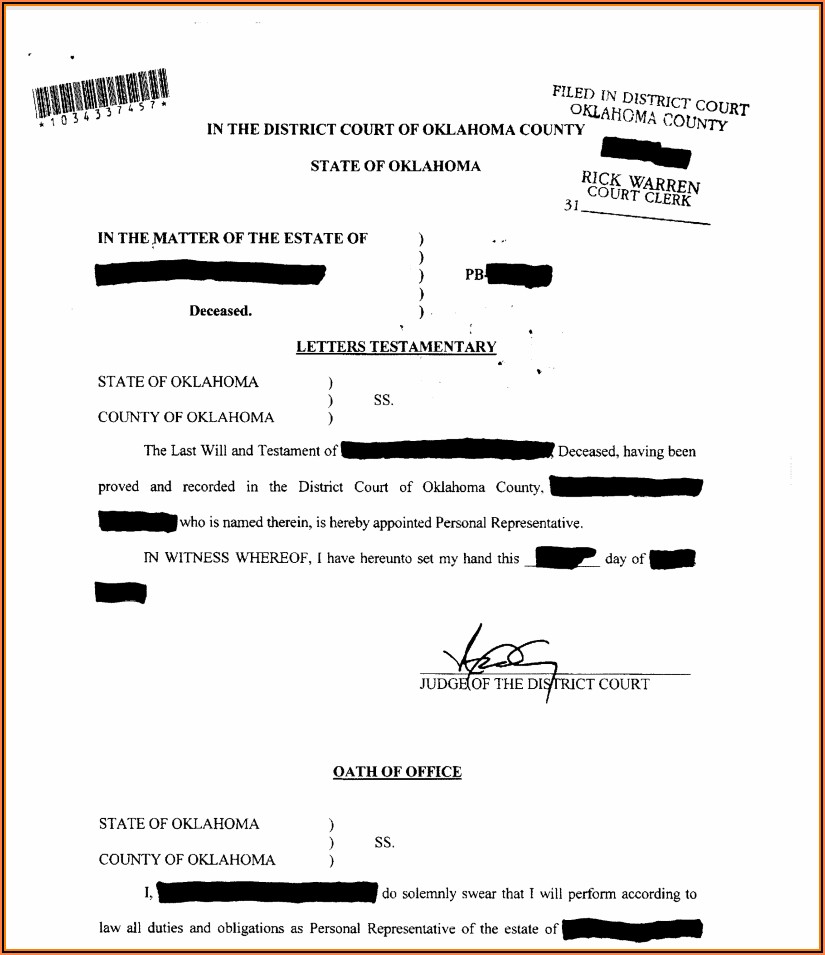

Hunting Lease Forms Oklahoma Form Resume Examples GM9O8QNYDL

• the individual income tax rate used to calculate fiduciary income tax was reduced by 0.25% for each. Web since the oklahoma return cannot be completed until the federal return is completed, the oklahoma tax commission has administratively adopted the policy of honoring the. Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted.

Fillable Maryland Form 504 (Schedule K1) Fiduciary Modified Schedule

However, with our preconfigured web templates, things get simpler. Web extension of time from the irs in which to file your federal return, an oklahoma extension is automatic. You can make an oklahoma extension payment with form 504, or pay. Web due date to file oklahoma tax extension. Web follow the simple instructions below:

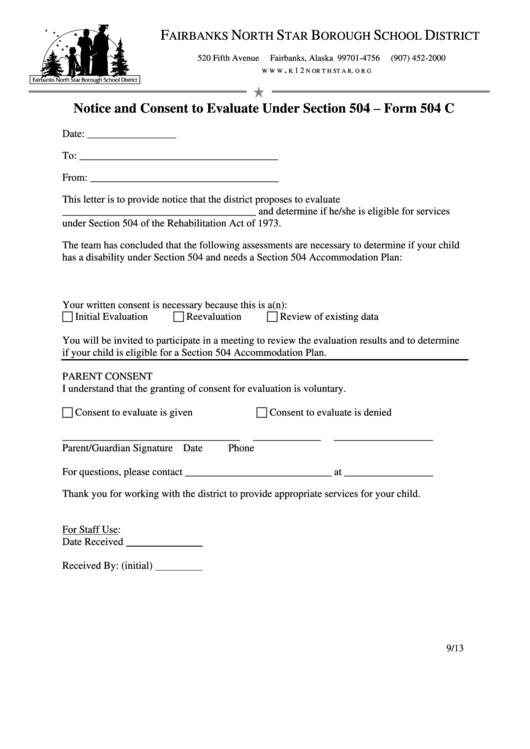

Notice And Consent To Evaluate Under Section 504 Form 504 C printable

Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. Web fill online, printable, fillable, blank form 2: Web an extension of time to file with the irs has been granted to: However, with our preconfigured web templates, things get simpler. Web in order.

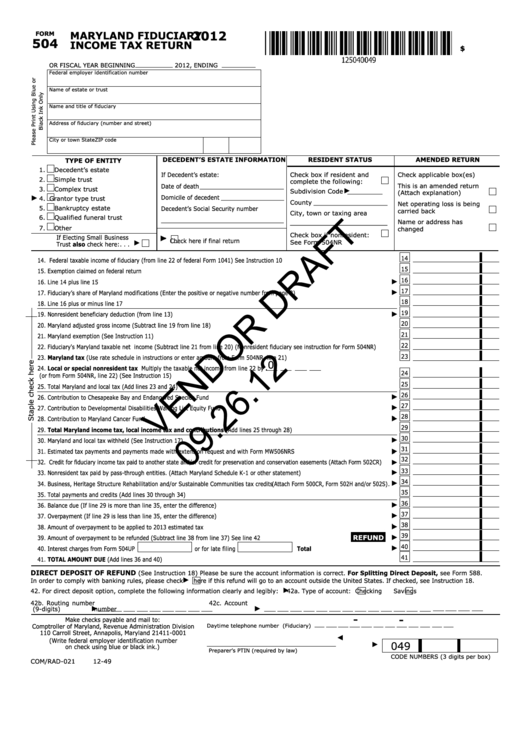

Form 504 Draft Fiduciary Tax Return/schedule K1 Fiduciary

Extension is valid only if 90% of the tax liability is paid by the original due date. Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. Tax commission is requested to: However, a copy of the federal extension must be provided with your..

Fillable Maryland Form 504 Fiduciary Tax Return/schedule K1

Web fill online, printable, fillable, blank form 2: Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission. At least 90% of the tax. 15th day of the 4th month after the end of your tax. Oklahoma income tax computation 7rwdo lqfrph wd[ oldelolw\ \rx pd\.

Tax Commission Is Requested To:

Web businesses that have a valid federal tax extension (irs form 7004) will automatically be granted an oklahoma tax extension for the same amount of time. 15th day of the 4th month after the end of your tax. Web since the oklahoma return cannot be completed until the federal return is completed, the oklahoma tax commission has administratively adopted the policy of honoring the. Web if you make your extension payment electronically, do not mail form 504.

• The Individual Income Tax Rate Used To Calculate Fiduciary Income Tax Was Reduced By 0.25% For Each.

Use fill to complete blank online state of. Tax commission is requested to: Web in order to get an oklahoma tax extension, at least 90% of your state tax liability must be paid on time. Web an extension of time to file with the irs has been granted to:

Web Your Social Security Number:

Web fill online, printable, fillable, blank form 2: Web 5 rows we last updated oklahoma form 504 in january 2023 from the oklahoma tax commission. Extension is valid only if 90% of the tax liability is paid by the original due date. Web extension of time to file with the okla.

Does Oklahoma Support Tax Extensions For Business Income Tax Returns?

At least 90% of the tax. However, with our preconfigured web templates, things get simpler. Web 2 what’s new in the 2022 oklahoma fiduciary tax packet? What form does the state require to file an extension?